ETF Portfolio Update: February 2026

Profitable Small Caps Outperform

Investing has never been easier.

You buy an ETF

You are invested in hundreds of companies at the same time

Let’s update you on Our ETF Portfolio today.

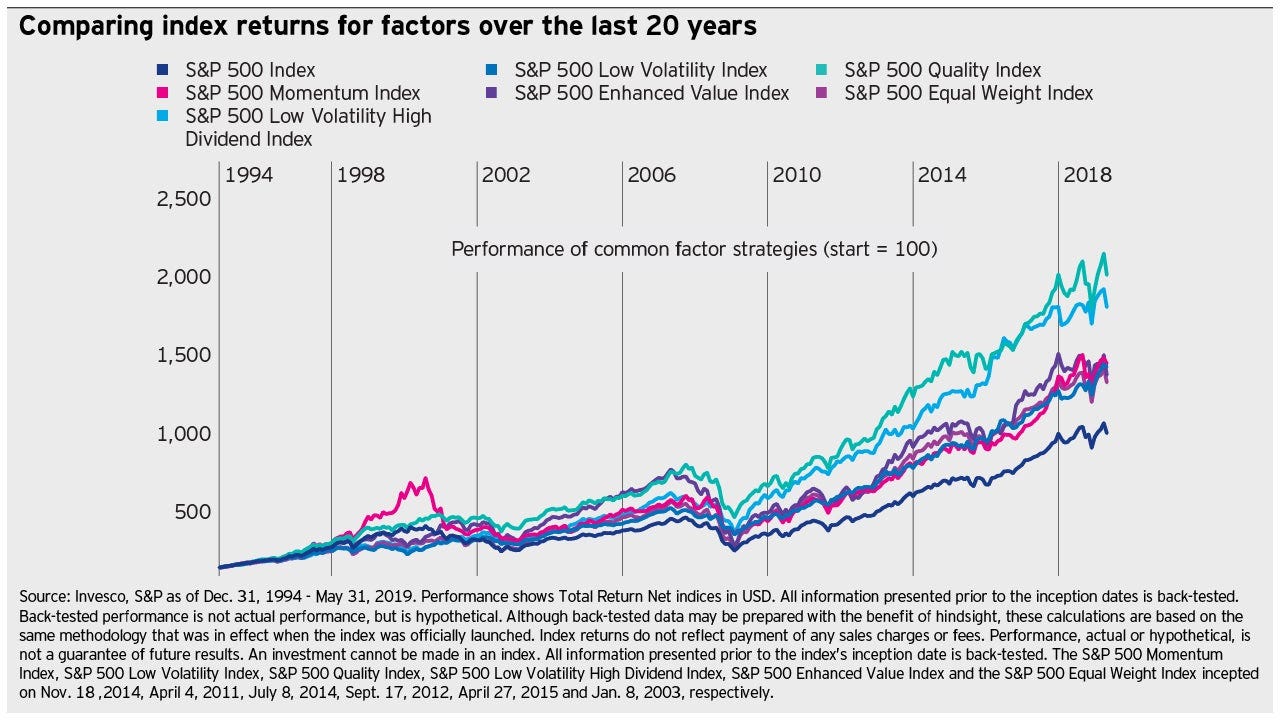

Multiple roads lead to heaven

On the stock market, there are multiple roads that lead to heaven.

👑Quality: Only invest in companies that have already won

📏Size: The smaller the better

🚀Multifactor: These 4 factors outperform - Quality, Size, Value & Momentum

🌏Emerging Markets: Emerging Markets tend to do better on the long term

All these different strategies outperform the market over time.

You should pick the strategy and investment style you feel the most comfortable with.

