🖨️ How Warren Buffett Prints Billions

Warren Buffett 101

Warren Buffett is the best investor in the world.

He turned $14 million into over $1 trillion since he took over Berkshire Hathaway in 1965.

Let’s teach you some invaluable lessons from the Oracle of Omaha.

Who is Warren Buffett?

Warren Buffett is a legend in the world of investing.

People often call him “the Oracle of Omaha”.

Born in 1930 in Omaha, Nebraska, Warren Buffett showed an early interest in numbers and business. He bought his first stock at age 11 and filed his first tax return at 13.

Buffett was heavily influenced by Benjamin Graham and his book ‘The Intelligent Investor’.

Warren Buffett deeply admired Benjamin Graham. To learn directly from him, he applied to Columbia University.

After his studies, Warren Buffett offered to work for free for Benjamin Graham, but was rejected. Today, Buffett laughs with this, stating that even when he would work for free for Graham, he was too expensive.

Three years later, Benjamin Graham ended up hiring Warren Buffett. The Oracle of Omaha once stated that this was the best investment he ever made.

In 1965, Buffett took control of Berkshire Hathaway, a struggling textile company, for around $14 million. Over the next sixty years, he transformed it into a global conglomerate worth over $1 trillion.

Today, Warren Buffett is the fifth-wealthiest person in the world with a net worth of over $150 billion. On top of that, he has already given away $60 billion to charity.

Want to learn more? Grab my free e-book of 60 pages about Warren Buffett here.

Investment Philosophy

Warren Buffett’s investment approach is very straightforward.

His philosophy can be summarized in three core principles:

Buy wonderful companies at fair prices

Be patient and think long-term

Avoid unnecessary risk and complexity

1. Buy Wonderful Companies at Fair Prices

Buffett seeks out businesses with:

Durable competitive advantages (strong brands, network effects, …)

Consistent earnings and high returns on equity

Capable and shareholder-friendly management

Predictable and strong cash flows

He prefers to buy these wonderful companies at fair prices, using a margin of safety.

2. Be Patient and Think Long-Term

Warren Buffett is known for holding investments for years, even decades.

He believes wealth grows through compounding.

Lots of buying and selling? That just costs you money in taxes and fees.

“Our favorite holding period is forever.” — Warren Buffett3. Avoid Unnecessary Risk and Complexity

Warren Buffett avoids businesses he doesn’t understand.

He always stays within his circle of competence.

He stays away from companies with too much debt. Instead, he invests in stable and predictable businesses.

