💰 How to outperform the market by Nick Sleep

Nick Sleep is one of the greatest investors of all time. Between 2001 and 2013 he managed to report an astonishing annual return of 20.8%. A yearly outperformance of 14,3% per year (!) compared to the MSCI World.

In this article, we will share 15 essential investment lessons from Nick Sleep, one of the best investors in the world.

1. Start with the business model

Make sure you understand how a company makes money.

Invest in companies which have a good business model that have had success in the past. The best business models don’t change much over time.

“Our most profitable insights have come from recognizing the deep reality of some businesses, not from being more contrarian than anyone else.” – Nick Sleep

2. Think on the long term

Would you buy a house if you only wanted to live in it for a few weeks? No. The same goes for stocks.

Only buy a stock when you’d be perfectly happy to hold it if the market would shut down for 10 years.

“We own shares for multi-year periods and so our continued investment success has far more to do with the economics of the underlying businesses than it has to do with their last share price quote.” – Nick Sleep

3. Invest in companies with skin in the game

Invest in companies which are run by their founders.

When you do this, you automatically increase your chances to outperform the market.

“There is a strong correlation between the percentage of insiders in the company and the quality of the company (healthiness of balance sheet, profit margin and return on invested capital).” – Nick Sleep

“Almost ninety percent of the portfolio is invested in firms run by founders or the largest shareholder, and their average investment in the firms they run is just over twenty percent of the shares outstanding.” – Nick Sleep

4. Focus on what matters

Good investors ignore the noise.

Next quarter’s earnings are worthless. Instead, focus on the moat of the company and its ability to maintain their competitive advantage.

“At its heart, investing is simple, and to make it seem anything but, with the frequent repartition of short-lived facts and data points, may be a conceit. Indeed, it could be argued that a running commentary obfuscates a discussion of the things that really matter.” – Nick Sleep

5. Have patience

Compounding works like magic when you let it work long enough for you.

Don’t try to get rich quick or use debt to invest in the stock market. Good investing starts with good risk management.

“At the beginning of the Annual General Meeting of the Berkshire Hathaway Company they show this little video and each year Buffett is asked what’s the main difference between himself and the average investor, and he answers patience. And there is so little of it these days. Has anyone heard of getting rich slowly?” – Nick Sleep

6. Follow a good investment process

Buy good business, don’t overpay, do nothing. So easy in theory, so hard in practice.

Your investment process determines the success of you as an investor. Lean from great mentors and become the best investor you possibly can.

“Good investment process is not apparent in one quarter’s worth of transient stock price quotations, or one year for that matter!” – Nick Sleep

7. Learn from your mistakes

When making investment decisions, either you learn or you earn.

Consider investment mistakes as learning opportunities.

“Investment mistakes are inevitable and indeed to some extent desirable, and we have no interest in hiding them from you (or in portfolio window dressing) - as they say, it is what it is.” – Nick Sleep

8. Focus on the number of outstanding shares

Don’t invest in companies which dilute existing shareholders.

Take a look at the evolution of the outstanding shares over the past 10 years. You want this number to be constant or deceasing.

“We want to buy companies with no increase in shares outstanding over the last 10 years.” – Nick Sleep

9. Never use shorts or leverage

Nick Sleep never uses leverage, shorts, or financial derivatives and neither should you.

Good investing is consistently doing above average without taking too much risk.

“There are only three ways a smart person can go broke: liquor, ladies and leverage.” - Charlie Munger

10. Look for scale economies shared

Invest in companies that provide great benefits for their clients.

Economies of scale are crucial to achieve this. It allows the company to drive down costs and pass those savings to their customers.

11. Become a learning machine

The best investors are those who become learning machines.

Read as much as you can and become wiser every single day.

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines.” - Charlie Munger

12. A crisis offers opportunities

When Nomad Investment Partners lost almost 50% during the financial crisis, Nick Sleep did one crucial thing… he bought more of his favorite stocks.

Bear markets offer great opportunities for investors. You just don’t realize it at the time.

13. Let your winners run

The biggest mistake you can make is to sell a stock that goes on to rise tenfold.

When you have found a great company, you should stick with it.

Nick Sleep was one of the first investors to find out about Amazon. Today, he is invested in only 3 stocks: Amazon, Costco, and Berkshire Hathaway.

