EBITDA is an opinion, cash flow is a fact.

The Cash Flow Statement is one of the most important statements in a 10-K.

In this article, I’ll teach you how to analyze a Statement of Cash Flows in a few minutes.

What is a Cash Flow statement?

A cash flow statement shows you how much cash goes in and out a company over a certain period.

The purpose of this statement is to track how much cash is moving through a business.

You want to invest in companies that generate cash and manage their cash position very well.

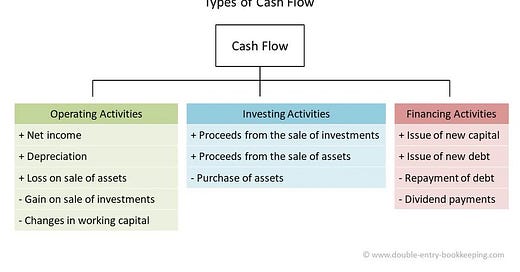

Every cash flow statement consists of 3 parts:

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Cash Flow from Financing Activities

In this article, we’ll use an example to make everything clear:

Difference with an income statement and balance sheet

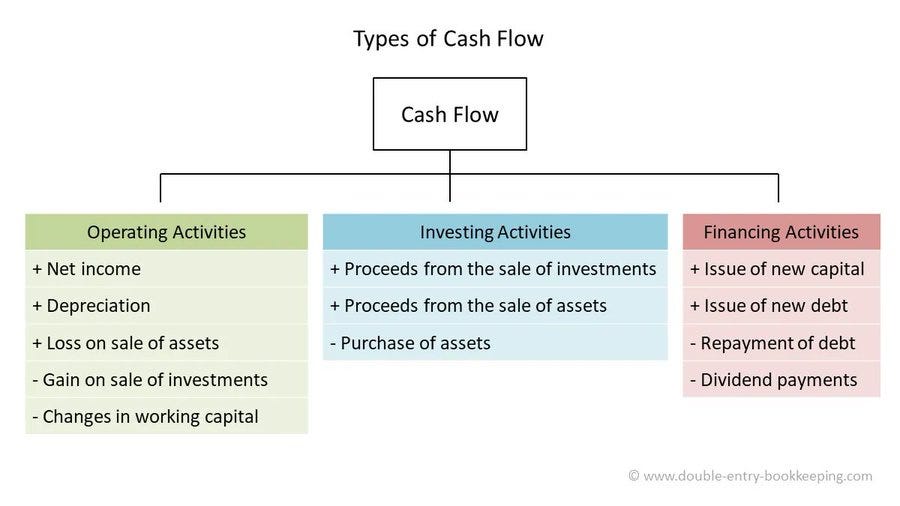

There is an important difference between a cash flow statement and an income statement and balance sheet.

A balance sheet and income statement use ACCRUAL ACCOUNTING. This is a method where revenue and expenses are recorded when an accounting transaction occurs.

A cash flow statement uses CASH ACCOUNTING. As a result, the cash flow statement only records transactions when money effectively enters or exits the company.

This a very important difference.

Balance sheet and income statement = Accrual accounting

Cash flow statement = Cash accounting

Now you know the difference between accrual accounting and cash accounting, we’ll dig into each section of the Cash Flow Statement.

Cash Flow from Operating Activities

This section shows all cash the company generated from its normal business activities.

In other words: it shows you all the cash a company earned from selling its normal products and/or services.

When a beer company generates $2 per beer in operating cash flow and sold 2 million beers in a certain year, its cash flow from operating activities would be equal to $4 million.

The cash flow from operating activities is comparable to net income, but it filters out a few income and expense posts that didn’t cause actual cash to enter or exit the company.

You can calculate the cash flow from operating activities as follows:

Cash Flow from operating activities = net income + non-cash charges +/- changes in working capital

Non-cash charges

A non-cash charge is a write down or accounting expense that does not involve a cash payment.

A few examples of non-cash items:

Depreciation and amortization

Asset impairment

Deferred income tax

Write-downs of goodwill

Stock-based compensation

Working capital

Working capital is the money a company has available to meet its current, short-term obligations.

