An example of a clear secular trend? Cybersecurity.

It is expected that this market will grow by almost 14% per year until 2030.

Let’s dive into Fortinet today, one of the highest quality names within the cybersecurity industry.

Fortinet

General information:

Type: Owner-Operator Quality Stock

ISIN: US34959E1091

Ticker: FTNT

Current Stock Price: $51.3

Onepager

Here’s a onepager with the essentials of Fortinet:

(Click on the picture to expand)

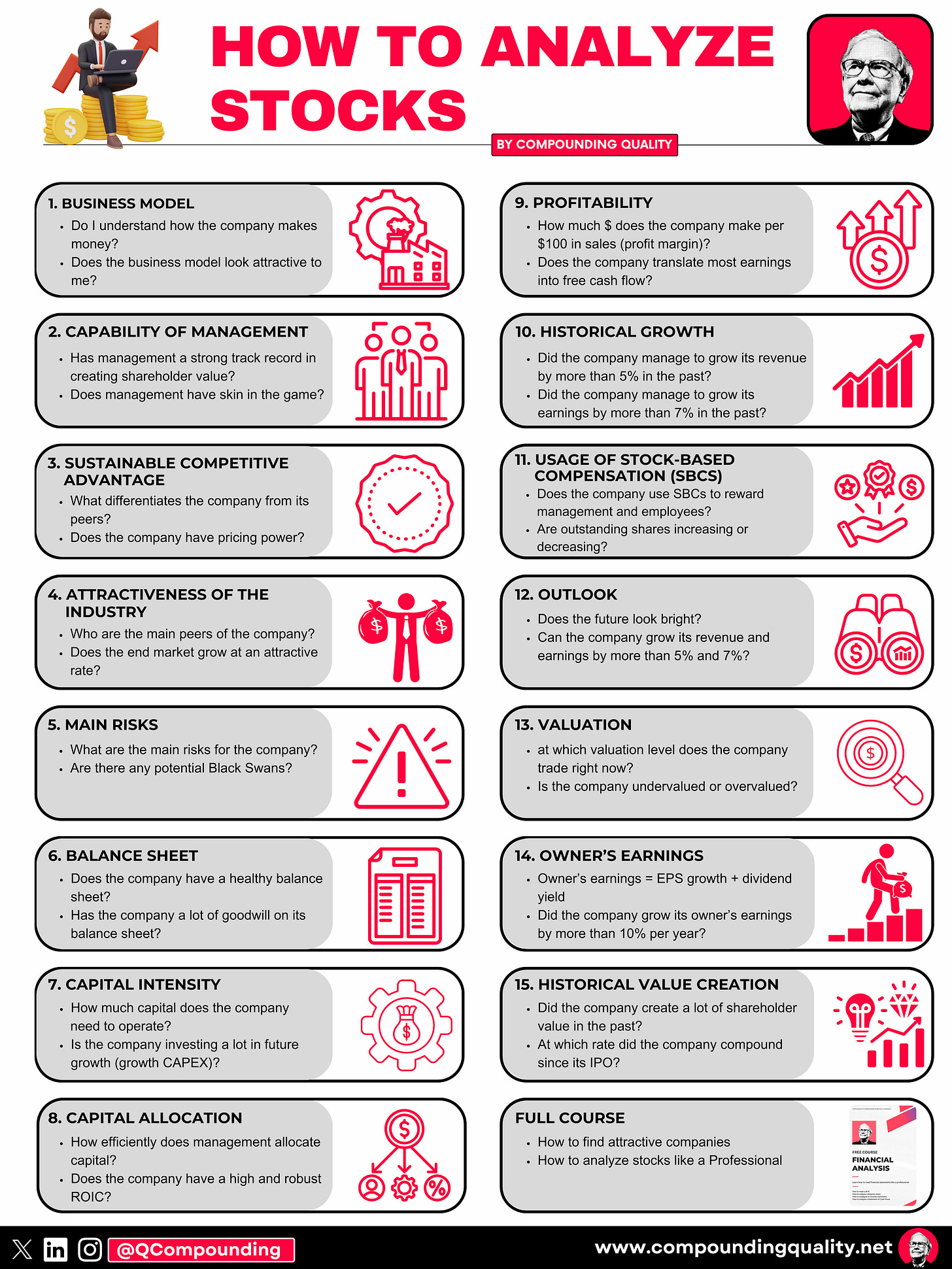

15-Step Approach

Now let’s use our 15-Step approach to analyze the company.

At the end of this article, we’ll give Fortinet a score on each of these 15 metrics which results in a Total Quality Score.

1. Do I understand the business model?

Fortinet is a global leader in cybersecurity and networking solutions for organizations, including enterprises, communication service providers, government organizations and small businesses.

The company focuses on 6 areas.

I’ll try to explain each segment to you like I would to my 11-year old niece (Keep It Simple, Stupid!):

Secure Networking: making sure that the way computers and devices connect and share data is protected from bad people or harmful software.

Zero Trust Access: Fortinet’s Zero Trust Access enables customers to know and control who and what is on their network

Cloud Security: Cloud security is about keeping your data and applications safe when using cloud services. It involves using strong passwords, encryption, and other measures to protect information stored and used in the cloud. Fortinet uses their virtual firewall and other software products for this.

AI-Driven Security Operations: Using artificial intelligence to help protect computer networks. It means using smart computer programs to detect and respond to security threats more quickly and effectively.

FortiGuard Security Services: FortiGuard security services counter threats in real time with AI-powered, coordinated protection. It includes things like antivirus, intrusion detection, and web filtering to keep computer networks safe from threats

Support and Professional Services: It provides assistance and guidance to customers who use Fortinet's products. FortiCare support helps with troubleshooting issues, software updates, and ensuring that these security systems work effectively.

