💰How to outperform the market by Mark Leonard

Constellation Software is the best serial acquirer in the world.

Since the company IPO’ed in 2006, Constellation Software has acquired more than 500 companies, turning $25 million into $35 billion.

I’ve read every annual shareholder letter of Mark Leonard, founder and CEO of Constellation Software, and mapped everything for you in this article.

The power of compounding

Mark Leonard reminds me a lot of Warren Buffett.

To put his phenomenal track record into perspective: when you would have invested $10.000 in Constellation Software at the IPO in 2006, your investment would be worth $2 million (!) today.

Interesting. Right? Let’s see how he has done this.

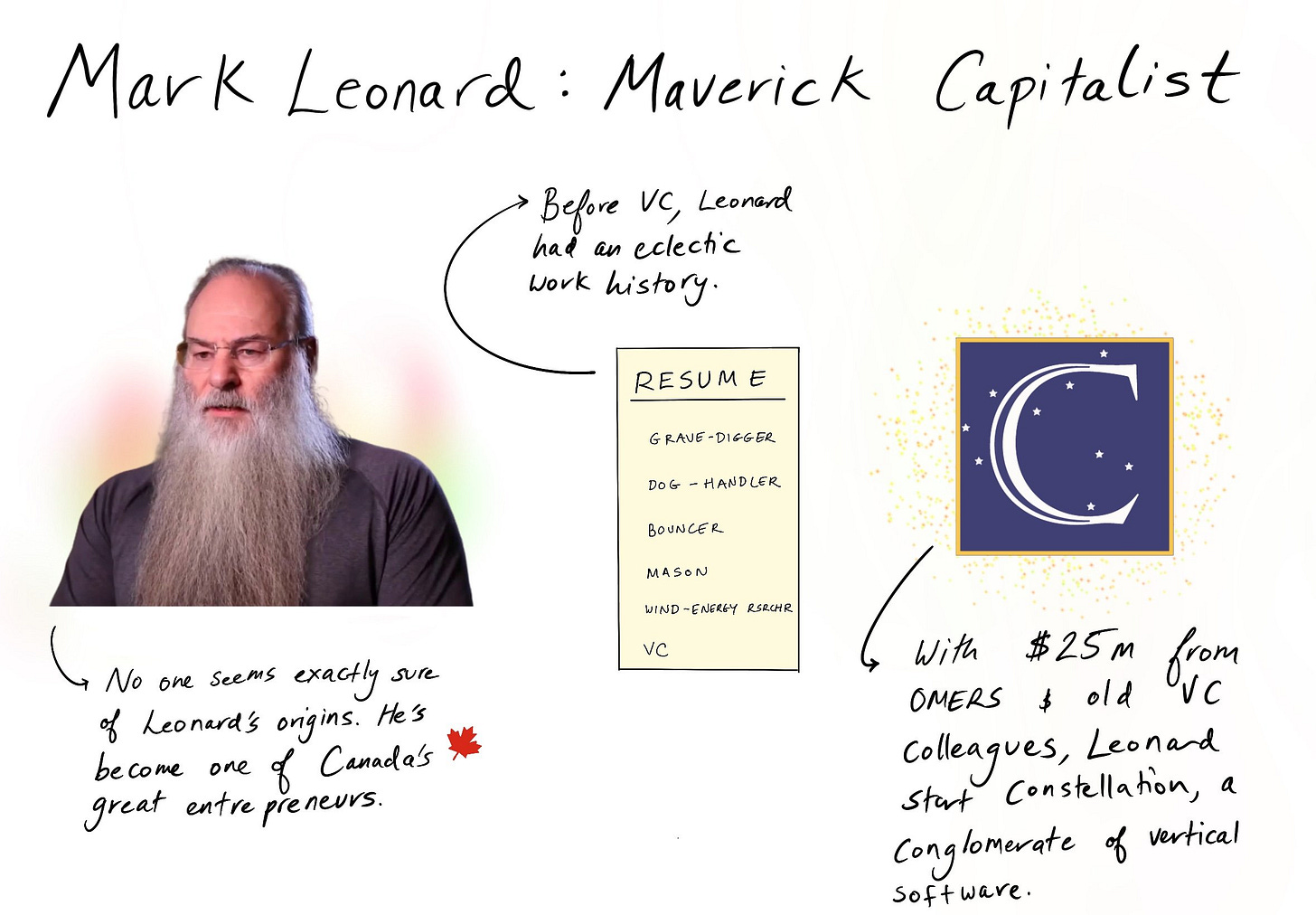

Who is Mark Leonard?