Performance

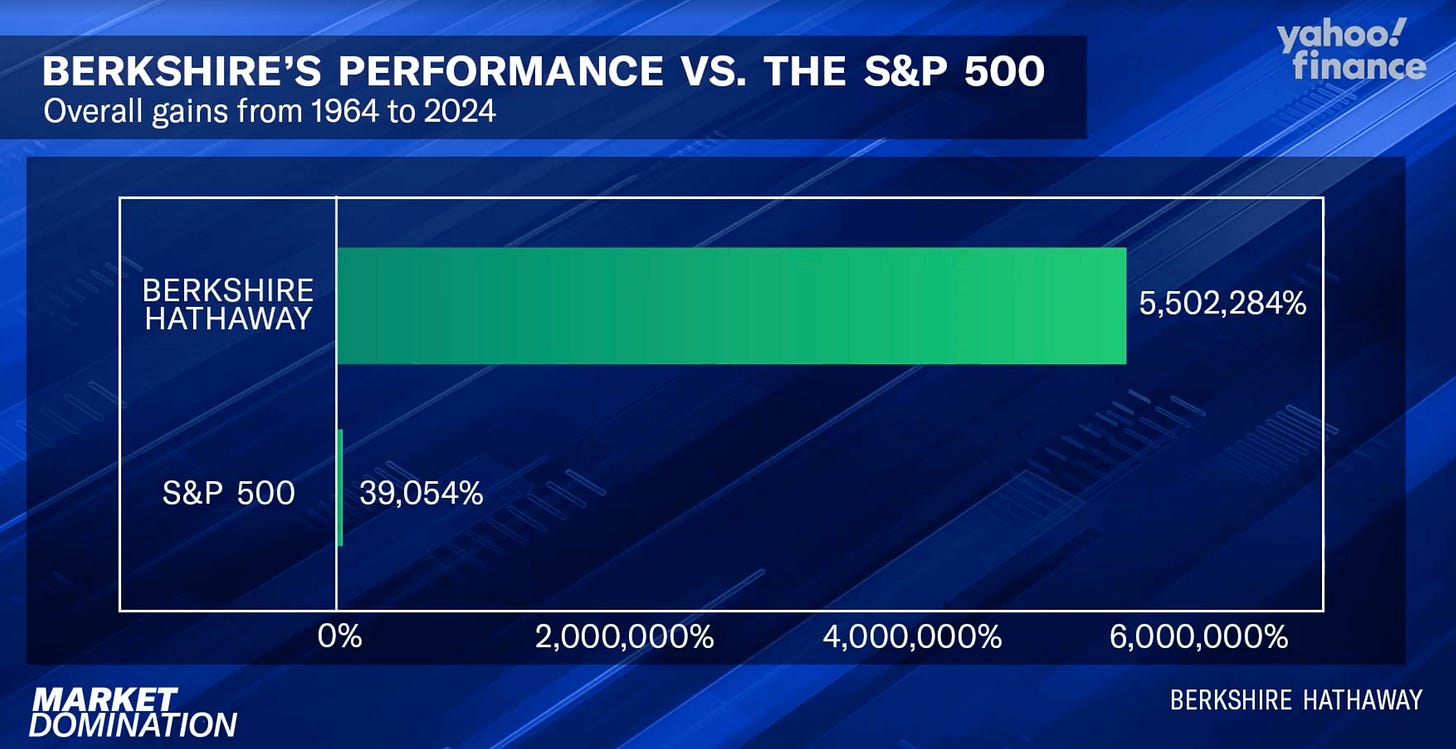

Berkshire Hathaway’s performance under Warren Buffett is legendary:

Since 1965, Berkshire’s stock price has compounded at an annual rate of over 19%, far outpacing the S&P 500

A $10,000 investment in Berkshire in 1965 would be worth over $447 million today

What’s also remarkable? Berkshire Hathaway almost always outperforms the market during bear markets.

Warren Buffett’s Portfolio

Let’s now take a look at Warren Buffett’s Portfolio.

Please note that only the listed equities are shown.

Roughly 60% of Berkshire Hathaway is invested in non-listed companies. Think about companies such as Geico, BNSF, and Dairy Queen.