2. Is management capable?

Ken Xie and Michael Xie founded Fortinet in 2000.

Ken Xie has been the CEO since 2000 and his brother Michael Xie is the President and Chief Technology Officer (CTO).

Ken Xie owns 8.1% of the company and Michael Xie owns 8.9%. All insiders together own 17.5% of the outstanding shares.

This means we’re talking about an Owner-Operator Quality Stock.

3. Does the company have a sustainable competitive advantage?

Fortinet has a sustainable competitive advantage based on switching costs and network effects.

Switching costs: It’s difficult for customers to switch to other cybersecurity vendors due to Fortinet’s extensive presence across IT infrastructure and a need for retraining

Network effects: Fortinet uses AI to analyze data from their security solutions, helping the company to detect and respond to threats more effectively. This attracts more customers and enriches their threat detection capabilities, creating a reinforcing loop

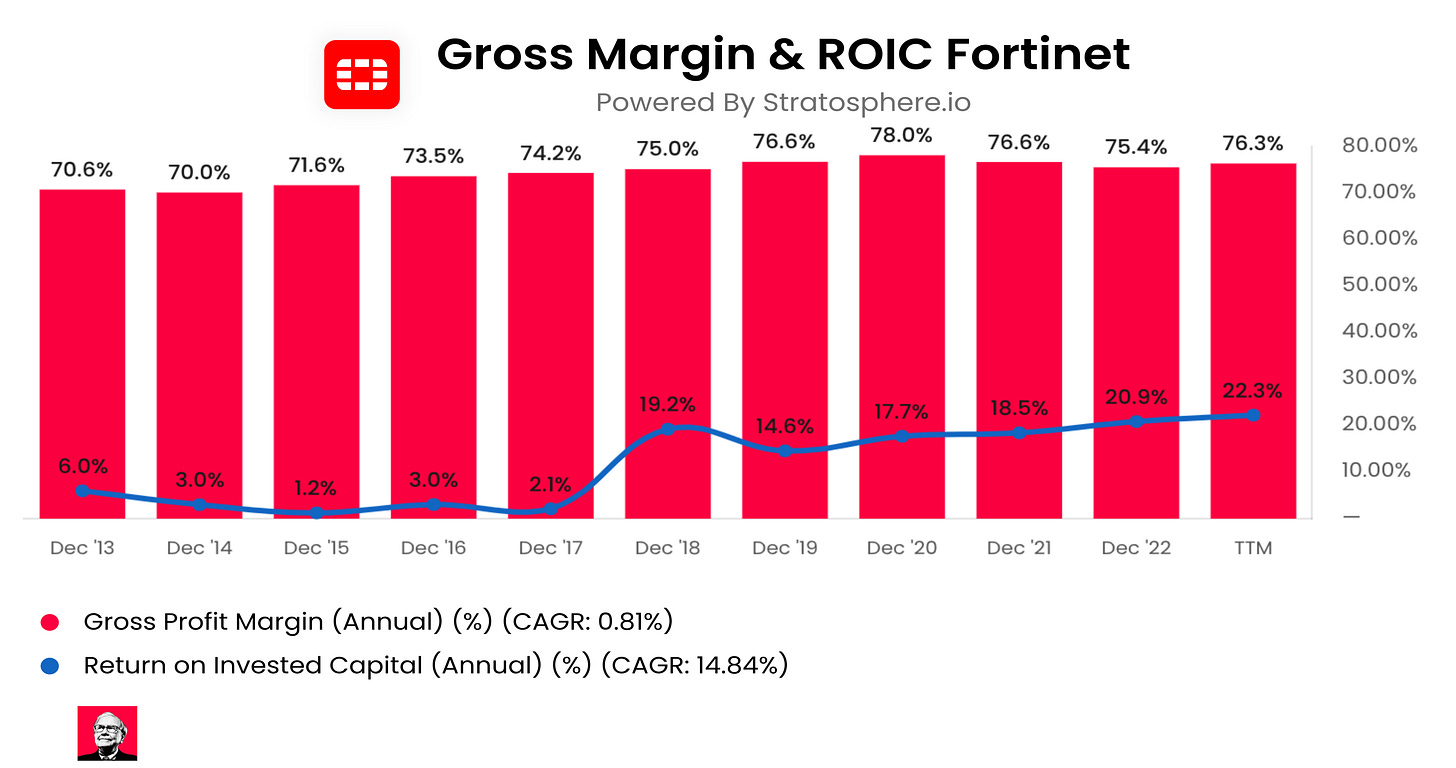

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin and ROIC:

Fortinet reached a tipping point in terms of profitability in 2018, explaining the strong increase in ROIC.

4. Is the company active in an attractive end market?

The cybersecurity market is highly fragmented. Palo Alto Networks is the market leader followed by Fortinet.

It is highly likely that the industry will consolidate in the years to come. Currently, it is estimated that companies use 60-80 different security solutions and that they wish to narrow down this number to 15-20 key solutions. This offers opportunities for platform-based cybersecurity companies like Fortinet as they can help companies to consolidate their digital footprint.

Fortinet estimates that their Total Addressable Market (TAM) will grow from $122 billion in 2023 to $192 billion by 2027, a CAGR of 12.0%.

5. What are the main risks for the company?

Some of the main risks for Fortinet:

Major public cloud providers could start providing their own security solutions

Disruption: what will the industry look like in 10 years from now?

A risk that Fortinet misses the next big technology

Reputational risks due to data breaches

Regulatory risks

Rich valuation level (see later)

Now let’s dive into the Fundamentals of Fortinet and give them a Total Quality Score based on all 15 metrics.