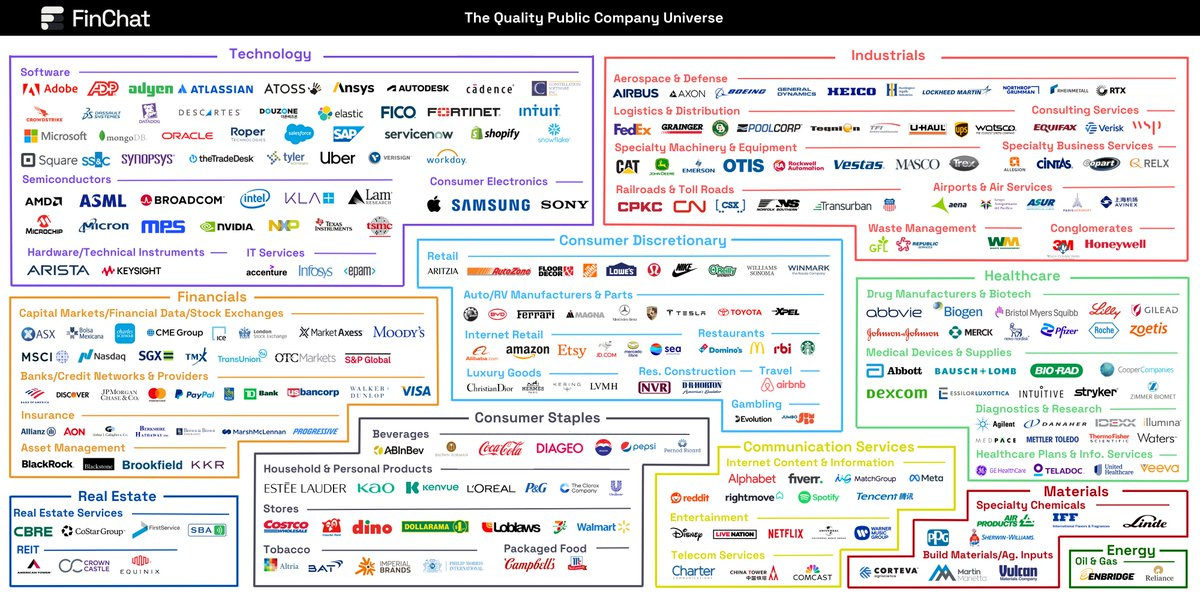

How To Hunt for Quality Stocks

Over 100 Quality Stocks

Finchat is an amazing tool.

I use it to create investment cases and find interesting stocks to buy.

Today I’ll show you how to screen for quality stocks.

Multiple Roads

First of all, it’s important to understand that multiple roads lead to Rome.

You can use different screening criteria to find great stocks.

There is also no golden truth in the criteria used in these screeners.

That’s why it’s interesting to use different variants.

In this article, I’ll show you three screening criteria you can use to find the best companies in the world.