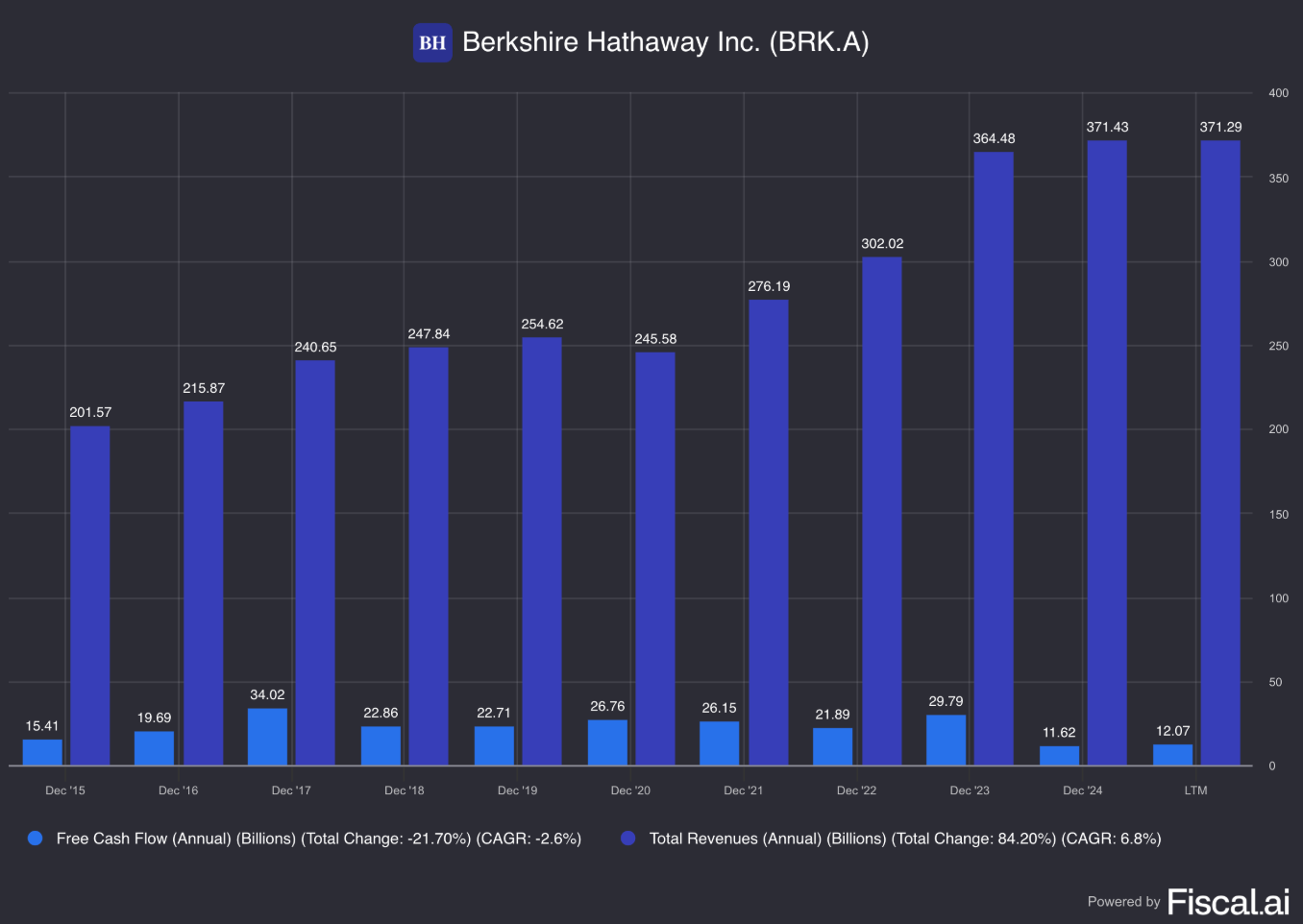

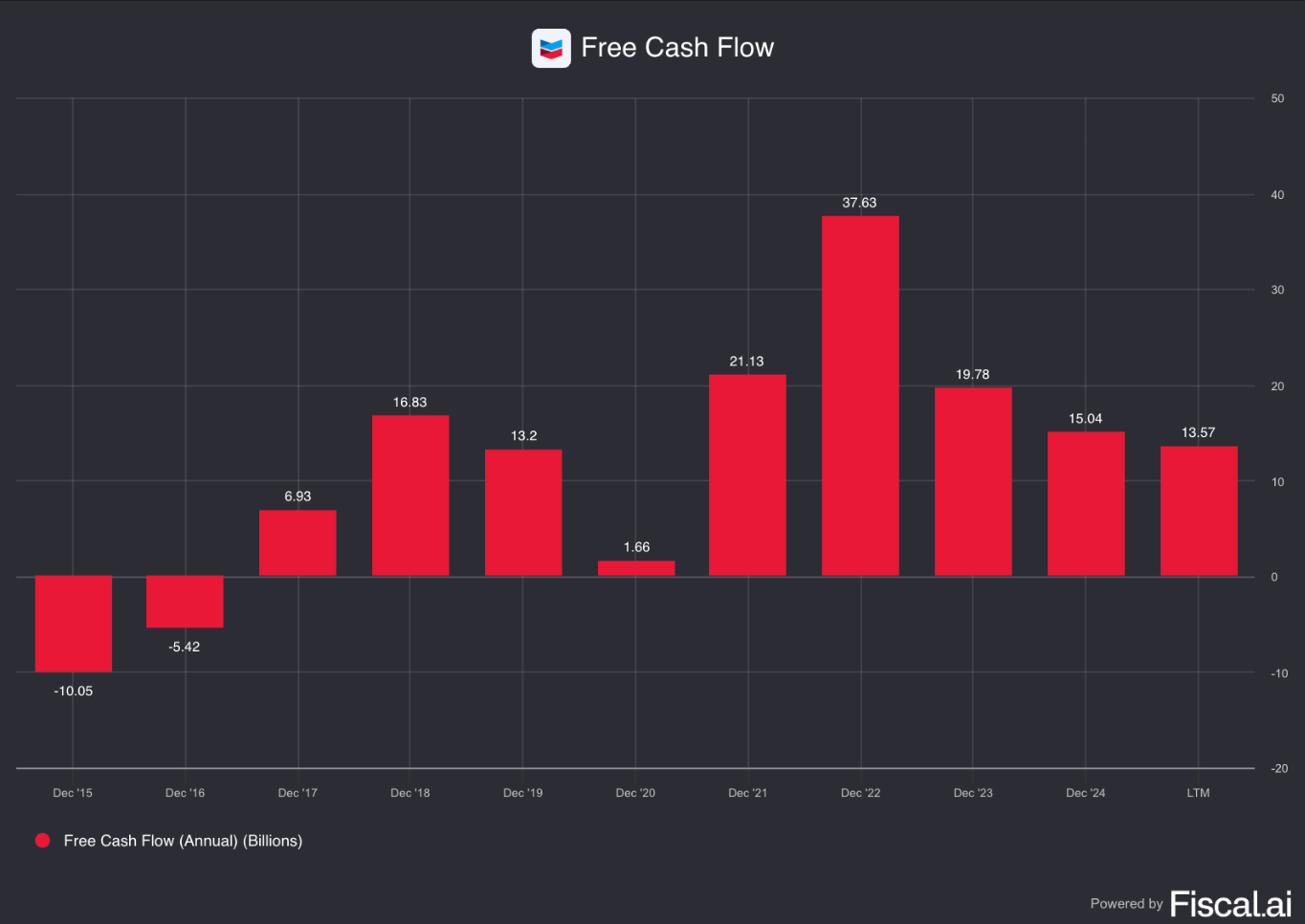

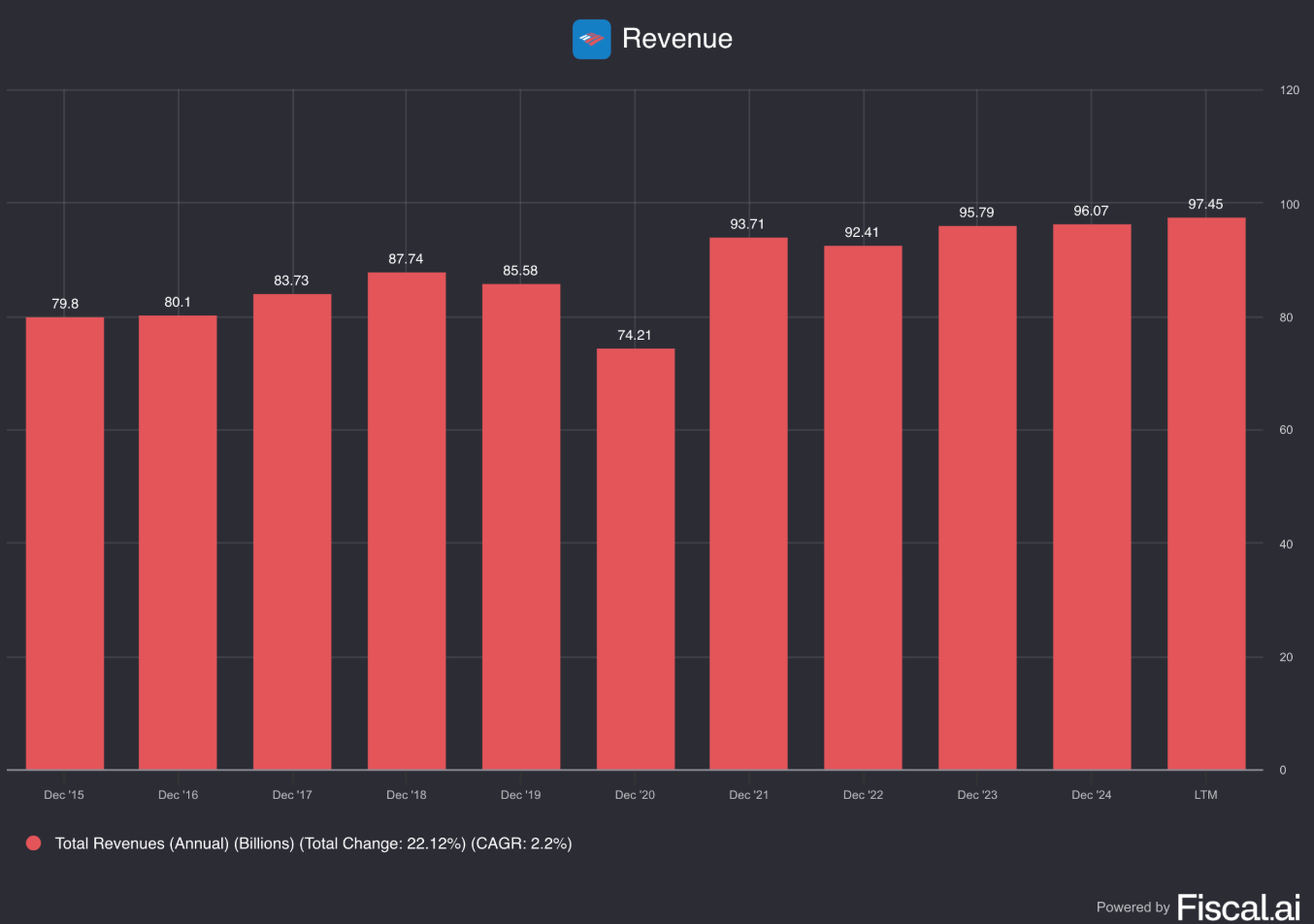

5. Chevron ($CVX) – Weight: 7.7%

How does the company make money?

Chevron profits from oil and gas exploration, production, refining, and sales.Why Buffett likes Chevron

As a major energy company, Chevron provides diversification and strong cash flows, especially during periods of high commodity prices.

4. Bank of America ($BAC) – Weight: 10.2%

How does the company make money?

Bank of America profits from lending, investment banking, wealth management, and transaction fees.Why Buffett likes Bank of America

As one of America’s largest banks, BAC benefits from economies of scale, a vast deposit base, and a strong position in the U.S. economy.

Please note that Warren Buffett sold over 39% of Berkshire’s Bank of America shares recently.

He took profits on the company and is waiting for other, more attractive investment opportunities (Berkshire Hathaway has almost $350 billion in cash today).

3. Coca-Cola ($KO) – Weight: 11.1%

How does the company make money?

Coca-Cola earns revenue by selling beverages worldwide, including sodas, juices, and water.Why Buffett likes Bank of America

Buffett has held Coca-Cola since 1988. He loves the global brand, steady demand, and robust dividend.

Since 1998, Coca-Cola’s stock price has increased from $16.4 to $68.8 per share.

