🏰 Don't Worry Invest Happy

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes. If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder:

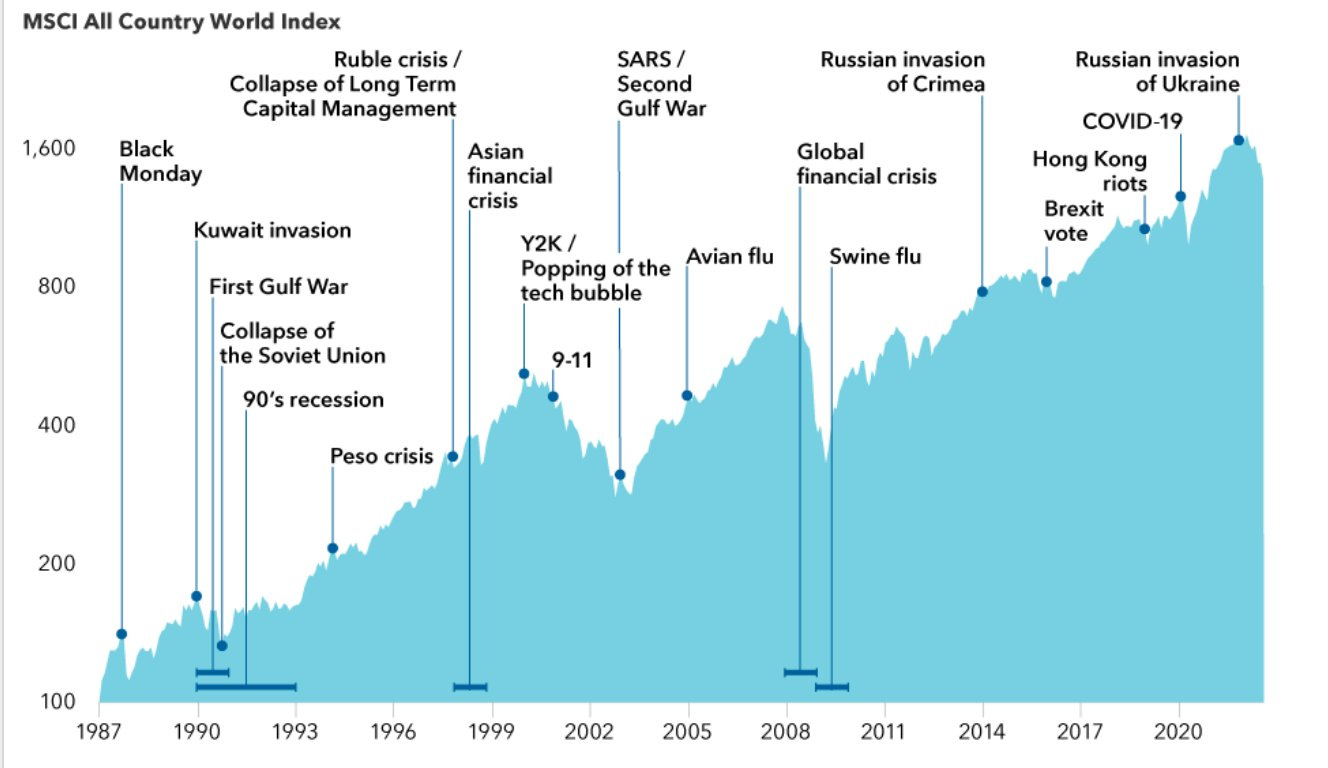

1️⃣ Don’t Worry Invest Happy

Don't worry. Just focus on the long term and you’ll be fine.

The longer your investment horizon, the better.

2️⃣ What’s really going on at board meetings

Carl Icahn on what's really going on at board meetings.

This is truly shows why it is important to do your own homework. Retail investors have BIG advantages compared to professional investors (and I can know this because I manage an Equity Fund).

3️⃣ One simple investment quote

Look at the fundamentals of the company and not at the stock price.

