One of the best compounders in the world? Heico.

Here’s what a $10,000 investment would have given you since 1990:

S&P 500: $288,000

Berkshire Hathaway: $795,000

Heico: $8,563,000

Did you miss the flight? Let’s find out.

Heico - General Information

👔 Company name: Heico

✍️ ISIN: US4228061093

🔎 Ticker: HEI

📚 Type: Owner-Operator

📈 Stock Price: $228

💵 Market cap: $27.7 Billion

📊 Average daily volume: $137 Million

Onepager

Here’s a onepager with the essentials of Heico

Many of you have asked about this, so I’m considering launching an investment fund based on the principles I’ve shared with you over the years.

To gauge interest and understand potential investments from my readers and followers, I’ve created a short survey.

Might you be interested? Fill in this survey to be kept up to date.

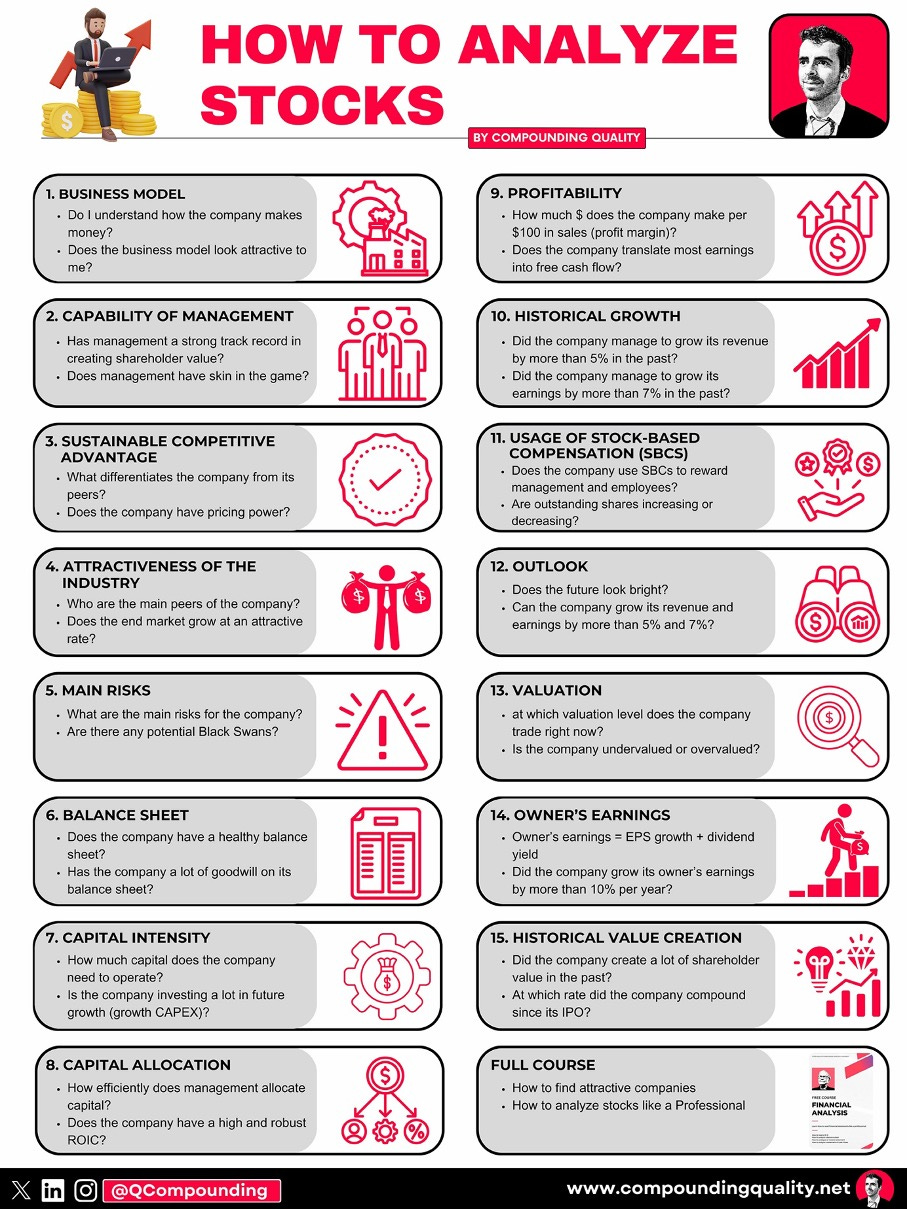

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Heico a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

At any given moment, roughly 10,000 planes are soaring through the sky.

