🥂 ETF Portfolio Anniversary

Don't look for the needle in the haystack. Just buy the haystack!

That’s the entire philosophy of passive investing.

Let’s teach you everything you need to know today.

Why most investors underperform

Let’s be honest with each other.

More than 95% of investors underperform the market.

The main reasons?

Trading too much (costs harm your return)

Trying to time the market

Making emotional investment decisions

Lack of patience

…

This study by JP Morgan shows that the average investor achieved an annual return of 3.6%, while the S&P 500 returned 9.5% over the past 20 years.

A difference of 5.9%!

That’s why a lot of investors would be better off investing in ETFs.

What is an ETF?

Imagine a basket of fruits.

Instead of buying each fruit separately, you can buy a basket that contains a mix of apples, bananas, and oranges.

This basket represents an ETF.

By buying an ETF or Exchange Traded Fund, you invest in hundreds of stocks or bonds simultaneously.

With one purchase, you are immediately diversified. You invest in a specific index like the S&P 500 or a specific sector like technology or healthcare.

ETFs versus actively managed funds

Let’s use the example of the basket of fruits again.

As you know by now, ETFs are like buying a pre-made basket of fruits. You know what's inside, and the price reflects the overall value of the fruits.

Actively managed funds are like hiring someone to pick fruits for you.

They claim to be better at picking the best fruits, but they charge you a fee for their expertise.

Charging a fee for picking the best fruits would be justified when these experts would be better at picking fruits.

But this doesn’t seem to be the case in the investment world.

More than 90% (!) of actively managed funds underperform the market.

Banks charge you high fees but don’t deliver extra value

The average fees to let your money be managed by a so-called ‘professional’:

One-time entry fee: 3%

Commission: 1.5% annually

No exit fee

The average fee to invest in ETFs:

Yearly expense: 0.2%

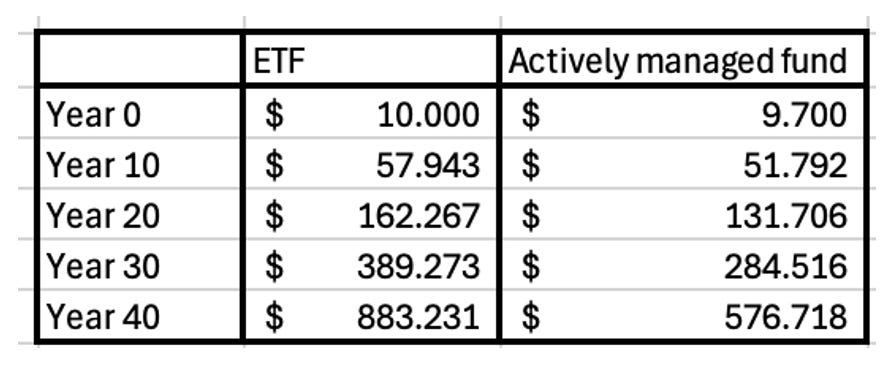

Imagine you have $10,000 to invest for 40 years.

You add $200 to your investments every single month.

If both the banking fund and ETF return 8% per year, this is what your investment will look like:

You would have almost twice as much with an ETF versus an actively managed fund.

Costs hurt your investment results a LOT.

Where can I buy an ETF?

The “store” where you can buy your basket of fruits (ETFs) is called a broker.

It’s a place on the internet where you can buy things like ETFs, stocks, bonds, …

The broker you choose should depend on a couple of things, including where you live, fees, user-friendliness, ...

Here are some examples:

In America:

Interactive Brokers: A global broker offering a wide range of ETFs at low prices

Charles Schwab: known for its low-cost trading, extensive range of investment options, and comprehensive research tools

Fidelity Investments: known for its superior customer service and advanced trading platforms

In Europe:

Interactive Brokers: A global broker offering a wide range of ETFs at low prices

DeGiro: A popular European broker with low fees and access to many ETFs.

Lynx: provides access to global markets, advanced trading tools, and competitive fees.

The broker I prefer is called Interactive Brokers. This is because Interactive Brokers offers low prices and allows you to invest in a wide range of ETFs.

How does an ETF work and what’s the difference with a Fund?

ETFs, or "exchange-traded funds," are funds you can buy and sell on the stock market. It’s what the name implies:

Here are the most important differences:

ETFs are generally preferred over actively managed funds because they have much lower costs and can be bought and sold at any time.

Dollar-cost averaging 🆚 lump-sum

Here is a common question many investors have:

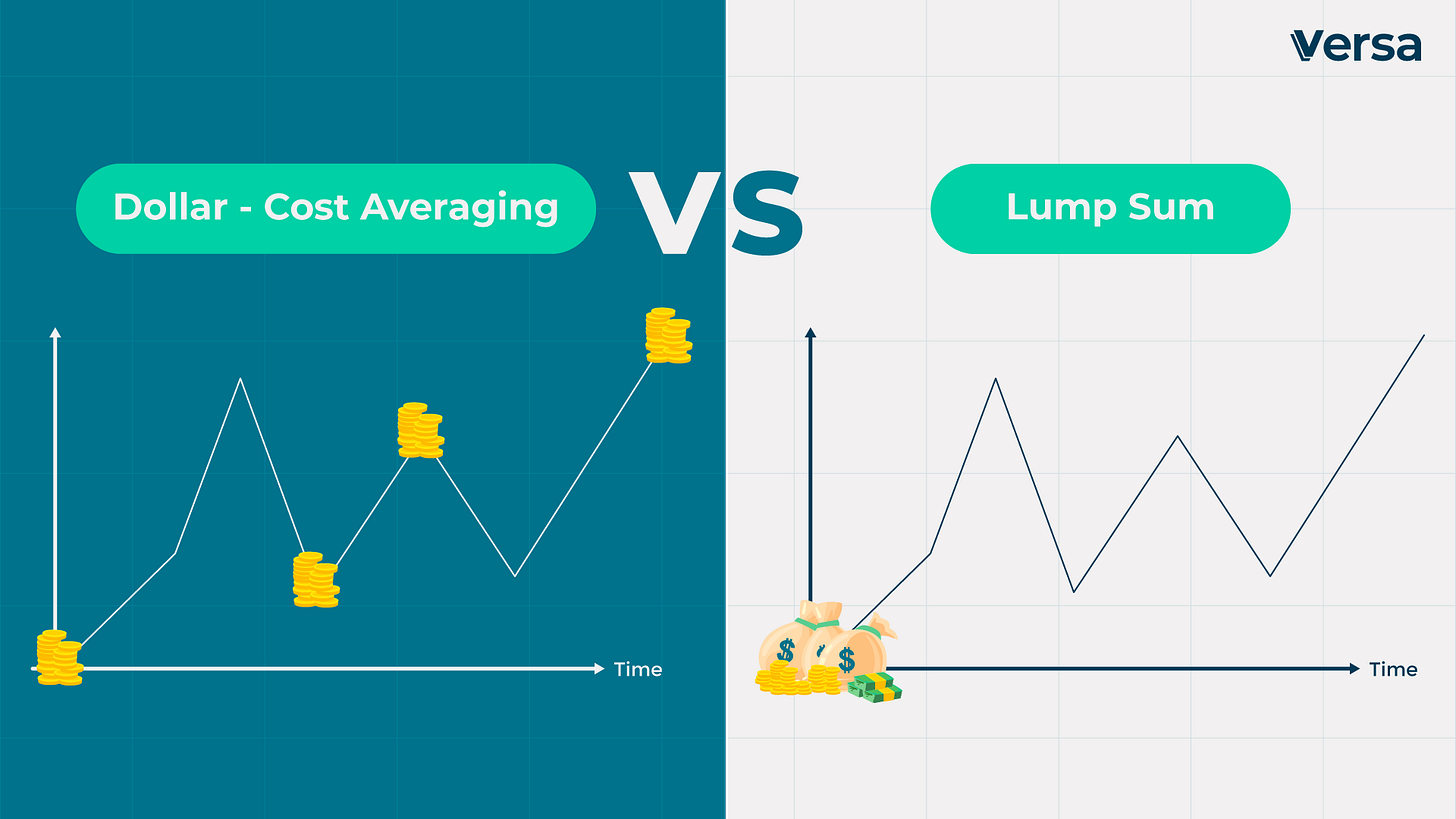

I have $100,000 to invest. Should I invest this money all at once or should I spread my investment over time?

You have two options:

Lump-sum investing: invest everything at once

Dollar-cost averaging: invest periodically

While academic research has proven that lump sum investing is better in most cases, I’d personally always use dollar-cost averaging.

How would you feel when you invest $100,000 today and the stock market would be down 30% in 6 months from now?

Because that’s what happens from time to time.

When you have a significant amount to invest, investing periodically ensures a good night's sleep.

I’d personally spread my investment throughout 12 to 18 months.

Example: Invest $6,667 per month for 15 months ($6,667*15 = $100,000).

Here’s a visualization of Dollar-Cost Averaging versus Lump-Sum Investing:

Now let’s dive into the ETF Portfolio and put the year in review.

ETF Portfolio

Our ETF Portfolio has a bias towards a few factors:

🌏 Emerging Markets - Small exposure to Emerging Markets

📏 Size - The smaller the better

⚖️ Equal-Weight - Equal-Weight ETFs outperform the market

🚀 Multifactor - Quality, size, value & momentum

👑 Quality - Only invest in companies that have already won

Why do we use these factors?

🌏 Emerging Markets

Countries in Emerging Countries should grow faster than Developed Markets. The stock prices should follow.

When you invest $10,000 for 40 years:

Emerging Markets: $194,369

MSCI World: $128,910

A difference of $65,459.

📏 Size matters

Smaller companies have more upside potential.

When you invest $10,000 for 40 years:

Small-cap stocks: $261,330

MSCI ACWI IMI: $122,309

A difference of $139,021.

⚖️ Equal-weight

Equal-weight ETFs outperform the market by 1.8% per year on average in the very long term.

When you invest $10,000 for 40 years:

Equal-Weight S&P500: $250,008

S&P500: $133,837

A difference of $116,171.

🚀 Multifactor

Value, Momentum, Quality, and Low Size outperform the market over time.

Using a Multifactor ETF, you can combine these factors.

When you invest $10,000 for 40 years:

Multifactor: $351,880

MSCI World: $128,910

A difference of $222,970.

👑 Quality

Quality Stocks tend to outperform by 4.2% per year in the very long term.

When you invest $10,000 for 40 years:

S&P500: $133,837

Quality Stocks: $626,991

A difference of $493,154.

Performance

Currently, the average return of the ETFs within Our Portfolio is +10.3%.

Let’s dive into the Portfolios.

We will also add to our positions.