You know what’s weird?

By investing in ‘Minimum Volatility’ stocks, you outperform the market over time.

This means you can do better than the market by buying boring and easy-to-understand companies.

General wisdom

As a rule of thumb, the more risk you take on the stock market, the higher your expected return.

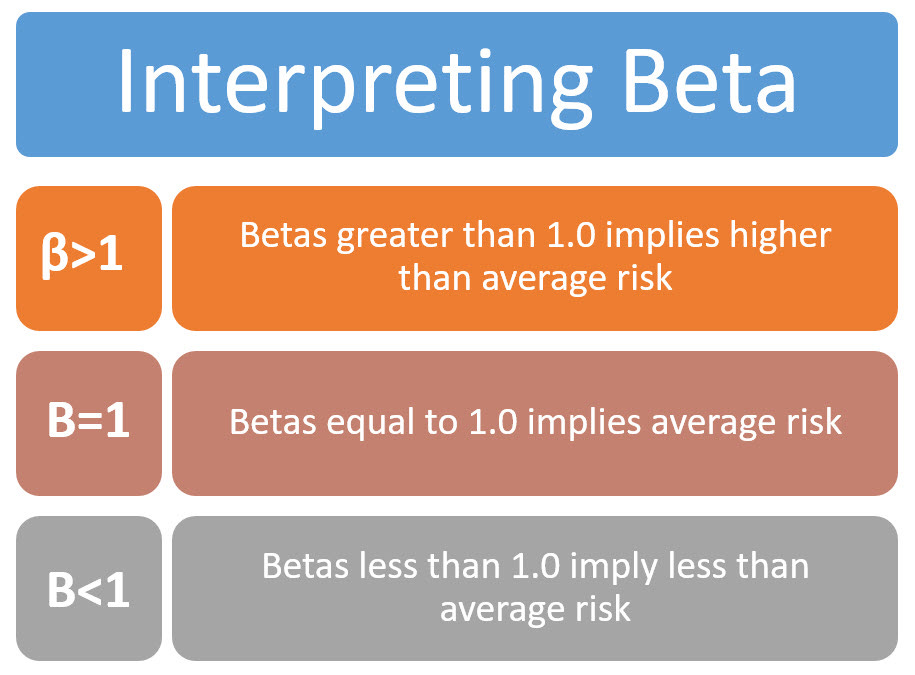

In academic literature, investment risk is measured using a word called ‘Beta’.

Beta

Beta measures how much a stock moves compared to the overall market.

The theory says that a stock with a beta of 1.5 moves 50% more than the market.

If the S&P 500 goes up 10%, the stock should go up 15%. And if the S&P 500 drops 10%, the stock should fall 15%.

Companies with a high beta:

Tesla Inc. (TSLA): 2.58x

NVIDIA Corporation (NVDA): 1.96x

Advanced Micro Devices (AMD): 1.88x

Amazon.com Inc. (AMZN): 1.39x

Apple Inc. (AAPL): 1.26x

Companies with a low beta:

Walmart Inc. (WMT): 0.69x

PepsiCo Inc. (PEP): 0.50x

Johnson & Johnson (JNJ): 0.48x

Coca-Cola Co. (KO): Beta of 0.45x

Procter & Gamble Co. (PG): 0.42x

Is Beta a great metric?

But does a high beta equal high risk?

The answer is ‘no’.

But please don’t take my word for it:

"To invest successfully, you don't need to understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these." - Warren Buffett

"Risk is often about the possibility of permanent capital loss, which is more significant than short-term fluctuations (Beta)." - Howard MarksVolatility isn’t risk. True risk is the chance of permanent capital loss.

The relationship between risk and return is usually shown like this in classic finance literature:

But based on the chart above, the more risk you take, the higher your return will be.

If risky investments always gave higher returns, they wouldn’t be risky.

Howard Marks said that we should look at risk like this instead:

"Investments that seem riskier have to appear likely to deliver higher returns, or else people won’t make them.”Risky investments are not guaranteed to give high returns.

That’s why this graphic below shows the truth much better:

As risk increases:

The expected return goes up

The range of possible results gets wider

The bad outcomes get even worse

This is what investment risk means.

Risky investments give less certainty about the result. You might do worse than someone who chooses safer options. You could even lose money.

The more risk you take, the higher your potential return.

This makes complete sense and it’s very logical if you ask me.

And yet…

Low volatility (slightly) outperforms

Here’s the performance of the MSCI World Minimum Volatility Index:

While it didn’t outperform recently (due to the outperformance of Big Tech), the Minimum Volatility Index has slightly outperformed since its inception in 1988.

Something similar can be seen when we look at the S&P 500 Low Volatility Index:

It looks like you get rewarded for investing in very predictable, boring stocks.

The essence

If you use the Minimal Volatility strategy, you do the following:

You invest in stable companies that have low volatility.

These stocks are often active in sectors like consumer goods, healthcare, and utilities.

You might not make big profits in a bull market, but you lose less when things go wrong.

The advantage of this investment strategy:

Lower risk: Your portfolio doesn’t drop as much during market crashes.

Smoother returns: You won’t make quick, big gains, but you also won’t suffer big losses.

Good for long-term investing: Ideal for investors who want steady growth without too much stress.

Some companies that match these criteria? Berkshire Hathaway, Walmart, and Republic Services.

ETF Idea

And this brings us to a new ETF Idea.