🎙️Quality Investing

Interview Luc Kroeze

Hi Partner 👋

Welcome to this week’s 📈 free edition 📈 of Compounding Quality. Each week we talk about the financial markets and give an update on our Portfolio.

If you’re not a subscriber, here’s what you missed this month:

If you haven’t yet, subscribe to get access to these posts, and every post.

Those who keep learning keep rising in life.

The Art of Quality Investing explains the entire Quality Investing philosophy to you.

In this interview, you’ll learn about the investment philosophy of Luc Kroeze, a quality investor at heart.

🎙️Interview Luc Kroeze

Compounding Quality: What is the essence of quality investing?

Luc Kroeze: Quality investing focuses on identifying excellent companies based on clearly defined criteria.

But in the end, it’s important to understand that all intelligent investing is value investing. You try to buy companies for less than what they’re worth.

A distinction can be made between:

Value Investing

Growth Investing

Quality Investing

Old-school value investors are primarily concerned with the price of the stock. The quality of the underlying company is a secondary concern or even no concern at all.

The difference between a value investor and a quality investor is that the latter does not put price first. Quality investors are willing to pay a premium for exceptional companies. For some outstanding businesses, it’s worth paying up for as they keep growing their intrinsic value at attractive rates.

Growth investors target high revenue growth, even if it comes at the expense of its profitability or even its financial health. This is different compared to quality investors. Quality investors only become interested when the business has a long track record of steady growth, exceptional profitability, cash flow generation, and good financial health. In other words, the quality investor does not focus on the winners of tomorrow but on companies that have already won.

In summary, quality investing to me means selecting companies in such a way that only the very best remain. When these companies trade at a fair price, you buy them with the intention of never selling them again.

Compounding Quality: How can ‘The Art of Quality Investing’ help investors to invest in quality stocks?

Luc Kroeze: I hope the book can guide novice as well as experienced investors in their search for quality companies.

I have read quite a bit about investing, particularly about quality investing, but often missed a clear framework for practical application. I have tried to fill that gap with this book.

I cannot guarantee that the stocks of the companies that match the criteria outlined in the book will result in a good performance for you as an investor.

What I can guarantee is that the framework in the book will guide you to excellent companies (here’s a list of 15 companies that match the criteria outlined in the book).

I feel good knowing I put my money into the best companies in the world. The strategy helps me to sleep better at night than when I used to invest in cheap stocks of not-so-great companies.

Compounding Quality: What’s the best investment decision you’ve ever made?

Luc Kroeze: You would probably expect me to name a successful company I own. After all, successful results are appealing.

But the best investment decision I made was to start focusing on quality investing. Just like Buffett, I evolved from buying fair companies at a wonderful price to wonderful companies at a fair price.

Starting to pick quality companies improved my results and gave me peace of mind. This is often an overlooked benefit of quality investing.

Compounding Quality: What’s the worst investment decision you’ve ever made?

Luc Kroeze: The worst decision I made was undoubtedly starting to pick stocks without knowing what I was doing.

Of course, these poor investment decisions taught me some important lessons that came in handy later on, but I believe I could have learned those lessons without unnecessarily losing money.

Compounding Quality: In the book, you created a checklist to identify quality stocks, can you go over this checklist?

Luc Kroeze: I have developed a checklist that will allow you to find excellent companies. The checklist consists of both qualitative and quantitative criteria.

Qualitative criteria:

Is the company easy to understand?

Does the company operate globally and does it have a diversified customer base?

Can the company grow at attractive rates?

Has the company a sustainable competitive advantage?

Does the company have pricing power?

Does the company hold a market-leading position?

Is the company led by great managers?

Is the company recession-resistant?

Does the company face potential disruption risk?

Quantitative criteria:

Does the company have a strong track record of revenue and profit growth?

Can the company translate most earnings into free cash flow?

Does the company generate a high ROIC?

Does the company have a healthy balance sheet?

In the book, we go over all the criteria. The framework should allow you to find wonderful companies.

Compounding Quality: Can you give some examples of companies that match these criteria?

Luc Kroeze: Companies where you can check off all criteria are rare.

