🔍How to analyze a stock

Learn to write investment cases like a professional

Knowing how to analyze a stock is crucial to make good investment decisions.

The best investors in the world use a strict and rational framework to analyze stocks.

In this article, I’ll teach you how to analyze stocks like a professional.

Start reading about the company

After you found a company which might be interesting, you should start with reading everything you possible can about the company.

Let’s say that you want to analyze S&P Global. You start by looking at the following sources:

After you’ve read a few hours about the company, you’re already able to form a first impression.

If the stock still looks interesting, you can dive deeper and write a full investment case.

Investment case

The beautiful thing about writing investment cases is that you can use the same structure for each case.

This also means that the more investment cases you write, the better you’ll get at it.

We’ll show you step by step how you can do this.

1. Business profile

First things first: it all starts with the business profile.

How does the company make money? Do I understand the products/services the company sells?

If the business profile doesn’t look attractive to you or you don’t understand it properly, you can stop looking into the company right away.

Always invest within your circle of competence.

2. Revenue split

After you’ve taken a look at the business profile of the company, you can go on and look at the revenue split.

In which different segments does the company make money? And how does the geographical split look like?

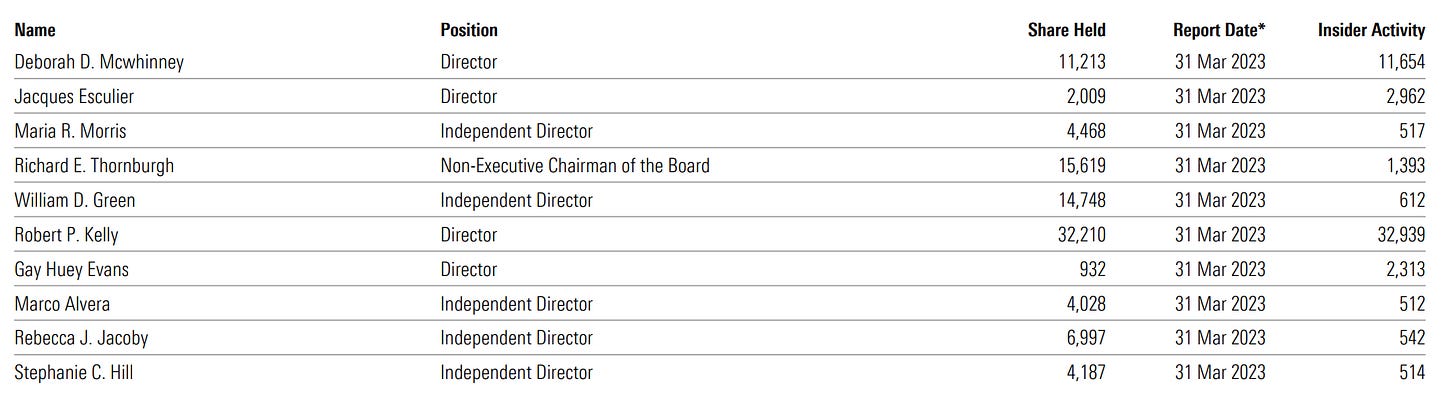

3. Management and shareholder structure

You want to invest in companies which are led by great managers.

It’s always interesting to look at the track record of current management. Preferably, you want to invest in companies with skin in the game.

When insiders are heavily buying into their own stock, it’s a great sign too.

4. Moat

A moat is crucial for quality investors.

You want to invest in clear market leaders with strong pricing power. Those companies are often characterized by high and stable gross margins as well as high and stable Returns On Invested Capital.

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable.“ – Warren Buffett

S&P Global has a wide moat without doubt. Together with Moody’s and Fitch, they are the clear market leader in bond ratings. S&P Global has a lot of pricing power too. On average, they increase their prices with 4% per year.

If you want to learn more about moats, take a look here: 👑 What you need to know about moats

5. SWOT Analysis

Identifying the strengths and weaknesses as well as the opportunities and threats of a company is crucial to make good investment decisions.

Invest in companies with a lot of strengths & opportunities but with only limited weaknesses & threats.

Main strengths/opportunities S&P Global:

Sustainable competitive advantage

Pricing power

Active in a strong secular trend

Capital light business model

High profitability

Main weaknesses/risks S&P Global

High valuation

6. Capital intensity

The best companies don’t require too much capital to grow.

That’s why you should always look at the capital intensity of a company before you consider investing.

The CAPEX/Sales and CAPEX/Operating Cash Flow are 2 great metrics to look at the capital intensity of a company.

Seek for companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 15%.*

S&P Global has a very low capital intensity:

CAPEX/Sales: 0.8%

CAPEX/ Operating Cash Flow: 2.6%

* Please note that when a company is investing heavily in future growth, the growth CAPEX can be very high. This is no problem for quality investors as long as the growth investments create value (ROIC > WACC)

7. Capital allocation

Capital allocation is the most important task of management.

When a company generates free cash flow, it can allocate this cash as follows:

Reinvest in the business

M&A

Dividends

Share buybacks

In an ideal world, you want to invest in companies which can reinvest most of their free cash flow in their own business at attractive rates of return.

The Return On Invested Capital (ROIC) is a great way to see how efficiently a company is allocating its capital.

You want to invest in companies with a ROIC > 15%. When a company has a high and consistent ROIC, it’s also a great indication that the company has a moat.

S&P Global has a very high and consistent ROIC. This indicates that the company is allocation capital efficiently.

8. Balance sheet

Only invest in companies which are in good financial health.

A healthy balance sheet allows companies to be flexible and capitalize on opportunities.