You have likely been on one this year, which means you have been in contact with Heico.

Heico ensures planes and spacecraft stay in the air by providing vital replacement parts. They are a clear leader in a niche market.

Their product line includes more than 14,000 parts, including engine components, cooling system components, and brake pads.

But there’s more.

They currently own 98 subsidiaries operating in niche segments of aviation, defense, space, medical, telecommunications, and electronics.

That makes Heico a serial acquirer.

Serial acquirers can offer great benefits:

(If you’re interested in learning more about serial acquirers, click here)

Heico usually buys 80% of the subsidiaries to keep the ownership mindset alive.

They operate in two segments:

The Flight Support Group (68.1%) makes and repairs aircraft parts for commercial, military, and business planes

The Electronics Technologies Group (28.9%) makes and sells advanced electronics for aviation, defense, and other industries

2. Is management capable?

Given the importance of the acquisitions to Heico's growth, we need an exceptional capital allocator at the helm.

In other words, we want people to pay the price for making wrong acquisitions.

This is certainly the case for Heico.

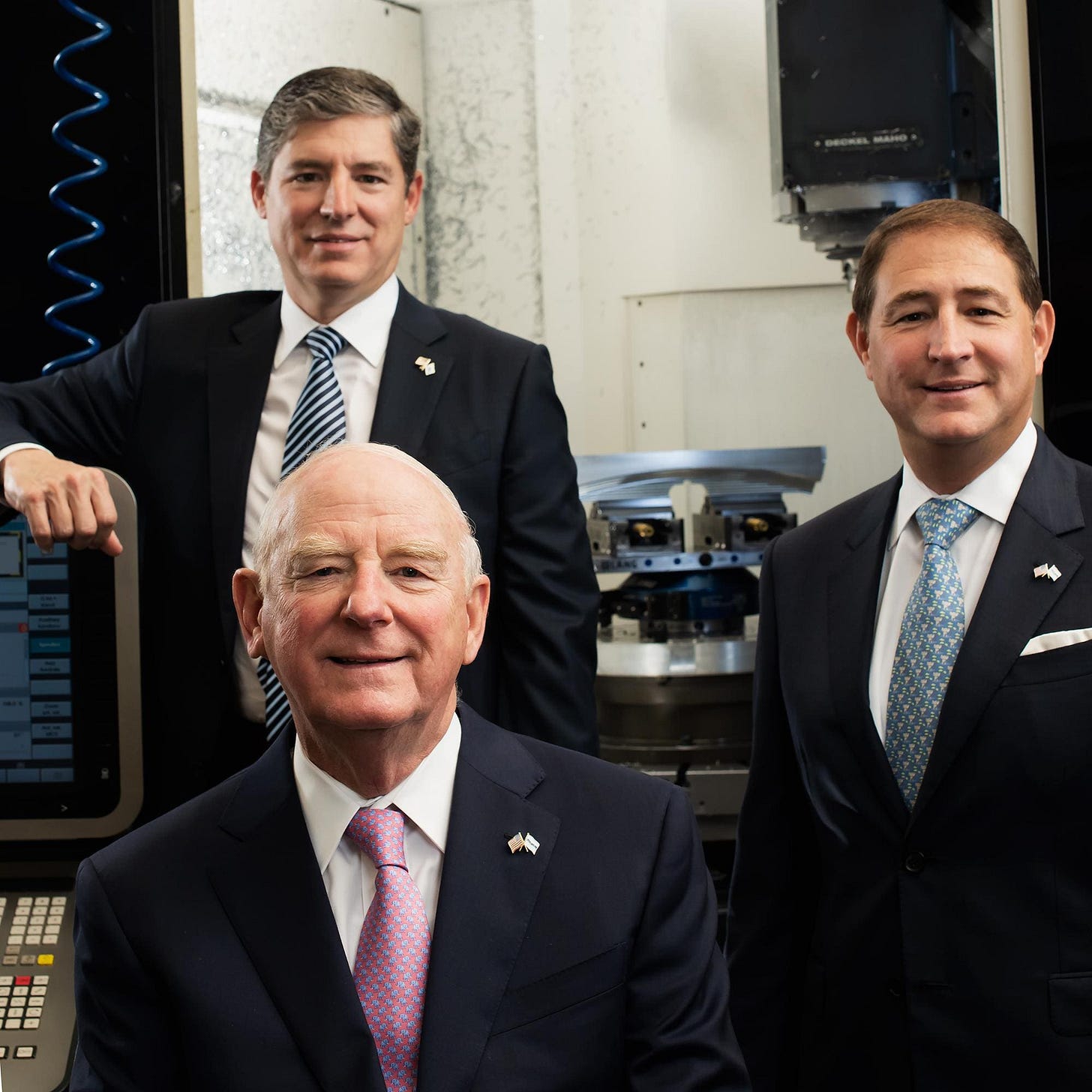

The Mendelson family took control of the company in 1990.

