Investing today is easier than ever.

With a single click, you own a piece of hundreds of companies through an ETF.

But here’s the dirty little secret: Most ETFs aren’t nearly as diversified as you think.

The essence of an ETF

Imagine you walk into a grocery store. Instead of buying apples, bananas, and oranges separately, you grab a pre-packaged fruit basket. Convenient, right?

That’s how ETFs work. Instead of picking individual stocks, you buy a ready-made basket. It sounds great. And for years, ETFs have been sold as the best way to invest: low fees, broad exposure, easy diversification.

No wonder investors have poured trillions into them.

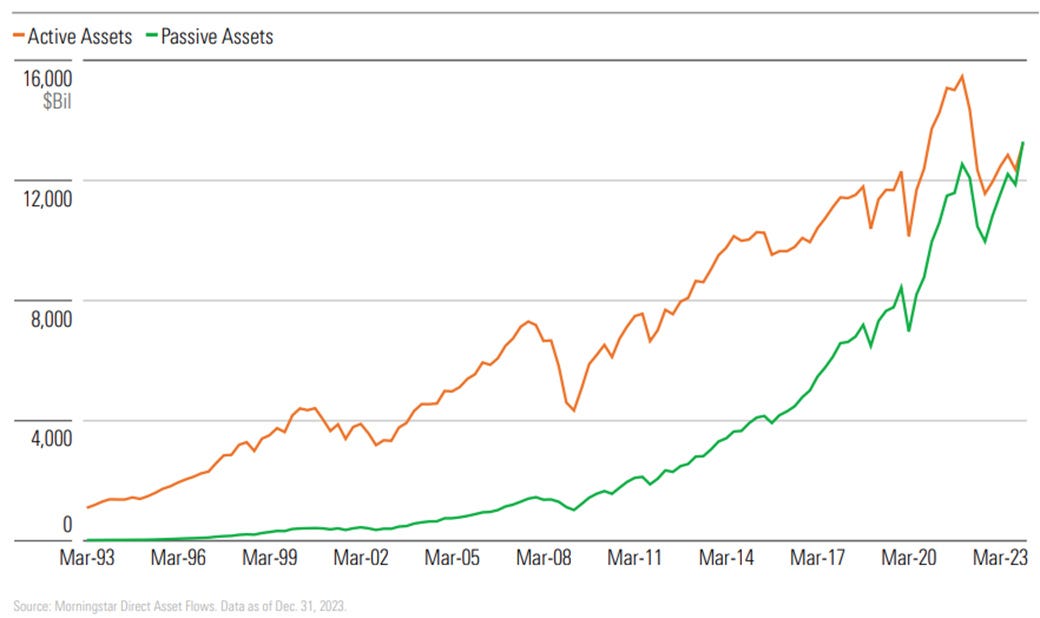

In fact, for the first time last year, there’s more money (Assets Under Management) in passive funds versus active funds:

If you want to learn more about the essence of ETFs, you can download this free course:

More risk than you think

The stock market has done really well in the recent past.

The S&P 500 returned 14% per year over the past 13 years.

If you invested $10,000 in 2012, you’d have $50,000 today.

But you know what the problem is?

Most indices are way too concentrated.

Since 1996, it has never happened that the top 10 position had such a high weight.

Apple, Nvidia, Microsoft, Amazon, Meta Platforms, Alphabet, and Tesla account for 32.7% of the S&P 500.

36.3% is invested in the top 10 stocks:

Please note that Alphabet is shown twice. GOOG and GOOGL are both Alphabet stocks, but GOOGL has voting rights, while GOOG does not.

And if you think that’s bad, the situation is even worse for the Nasdaq.

The top 10 stocks make up a staggering 56.3% of the portfolio.

This isn’t diversification. It’s a concentrated bet on Big Tech.

There are two main reasons why I’m cautious about this:

Big Tech is valued at way more expensive valuation levels than the broad market

Over time, reversion to the mean takes place. Most companies can’t continue to outperform forever

As you can see in the chart below, it's rare for a company to maintain a market-leading position for 10 years or more:

The solution

The solution to this problem?

Make sure you diversify.

That’s why I’m a huge fan of an equal-weight ETF on the S&P 500, especially at this point in time.

You are way better diversified as each of the 500 companies gets an equal weight of 0,2% (1/500).

While that hasn’t been the case recently, equal-weighted indices tend to outperform in the long run because they are better diversified and include more exposure to smaller companies.

Since 2019, the market-cap weighted S&P 500 has outperformed the equal-weight variant:

But if we look at the long-term picture, the equal-weight variant outperforms:

ETF Portfolio

Our ETF Portfolio is a great mix of ETFs that should be able to outperform in the long term.

We use multiple factors that tend do well:

👑 Quality - Only invest in companies that have already won (GOAT)

📏 Size - The smaller the better (EWSP & IUSN)

🚀 Multifactor - Quality, size, value & momentum (IBCZ)

🌏 Emerging Markets - Small exposure to Emerging Markets via EMIM

According to RBC Global Asset Management, here are the chances you’ll outperform over a period of 5 years:

Small cap stocks: 56%

Value stocks: 73%

Quality: 83%

Momentum: 87%

Low volatility: 92%

Let’s now dive in the ETF Portfolio itself.

You have 24/7 access to the ETF Portfolio here: