Let’s dive into PayPal today.

A cheap company that is currently heavily buying back shares.

You’ll receive a full investment case with everything you need to know.

PayPal Holdings ($PYPL)

PayPal is a buyback machine trading at a low valuation - a great recipe for strong returns.

💳 Company name: PayPal Holdings

✍️ ISIN: US70450Y1038

🔎 Ticker: PYPL

📚 Type: Cannibal Stock

📈 Stock Price: $68.9

💵 Market cap: $68.1 billion

📊 Average daily volume: $782 million

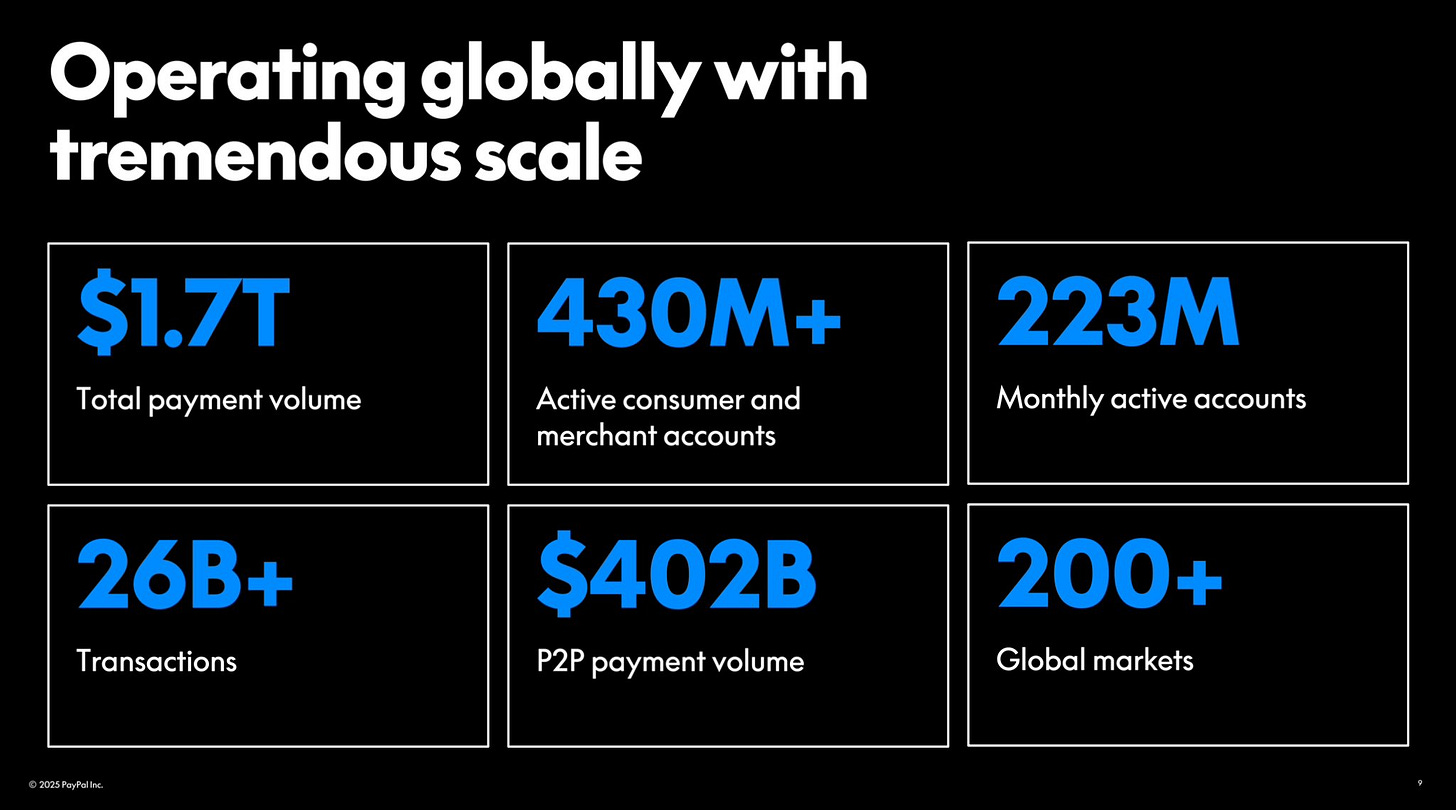

It is a big and powerful digital payment company. They are well-known and widely used.

