Investable Universe

Are you ready for the Compounding Quality Universe?

The list contains 139 companies which are considered as high quality.

In other words: when valuation looks attractive we might want to buy these stocks.

Creation of the watchlist

The essence of all companies we want to own is very simple:

Buy wonderful companies

Led by outstanding managers

Trading at fair valuation levels

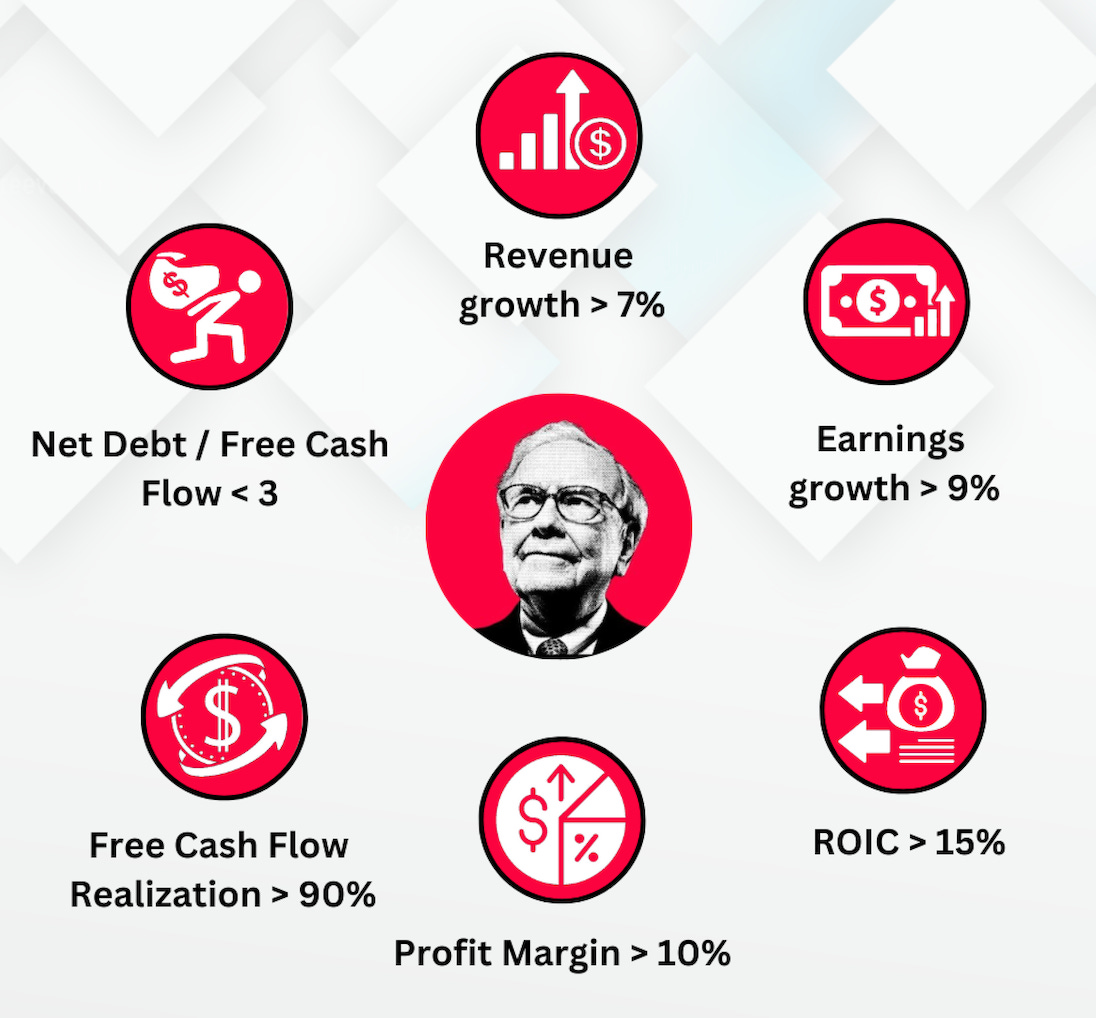

Via Bloomberg, we screened for quality stocks like this:

When you screen for these criteria, you’ll find around 300 companies.

The list was further trimmed down to 139 companies based on the following criteria:

We should be able to understand the business model

The business model should look attractive

The company should be led by great managers

The company should have a sustainable competitive advantage (moat)

Commodities, banks, and cyclical businesses are excluded

The companies that remain can all be considered as high quality.

“We buy stocks the way we buy toilet paper: high quality, on sale, and in bulk sizes.” - Allan Mecham

Outperformance

The investable universe managed to outperform the S&P 500 by a wide margin in the past.

We expect that this trend will continue in the future.

Why? Let’s take a look at this table:

As you can see, the universe has the following characteristics compared to the S&P 500:

Healthier balance sheet

Lower capital intensity

Better capital allocation

Higher profitability

Higher historical AND expected growth

Slightly lower valuation

To summarize: you invest in better companies that are trading at cheaper valuation levels.

That’s exactly why this universe managed to outperform the S&P 500 with more than 5% per year in the past.

Are you ready? Let’s dive into the list!