Fundsmith - one of the best quality funds in the world

One of the best quality equity funds in the world

Hello everyone,

Recently we wrote a Twiter Thread about Fundsmith, a quality fund managed by Terry Smith:

Please let me know if it adds value to you that we also put this Twitter Thread on our blog. Feedback is more than welcome.

1. In this thread, we will cover one of the purest Quality Investment Funds in the world: Fundsmith. Since the fund launched in 2010, they achieved an astonishing CAGR of 15.46% after fees.

2. Fundsmith’s investment philosophy is based on 3 pillars:

Buy good companies

Don’t overpay

Do nothing

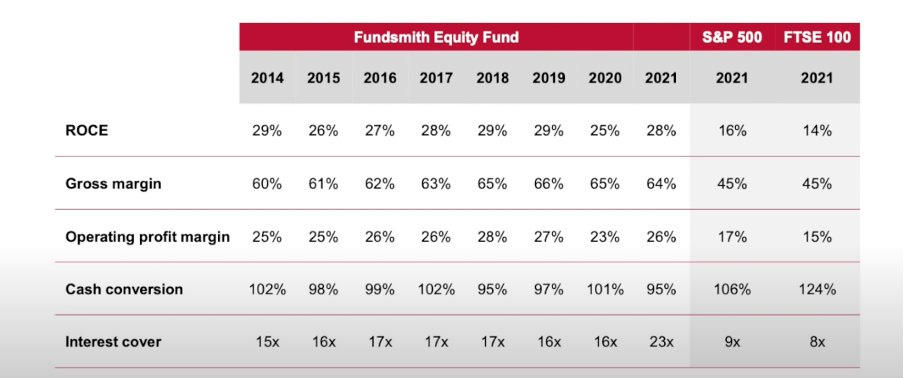

3. First and foremost, you want to buy good companies. These are companies with a healthy balance sheet, good capital allocation, strong secular trend, high margins, and integer management. Here you can find the characteristics of Terry Smith’s portfolio:

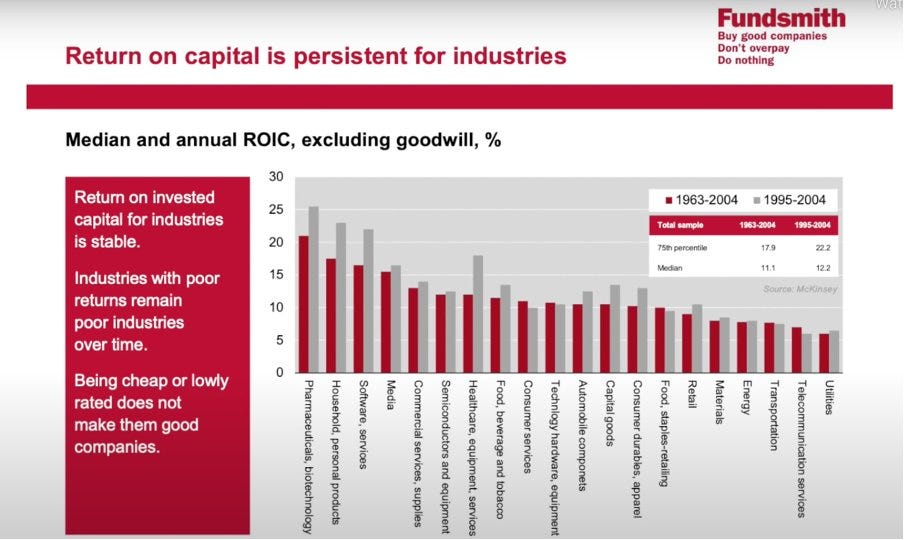

4. Capital allocation metrics (e.g., ROIC / ROCE) are very important for quality investors. When you can find great capital allocators who operate at high margins and are operating in an industry with a strong secular trend, you have a strong advantage as an investor.

5. Charlie Munger also talks about the importance of capital allocation: "Over the LT, it's hard for a stock to earn a better return than the underlying business. If they earn 6% on capital over 40 years and you hold it for 40 years, you're not going to make much more than 6%.”

6. FCF conversion is very important too. How much of earnings are translated into free cash flow? Make sure to subtract stock-based compensations from the FCF. You prefer companies with constant and structurally high conversion ratios. L’Oréal is a good example:

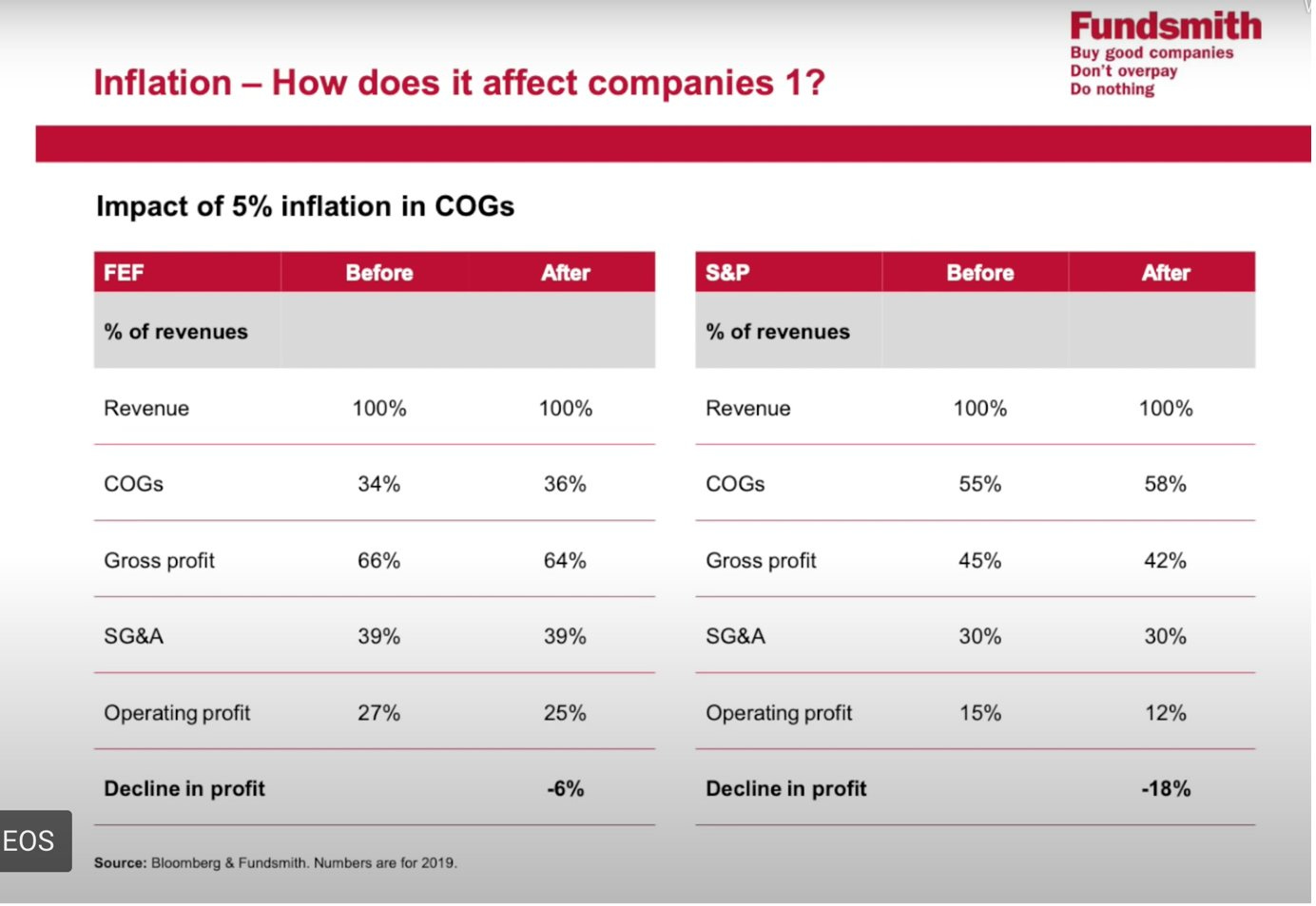

7. Quality companies usually perform better than non-quality companies in periods of high inflation. Why? Because they have more pricing power and an increase in COGS doesn’t have as much impact on their FCF and FCF margins:

8. Obviously, you don’t want to overpay for quality. However, quality investors first screen for the quality of a business and afterwards look at the price. Dixit Buffett: “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

9. "If you bought the S&P 500 at a P/E of 5.3x in 1917 and sold it in 1999 at a P/E of 34x, your annual return would have been 11.6%. Only 2.3% p.a. came from the massive increase in P/E. The rest of your return came from the companies’ earnings and reinvestments." - Terry Smith

10. It is also very important to trade as less as possible. It is proven that death investors perform better than most investors due to their lack of trading. Trading costs harm your compound effect:

11. Over the medium and long term, quality stocks perform better than the market in general. Just look at the MSCI Quality Index:

12. Terry Smith performs even better than that with a return of 433.25% since their IPO (compared to 218.33% for the S&P500). Their CAGR (15.46%) is remarkable especially since Fundsmith is down -20.5% YTD.

13. In total, Fundsmith has 26 positions. In the picture hereunder, you can see some quality metrics for all positions. Please note that data per 31/12/21 of Bloomberg were used. So new positions like Alphabet and Adobe were not included. Facebook (Meta) is also not included.

14. As already said, Fundsmith achieved an astonish CAGR of 15.46%. The funny thing is that when Fundsmith would have held their current portfolio (per 31/12/2021) since 2010, their CAGR would have been 21.67%! In recent years, Terry Smith focused more on technology companies.

Love Terry, great article!

This is great! Looking forward to more content from you 😄