🎙️ Interview François Rochon

François Rochon is one of the best quality investors in the world.

Since 1993, his personal portfolio, that serves as a model at Giverny Capital, has returned more than 5000% over three decades. He compounded at 14.4% before management fees (and 13.2% after management fees)*.

Compounding Quality had the honor to interview Mr. Rochon.

An interesting talk about Quality Investing, Warren Buffett, Big Tech, the importance of reading, and much more.

“Our core holdings are the same as last year. We own shares of the best businesses in the world. Our attitude is that of a museum director: we only want to own masterpieces.”

François Rochon

You don’t know François Rochon yet?

You can read this article to learn more about Rochon’s investment philosophy: How to outperform the market by François Rochon.

Interview François Rochon

Compounding Quality: How would you define yourself as an investor?

François Rochon: I’m a value investor. In essence, I think every good investor is a value investor: you try to buy companies for less than what they’re worth.

However, value investing is not just about finding cigar butts that trade at a very low price-to-earnings multiple or below their book value.

You should also take the quality of the business and future growth into account. I want to own great companies that can grow their intrinsic value per share at attractive rates. It’s very important that these companies have a sustainable competitive advantage and do something unique.

When you’ve found a company that matches these criteria, the company can be undervalued even if it trades 25 or 30 times earnings.

Compounding Quality: How do you value a company?

François Rochon: I try to use common sense and always use the same valuation approach.

I try to determine two things:

How much the company will earn (EPS) in 5 years from now

The fair P/E multiple at which I think this company should trade over time

Let’s say that company X earns $1 per share today and trades at a P/E multiple of 18x and that I make the following assumptions:

The company will earn $2 per share in 5 years from now

A fair P/E multiple would be 20x

In that case, your expected return looks like this:

Stock price = EPS * P/E multiple

Stock price today = $1 * 18 = $18

Stock price in 5 years from now = $2 * 20 = $40

When my assumptions would be correct, my return would be equal to 122.2% or 17.3% per year.

I want to earn 15% per year based on these calculations. This would mean that the stock should double every 5 years.

A hurdle rate of 15% provides me with a Margin Of Safety in case my assumptions were wrong.

Compounding Quality: Your ‘Rule of 3’ is amazing. Can you explain it to our audience?

François Rochon:

Sure.

One year out of three, the stock market will go down at least 10%

One stock out of three that we buy will be a disappointment

One year out of three, we will underperform the index

Having these rules in place helps us to be better prepared when we face these obstacles. It’s very important that you mentally prepare yourself for tough times.

Having clear investment rules is very important. It helps you to be realistic.

“No wise pilot, no matter how great his talent and experience, fails to use a checklist.” - Charlie Munger

Compounding Quality: In each shareholder letter, you compare Giverny’s Owner’s Earnings with the evolution of the stock price. Why is this so important for you?

François Rochon: In the long term, stock prices tend to follow the Owner’s Earnings of a company. This principle was based on the concept that Warren Buffett first used in his shareholder letter of 1989 that he labelled “look-through” earnings.

It’s very simple to calculate the Owner’s Earnings. We arrive at our estimate of the increase in intrinsic value of our companies by adding the growth in earnings per share (EPS) and the average dividend yield of the portfolio. So we just multiply the EPS by the number of shares we own of each company. We add them all up and compare the total with the total of the previous year. And to that growth rate, we add the average dividend yield.

As you can see in the picture below, Giverny Capital’s Portfolio increased its Owner’s Earnings by 2591% (including dividends) since 1996 which is roughly in line with the performance of the Portfolio as the Portfolio has increased by 2234%.

While in the short term there might be a (huge) difference between the evolution of the Owner’s Earnings and the performance of a stock, stock prices tend to follow the evolution of the Owner’s Earnings in the long term.

Compounding Quality: In each shareholder letter, you write about ‘The Podium of Errors’ (3 biggest mistakes of the year). Why is this so important to you?

François Rochon: This concept was also inspired on Warren Buffett.

Warren Buffett talked in his shareholder letter about his ‘Mistakes du jour’. I thought that if Warren Buffett can recognize his mistakes, I certainly can too.