Today, I think LVMH, Otis, and Zoetis are great examples. However, I think Otis's growth prospects may be a bit on the lean side

You can find my 3 favorite stocks in this article.

Compounding Quality: The book talks a lot about pricing power. Why is it so important?

Luc Kroeze: Pricing power is the extent to which a company can increase its prices without losing customers.

Companies with pricing power have a certain control over their growth, even in challenging market conditions. The products or services may offer something unique that makes customers willing to pay. Or it is difficult, time-consuming, or risky to switch to a competitor, which means that price increases are tolerated.

Pricing power is a form of growth that does not require direct investment. Warren Buffett once said that pricing power is the strongest characteristic a company can have. I agree with him.

Compounding Quality: You talk about the importance of ROIC in the book. There are 2 variants. Can you elaborate on them?

Luc Kroeze: ROIC is a powerful metric that can tell you various stories. It provides insight into the value creation and efficiency of a company. It also reveals a lot about capital requirements.

Furthermore, a high return on invested capital signifies the presence of a sustainable competitive advantage.

I use two variants of ROIC, and both provide unique insights:

A traditional variant

Operational ROIC

In the traditional variant, I include goodwill in the invested capital. It tells you something about the capital allocation skills of management.

In the operational variant, I exclude goodwill and other items from the invested capital that do not require investments when the company wants to grow organically. The operational variant gives you an idea of how much a company needs to invest in the future to achieve a certain growth rate.

If you want to evaluate management’s capital allocation skills, the traditional calculation of ROIC is sufficient. However, if you want to understand how the company fundamentally generates profits and how much cash will roughly remain after financing its potential growth, calculating operational ROIC is my go-to method.

Compounding Quality: If you were obliged to invest all your investable assets with one person and you couldn’t choose Warren Buffett, who would you pick?