Getting Rich: Quality Stocks with a lot of growth potential

Staying Rich: Established Quality Stocks

Living Rich: Quality Stocks with an attractive dividend yield

Finchat

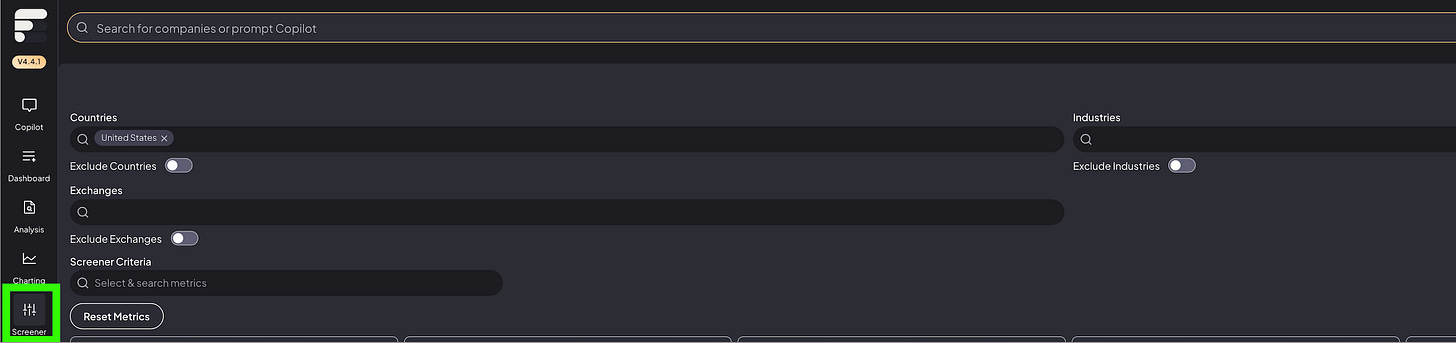

We will use the stock screener of Finchat to screen for quality stocks.

You can go to the Finchat stock screener by following these steps:

