ETF Portfolio Update: October 2025

Will emerging markets outperform?

Today, investing is easier than ever.

With just one click, you can invest in thousands of companies over the entire world.

Let’s give you an update of Our ETF Portfolio today.

Emerging Markets

I’ve always been a fan of investing in emerging markets.

Why? Companies in developing countries enjoy a clear secular trend.

As these country develop, its economy grows quickly.

That makes it easier for companies active in these markets to grow attractively too.

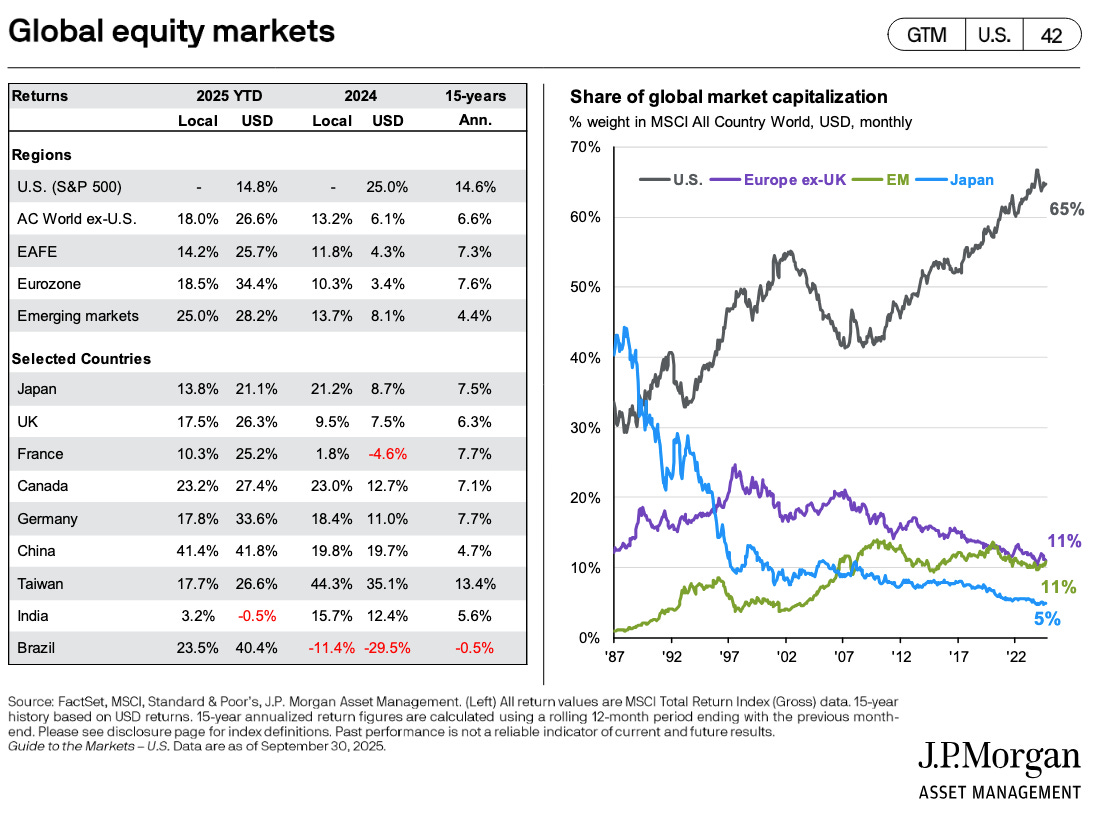

Just look at the table below.

Emerging Markets outperform the MSCI World over time:

Growing workforce

The reason why these countries are growing faster?

They have a younger population, and in some of these countries the working population is still growing.

This isn’t the case in the US and Europe.

According to the International Labor Organization, over 60% of people in low-income countries are under 25 years old, compared to just 27% in richer nations.

As a result, the real GDP growth in Emerging Markets is 4.2% compared to 1.6% in Developed Markets:

What are the main drivers for economic growth?

You know what else is interesting?

In the long term, the stock market yields an average return of around 7% per year.

Not because it's a magic number, but because there are two simple forces behind it: earnings growth and dividend yield.

Earnings growth comes from two sources: economic growth and inflation.

The economy grows by an average of 3% per year, with inflation adding another 2%. Together, that’s 5%.

Add to that an average dividend yield of 2%... and you’re at 7%.

It's no coincidence. It's easy math.Emerging markets today

Why I am writing about Emerging Markets today?

It might be interesting to have exposure to these markets nowadays.

Emerging Markets tend to outperform when:

The U.S. dollar weakens

Commodity prices rise

Valuations in Developed Markets get stretched

And guess what?