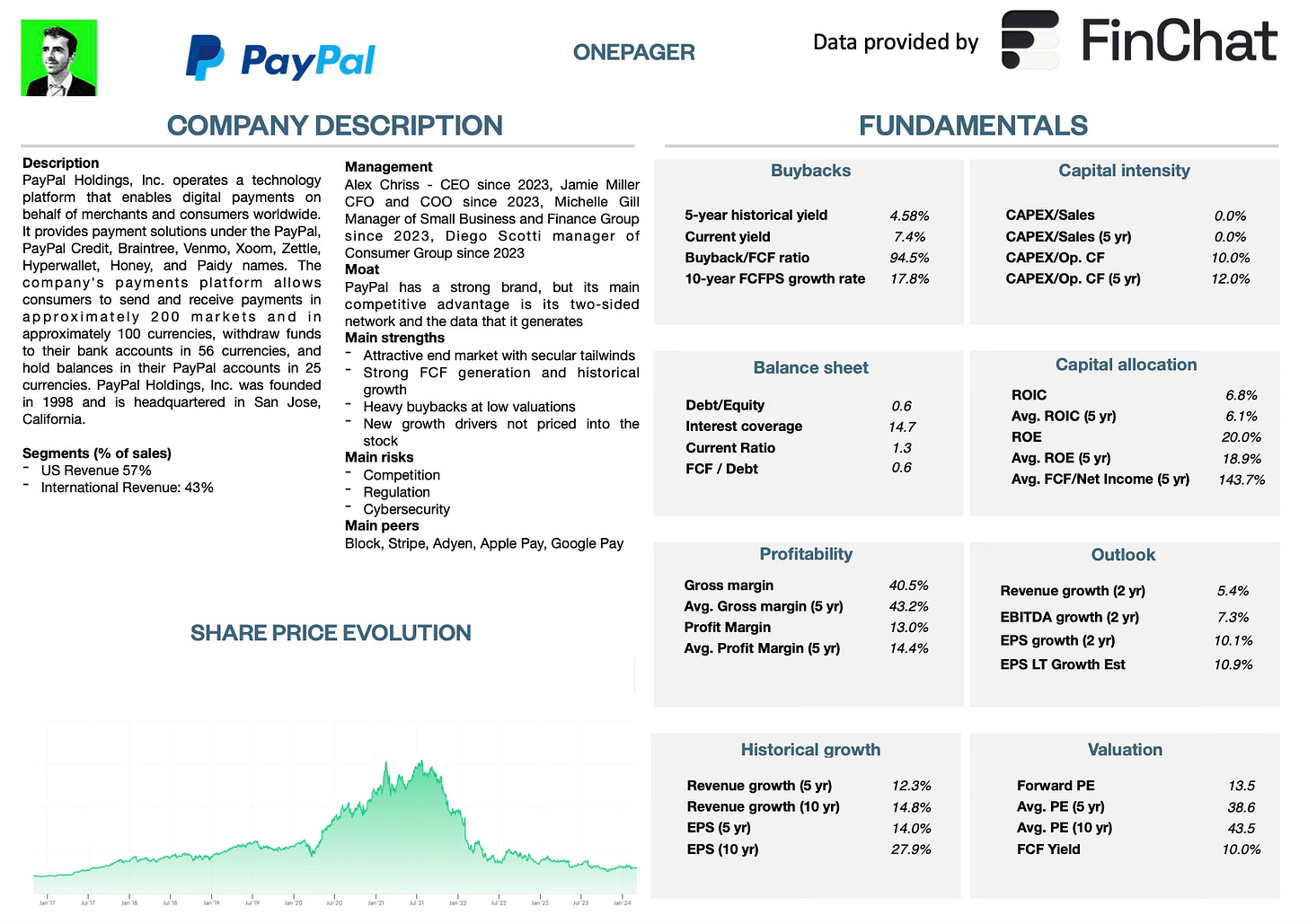

Onepager

You don’t know PayPal yet?

Here are the basics (click on the picture to expand):

Key Investment Rationale

Solid Balance Sheet - PayPal could pay off its net debt with a few months of Free Cash Flow

Lots of Cash Flow - The company has grown its FCF by 15% per year for the last decade

Secular tailwinds - PayPal’s industry is expected to grow between 11% and 21% per year for the next 5 years

Massive buybacks - The company has bought back more than 12% of shares outstanding in the last 2 years alone

Attractive Valuation - the current P/E ratio is 65% lower than the 5-year average

A conservative Earnings Growth Model says we can expect a 12% return

Other methods predict up to 20% returns per year

Full Investment Case

TJ bought PayPal for the Portfolio of Compounding Dividends.

You can find his full investment case here:

Portfolio Compounding Dividends

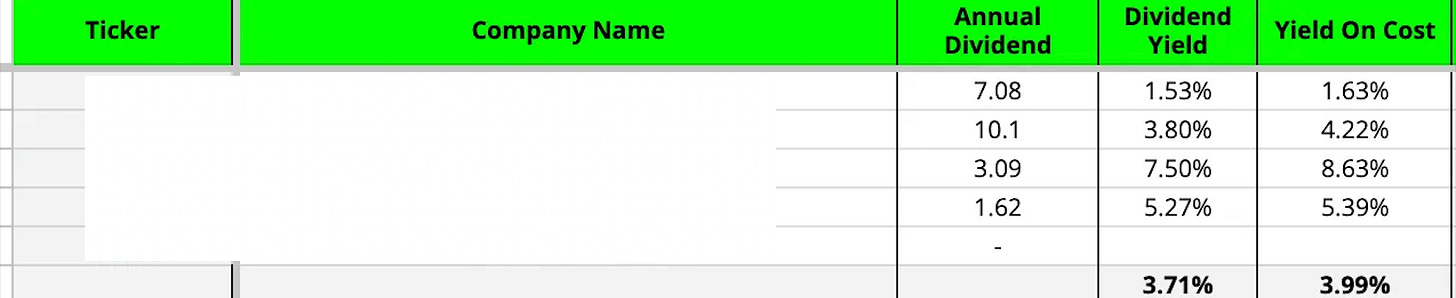

The beautiful thing about dividend investing?

No matter whether the stock market goes up or down, you get paid your dividends.

And the companies TJ buys are increasing their dividends (almost) every single year.

That’s exactly why it’s very interesting to look at the Yield On Cost.

The Yied on what?

The Yield On Cost compares the current Dividend Per Share with your purchasing price.

Here’s what things look like for the current Portfolio of Compounding Dividends:

I wouldn’t be surprised if the Yield On Cost exceeds 10% one day.

To be continued!

If interested, you can explore Compounding Dividends here.

Everything In Life Compounds

Pieter

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data