On the left, click on the ‘Screener’ section

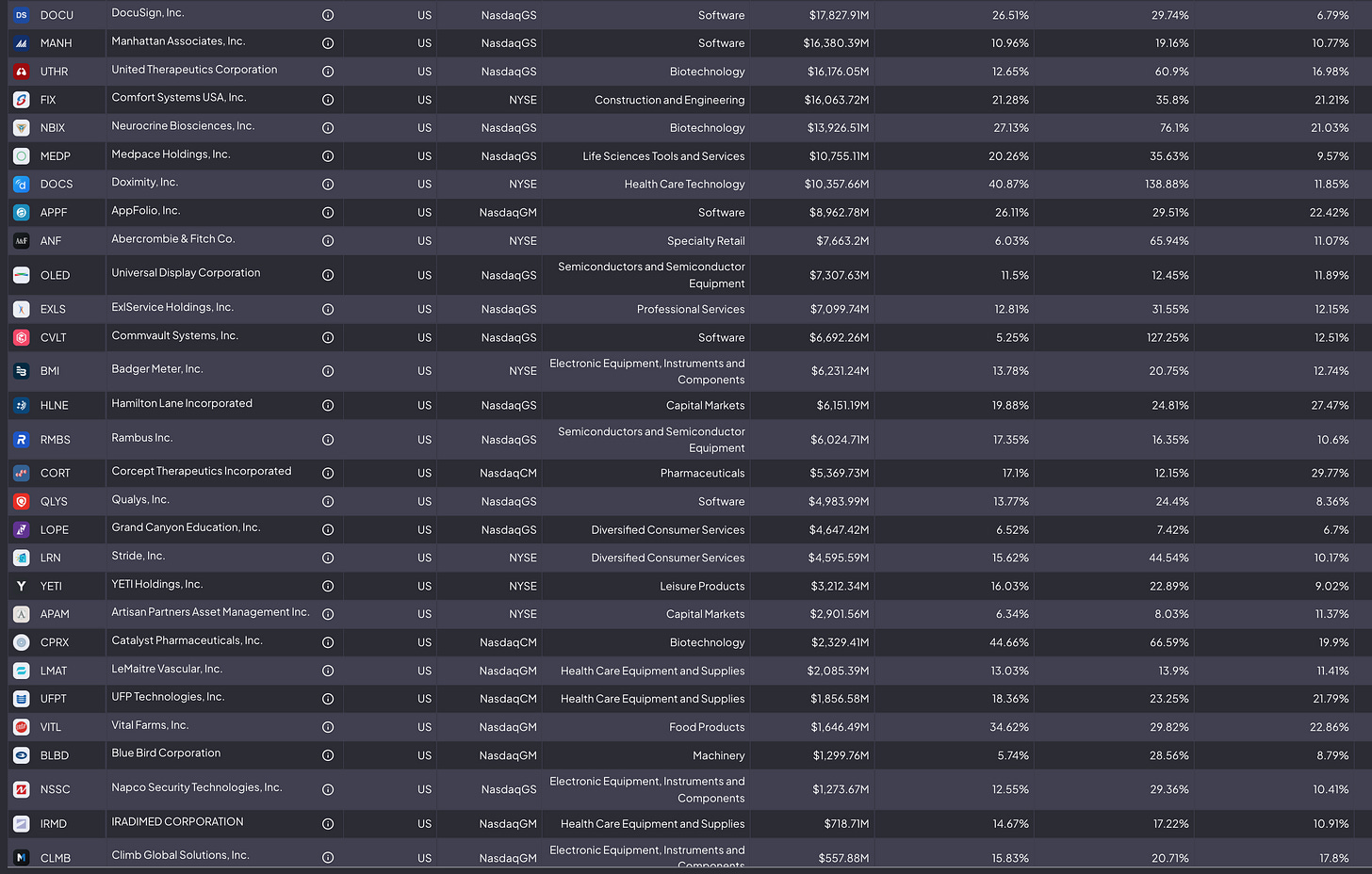

Screen for Getting Rich Stocks

Here are the criteria I use:

Revenue growth > 9% per year

EPS growth > 12% per year

FCF / Net Income > 80%

Profit Margin > 10%

ROIC > 15%

Net Debt / EBITDA < 3X

Please note that for the Revenue and EPS Growth, we want the historical growth as well as the outlook to be higher than 7% and 9% per year respectively.

In Finchat, the screening criteria look like this:

The companies that match these criteria:

Screen for Staying Rich Stocks

The criteria we use:

Revenue growth > 5% per year

EPS growth > 7% per year

FCF / Net Income > 80%

ROIC > 15%

Net Debt / EBITDA < 3X

Debt/ Equity < 80%

In Finchat, the screening criteria look like this:

The companies that match these criteria:

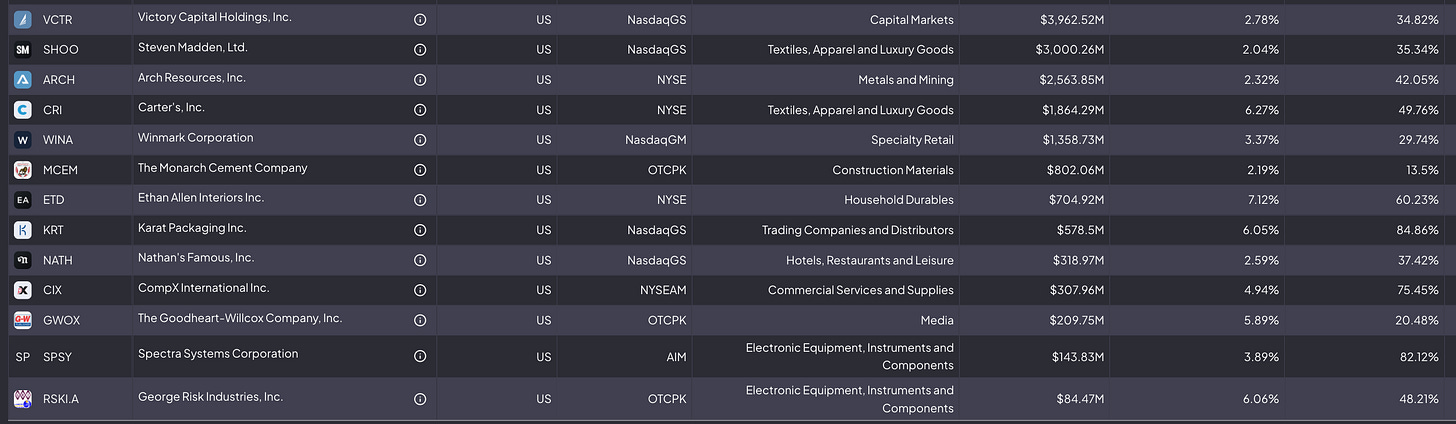

Screen for Living Rich Stocks

The criteria we use:

Dividend Yield > 2%

Payout Ratio < 90%

Dividend Per Share 5-Year CAGR > 10%

Profit Margin > 5%

ROIC > 10%

Net debt / EBITDA < 3X

In Finchat, the screening criteria look like this:

The companies that match these criteria:

Conclusion

That’s it for today.

Did you get some investment inspiration?

Please note that via this special link, you get a 15% discount on Finchat.

Do you want to walk our investment journeys together?

Test out Compounding Quality risk-free.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Activate your trial here:

Everything In Life Compounds

Pieter

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data