Working capital = Accounts receivable + Inventory - Accounts payable

As can be seen in the formula, working capital consists of 3 parts:

Accounts receivable: the money customers owe the company

Accounts payable: the money the company owes its suppliers

Inventory: the value of the goods that the company hasn’t sold yet

The less working capital a company needs, the better.

Why? Because it means that a company doesn’t need much cash to fund its ongoing business activities.

A few companies even have a negative working capital. This means that its suppliers are funding the ongoing business activities of the company as the accounts payable are larger than the accounts receivable + inventories.

Changes in working capital

Remember that from going to net income to operating cash flow, you only needed to take the changes in working capital into account.

Let’s show the formula again to refresh your mind:

Net cash provided by operating activities = net income + non-cash charges +/- changes in working capital

Why do you only need to take the changes in working capital into account? Because when a company needed $5 million to fund its operations last year and it also needs $5 million to fund its operations this year, there were no cash changes.

Changes in working capital:

Accounts receivable: negative if it increases.

Why? Because clients not paying you immediately can be seen as giving a small loan to your customers for a short period

Inventory: negative if it increases

Why? Because you aren’t earning money on products in your inventory

Accounts payable: positive if it increases

Why? Because if you don’t pay your suppliers immediately, your suppliers are giving a ‘free loan’ to you