Mark Leonard is the founder and CEO of Constellation Software.

After working in Venture Capital for 11 years, Mark came up with the idea to create a conglomerate to acquire and hold Vertical Market Software (VMS) companies.

The idea of Constellation Software was very simple: acquire niche software companies with the following characteristics:

Loyal customer base

Strong market position

Active in Vertical Market Software (VMS)

But what is Vertical Market Software? VMS software is developed for niche applications and/or a specific clientele. Think about a software system for an amusement park to show the waiting lines of different roller coasters or applications for certain medical requirements.

Lessons learned from Mark Leonard

As you know by now, Mark Leonard’s track record has been phenomenal.

Here are the key principles he used to build his empire.

1. Buy-and-build

Just like Warren Buffett, Mark Leonard thinks like an owner.

When Constellation Software acquires a company, they do this with the intention to own it forever.

This is a completely different mindset compared to most M&A activities.

“If everything you do needs to work on a three-year time horizon, then you're competing against a lot of people. But if you're willing to invest on a seven-year time horizon, you're now competing against a fraction of those people.” – Jeff Bezos

2. Focus on Return On Invested Capital

Mark Leonard uses the ROIC as a proxy for a company’s moat.

When a company has a high and stable ROIC as well as high and stable gross margins, it’s a great sign that the company has a sustainable competitive advantage.

If you want to learn more about ROIC, take a look here: What you need to know about Return On Invested Capital.

“The high ROIC achieved over the last decade suggests that we have very good businesses.” - Mark Leonard

3. It’s all about capital allocation

A lot of CEOs don’t have proper capital allocation skills.

That’s a pity because capital allocation is the most important task of management.

“Over the long term, stock returns will be determined largely by which capital allocation decisions the CEO makes. Two companies with identical operating results and different approaches to allocating capital will derive two very different long-term outcomes for shareholders.” - Mark Leonard

4. Reinvestment opportunities

The best businesses are companies that have very high margins, a low capital intensity and can reinvest their free cash flow at attractive rates.

Organic growth is the most preferred source of growth and there is plenty of this in the VMS market. It’s one of the key reasons why Constellation Software is so successful.

'“In our businesses we can nearly always grow revenues organically without incremental capital.” - Mark Leonard

