🎤 Three crashes, one lesson

Interview Boris Sheikman

One of the most rewarding things about Compounding Quality?

The Community.

In the Community, like-minded people share daily investment insights and ideas.

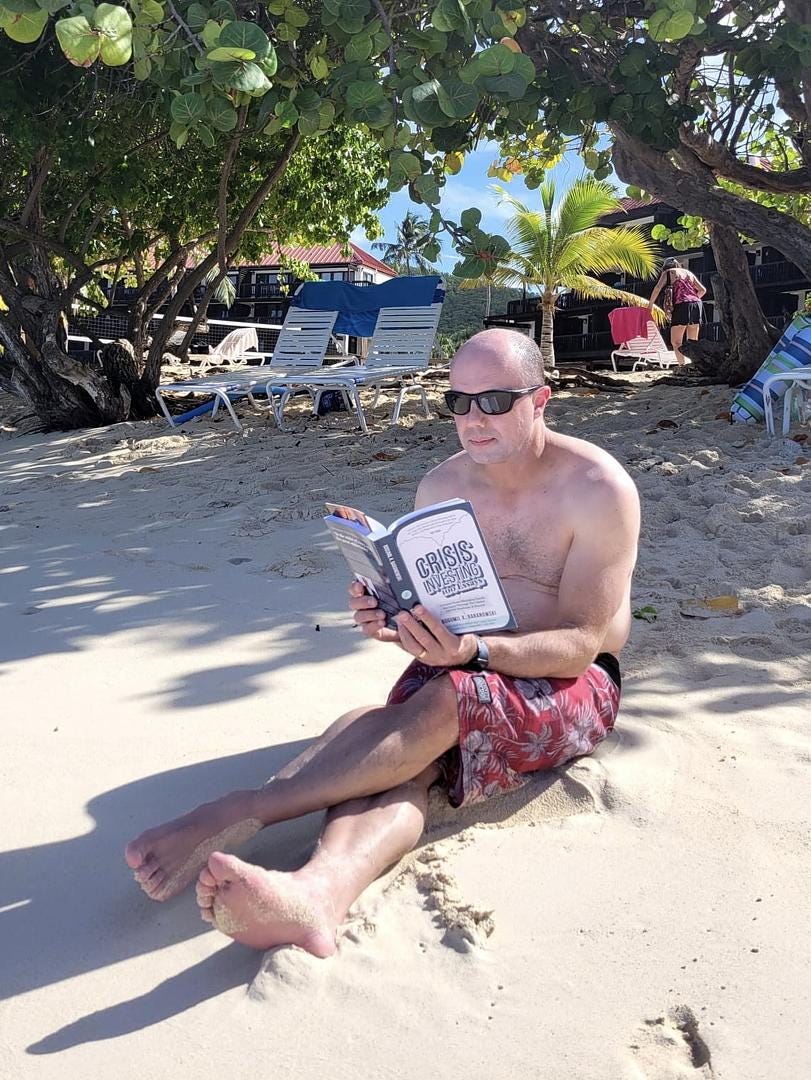

One of the most active members of the Community is Boris Sheikman.

Bio Boris Sheikman:

- Age: 47

- Lives in: United States

- Job: Baker Hughes (Oil & Gas Industry)

- Invests since: 2020

- Favorite stock: Amazon & Google

- Best investment ever: Without a doubt, my family!

Let’s dive into his investment story today.

How did your investment journey start?

Boris Sheikman: When I was 19 years old, the Dot-Com bubble took place. People around me started driving nice cars while I was driving an old beat-up Nissan. There was this weird company called Amazon that could be interesting according to some friends. I watched the stock flounder and meander and decided to sell it. Then it rocketed up and crashed spectacularly, losing 95% of its value.

And yet, when you could have bought Amazon at the height of the Dot.Com bubble, a $10,000 investment would have turned into $500,000. It’s a beautiful example of the magic of compounding.

During the Great Financial Crisis, something similar happened. I didn’t understand what was going on, but I saw some companies rise and then decline by over 70%. It was another boom and bust that I lived through. At the time, I thought I did good by not getting involved. The stock market was a casino. Investing back then would have been a great decision in hindsight. Businesses were on sale…

Fool me once, shame on you; fool me twice, shame on me. I fooled myself twice before and I wouldn’t let it happen again. The Dot-Com boom and bust and the Great Financial Crisis would eventually turn into blips when looking at the long term growth of markets and the economy.

As a young man, I could have invested at both the peak of the Dotcom bubble and the Financial Crisis and I would have done very well.

So when the COVID pandemic took place in 2020, I knew what was going on and I started investing.

To be honest, I had no idea what I was doing when I started.

I thought I understood companies like Amazon, Microsoft, and Visa … so I decided to buy them. This was a very good decision in hindsight and I appreciate how lucky I was to do so. It taught me to never underestimate the role of luck in your portfolio and in life.

What’s the best investment you’ve ever made?

Boris Sheikman: The best investment anyone can make is in their family.

There is no greater potential return on love, patience, and kindness than seeing your kids grow into your personal superstars and to take care of your life partner so you can be taken care of by them. My family is the foundation I rest my pillars on. It’s the answer to a happy life if you ask me.