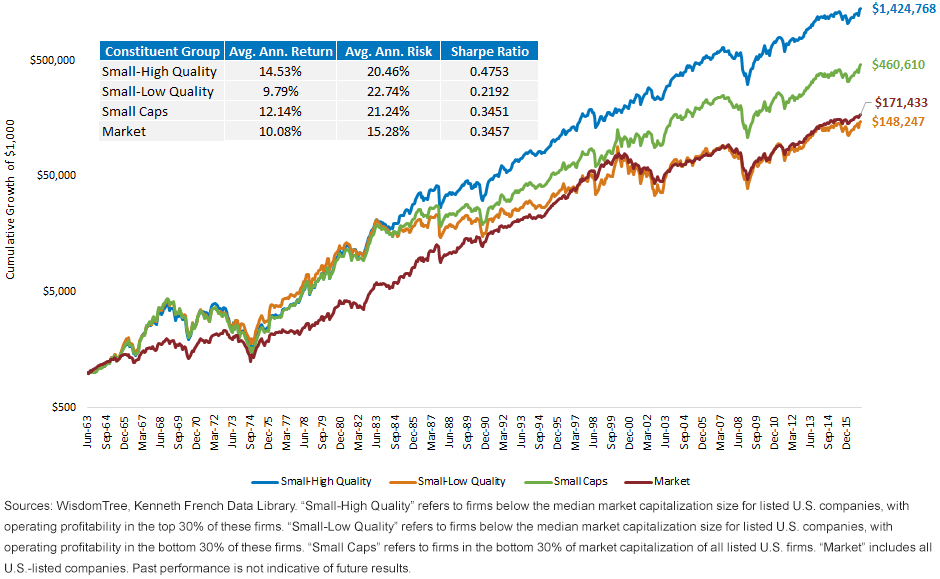

Small = beautiful

Small companies tend to outperform the market in the long term.

Just look at this chart:

The smallest companies outperformed large caps by 1.8% per year on average.

As compounding works exponentially, this results in a massive outperformance over time.

Just imagine you invested $10,000 twenty years ago:

Large Caps: $64,870 (9.8% return)

Small Caps: $89,800 (11.6% return)

Small caps are cheap

Another interesting thing about small caps right now?

Today, they are way cheaper than large caps.

I think the market is in an exaggeration phase for many large caps.

That’s why investing in smaller companies could make a lot of sense.

Mid Caps: 29% cheaper than large caps

Small Caps: 32% cheaper than large caps

I think this valuation gap won’t continue to exist:

Between 2004 and 2020, smaller companies traded at a premium

Today, smaller companies trade at the lowest relative valuation in 25 years

Since 2020, the valuation gap has only become wider

The key message?

Small caps outperform large caps

Today you can buy them at a wide discount.

This looks like a recipe for beating the market.

Which Small Caps to Buy?

If you want to keep it easy, you could just buy the Russell 2000.

This index tracks the performance of 2,000 small companies in the US.

But there is a problem with this index.

It includes a lot of unprofitable companies.

I think we can do better.

