Time to buy this stock?

Extensive Portfolio Update (Part II)

Investing is a beautiful intellectual game.

You are receiving an extensive Portfolio Update.

This helps you to make the right investment decision.

You can read the first part here.

Brown & Brown ($BRO)

How does the company make money?

Brown & Brown is an American insurance company. They act as a middleman to find the right coverage for things like cars, homes, health, or businesses.Weight in Portfolio: 4.7%

Performance (%): +8.8%

Update investment case

Brown & Brown is a phenomenal company in Our Portfolio. I’m very proud to own it.

The interesting part? Insurance companies are struggling a little bit right now. This is something we like as we love to buy amazing companies at lower prices.

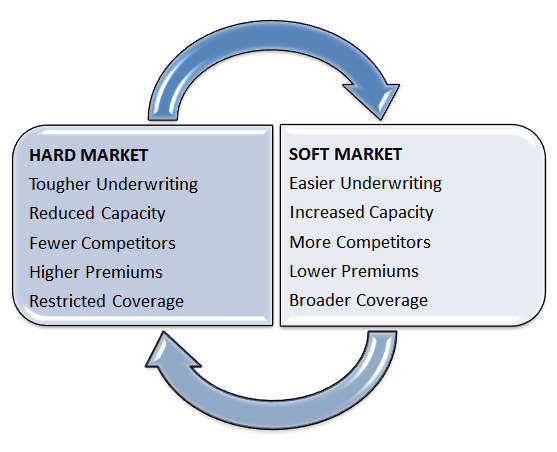

The insurance industry is characterized by a soft market and hard market. They indicate the general conditions of the insurance industry:

A hard market is usually more attractive for insurance companies like Brown & Brown.

But today, we’re moving more and more into a soft market. Insurance companies are reducing their prices to attract new business.

This results in more competitive pricing and reduced margins.

This story from Mike Kehoe (CEO of Kinsale Capital) probably shows it best:

On average, soft markets tend to last 3-7 years while hard markets last 1-4 years.

Is this the most ideal situation for an insurance company like Brown & Brown?

No. But I think the quality of the business is more than strong enough to keep performing well in the years ahead.

If we look at the most recent results of Brown & Brown (Q2 Results published in July), here are the most important takeaways:

Strong revenue growth: +9.1% (organic growth: +3.6%)

Adjusted EPS: +10.8%

Brown & Bron completed 15 acquisitions in the quarter, adding $22 million in estimated annual revenue (BRO is a serial acquirer)

The most important happening for Brown & Brown over the past few months?

The acquisition of Accession Risk Management.

What is Accession Risk Management?

Accession Risk Management is a significant player in the insurance industry, with over 5,000 professionals operating across the U.S. and Canada. The company primarily focuses on the middle-market segment and has a strong track record of growth, having completed more than 190 acquisitions to date. In 2024, Accession reported pro forma revenue of $1.7 billion and placed $15.7 billion in premiums. Its revenue has grown rapidly over the past few years, rising from $663 million in 2020 to $1.7 billion today.The deal in bullet points:

Deal size & financing:

$9.83 billion cash-and-stock acquisition.

$4 billion to be raised, leading to 13.3% shareholder dilution.

Valuation & growth:

BRO paying 5.7x revenue (compared to BRO’s 6.2x earnings multiple).

Appears expensive, but Accession’s revenue is predictable and growing fast.

Impact on shareholders:

Dilution of 13.3% offset by expected net income contribution.

Accession could add ~$148 million in net income (assuming BRO margins), roughly +13.6% to BRO’s net income.

The key insight on my end? I like the deal and I believe in the capital allocation skills of management.

The multiple paid for acquiring Accession might look high at first sight but they have a very predictable revenue stream and operate at attractive profitability rates.

You might see the dilution as a negative thing on first sight but it’s more than offset by the increase in revenue and net income.

I’m very tempted to add to my Brown & Brown at this point in time.

Current valuation level

Expectations intrinsic value

Expected growth intrinsic value 2026: +12.0%

Expected growth intrinsic value in the long term: +12.0%

Conviction level

8.5/10: Brown & Brown is an amazing company that starts to trade at attractive valuation levels. It might be an interesting time to add to our position.

We change our rating from ‘Buy’ to ‘Strong Buy’