Today, they are still active and hold 16.6% of the shares. For the Mendelsons, Heico isn’t just a business, it’s family wealth. That’s like music to my ears. Why you may ask?

Family-run businesses focus on long-term value creation.

Since the Mendelsons took over, Heico has generated a total return of roughly 82,000% (CAGR = 22%). Before them, the CAGR was only 3.2%. It looks like they are doing something right.

But the most impressive part? 400 (!) employees of Heico own more than $1 million worth of Heico stock. That’s roughly 4.5% of all employees.

The conclusion? Heico is a great example of an Owner-Operator.

"The stock has turned a lot of ordinary Heiconians, especially early staffers, into millionaires. No, that’s incorrect, multimillionaires.” - Larry Mendelson

3. Does the company have a sustainable competitive advantage?

Heico has a strong moat.

Airlines love them because Heico’s parts are cheaper than the original manufacturers’ but work just as well.

This sounds too good to be true, right?

It isn’t! Heico is lazy and very smart at the same time.

The Mendelsons saw an opportunity to expand the product line by reverse engineering existing parts. This clever move saved them from expensive R&D, making them the lowest-cost producer.

Thanks to tough regulations, their moat is even stronger. FAA (Federal Aviation Administration) approval can take years, as safety is the priority. An airline buying cheaper parts from unknown manufacturers invites disaster.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 38.9% (Gross Margin > 40%? ❌)

Return On Invested Capital without Goodwill (ROIC:) 10.0% (ROIC > 15%? ❌)

At first sight, the Gross Margin and ROIC don’t look attractive.

We will dive into this later in this article.

4. Is the company attractive in an interesting end market?`

Serial acquirers are great at turning money into more money.

Why? There are three big reasons:

There are a lot of new opportunities to invest in

They have smart leaders who know exactly how to use capital

Dual growth engines create more Free Cash Flow (organic growth and new acquisitions)

But there’s more to it with Heico.

Their specific businesses operate in a great spot because of some exciting trends:

Unfortunately, the world isn’t getting much safer

What is the first thing that people do when they become more wealthy? Traveling

The aviation industry is expected to grow at a CAGR of 4.4%, while the defense industry is expected to grow at a CAGR of 9.8%.

These are attractive growth rates.

5. What are the main risks for the company?

Howard Marks once told the following:

"A gambler bet everything on a race with only one horse. Confident he'd win, he watched as the race began. Halfway through, the horse jumped the fence."The lesson? In investing, there’s no such thing as certainty.

Like any business, Heico faces risks:

If the business gets larger, small acquisitions don’t move the needle anymore

High dependence on the Mendelsons

Lack of good reinvestment opportunities

Not being able to get certain parts from the OEMs (Original Equipment Manufacturers) could hurt the performance

OEMs could develop patents or methods that block Heico from making replacement parts

A failure of a part in a plane could cause massive reputation damage

Rich valuation levels (see later)

Serial acquirers counteract some risks by great diversified cash flow streams:

If you break one of the 98 legs off a table, the table will still stand straight. Heico has 98 different revenue streams from its subsidiaries.6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

Interest coverage: 5.2x (Interest Coverage > 15x? ❌)

Net Debt/FCF: 3.7x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 44.4% (Goodwill to assets < 20%? ❌)

The balance sheet doesn’t look ideal. But there are some important nuances:

The interest coverage isn’t so worrisome as Heico has predictable revenue streams

Given the many acquisitions, higher goodwill is normal

7. Does the company need a lot of capital to operate?

The less capital a business needs to operate, the better

Here’s what things look like for Heico:

CAPEX/Sales: 1.5% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating cash flow: 9.3% (CAPEX/Operating CF? < 25%? ✅)

It’s great seeing Heico is so capital-light. That means that there is a lot of cash available for new acquisitions.

Now let’s dive into the most important fundamentals of the company.