It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

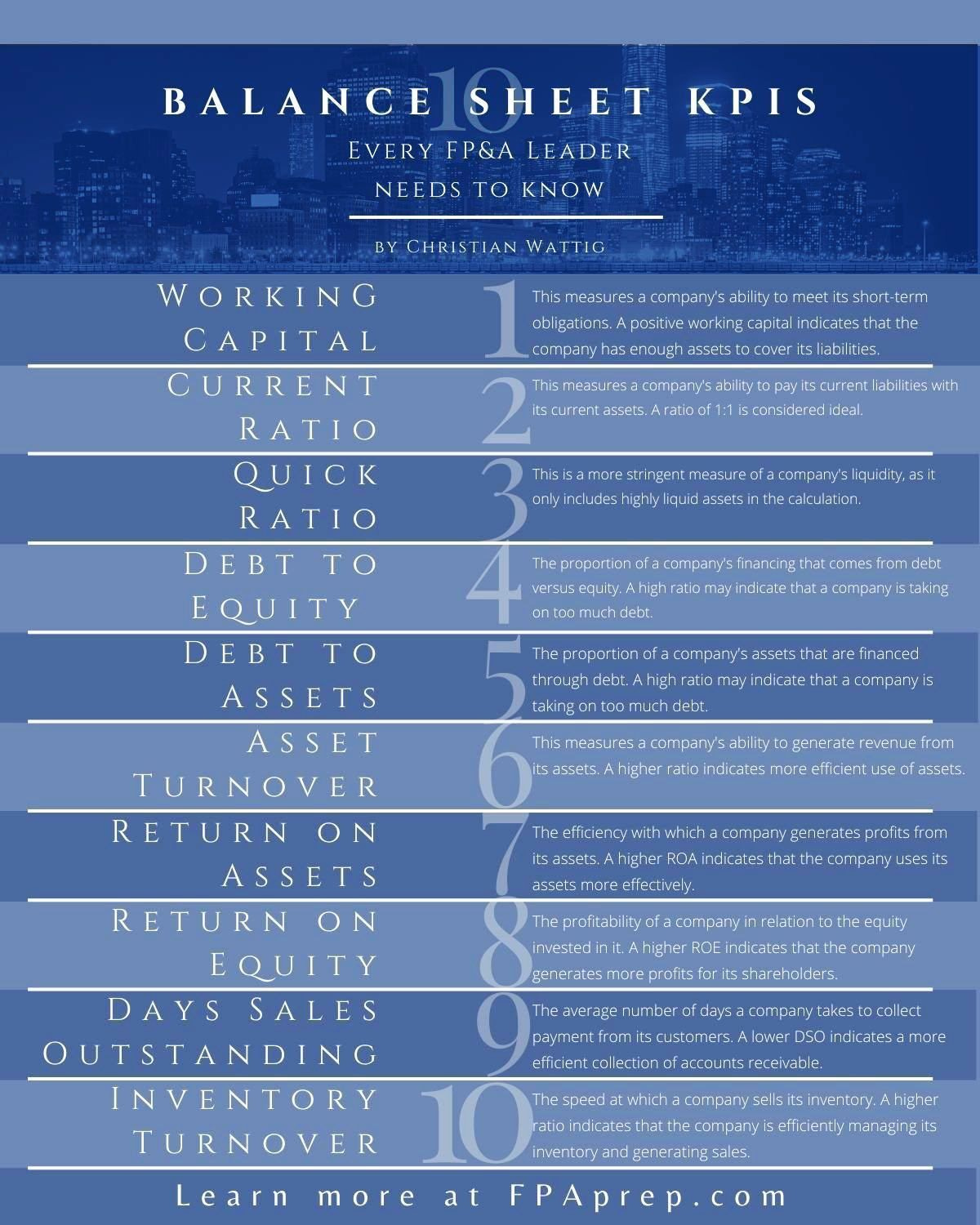

You know how to analyze a balance sheet?

This framework from Christian Wattig will help you:

There’s always something to worry about.

Since 1900, the Dow Jones increased from 66 points to more than 37,500 points and this while we had two world wars, nuclear boms, epidemics, and much more.

The next 100 years will probably be the same.

When you expect that the Dow Jones will return more than 8% per year until 2100, the Dow Jones will be valued at more than 1,500,000 points.

Never ever underestimate the power of incentives.

Invest in companies where the interests of management are aligned with the ones of you as a shareholder.

"Never ask a barber if you need a haircut." - Warren Buffett

Visuals can be very powerful.

Here are 15 visuals every investor needs to memorize:

Read the thread

Alphabet is a fantastic business and it still trading at reasonable valuation levels.

Charlie Munger once said that Alphabet has the widest moat he has ever seen.

Here’s a onepager summarizing the essentials (click on the picture to expand):

If you enjoyed this piece, please hit the “Like” button. Thank you for your support!

That’s it for today.

Whenever you’re ready, here’s how I can help you:

Until the 31st of December, you pay only $399 instead of $499.

Upgrade to paid

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Compounding Quality serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

The information found on this website should not be interpreted as investment advice, nor does it express any viewpoint on the future trading prices of any company's securities. The opinions and information shared here should not be taken as specific guidance for making investment decisions. Investors are encouraged to conduct their own research and evaluations based on publicly available information, rather than relying on the content herein.

No Offer or Solicitation

The content, including opinions and expressions, present on this website, is not a direct or indirect offer or solicitation to buy or sell securities or financial instruments mentioned.

Forward-Looking Statements and Uncertainties

Any forward-looking statements, projections, or market forecasts contained in this content are inherently uncertain and speculative. They are based on certain assumptions and may not accurately reflect actual future events. Unforeseen events might impact the performance of discussed securities significantly. The provided information is current as of the preparation date and might not apply to future circumstances. The publisher is not obligated to correct, update, or revise the content beyond its initial publication date.

Position Disclosures

The publisher, its affiliates, and clients may hold long or short positions in the securities of companies mentioned. Such positions are subject to change without guarantee.

Liability Disclaimer

Neither the publisher nor its affiliates assume liability for any direct or consequential losses arising directly or indirectly from the use of the information provided in this content.

Consent and Agreement

By accessing the site or affiliated social media accounts, you signify your agreement to this disclaimer and the terms of use. Unauthorized reproduction of the content, whether through photocopying or other means, is unlawful and subject to legal consequences.

Website Ownership and Terms

Compounding Quality (www.compoundingquality.net) is operated by Substack. By accessing the site, you agree to adhere to the current Terms of Use and Privacy Policy. These terms are subject to potential amendments. The content on this site does not constitute an offer to buy, sell, or subscribe to securities where prohibited by law.

Regulation and Investment Guidance

Compounding Quality is not an underwriter, broker-dealer, Title III crowdfunding portal, or valuation service. The site does not provide investment advice or transaction structuring.

Compounding Quality does not validate the adequacy, accuracy, or completeness of information provided. Neither the publisher nor any associated parties make any warranties, explicit or implied, regarding the information's accuracy or the use of the site.

Investing in securities carries substantial risk, and investors should be prepared for potential loss. Each individual should independently assess whether to invest based on their own analysis.

CQ, thank you for another awesome post!

Earlier today I listened to and enormously enjoyed your interview on The Millennial Investing podcast. This interview, by itself, is a master class on Quality Investing! Outstanding work as always, my friend and partner!