🎙️ Interview Ardal Loh-Gronager

The Perceptive Investor

Do you know Ardal Loh-Gronager?

Ardal and I met this year in Omaha after the AGM of Warren Buffett.

He wrote an excellent book called ‘The Perceptive Investor’. Let’s dive into his investment philosophy today.

Who is Ardal Loh-Gronager?

Ardal is a British‑Danish entrepreneur. He founded and runs Loh‑Gronager Partners, a London‑based investment partnership inspired by Warren Buffett’s original model.

Loh-Gronager is the author of The Perceptive Investor. This book is about investing in undervalued, high-quality companies.How to become an AI CFO

One of the best finance experts I know? Nicolas Boucher.

He’s giving a free masterclass on how CFO’s can benefit from Artificial Intelligence.

The event will take place today. You can register here:

🎙️ Interview Ardal Loh-Gronager

Compounding Quality: What inspired you to write The Perceptive Investor?

Ardal Loh-Gronager: Writing a book wasn’t part of my plan. In the months leading up to launching Loh-Gronager Partners, I felt a strong need to formalize my thinking. Nothing sharpens your views like putting them into words.

At first, I wrote The Perceptive Investor for an audience of one: myself. I wanted clarity on how I thought about markets, decision-making, behavioral psychology, portfolio construction, and risk management.

It became a way to organize my ideas and test them against the accumulated wisdom of those who came before me.

My process, like that of many great investors and operators I studied, wasn’t born perfect. It evolved. Mistakes were the curriculum.

What mattered most was staying curious and committed to learning. That, I’ve found, is the cornerstone of any enduring investment philosophy.

Compounding Quality: How would you describe your investment philosophy today?

Ardal Loh-Gronager: We take a long-term, concentrated approach to value investing. We want to be the proud owners of exceptional businesses.

Our portfolio is roughly split between ten holdings in developed markets and ten in emerging markets.

The businesses we own are very diverse.

However, they each possess the following characteristics:

A widening moat

Strong leadership teams with high integrity

A true owner’s mindset of management

Compounding Quality: You studied the world’s most successful value investors. What did you learn from them?

Ardal Loh-Gronager: Among the many qualities I observed across the investors and entrepreneurs, one stood out above the rest: focus.

To succeed, discover what drives you. You should learn how to focus if you want to outwork your peers.

It showed up in different forms. John D. Rockefeller had an unshakable drive to build the world’s greatest oil company.

Warren Buffett mastered the ability to tune out the noise of markets and media so he could operate in line with his nature. Regardless of external pressure.

