The most valid reason to sell a stock?

Your investment thesis isn't longer intact

Today it’s time to sell a stock in Our Portfolio.

It’s the second stock we ever sold. The proceeds will be used to buy a new company.

Reasons To Sell a Stock

Selling a stock can be very dangerous.

Why?

A stock can decline only 100%, but the upside potential is unlimited.

The biggest investment mistake I ever made?

Selling my winners too soon.

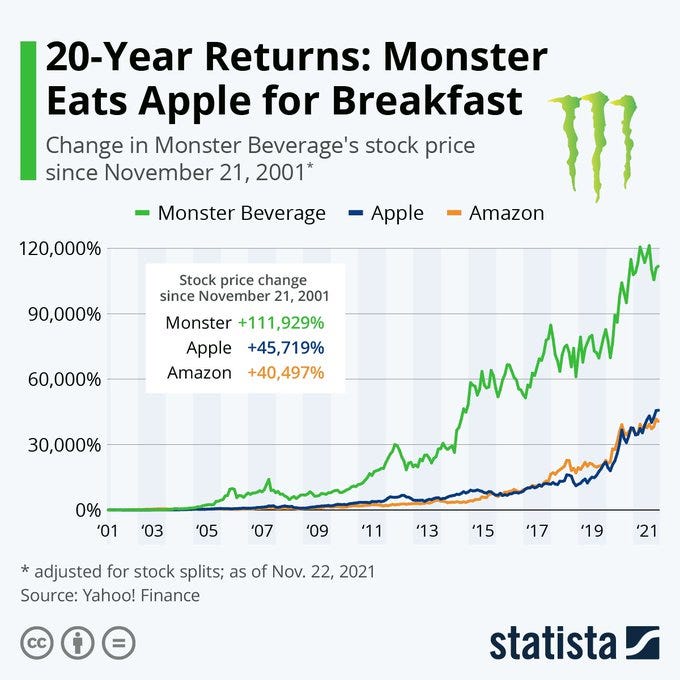

Just imagine you sold Monster Beverage for $0.01 in 1987 or Apple for $0.3 in 1991.

Since their IPO, both stocks are up 72,000% and 85,000%, respectively.

The secret of successful investing is to let the magic of compounding work for you as long as possible.

It is not without reason that compound interest has been called the eighth wonder of the world.

In the past, I wrote an article with 7 reasons to sell a stock.

Here they are:

You made a mistake

You’ve found a better opportunity

The company is losing its moat

The stock is (dramatically) overvalued

Change in management

Growth is slowing down

You need cash

I think there are 4 points in our investment case that aren’t intact anymore:

I made a mistake: The company is less strong than I initially thought

I’ve found a better opportunity: the proceeds will be used to buy another company with a better outlook

The company is losing its moat: The competitive landscape is becoming more and more intense

Growth is slowing down: The business evolved from a growth company to a cheap Cannibal Stock