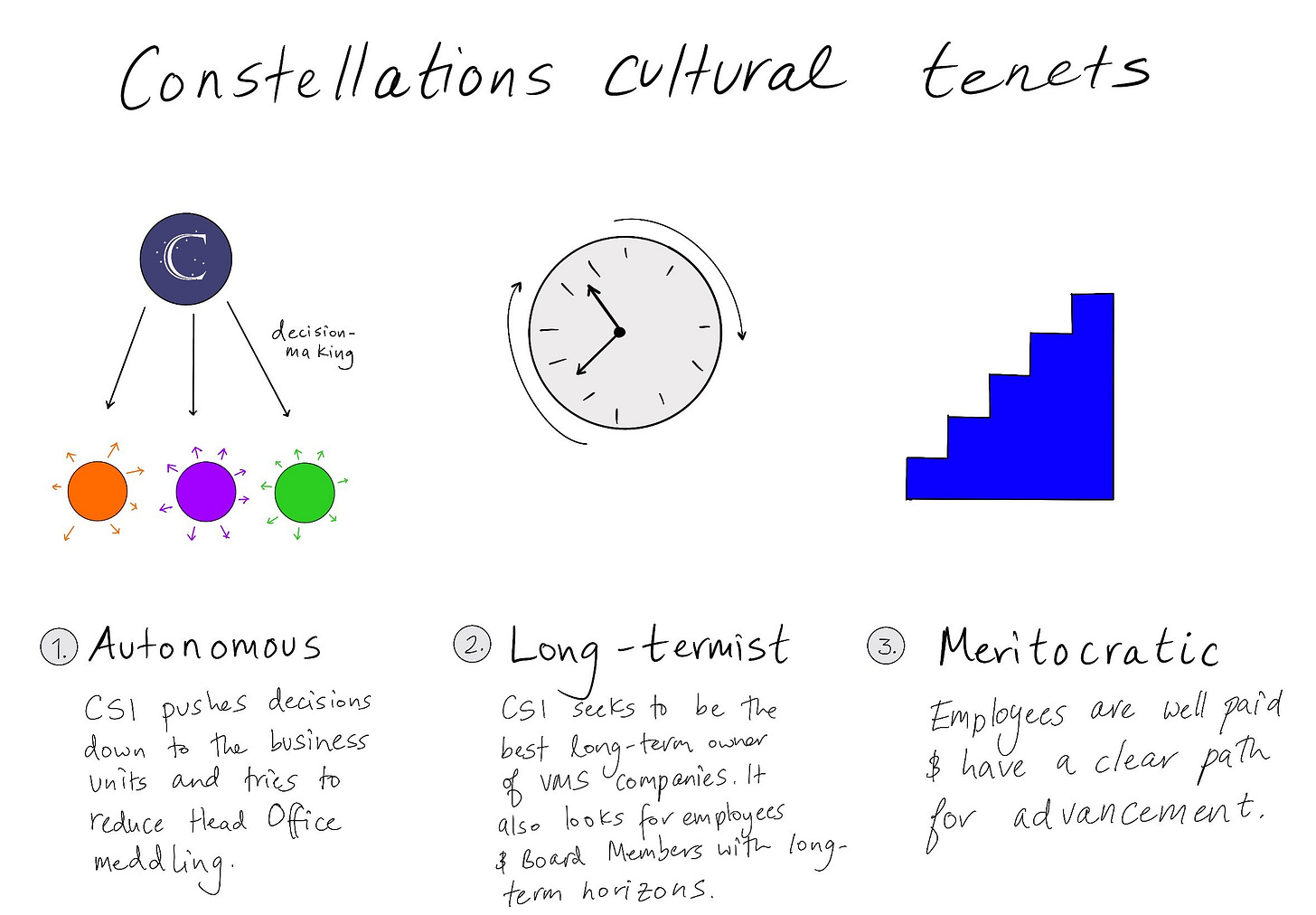

5. High autonomy creates value

Mark Leonard tries to keep the autonomy of his employees as high as possible.

Constellation Software has a very decentralized business model and when they acquire a company, they do not seek to take over day-to-day operations. It’s very similar to the business model of Berkshire Hathaway.

“The key is always to hire the right people first, train them well, push decisions down the organization, and then resist the temptation to be involved with details. Putting this trust and power in the hands of workers is critical to success.” - Warren Buffett

6. Size matters

The law of large numbers states that the larger you get, the harder it is to grow at very high rates.

It’s way easier for a company which earns $1 million to double its earnings compared to a company which earns $50 billion.

This also means that the larger you get, the harder it becomes to buy great businesses at an attractive price.

“Anyone who says that size does not hurt investment performance is selling.” - Warren Buffett

7. Founder-led businesses

Invest in companies where management LOVES what they do.

The best companies are run by people who have skin in the game. They aren’t running the company for the money it earns. They just love what they do. Their company is like a baby for them.

“Our favorite and most frequent acquisitions are the businesses that we buy from founders.” - Mark Leonard

8. Cash is like oxygen

Cash can pile up when Mark Leonard doesn’t see investment opportunities.

Mark Leonard only wants to acquire companies when it makes economic sense.

Cash gives you a lot of opportunities to invest heavily during bear markets and stock market crashes.

“Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.” - Warren Buffett

9. Pray for stock price corrections

Warren Buffett once said: “Any calls you get on Sunday, you’re going to make money. Those rare calls are the best since they are inevitably from seriously distressed sellers."

Mark Leonard has said something similar as his most attractive acquisitions took place during recessions.

“Unlike most people, we would be hoping that there would be a major correction in the stock market. If I have the access to capital and there is a downturn, we will buy as much as we can.” - Mark Leonard

9. Culture is everything

Culture eats strategy for breakfast.

You want to invest in companies with such a good culture that every layer of the organization is focused on creating shareholder value.

“It takes a lot of time and effort to attract and educate competent shareholders and partners.” - Mark Leonard

10. Price versus intrinsic value

In the long term, stock prices will always follow the intrinsic value.

That’s why you shouldn’t focus on daily stock price fluctuations. Instead, focus on the fundamentals of the company.

“Ideally, we’d like Constellation’s stock price to appreciate in tandem with our fundamental economics.” - Mark Leonard

All shareholder letters of Mark Leonard

Download all shareholder letters of Mark Leonard compiled in 1 PDF for free here:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Another great post CQ, thanks for sharing!

Quality article. Thanks for putting it together