Can you describe a time when an investment didn’t work out, and how you responded?

Boris Sheikman: During the SPAC bubble, I invested $3,000 in a SPAC that turned into an electric vehicle company. It was purely based on hype.

Today this investment is worth somewhere around $0.90.

The mistake I made was clear. I invested in a company that wasn’t profitable, didn’t have a moat, and couldn’t be considered quality at all.

It taught me to stick to quality companies with strong cash flows.

How has your investment style evolved over the years?

Boris Sheikman: At some point, I owned over 120 (!) stocks.

When I bumped into this guy called Warren Buffett I digested everything I could find. Thanks to Buffett, I knew I made a mistake by owning so many stocks.

And then… by pure chance… you and I bumped into each other in Omaha. You were about to speak at Gabelli’s conference the day before the Berkshire Hathaway meeting together with among others Christopher Bloomstran.

When the student is ready, the master appears.

Starting from then, I started to focus solely on quality stocks.

What’s your favorite book?

Boris Sheikman: One of my favorite books is Finite and Infinite Games by James P. Carse. The book contrasts two approaches to life:

Finite games: Players compete within fixed rules for a defined goal

Infinite games: Players keep playing and evolving the game itself

The book invites readers to adopt an infinite mindset, embracing creativity, openness, and continuous growth over rigid competition and finality.

Who is the investor you learned the most from?

Boris Sheikman: I’m learning a lot from you and the Community of Compounding Quality.

What I love about Compounding Quality is the clean and very simple framework used. As a result, I started using a disciplined approach focused on quality stocks.

I want to make investment decisions that are as rational as possible.

If you were obliged to invest all your investable assets with one person, who would you pick?

Boris Sheikman: This is a very tough question. It would be a toss up between Bogumil Baronowski and Howard Marks.

Howard Marks : Howard Marks understand how to read market sentiment and manage risk. His memos are the definition of what it means to keep your head and keep it cool while the market is losing its head and ratcheting up the temperature.

Bogumil Baronowski : A seasoned global investor and author, known for his emphasis on independent thinking, patience, and the importance of understanding the businesses behind the stocks. Bogumil Baranowski often says that the wealth we create may not be something we need right away but it’s also not something we can afford to lose. Preserving wealth is just as important, and challenging, as creating it.

I would trust either one completely with my fortunes.They understand that investing is a marathon and not a sprint and they act accordingly.

If you ever launch a fund, it may come in and steal the scene from both of these two though!

How do you keep improving as an investor?

Boris Sheikman: In three words:

Reading

Listening

Journaling

I read every evening after work for about 30-60 minutes. Reading is the best way to download something in your head. It’s amazing how much wisdom can be found in a $20 book.

During my commute and when I take a walk during lunch, I always listen to podcasts. My favorites are Bogumil’s Talking Billions, William Green’s Richer, Wiser, Happier, and The Acquired Podcast hosted by Ben Gilbert and David Rosenthal.

Last year we met in Omaha during the AGM of Berkshire Hathaway. Why should everyone attend this meeting?

Boris Sheikman: I attended the Berkshire AGM for the first time in 2024. It’s amazing to meet so many like-minded people. It has been a true eye-opener for me.

Investing can be a very lonely pursuit, especially for retail investors who may not know other investors in their neighborhood to meet up with. In contrast, the AGM was practically overflowing with investors who are eager and willing to share their world with you. You can meet people standing in line to get into the meeting and at nearby presentations. Investing need not be a solitary activity!

We can all learn a lot from each other and the AGM is a fantastic event to make connections with fellow investors!

I will definitely go back next year.

Do you have some favorite stocks for our readers?

Boris Sheikman: For sure! Here are my top 5 individual business ownership holdings:

Google ($GOOG): 6.2%

Apple ($AAPL): 4.4%

Microsoft ($MSFT): 3.9%

Amazon ($AMZN): 3.6%

Ameriprise Financial ($AMP): 3.0%

Thanks for this interview. Any last things you want to share?

Boris Sheikman: Investing is a beautiful intellectual game.

You learn something new about the world and yourself everyday. Even better, I am thankful for all the people I have been fortunate to meet and become friends with.

We may own Visa and Mastercard for 5 or 10 years but we can be friends and Partners for a lifetime. That’s the true gift of investing and the Community of Compounding Quality.

And as Charlie Munger once said: “The best thing a human being can do is to help another human being know more.”

Everything In life compounds. So, let’s compound kindness, patience, love, and compassion. Let’s help each other grow to become a better version of ourselves everyday.

Everything In Life Compounds

Pieter

Whenever you’re ready

That’s it for today.

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Tuesdays, Thursdays & Sundays)

📚 Full access to our entire library of data-driven articles

📈 An insight in our Portfolio full of quality stocks

🔎 Full investment cases about interesting companies

📊 Access to the Community

Thank you for reading!

Book

Order your copy of The Art of Quality Investing here

Compounding Dividends

Do you like dividends? Test out Compounding Dividends here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Thank you for this great interview, Pieter and Boris. I look forward to again seeing you both in Omaha.

Good stuff. More of these type of interviews please!