One of the fastest-growing quality stocks with a lot of growth potential? KKR.

The company returned 25.2% (!) per year to shareholders since 2010.

Let’s dive into this amazing Private Equity firm.

This investment case was made together with OPTO.

OPTO focuses on the world’s most innovative public companies, prioritizing disruptive technologies and stocks with the longevity and staying power to dominate as their industries evolve. As part of this mission, we collaborated with Compounding Quality to uncover an exciting opportunity in KKR, contributing insights that helped shape its analysis.KKR & Co - General Information

👔 Company name: KKR & Co. Inc.

✍️ ISIN: US48251W1045

🔎 Ticker: KKR

📚 Type: Owner-Operator Stock

📈 Stock Price: $148.2

💵 Market cap: $131.7 billion

📊 Average daily volume: $481.4 million

Onepager

Here’s a onepager with the essentials of KKR:

(Click on the picture to expand)

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give KKR a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Imagine you and your friends pool money to buy a neighborhood shop, hoping to improve it and eventually make a profit to share.

That’s exactly what KKR does but on a much larger scale.

KKR helps people and companies grow their money by investing in businesses, real estate, and other big projects.

KKR makes money in three ways:

Insurance Revenue (57.7% of total revenue): KKR owns insurance companies that collect premiums (money people pay for insurance) and invests that money to make more.

Asset Management Revenue (26.4% of total revenue): Fees for managing money from pension funds or wealthy people.

Other Revenue (15.9% of total revenue): This includes money from things like lending (giving loans) or profits from their own investments.

Since the IPO in 2010, the company has diversified its activities and geography:

Here’s how Co-CEOs Bae and Nuttall describe KKR:

“A business model that allows us to compound earnings and value for the very long term while retaining our culture.”2. Is management capable?

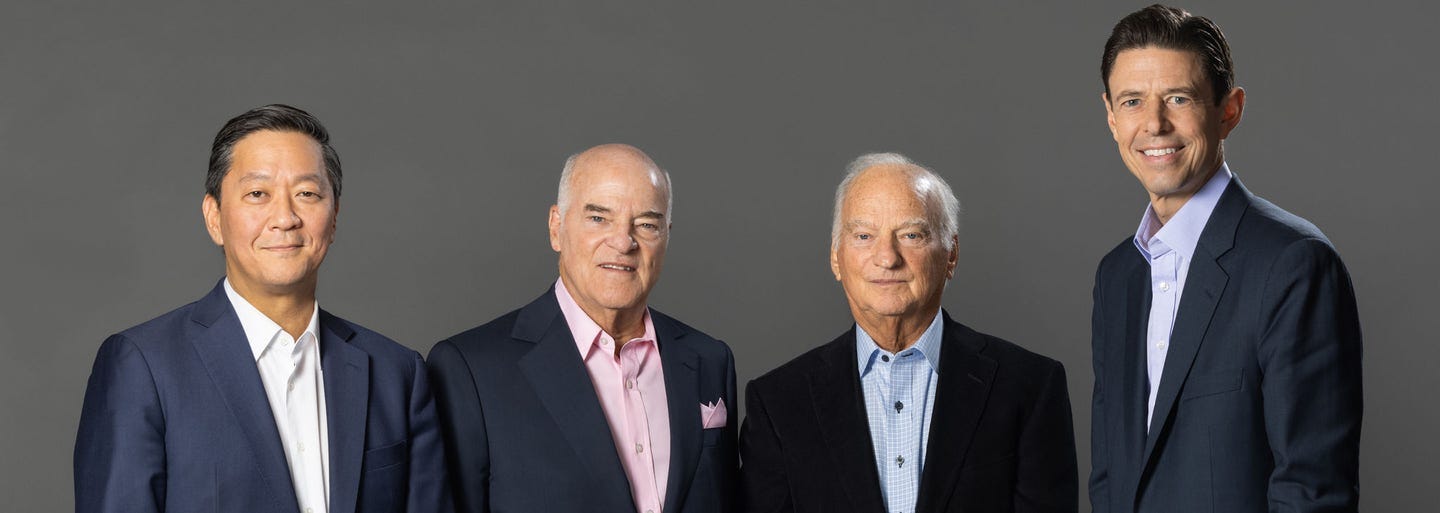

Jerome Kohlberg, Jr.Henry Kravis, and George Roberts co-founded KKR in 1976.