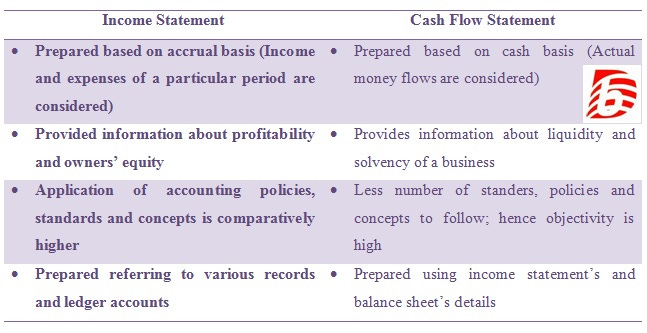

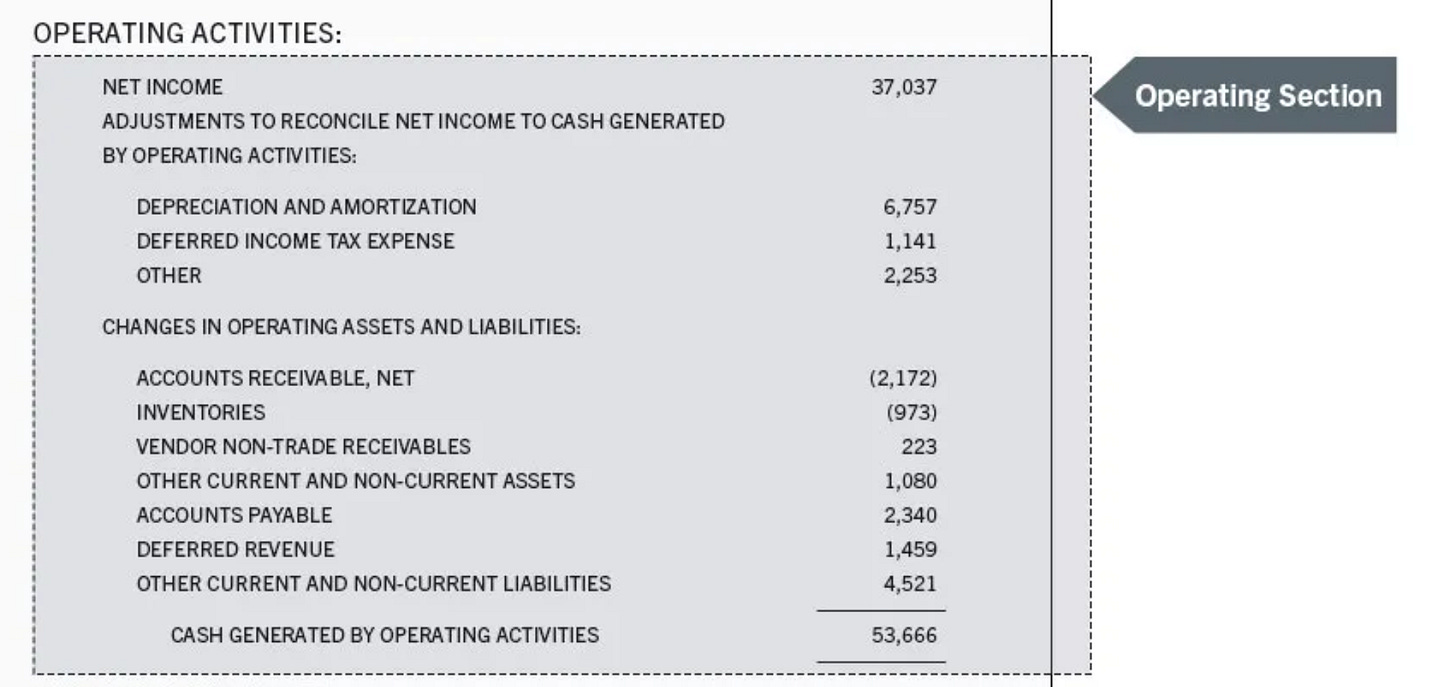

Example Cash Flow from Operating Activities

You don’t understand everything completely yet? No worries.

An example will make everything a lot more clear. Let’s use these numbers:

Net cash provided by operating activities = net income + non-cash charges +/- changes in working capital

Net cash provided by operating activities = $37,037 + ($6,757 + $1,141 + $2,253) + (-$2,172 - $973 + $223 + $1,080 + $2,340 + $1,459 + $4,521) = $53,666

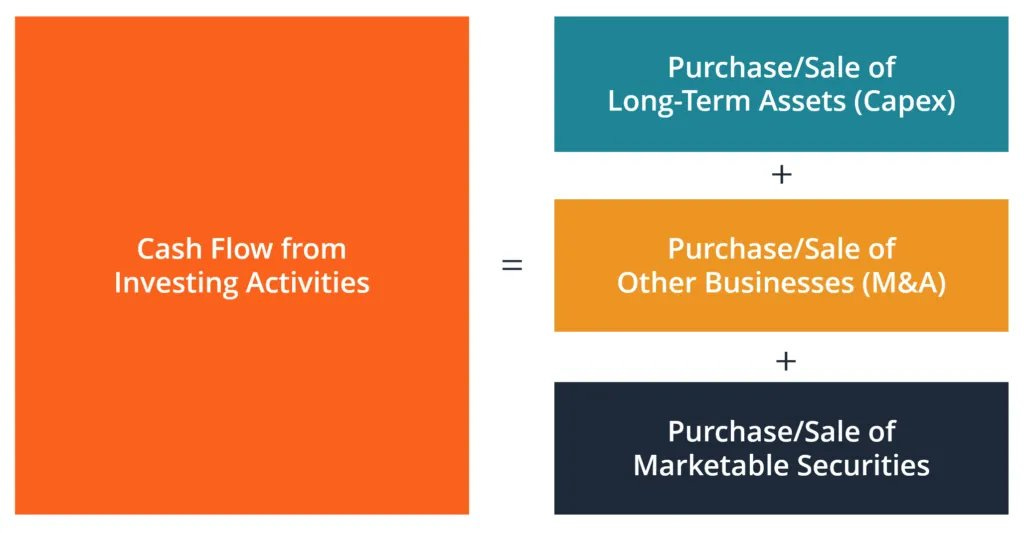

Cash Flow from Investing Activities

The Cash Flow from Investing Activities gives you an overview about the company’s investment related income and expenditures.

The Cash Flow from Investing Activities consists of 3 major parts:

Capital expenditures (CAPEX)

The cash a company spends to buy, maintain or improve its fixed assets (buildings, vehicles, equipment, land, …)

Mergers & Acquisitions

Purchase/Sale of marketable securities

Marketable securities are assets that can be liquidated to cash quickly. These securities can be bought and sold on a public stock exchange

You can calculate the cash flow from investing activities as follows:

Cash flow from investing activities = Sale of marketable securities + divestments - CAPEX - Mergers & Acquisitions - purchase of marketable securities

Example Cash Flow from Investing Activities

Now let’s make everything concrete again with our example:

Cash flow from Investing Activities = Sale of marketable securities + divestments - CAPEX - Mergers & Acquisitions - purchase of marketable securities +/- other

Cash flow from investing activities = ($104,130 + $20,317) + $0 - $0 - ($496 + $8,165 + $911) - $148,489 - $160 = -$33,774

Free cash flow

After you’ve taken a look at a company’s cash flow from operations and cash flow from investing activities, you can calculate the free cash flow.