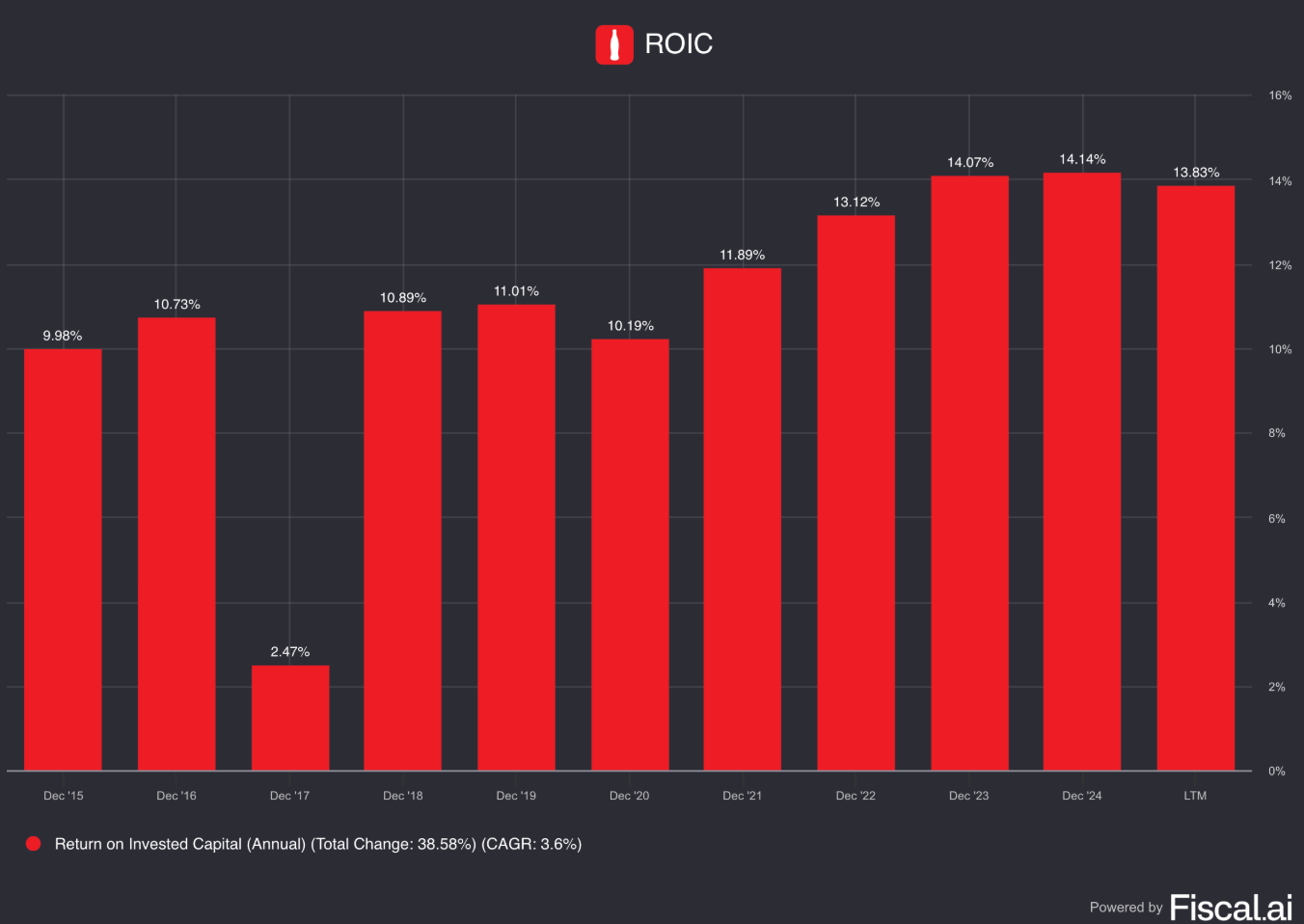

In the chart hereunder, you can see a low ROIC in 2017. Why? There are three reasons:

They changed their bottling setup, costing money

A big one-time tax expense from the new U.S. tax law

They made some strategic acquisitions, which pushed up their invested capital

All of this made returns look weaker... but the ROIC recovered very fast.

2. American Express ($AXP) – Weight: 15.8%

How does the company make money?

American Express makes money through transaction fees, interest on credit balances, and annual cardholder fees.Why Buffett likes American Express

American Express has a powerful brand, a loyal customer base, and a business model that generates consistent, high-margin cash flows.

American Express is seeing declining profit margins. Why?

They’re spending more on rewards and services to keep customers happy. At the same time, people are spending less… and charge-offs are rising.

Tough times. But smart companies adapt.

1. Apple ($AAPL) – Weight: 25.8%

How does the company make money?

Apple earns revenue from selling iPhones, Macs, iPads, wearables, and services like the App Store and Apple Music.Why Buffett likes Apple

Apple is a cash-generating machine with a loyal customer base, powerful brand, and recurring revenue from its ecosystem.

Buffett has called Apple “probably the best business I know in the world.”

Please note that since the end of 2023, Buffett has sold roughly two-thirds of his position in Apple.

It’s probably because of valuation concerns.

Our Favorites

Warren Buffett’s portfolio is filled with great companies.

Let’s dive into Our Favorites.