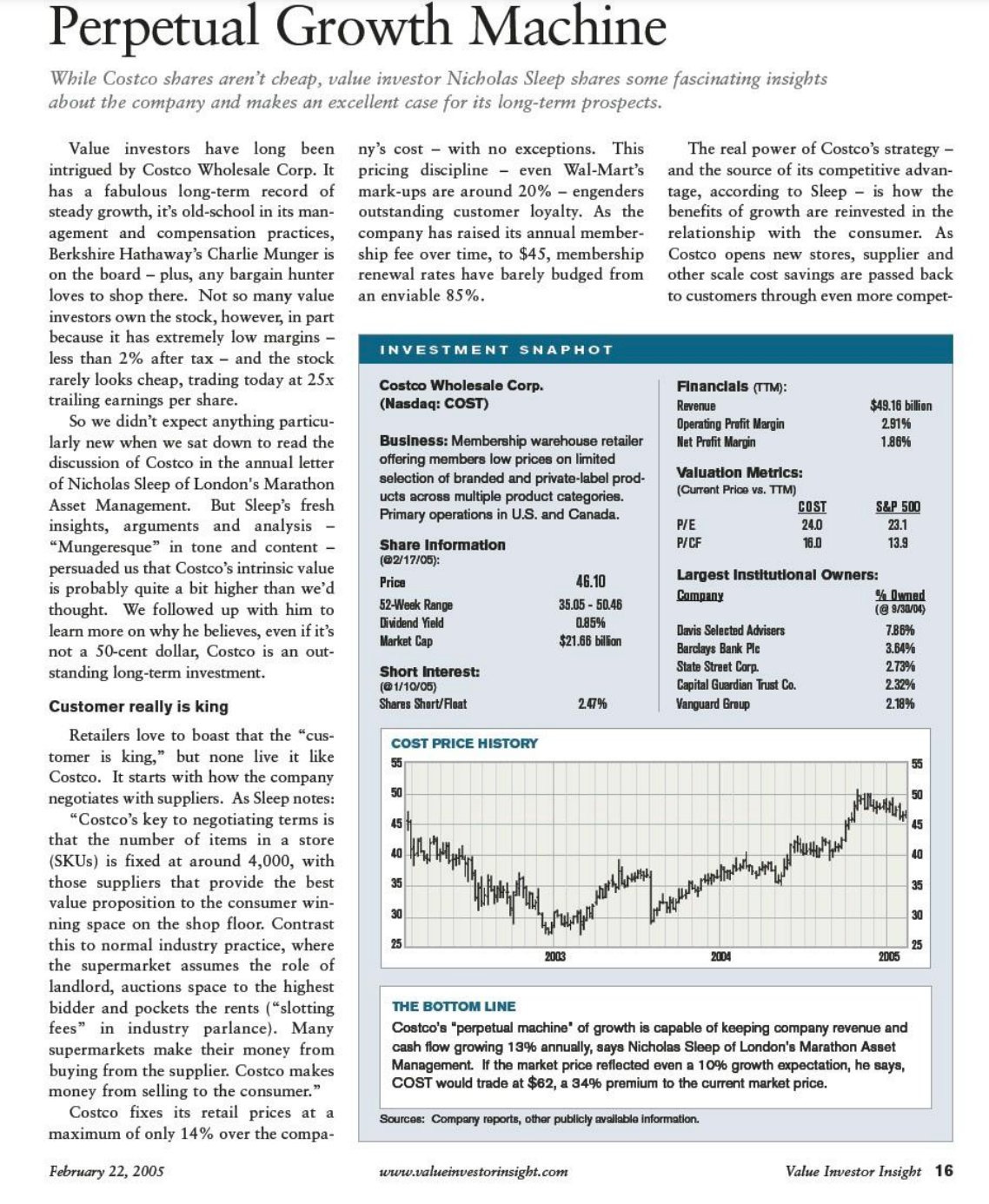

Here is his write-up on Costco in 2005. Since then, the stock is up more than 1000%.

14. Create the right environment

To make good decisions, you should be able to think rationally.

Always compare an attractive investment opportunity with your current portfolio.

Doing nothing and keeping trust in your current positions is also a decision.

15. It’s all about quality

In the end, it’s all about quality. You want to buy great businesses lead by quality managers achieving quality returns.

“It was all about quality… Money was secondary. It was much more about doing a good job, a quality job, doing the right thing.” – Qais Zakaria

All shareholder letters of Nick Sleep

Do you want to learn more from Nick Sleep? His annual shareholders letters are truly excellent full of golden investment wisdom. Download them here for free:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Reading the shareholder letters of great investors is more worthwhile than any advanced business degree.

Thank you for compiling the shareholder letters. Perfect bedtime reading!!