Just like Terry Smith, I like to look at 2 ratios to determine the healthiness of a balance sheet:

Interest Coverage Ratio

Net Debt / Free Cash Flow

The Interest Coverage Ratio (EBIT/Interest payments) indicates how easily a company can pay back the interests on its outstanding debt. You want this number to be higher than 10.

The Net Debt / Free Cash Flow shows you how many years it would take a company to pay down all its debt when it would use all available free cash flow. You want this number to be lower than 4.

For S&P Global, Interest Coverage and Net Debt / FCF are equal to 15.3x and 3.6x respectively.

If you want to learn more about how to analyze a balance sheet, take a look here: 🔍 How to analyze a Balance Sheet

9. Profitability

As a quality investor, you seek for companies which are very profitable.

The gross margin and free cash flow margin are 2 of the best metrics to look at the profitability of a company.

You can calculate the gross margin as follows:

Gross margin = (Revenue - Costs of Goods Sold) / Revenue

The higher the gross margin, the better.

A gross margin of 37.2% means that a company needs $0.628 to produce its products while it can sell them for $1.

The free cash flow margin can be calculated as follows:

Free cash flow margin = free cash flow / revenue

The free cash flow margin shows the percentage of sales which are translated into pure cash for the company. When a company has a FCF margin of 30%, for every $100 the company sells, $30 of cash is generated.

S&P Global’s gross margin and FCF margin are equal to 65.5% and 29.9% respectively.

10. Historical growth

The best companies are active in an attractive end market.

As a result, looking at the historical growth of a company can already tell you a lot.

Seek for companies with the following criteria:

Yearly revenue growth over the past 5 and 10 years: > 5%

Yearly earnings growth over the past 5 and 10 years: > 7%

When a company has been able to grow its revenue and EPS at an attractive rate in the past, it already gives you an indication that the company might also be able to do so in the future.

These are the number for S&P Global:

Revenue growth (CAGR): 13.0% (past 5 years) and 7.6% (past 10 years)

EPS growth (CAGR): 13.6% (past 5 years) and 13.8% (past 10 years)

11. Outlook

In the long run, stock prices will follow the evolution of the intrinsic value.

The intrinsic value is driven by 2 key factors: EPS growth and dividends.

Growth in intrinsic value = earnings per share growth + dividend yield.

Seek for companies which are active in a secular trend (urbanization, aging, cybersecurity, obesity, digital payments, …) as it will be easier for these companies to grow at an attractive rate.

Just like you preferred companies which managed to grow their revenue with more than 5% and EPS with more than 7% in the past, you want these companies to be able to continue to grow at these attractive rates in the future.

Here’s the outlook for S&P Global:

As you can see, S&P Global wants to grow its organic revenue with 7-9% per year and it’s EPS with 10-15% per year. These are attractive numbers.

12. Valuation

Quality investors look for wonderful businesses at a fair price.

The best way to value a company is by using a (reverse) discounted cash flow model. As this topic would bring us too far, we will elaborate on this in another article.

A great way to get a first grasp about a company’s valuation is by comparing its current price-to-earnings ratio with the average P/E of the past 5 years.

The forward P/E of S&P Global is equal to 27.8 compared to 27.2 for the 5-year average. This indicates that S&P Global looks slightly overvalued in comparison with its own historical average.

Here you can find the evolution of S&P Global’s forward P/E ratio:

If you want to learn more about valuation, take a look here: Everything you need to know about valuation.

13. Peer comparison

You also want to compare the company you are looking into with its main rivals.

To do this, you can compare all characteristics we’ve already mentioned in this article (revenue split, quality of management, moat, capital allocation, capital intensity, healthiness of balance sheet, profitability, valuation, …).

Preferably you want to invest in the best company in a certain industry. A market leader with substantially lower capital intensity, higher margins and better capital allocation compared to its peers.

A comparison of S&P Global’s P/E Ratio (white line) with Moody’s P/E Ratio (blue line) can be found here:

14. Historical stock price performance

As a quality investor, you don’t want to buy the next big thing. Instead, you want to buy companies that have already won.

That’s exactly why looking at the historical value creation of a company already tells you a lot. You want to buy companies which managed to compound at an attractive rate in the past.

S&P Global’s stock price grew at a CAGR of 13.9%.since 1989, which is satisfactory for us.

Conclusion

That’s it for today. To conclude:

Start with reading as much as you possibly can about the company

Analyze the stock:

Business profile: make sure you understand the business model

Revenue split: map out the company’s revenue split

Management & shareholder structure: invest in companies with a capable and integer management

Moat: seek for companies with a sustainable competitive advantage

SWOT: map out the strengths/opportunities and weaknesses/threats

Capital intensity: the lower the capital intensity, the better

Capital allocation: capital allocation is the most important task of management

Balance sheet: the healthier the balance sheet, the better

Profitability: the higher the profitability, the better

Historical growth: seek for companies which managed to grow their revenue and EPS with more than 5% and 7% respectively

Outlook: invest in companies active in a secular trend

Valuation: buy wonderful businesses at a fair price

Peer comparison: compare the company you’re looking into with its main rivals

Historical value creation: seek for companies which already managed to perform very well in the past

That’s it for today.

As these articles take a lot of time to write and I’ve already written more than 100 articles completely for free. It would be lovely to get your support.

You can support us by liking and/or reacting on this article, send us an email or share this article with friends and family. You guys are the best!

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

This article is pure gold, you are exceeding expectations week after week. A must read for any investor no matter how experienced. Thanks for your continuous contributions!

Great article QC, you are getting better!!! You are a quality stock yourself!