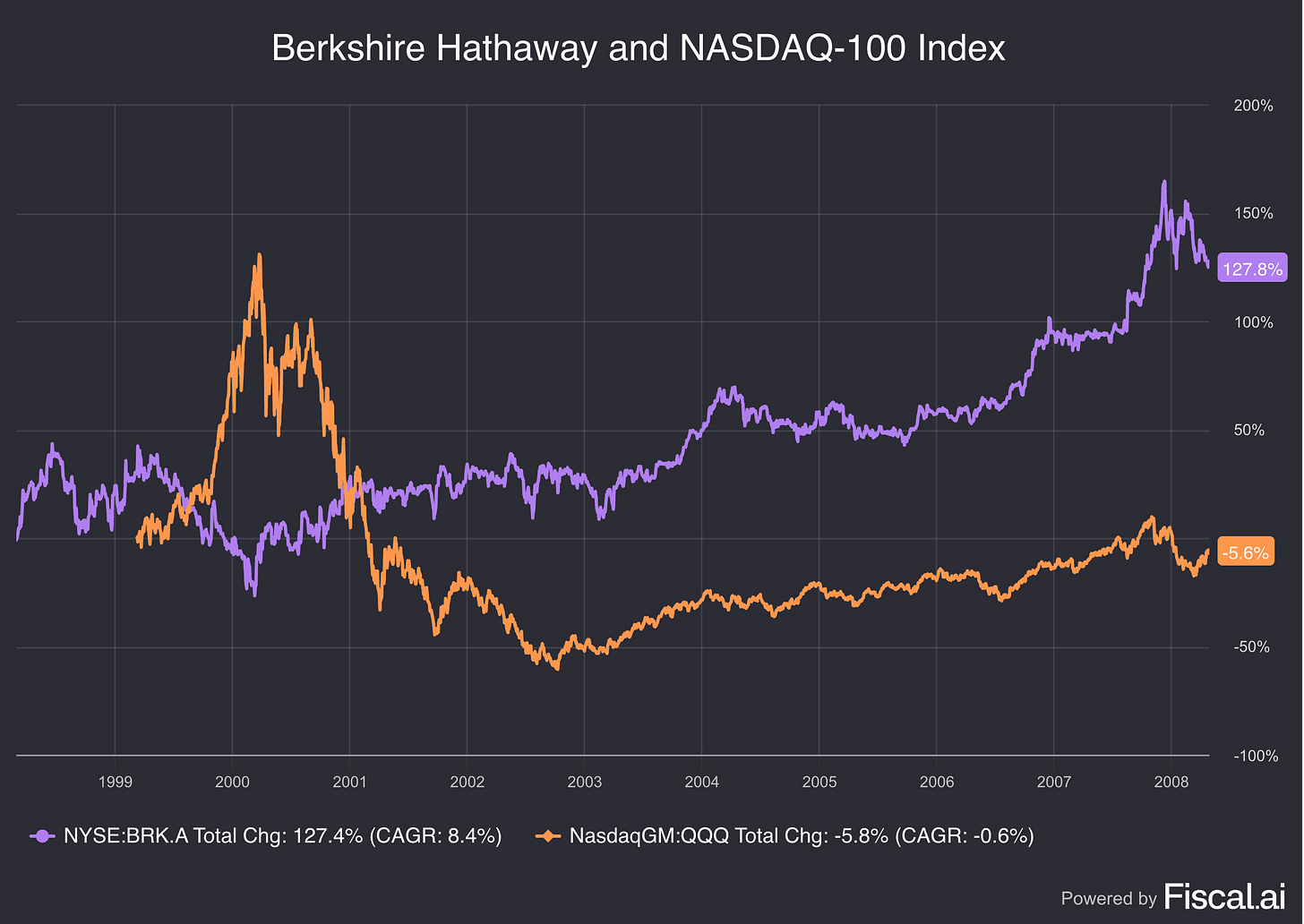

A defining example came during the late 1990s. As tech stocks soared, Buffett refused to chase the trend. Berkshire Hathaway’s stock was cut in half.

Many media outlets termed his value investing approach as going the way of the dinosaurs.

The dot-com bubble burst in 2000, and many of those high-flyers went to zero. Berkshire more than doubled in value.

Compounding Quality: You learned lessons from hundreds of present and historical figures. Which ones are the most important in your view?

Ardal Loh-Gronager: One of the most important lessons I took from my studies wasn’t about formulas or frameworks. It was learning from the mistakes of others. Especially the ones that could have been avoided with a bit more self-awareness.

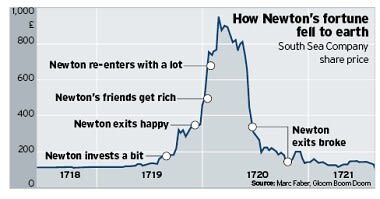

If I had to highlight just one example, it would be Isaac Newton.

His story demonstrates that even the very smartest people have had their fair share of mistakes, all of which we can learn from.

Newton had an estimated IQ of 190. He is widely regarded as one of the smartest people to have ever lived. But even he wasn’t immune to the pitfalls of emotional decision-making.

Newton made good money investing in the stock market during the initial stages of what became known as the South Sea Bubble in the 1720s. He sold his shares after a strong rally. Rational, disciplined, smart.

But then he watched others continue to get rich. Friends. Acquaintances. It gnawed at him. Eventually, he gave in.

He bought back in at twice the valuation level he initially sold it for, this time on margin. That decision came right before the crash.

He eventually lost a substantial part of his life savings. Reflecting on it later, he wrote, “I can calculate the motions of the heavenly bodies, but not the madness of people.”

Markets have a way of testing your conviction. Being a contrarian helps, but it’s not enough.

You also need the emotional resilience to stick to your principles when the crowd is moving in the opposite direction.