That’s exactly what’s happening today.

US companies are becoming more and more important as a percentage of the global market capitalization.

I expect some reversion to the mean over time:

Markets move in cycles

Sometimes, Developed Markets (like the U.S. or Europe) outperform.

Other times, Emerging Markets (like India, Brazil, or Indonesia) do.

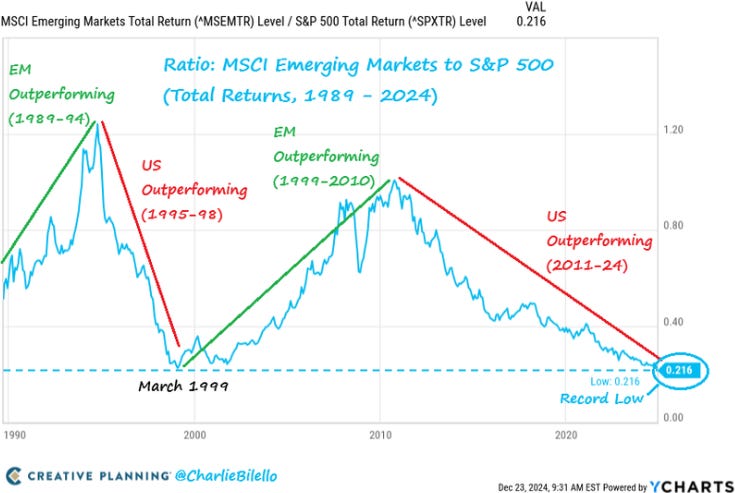

The performance tends to move in cycles:

2000–2010: Emerging Markets beat Developed Markets

2011–2025: Developed Markets (mainly the U.S.) dominated

2025? The setup might be shifting again

Just look at this graph.

It shows how the MSCI Emerging Markets Index has performed versus the S&P 500.

Emerging markets are now as cheap relative to the U.S. as they were in March 1999.

Right now, everyone is chasing the same stocks.

Developed Markets are hot. Prices are going up.

At some point, the crowd will notice that Emerging Markets are cheap. And full of opportunity.

When that happens? Emerging Markets will outperform sharply.

We want to have some exposure before that happens.

The Power of Diversification

All the stocks we own are based in developed countries.

Why?

I consider them within my circle of competence.

I strongly believe our Portfolio is set to outperform because we own the best companies in the world.

They will likely do well over time, regardless of what the market does.

I never invest in individual stocks from Emerging Markets.

I just don’t know the culture well enough.

But still… it makes sense to have some exposure to Emerging Markets.

The solution?

Buy an ETF.

An ETF gives us an easy way to diversify across hundreds of companies in Emerging Markets.

You don’t need to know each company by heart.

⭐ ETF of the Month (Spotlight)

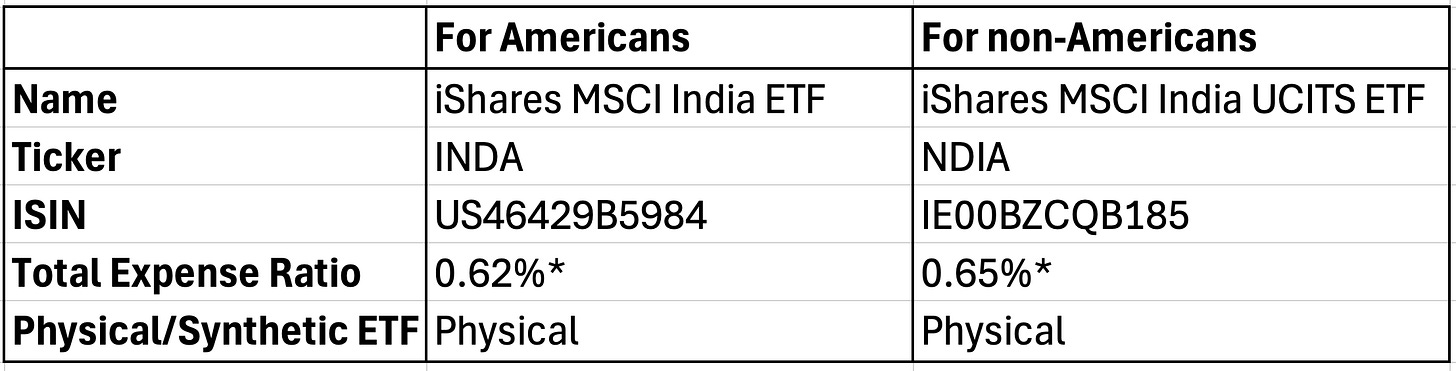

iShares MSCI India ETF

Here is some key information of the ETF:

*Ideally, we prefer a TER below 0.5%. Still, this ETF offers strong exposure to India’s fastest-growing companies and can easily make up for the slightly higher cost through superior long-term returns.