It’s very important to be humble and honest. You should treat your clients as Partners. Admitting your mistakes keeps you humble and this is very important when investing.

It’s important to highlight that the most costly mistakes have always been errors of omission. The stocks that you didn’t buy. In 1994, I refused to buy Starbucks because I thought the stock was overvalued at 40 times earnings. Since then, the stock is up 12,800% (129x).

Compounding Quality: Each year you also discuss ‘The flavor of the day’, a certain market segment you consider as overvalued. What’s the flavor of the day today?

François Rochon: Over the past few years, it was very hard to beat the S&P 500 index. Big Tech has played a big role in this as these companies performed exceptionally well.

I am quite skeptical about the valuation of companies like Nvidia and Tesla. The valuation of these companies looks very demanding and it will be very hard for them to meet expectations. A lot of future growth has already been priced in.

Big Tech has a large weight within the index. I am not sure whether these high valuation levels are justified at this point in time.

Compounding Quality: What’s a famous investment rule you don’t agree with?

François Rochon: It would be ‘You don't go broke taking a profit’.

You can’t go broke taking a profit, but I highly doubt it will make you very rich.

The key to successful investing is holding on to your winners. It only takes a few very big winners during your career to become a really successful investor.

Compounding Quality: Which key characteristics should a good investor have?

François Rochon: Warren Buffett always says that the most important quality for an investor is temperament, not intellect.

In essence, there are 3 qualities an investor must have:

Humility

Rationality

Patience

Be the kind of person you would want your daughter to marry with and always think on the long term.

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.” - Warren Buffett

Compounding Quality: Warren and Charlie are known as vivid readers. How much do you read?

François Rochon: I read a lot. Basically anything I can get my hands on. I read 10Ks, articles, blog posts, reports from Morningstar, …

I have been reading Value Line religiously every single week since the early 1990s.

The beautiful thing today is that thanks to the internet you can read the annual report of Japanese or Polish companies in English without any problems. That’s something you couldn’t do 20 years ago.

I don’t keep track, but I estimate that I spend 80% of my day reading.

Compounding Quality: What’s the best investment you’ve ever made?

François Rochon: There are two investments that come to my mind: Dollarama and O’Reilly Automotive.

I bought Dollarama in early 2010 and the stock has increased 24x. We sadly trimmed it a few times. Otherwise we would have benefited even more.

In 2004, we bought O’Reilly Automotive but we sold our last shares in February 2020. If we would have kept them, we would have a return of more than 4,000% on the company.

Both investments are good examples of the importance of letting your winners run.

Compounding Quality: What’s the worst investment decision you’ve ever made?

François Rochon: My worst mistakes are all mistakes of omission. The great companies within my circle of competence that I didn’t buy.

When I would have bought Starbucks in 1994, I would have made more than 12,000%. I knew it was a great company and that they would revolutionize the US coffee market but I thought the stock was overvalued at a PE multiple of 40x.

The same goes for Factset Research (the stock is up close to 6,000% since 1998). I knew the company very well because I met management. It’s a great business with great products. I bought the shares but at some point I sold them due to valuation concerns. This was a big mistake. I think that when you own a great company it is a mistake to sell it because it looks expensive.

Compounding Quality: If you were obliged to invest all your investable assets with one person and you couldn’t choose Warren or Charlie, who would you pick?

François Rochon: I would choose Glenn Greenberg. He manages the Brave Warriors Adviros Fund.

He’s a great investor with strong integrity and a great track record.

Compounding Quality: What’s the best piece of advice for someone who will keep investing for the next 20, 30 and 40 years?

François Rochon: I would give two pieces of advice.

First of all, always be prepared for tough times. You will experience recessions and bear markets and they will be painful. On average, a bear market takes place every six years or so.

The best protection against bear markets and economic crises is to own great companies that aren’t too sensitive to general economic conditions. You want to invest in companies with a healthy balance sheet and strong profitability.

Secondly, you must be very patient. When you invest in a company, it can take years before your investment bears fruit. You have to be patient and watch your tree grow.