Kravis and Roberts are still active in the company today as co-executive chairman. They’re cousins, best friends, and longtime business partners.

“It's important to remember that KKR is our family business. We did go public and change our shareholder base in doing so, but George and I remain the largest shareholders to this day and our culture still has that family business mentality.” - Co-founder Henry KravisJust like KKR has two co-founders, they also have two co-CEOs. Joseph Bae and Scott Nuttall have been leading the company since 2021. They both joined the firm in 1996.

Why would you choose two CEOs? Because both Joseph and Scott were so good KKR didn’t want to lose one of them. That’s why they decided to both give them the CEO role.

Insiders own 23.9% of the total shares outstanding.

3. Does the company have a sustainable competitive advantage?

KKR has a moat based on two aspects:

Expertise: Their in-house operations team creates a lot of shareholder value

Reputation: The firm’s proven track record attracts high-quality deals

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 48.5% (Gross Margin > 40%? ✅)

Return On Invested Capital (ROIC) 4.1% (ROIC > 15%? ❌)

The ROIC doesn’t look great, right?

Looking at the ROIC doesn’t make a lot of sense as KKR is an investment firm with a lot of assets under management (AUM). Those AUMs are included in the invested capital.

Instead, you should look at the Investment Rate of Return (IRR). This metric estimates investment returns using discounted cash flows.

KKR outperforms its benchmarks by a wide margin. This is a clear sign of a competitive advantage:

4. Is the company active in an attractive end market?

KKR is active in an enormous end market.

The Private Equity player is still just a small fish in the sea despite their big market cap ($130.2 billion):

The company leads in alternative assets across Asia. Alternative assets are non-traditional investments like private equity and real estate.

Since 2019, its Assets Under Management have tripled (!) in the region.

KKR expects its Asian business to grow as large as its core North American operations.

Here are KKR’s major competitors:

Blackstone: Global investment firm specializing in alternative asset management

Carlyle Group: Diversified private equity and global investment powerhouse

Bain Capital: Private equity firm investing in diverse global industries

5. What are the main risks for the company?

Here are the main risks for KKR:

Fast-moving environment (KKR invests in Artificial Intelligence)

The private equity market can be very volatile

Highly competitive industry

Regulatory and legal risk

Dependence on co-founders Kravis & Roberts

Size hurts performance

Rich valuation levels (see later)

6. Does the company have a healthy balance sheet?

I look at two ratios to determine the healthiness of KKR’s balance sheet:

Net Debt/FCF: 1.3x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 0.3% (Goodwill/Assets not too large? < 20% ✅)

KKR has a healthy balance sheet.

7. Does the company need a lot of capital to operate?

I prefer to invest in companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Here’s what things look like for the company:

CAPEX/Sales: 0.4% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 1.5% (CAPEX/Operating CF? < 25% ✅)

KKR is a very capital-light business.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.

KKR:

Return On Equity (ROE): 4.8% (ROE > 20%? ❌)

Return On Invested Capital (ROIC): 1.7% (ROIC > 15%? ❌)

These numbers are less important as KKR is an investment firm (see competitive advantage).

You should look at the Investment Rate of Return (IRR) for KKR (see the part about the company’s moat in this investment case). This metric estimates investment returns using discounted cash flows.

KKR can be considered as a great capital allocator.

9. How profitable is the company?

The higher the profitability of the company, the better.

Here’s what things look like for KKR:

Gross Margin: 48.5% (Gross Margin > 40%? ✅)

Net Profit Margin: 10.8% (Net Profit Margin > 10%? ✅)

FCF/Net Income: 259.1% (FCF/Net Income > 80%? ✅)

KKR is a very profitable business.

10. Does the company use a lot of Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably I want SBCs as a % of Net Income to be lower than 4%.

SBCs as a % of Net Income higher than 10% are seen as a bad thing.

KKR:

SBCs as a % of Net Income: 23.2% (SBCs/Net Income < 10%? ❌)

Avg. SBC as a % of Net Income past 5 years: 32.3% (SBCs/Net Income < 10%? ❌)

KKR uses a lot of Stock-Based Compensation. This is something we don’t like to see.