Compounding Quality: How do you approach valuation in today’s environment? Are traditional metrics like P/E or P/B misleading?

Ardal Loh-Gronager: At our Investment Partnership, every potential investment runs through a 250-question checklist. It’s a core part of our process. The checklist is split into two broad categories: quantitative and qualitative.

The quantitative section focuses on the numbers. Think return on invested capital, profit margins, or historical revenue growth. These are important, but we give them less weight. After all, the data is the same for everyone. One analyst’s read of the numbers rarely diverges meaningfully from another’s.

The qualitative side is different. It’s where our judgment matters most. Questions like “Is the management team a strong capital allocator?” or “Does this company benefit from network effects?” don’t have straightforward answers. That’s where we believe an edge is created.

Even on the quantitative side, context is everything. We track traditional metrics: price-to-earnings, price-to-book, and so on. But we never view them in isolation.

The relevance of each metric depends on the business model. A capital-light software business, for example, will look very different from an industrial company with heavy asset needs.

We don’t believe in a single magic metric. What matters is how the full picture comes together. Looking across metrics, across business models, and across competitors can reveal patterns. Sometimes, those patterns could reveal a durable competitive advantage that others might overlook.

Compounding Quality: Do you pay a lot of attention to management?

Ardal Loh-Gronager: We pay a lot of attention to management. I focus almost exclusively on what they do, not what they say. The same rule applies more broadly in life: actions reveal far more than words ever will.

The single most important metric for me when evaluating management is capital allocation skills. Have they consistently added value? Or has their decision-making diluted or destroyed shareholder value?

Some businesses can endure periods of poor leadership. But none can do so indefinitely. In the end, even great businesses need disciplined management to protect and grow intrinsic value over time.

Compounding Quality: What are the most common pitfalls for investors?

Ardal Loh-Gronager: The biggest pitfall in investing isn’t a bad stock pick. It’s a lack of self-awareness.

Too many investors underestimate their own susceptibility to cognitive and behavioral biases. The result? Poor decisions, often repeated.

Put it in historical context. The New York Stock Exchange was founded in 1817, less than ten generations ago. If you compressed the entire two-million-year history of Homo sapiens into a single day, modern portfolio theory would show up at 11:59:58.

The result? We’re running new software on Stone Age hardware.

Our brains haven’t evolved much since the time of woolly mammoths. Yet we’re trying to navigate highly complex markets using instincts designed for survival on the savannah. That creates problems.

These mental shortcuts, what psychologists call cognitive biases and behavioral heuristics, were designed to keep us alive. But in the markets, they work against us.

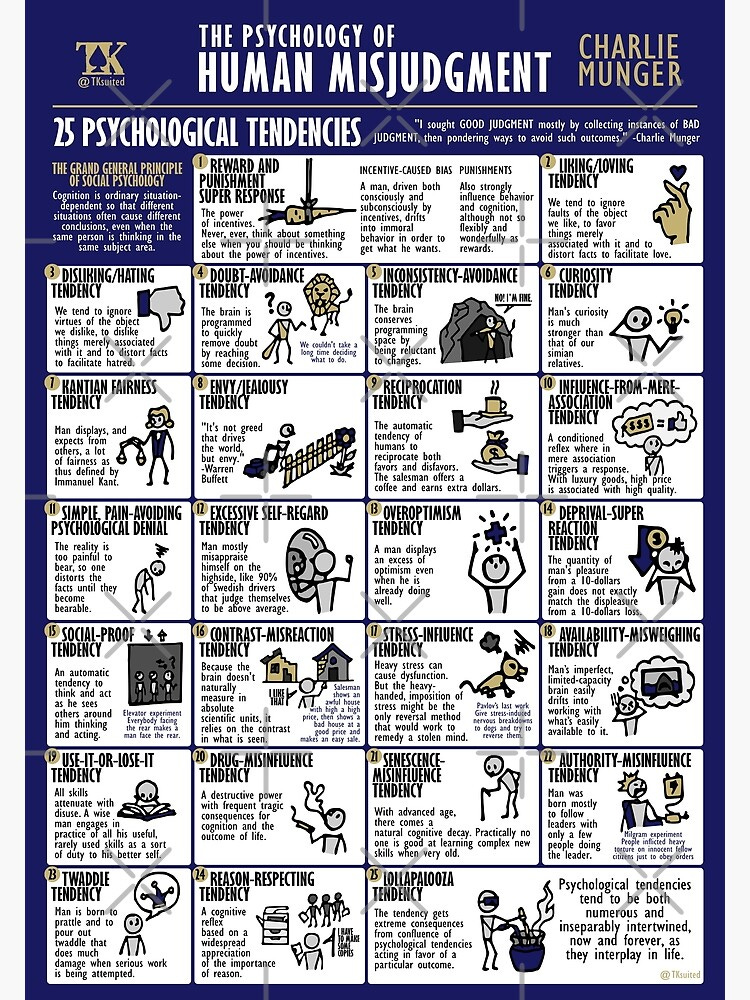

Charlie Munger knew this well. His speech, ‘The Psychology of Human Misjudgement’, is essential reading. In it, he explains how our brains trigger automatic responses that were once helpful but now hurt us as investors.

Take fear. If something rustled in the bushes, our ancestors ran. Better safe than sorry if a sabre-tooth tiger was lurking. But today? That same impulse makes people sell at market lows and buy at highs.

So, how do you manage it?

Control your environment. Make decisions in quiet, uninterrupted settings. Reduce exposure to bias triggers.

Ignore the media. News is engineered for attention, not accuracy. Fear sells. Constant exposure to headlines makes rational thinking harder, not easier.

Don’t check your portfolio constantly. As Nassim Taleb says, “Why would I put myself in a position where I may have negative emotional reactions to short-term drops?” At Loh-Gronager Partners, we don’t check prices during trading hours. That’s intentional. It helps us stay objective.

Compounding Quality: Your investing career began in 2009. How did you manage to start investing while no one else dared to?

Ardal Loh-Gronager: A lot of success, whether in life or investing, stems from luck. Being in the right place at the right time plays a major role. But the real differentiator is what you do with that luck. That’s where preparation kicks in. As the saying goes, “luck favors the prepared mind.”

I got lucky in 2009. I opened my broker account in March, just a month off the market bottom. It took a bit of time to set everything up and fund the account with about $150,000 in savings from various business ventures. The timing couldn’t have been better.

But what mattered more than timing was mindset. The headlines were apocalyptic. Talk of systemic collapse, market chaos, and a deepening recession dominated the news. I tuned it out. My focus was on finding exceptional businesses trading at massive discounts to their intrinsic value. That’s only possible if you believe one simple truth: “Most of the time, the world does not end. This too shall pass.”

That’s a view I still hold. Our outlook is shaped by our experiences.

Beginning my investing career during one of the worst financial crises of our time made a lasting impact.

It certainly shaped me as a long-term and contrarian value investor.

Compounding Quality: Where do you see the greatest opportunities for quality investors over the next 5 to 10 years?

Ardal Loh-Gronager: We have an edge as investors today compared to five or ten years ago. Accessing foreign markets has never been easier. Trading costs have fallen dramatically. And most importantly, management quality and shareholder transparency have improved across the board.

But despite all this progress, the data consistently shows a strong “home country bias” in investor portfolios. On the surface, that’s understandable. We’re most comfortable investing in businesses we know best.

At the same time, that familiarity can morph into a behavioral trap. Home country bias isn’t just a comfort zone. It can become a cognitive blind spot that limits opportunity and dampens long-term performance.

Over short periods, Emerging and Developed Markets often move in different directions. But over ten years or more, their returns usually come back in line. I’m talking about reversion to the mean.

The past seven years are a good example. Emerging Markets have mostly gone sideways or down. Developed Markets, especially the U.S., have surged thanks to the “Magnificent 7.”

History suggests this gap won’t last forever. If things revert as they often do, the next decade might favor Emerging Markets.

Compounding Quality: Thank you for your time, Ardal.

Ardal Loh-Gronager: Thank you for the opportunity to share with your audience!

The Perceptive Investor

Did you like this interview with Ardal, and do you want to learn more?

You can order your copy of his book ‘The Perceptive Investor’ here:

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Pieter, thank you for sharing this amazing interview! There's a lot in it for everyone to learn and benefit from !

Great interview. Found it very useful , Thanks for sharing !