What?

The iShares MSCI India ETF invests in 162 large- and mid-cap stocks covering 85% of the Indian stock market.

It’s a very easy way to get exposure to the fast growing Indian market.

Why?

India is one of the strongest growing economies in the world.

✅ Its population is now the largest on Earth

✅ The economy is expected to grow by 6.6% per year

✅ Benefiting from rising incomes, booming infrastructure, digitalization, …

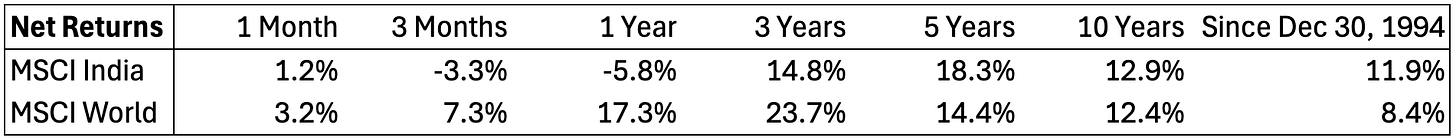

As a result, the MSCI India Index has outperformed the MSCI World by 3.5% per year since 1994.

An investment of $10,000 would be worth:

MSCI India Index: $290,117.4

MSCI World: $111,191.1

That’s a large difference.

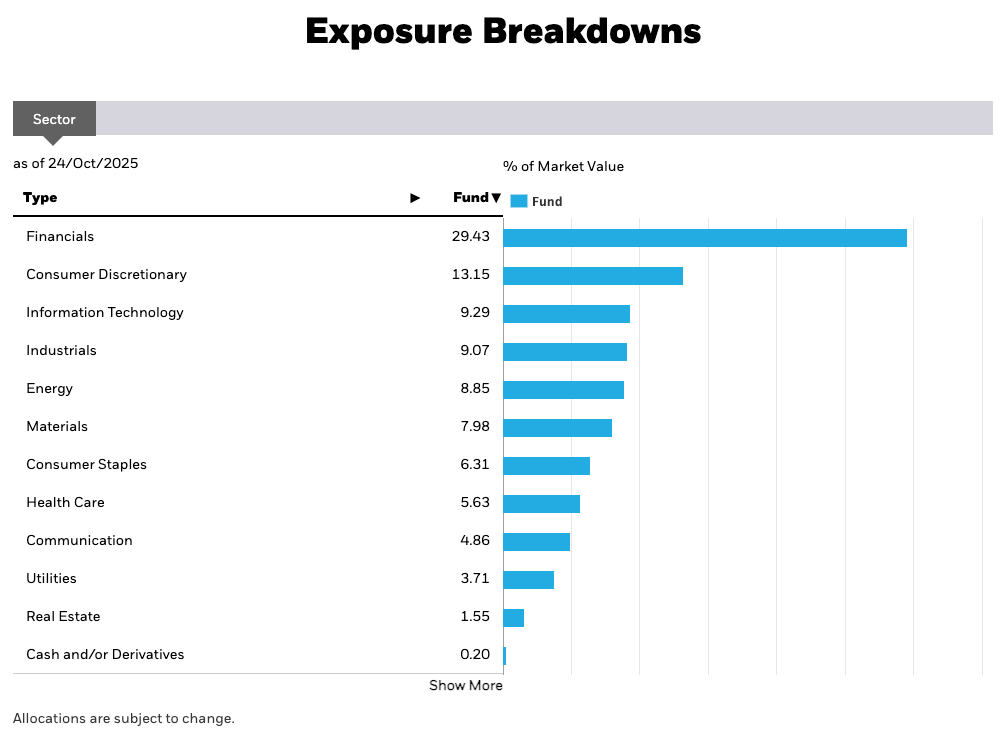

Sector split

Here’s the breakdown per sector:

Our ETF Portfolio

Our ETF Portfolio is a great mix of ETFs that should be able to outperform in the long term.

We use multiple factors that tend to do well:

👑 Quality - Only invest in companies that have already won

📏 Size - The smaller the better

🚀 Multifactor - Quality, size, value & momentum

🌏 Emerging Markets - Small exposure to Emerging Markets

Let’s now dive into the ETF Portfolio itself.

You have 24/7 access to the ETF Portfolio here: