Forget the Needle, Own the Stack

Buying a new ETF

Recently, one of the most popular newspapers and TV channels in Belgium interviewed me.

We talked about investing and which strategies you should use.

After our live talk, the news anchor approached me and asked how she could start investing.

The answer? Just keep it simple and buy an ETF.

You don't look for the needle in the haystack. Just buy the haystack!

Everyone can invest

My parents are incredibly cautious when it comes to money.

When I told them I wanted to start investing at just 13 years old, they did everything they could to discourage me:

“Your grandfather lost a fortune during the 1987 market crash.” And…

“I made bad investments in tech stocks in the 2000s.”But here’s the thing… they missed an important point.

If you had simply invested in a passive index fund in 2000, your money would have tripled.

And since 1987? That same investment would now be worth 15 times as much.

The key takeaway is that anyone can succeed in investing.

Putting money into a passive index fund, like one that tracks the S&P 500, is straightforward and effective.

In fact, with this approach, I’m confident you will outperform most professional investors over time.

The expected returns? 7-8% per year over the long haul.

Investing doesn’t have to be complicated if you’re patient and think long-term.

FAANG Bubble?

In 2024, five stocks (Nvidia, Apple, Meta, Microsoft, and Amazon) provided 45% of the returns of the S&P 500.

Nvidia on its own was responsible for 20% of the S&P 500 returns.

This trend can’t continue if you ask me.

I would encourage investors to stay away from FAANG stocks at this point in time.

That’s also why I prefer an equal-weight ETF on the S&P 500.

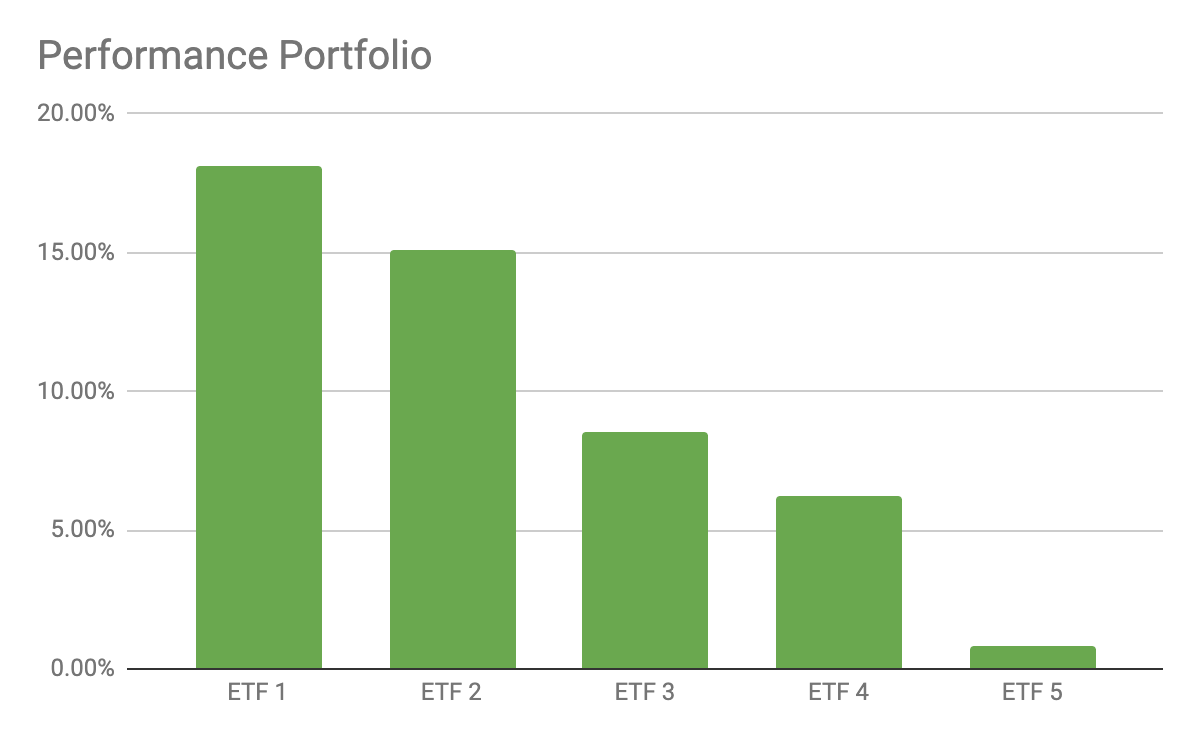

ETF Portfolio Performance

The performance of the American ETF Portfolio looks as follows:

The performance of the non-American Portfolio:

Today we’ll look in Our Portfolio and add to an existing position.