Don't look for the needle in the haystack. Just buy the haystack!

That’s the entire philosophy of passive investing.

Let’s dive in and announce the fourth ETF for the Portfolio.

Everyone can invest

My parents are the most conservative people you can imagine.

When I stated that I wanted to start investing at age 13, they tried to change my mind in every possible way.

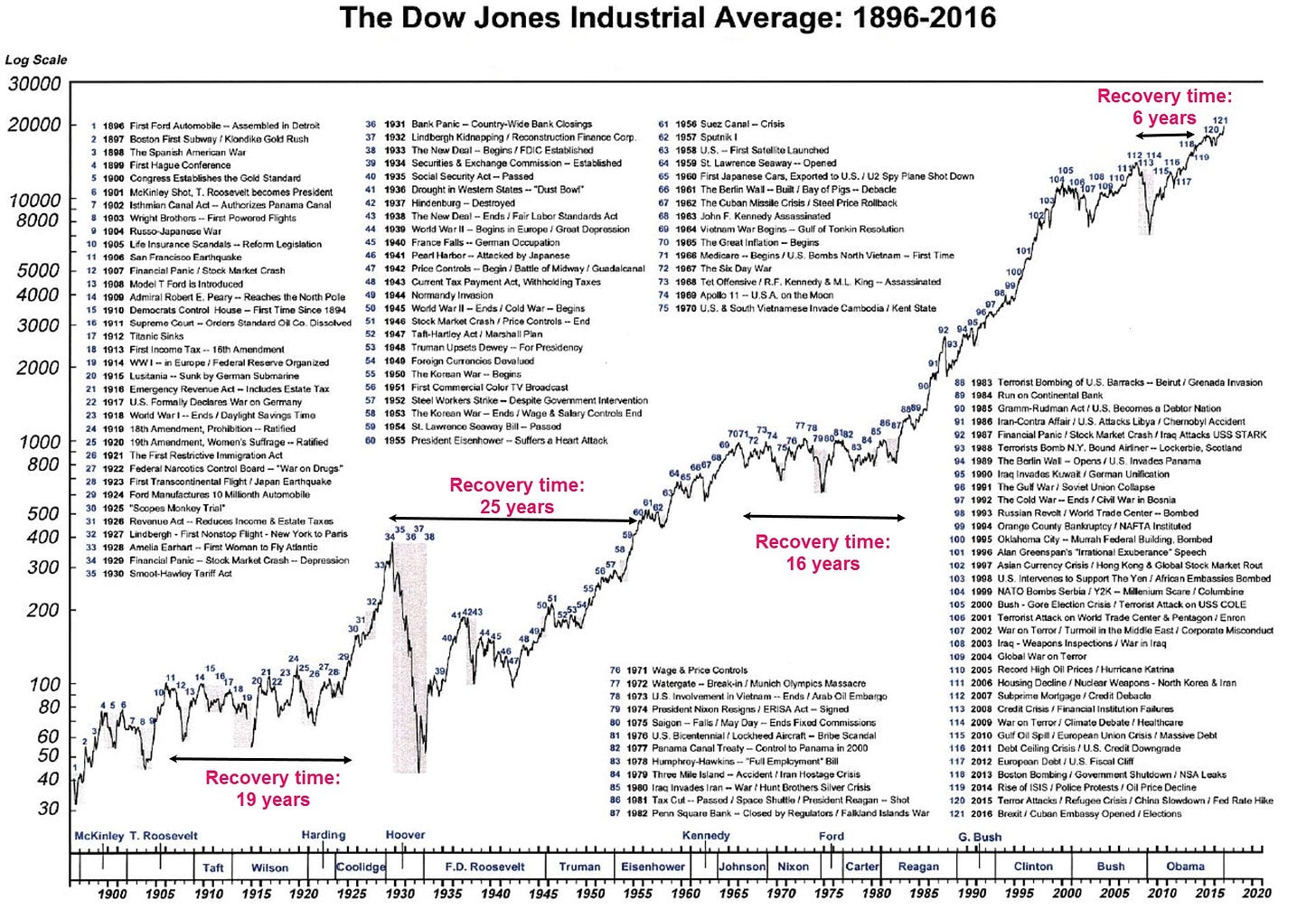

“Your grandfather lost a lot of money during the crash of 1987” and “I lost a lot of money from investing in technology stocks in the 2000s”.

That’s quite funny. You know why?

If you would have owned a passive index fund, you would have tripled your money since 2000 and you would have 15x’ed your money since 1987.

The key lesson here? Everyone can invest in stocks.

It’s very easy to invest in passive index funds that track indices like the S&P 500.

By doing this, I’m quite sure to state that you’ll perform better than almost all (professional) investors.

The return you’ll get? Around 7-8% on average in the very long term.

Investing can be very easy for those who think on the long term.

Dollar-cost averaging 🆚 lump-sum

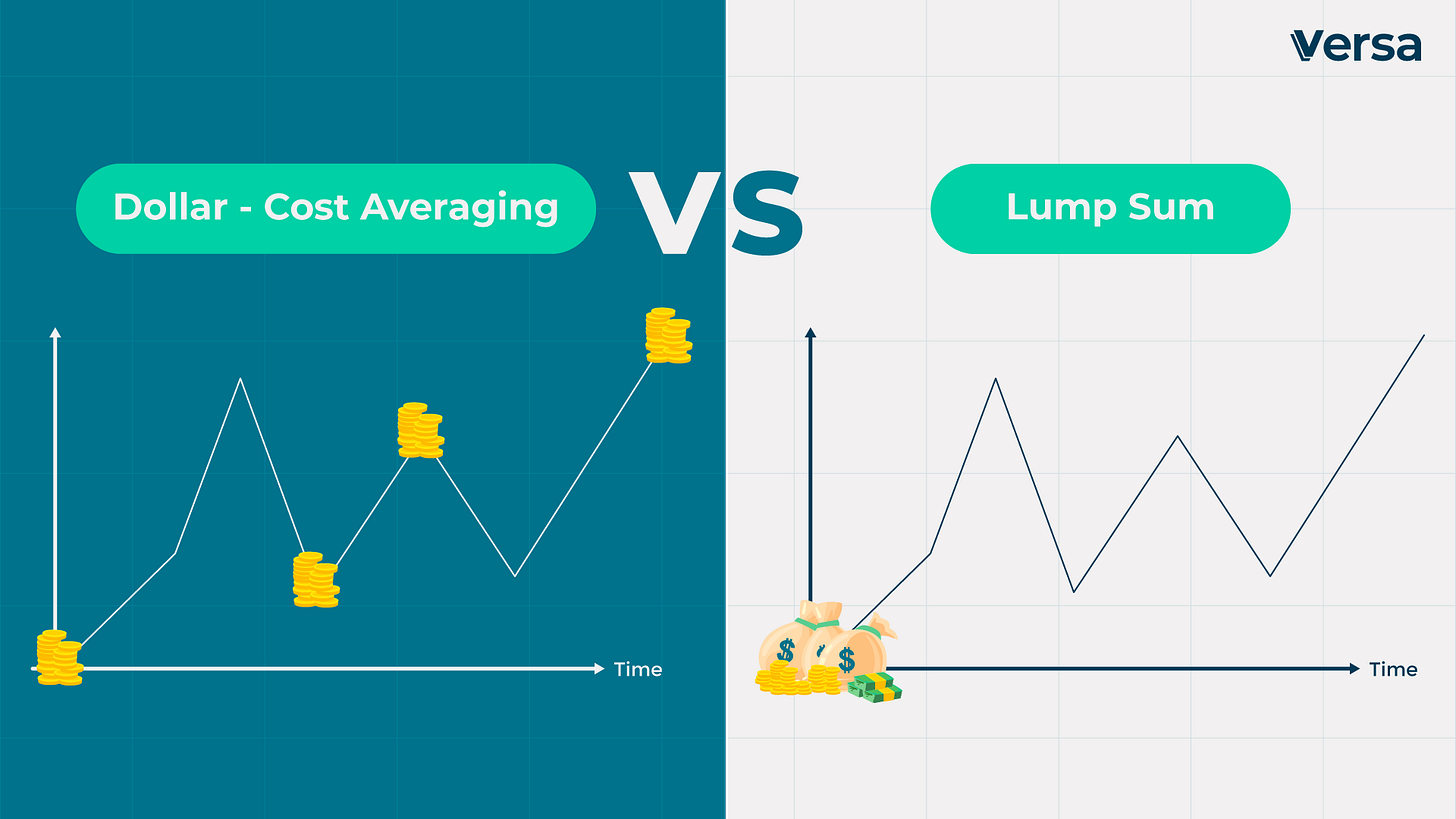

Here is a common question many investors have:

I have $100,000 to invest. Should I invest this money all at once or should I spread my investment over time?

You have two options:

Lump-sum investing: invest everything at once

Dollar-cost averaging: invest periodically

While academic research has proven that lump sum investing is better in most cases, I’d personally always use dollar-cost averaging.

How would you feel when you invest $100,000 today and the stock market would be down 30% in 6 months from now?

Because that’s what happens from time to time.

When you have a significant amount to invest, investing periodically ensures a good night's sleep.

I’d personally spread my investment over a period of 12 to 18 months.

Example: Invest $6,667 per month for 15 months ($6,667*15 = $100,000).

Here’s a visualization of Dollar-Cost Averaging versus Lump Sum Investing:

Now let’s dive into the ETF Portfolio.

Compounding Quality ETF Portfolio

As a reminder, here are the rules for the ETF Portfolio:

Every month, Compounding Quality will buy an ETF or add to an existing ETF for $500

There will be a maximum of 5 ETFs in the portfolio (Keep It Simple, Stupid!)

The costs of each ETF may not exceed 0.5% per year (3x as cheap as a mutual fund)

We bought three ETFs so far and today it’s time to buy the fourth one.