Free cash flow = operating cash flow - CAPEX

The free cash flow of a company is one of the most important financial metrics.

If you want to learn more about free cash flow, take a look at this article: What you need to know about free cash flow.

Cash Flow from Financing Activities

Last but not least, the Cash Flow from Financing Activities measures the cash movements between a company and its owners (shareholders) and its debtors (bondholders).

This section gives you an insight about how the company is financing its business activities.

The Cash Flow from Financing Activities consists of 3 major parts:

Borrowing and repaying debt

Issuance of stocks and share buybacks

Dividends

You can calculate the cash flow from financing activities as follows:

Cash Flow from financing activities = Debt issuance + issuance of new stocks - dividends - debt repayments - share buybacks

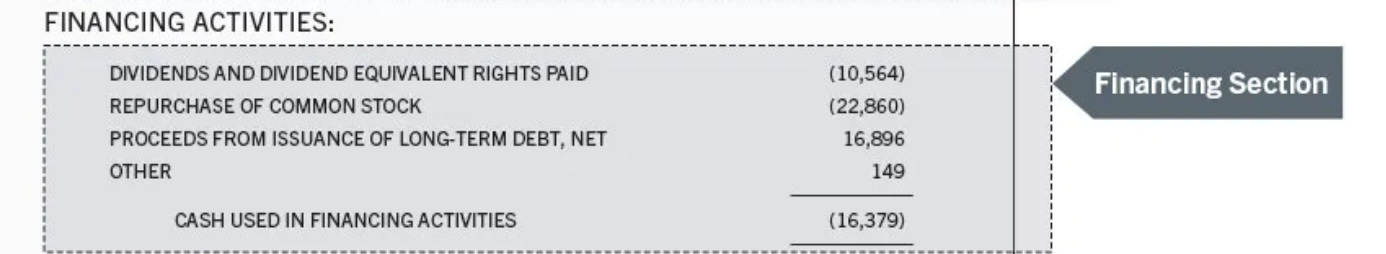

Example of Cash Flow from Financing Activities

Now you know the formula to calculate the Cash Flow from Financing Activities, we can calculate it for our example:

Cash Flow from financing activities = Debt issuance + issuance of new stocks - dividends - debt repayments - share buybacks +/- other

Cash flow from financing activities = $16,896 + $0 - $10,564 - $0 - $22,860 + $149 = -$16,379

Changes in cash balance

Finally, you can calculate the total changes in the cash balance:

Cash at the end of the year = Cash at the beginning of the year + CF from operating activities + CF from investing activities + CF from financing activities

In our example:

Cash at the end of the year = cash at the beginning of the year + operating cash flow + investing cash flow + investing cash flow

Cash at the end of the year = $10,746 + $53,666 - $33,774 - $16,379 = $14,259

It is a good sign when the cash at the end of the year is higher than the cash at the beginning of the year.

Why? Because it means that there is a positive difference between the cash that has entered the company and the cash that has left the company over a certain period.

Conclusion

That’s it for today. Here’s what you should remember:

The cash flow statement shows how much cash goes in and out a company over a certain period.

It consists of 3 parts: Cash Flow from Operating Activities, Investing Activities and Financing Activities

Cash Flow from Operating Activities: cash that enters and leaves the company from its normal business activities (selling its products and services)

Cash Flow from Investing Activities: cash the company needs to (dis)invest to maintain its normal business activities

Cash Flow from Financing Activities: cash movements between a company and its owners (shareholders) and its debtors (bondholders)

Financial statement series

This was the last article in this series.

If you liked this, you might also be interested in our previous articles:

Please note that every single article we write today is completely free. If this article was helpful for you, please let us know via a like or reaction in the comments. The greatest gift we can ask for you is that you share our Substack with friends and family.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Thanks for reading Compounding Quality ! You can subscribe for free here to receive our future articles:

Nice work, CQ!

Thank you so much for having this content free, it’s greatly appreciated, im sure everyone reading agrees!