When the fundamentals of a company are still good but the stock price is decreasing, you have no reason to sell at all.

“If a stock is down but the fundamentals are positive, you should buy more of it.” – Peter Lynch

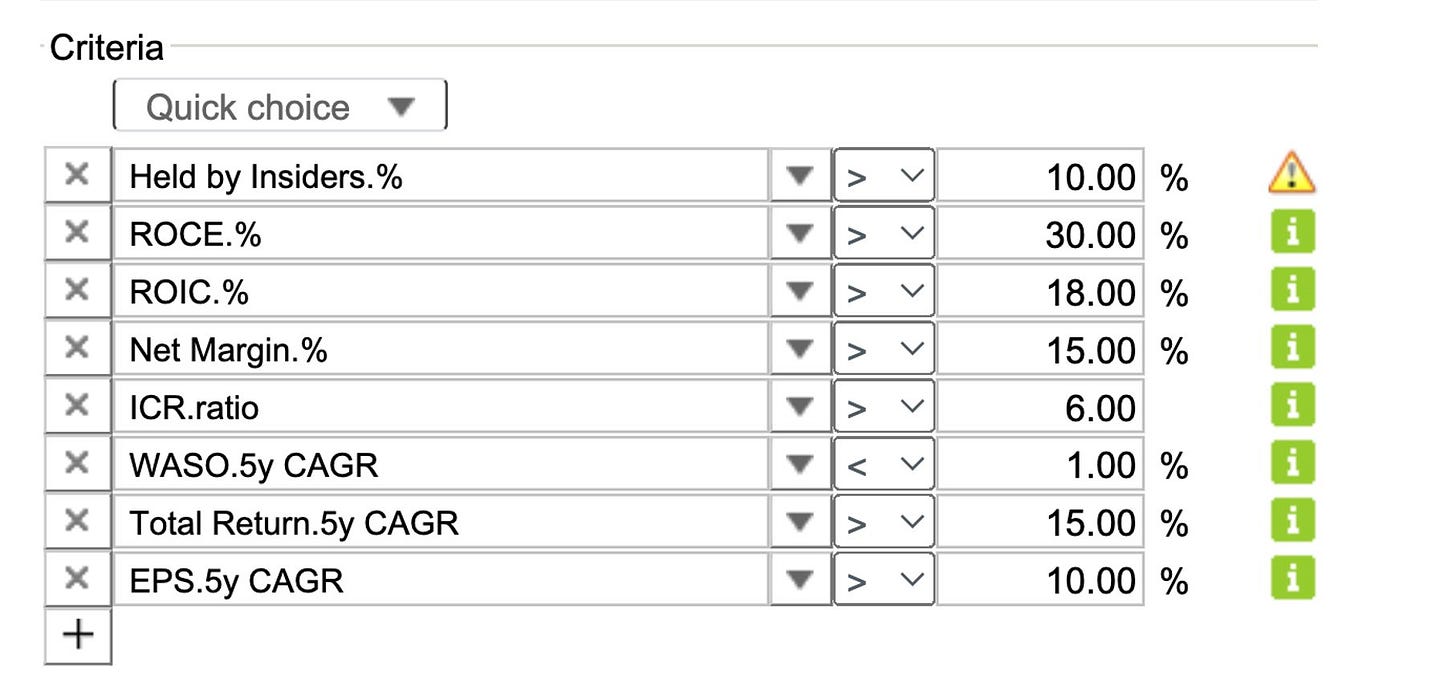

4️⃣ How to find owner-operator quality stocks

Do you want to find owner-operator quality stocks? Use these criteria to start your research journey.

(Source: UncleStock)

5️⃣ Example of a Quality Company

MIPS AB is a Swedish company which manufactures and sells sports helmets. The company offers a brain protection system for helmet market and is targeting 2 billion SEK in sales by 2027.

These are the kind of charts you want to see as a Quality Investor:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.