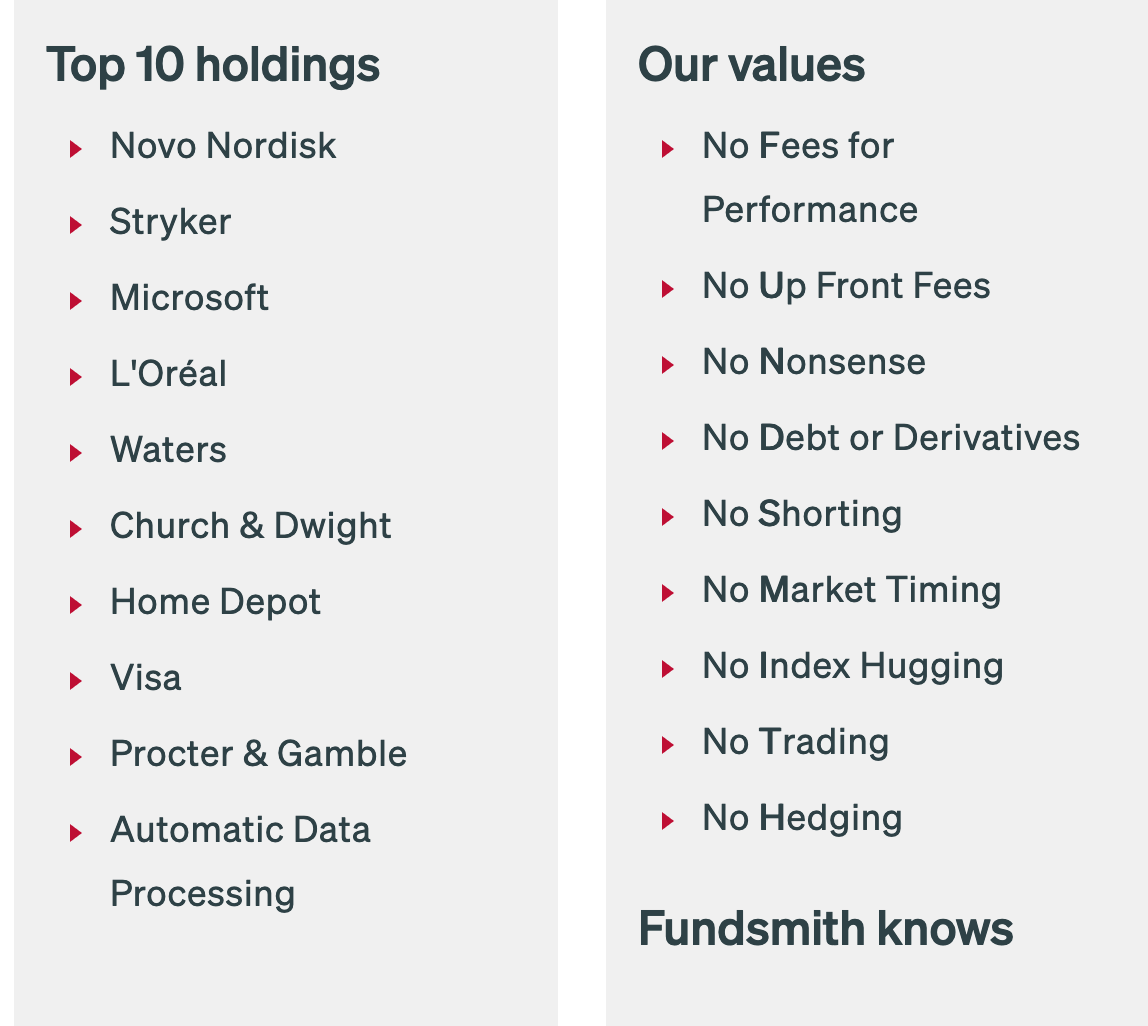

Luc Kroeze: There are plenty of excellent fund managers out there. But it's Terry Smith, in particular, who has inspired me, and I would entrust him with my money alongside a few index funds.

The man is straightforward and has a pragmatic investment approach. He's also not afraid to change his mind, without losing sight of the core principles of his strategy. I believe in the concept of quality investing, and I think Smith masters the strategy well.

Compounding Quality: Which key characteristics should a good investor have?

Luc Kroeze: We often talk about various complex metrics and numerical skills when it comes to investing.

However, I think the psychological aspect is ultimately the most important, yet the least understood.

Adam Smith sums it up quite well:

"Eighty percent of the market is psychology. Investors whose actions are dominated by their emotions are most likely to get into trouble."

In the long term, it's not just your analytical skills that will make the difference, but also how you manage your emotions in certain market conditions.

You need patience, and when things get tough, discipline and perseverance are crucial.

You must be able to think on your own. Be critical of yourself and admit when you’re wrong.

Dare to make mistakes. As an investor, you don't always have to be right. You just need to be right more often than wrong.

Compounding Quality: Why should everyone read The Art of Quality Investing?

Luc Kroeze: I hope this book provides a complete framework to invest in the best companies in the world.

This will help to give new investors a solid starting point.

For the experienced investor, I hope to provide additional information and insights. For example, I explain why you can pay higher multiples for quality companies. It is often claimed that quality deserves a premium, but rarely is it demonstrated why this is the case and how you can explain it numerically.

Furthermore, I hope The Art of Quality Investing can offer something to other types of investors as well.

I hope that you, whether experienced or just starting out, whether you are a growth-, quality-, or value investor, can learn something from the book.

The Art of Quality Investing

Since the book launched last week, thousands of copies have been sold already.

Order your copy here and don’t miss out:

Whenever you’re ready

That’s it for today.

Compounding Quality is all about securing your financial future.

Whenever you’re ready, here’s how I can help you:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

📊 Access to the Community

✍️ And much more!

Happy Compounding!

Pieter (Compounding Quality)

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Dear Pieter and Luc,

I was truly captivated by this interview. It's articles like these that not only educate and inspire but also unite people worldwide. Your book, which I'm currently engrossed in, is clearly deserving of its bestseller status. Pieter, your belief in the power of passion translating into remarkable results shines through in your work, and both you and Luc embody this philosophy. It's a privilege to have connected with you both and to have access to your invaluable insights. Gentlemen, you have my utmost respect and admiration!

Pieter,I can't wait to see you in Omaha, and I hope to meet Luc too in the near future.