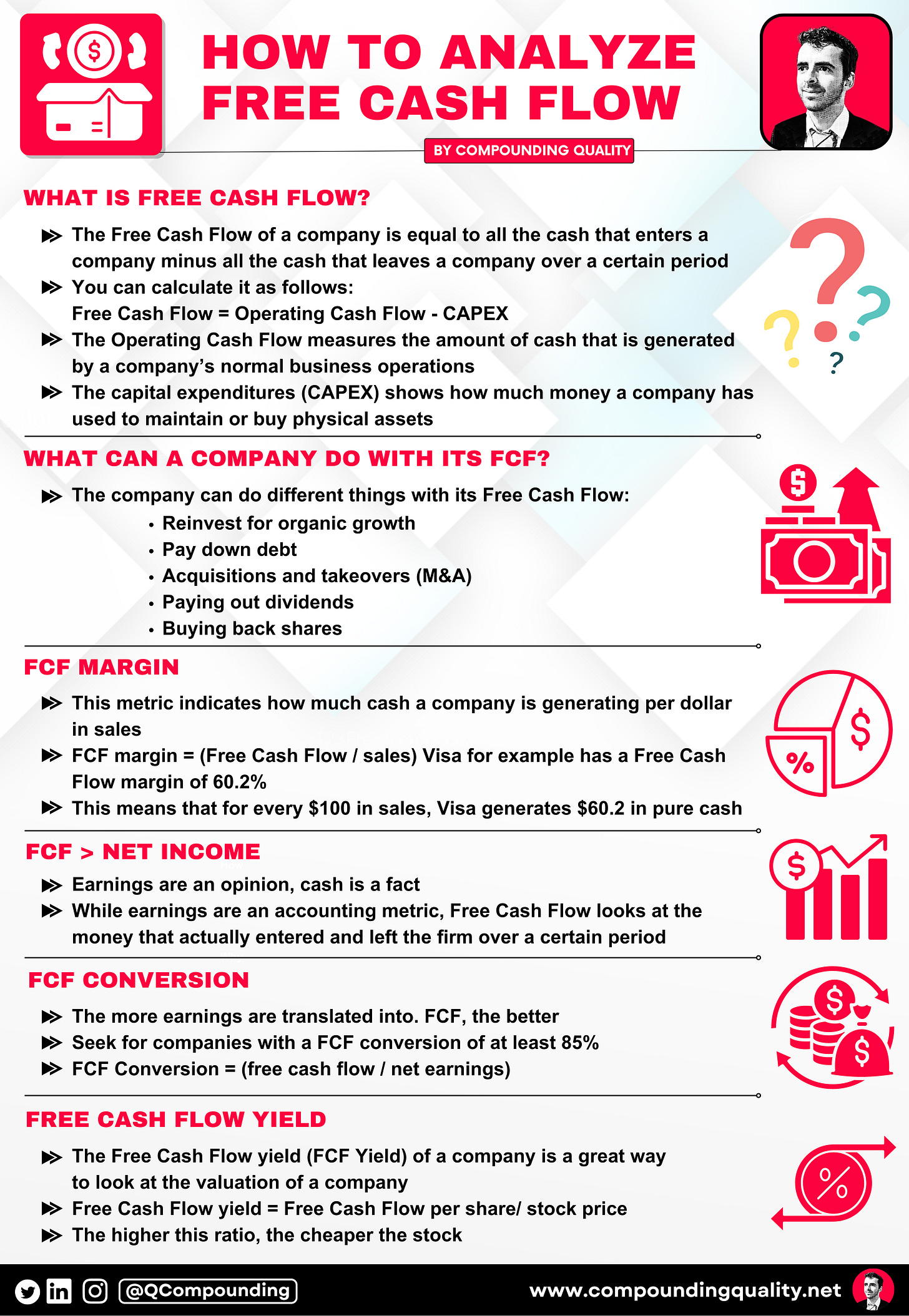

Cash Flow = King

Income is an opinion. Cash flow is a fact.

In the world of investing, Free Cash Flow (FCF) is the most important metric.

Free Cash Flow is simply the cash a company has left over once all expenses have been paid.

The Simple Formula

To calculate the Free Cash Flow, you only need two numbers:

Operating Cash Flow: The money the company make from selling its products and/or services

Capital Expenditures (CapEx): The money the company spends to keep the business running (new factories, laptops, or repairs).

Free Cash Flow = Operating Cash Flow – CapEx

You should only want to invest in small companies that are profitable.

That’s why we are looking at small caps with a positive Free Cash Flow.

This is already a great improvement from the Russell 2000.

But I still think we can do better.

Returns on Capital

Companies with strong Free Cash Flow have five strategic options:

Pay Down Debt: This strengthens the balance sheet

Reinvest: Invest back in the business to grow faster

Acquisitions: Buy other great businesses

Pay Dividends: Give cash directly to you

Buy Back Shares: Make your shares more valuable

The most attractive option?

Option number 2.

You want companies to reinvest heavily in their own future growth.

Just listen to Charlie Munger:

So here’s the strategy you can use:

Buy small companies

That are making money (positive Free Cash Flow)

And allocate that capital well (high Returns on Capital)

This strategy tends to do really well in the long term.

You could define it as ‘Small-High Quality’:

How to play this idea?

Via an ETF like the one below.