In the long term, stock prices always follow the owner’s earnings. Compounding can be very powerful in the long term.

Compounding Quality: Thank you very much for your time and insights, François. Any final thoughts for our readers?

François Rochon: If you have the right investment philosophy and right behavior, eventually you’ll do well in the long term.

Investing is all about delayed gratification. It’s about short-term pain for long-term gain. Think in terms of decades instead of quarters.

What matters in investing is humility, rationality and patience. Most investors don’t have patience. If you have patience, you’ll get richly rewarded in the stock market over time.

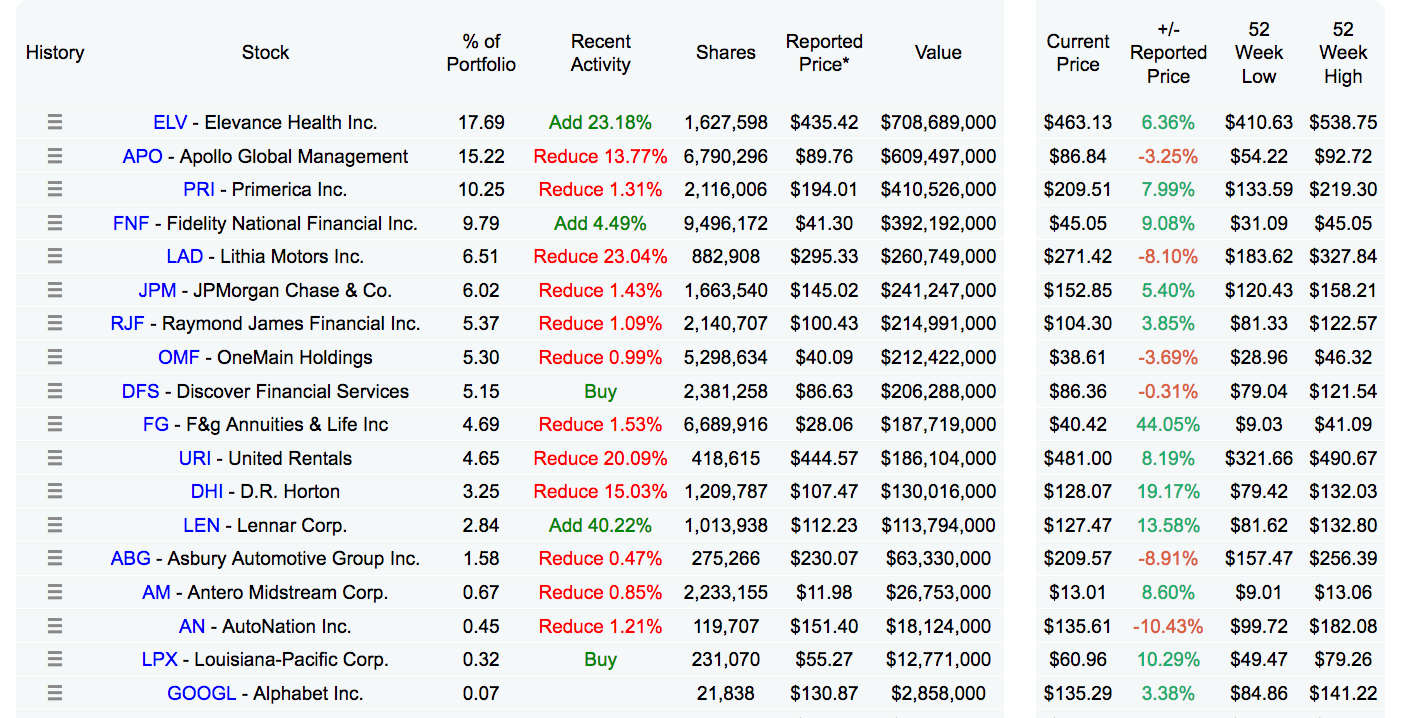

François Rochon’s Portfolio

You want to learn more? In the Community, we discuss François Rochon’s Portfolio with our Partners.