Just Keep Buying

Are you panicking about the recent stock market decline?

Use this article to keep your head cool and make the right decisions.

"A genius is a man who can do the average thing when everyone else around him is losing his mind." - Napoleon's definition of a military geniusShut Up and Wait

Did you know that there is a book called Shut Up and Wait?

Every single page has this chart:

The key lesson here?

Don’t worry about stock market fluctuations. Just keep buying great companies at a fair price.

Here are 5 great insights about how to stay calm when your stocks decline.

1. Prepare yourself

Berkshire Hathaway’s stock halved 4 times since Warren Buffett took charge in 1965.

And yet, Berkshire Hathaway is up +3,920,000% since then.

Here’s what Warren Buffett has to say about stock market crashes:

2. After every bear market, there’s a great bull market

In the long term, stocks always go up.

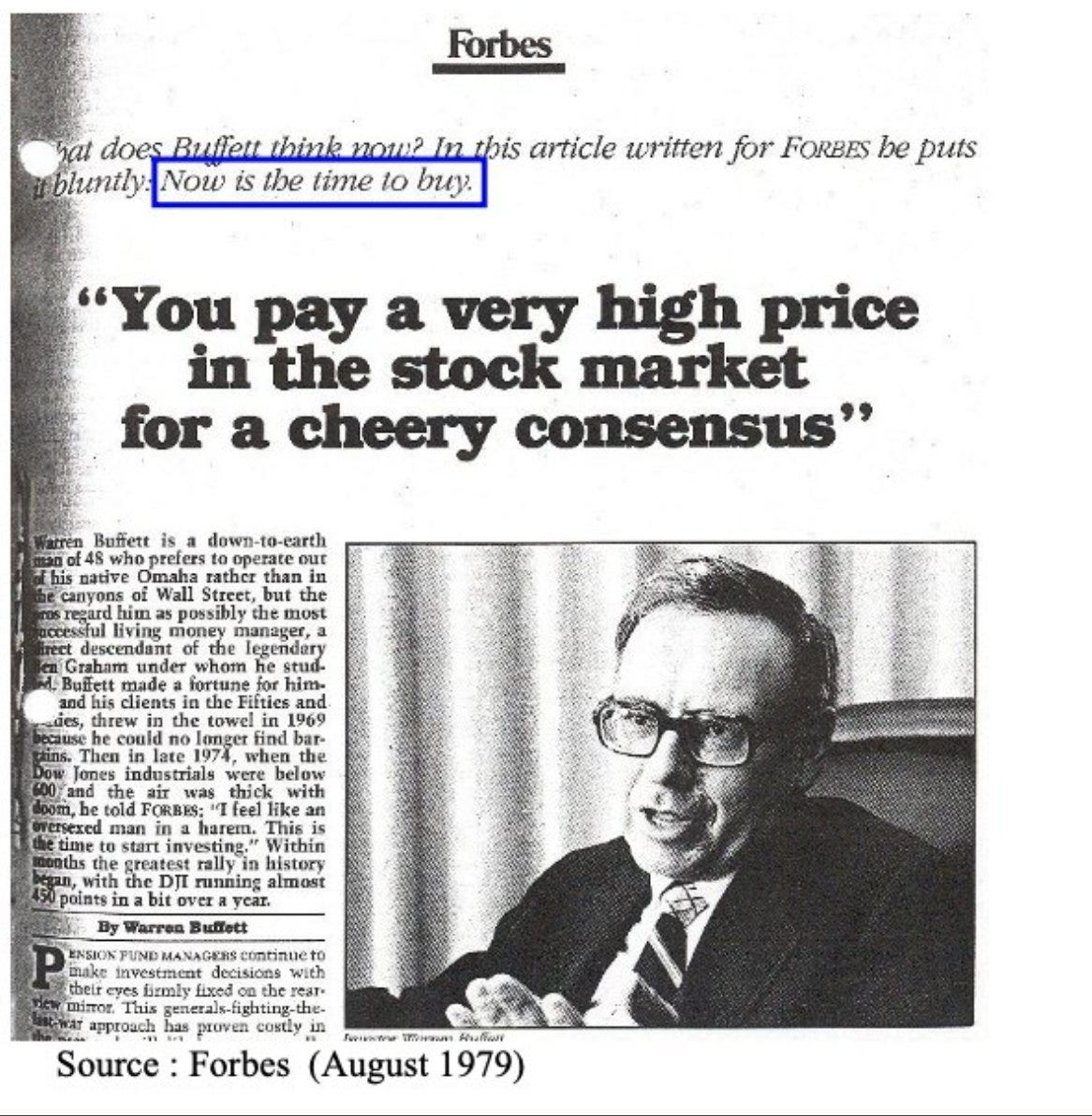

3. Stock market declines offer opportunities

Warren Buffett in the middle of the 2008 crisis: "I feel like an oversexed man in a harem."

4. Buy when there’s blood running through the streets

The best time to buy stocks?

When the media are talking about stock market crashes.

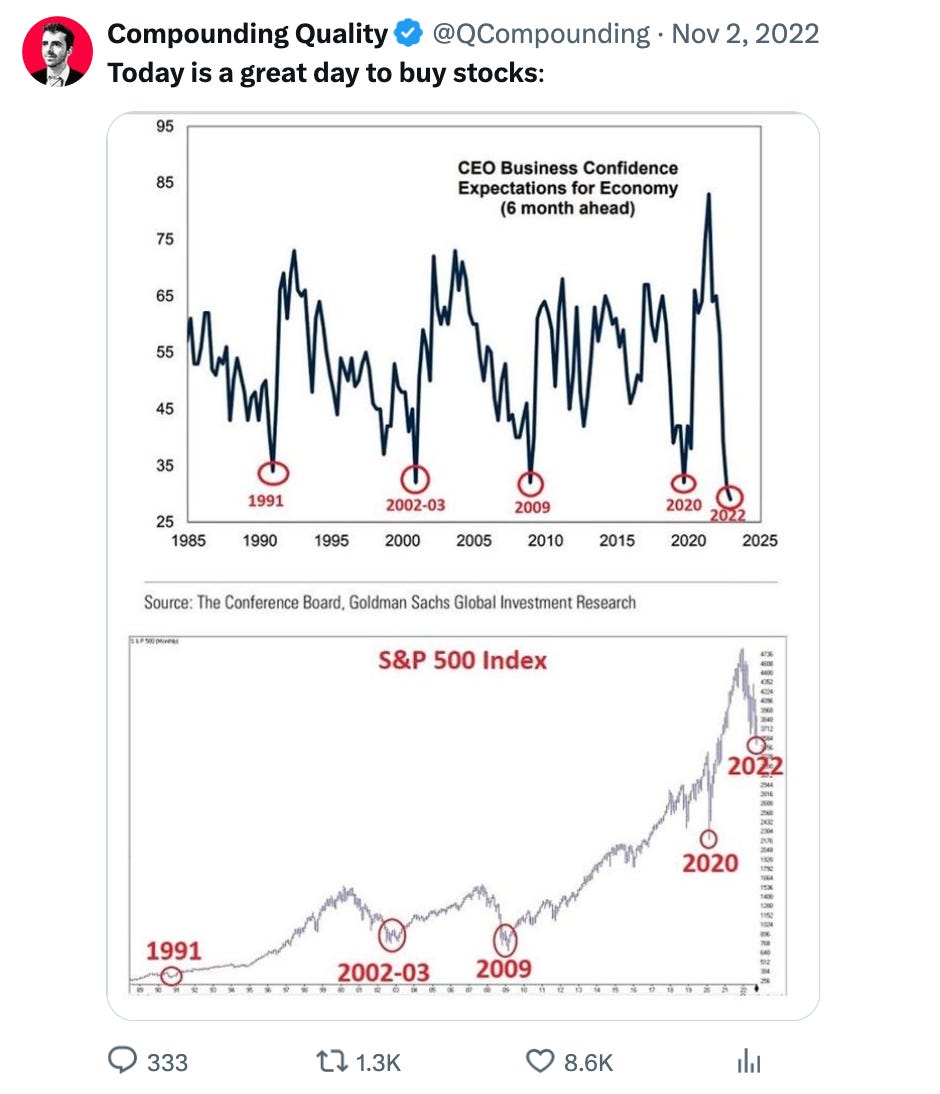

5. Confidence as a contra-indicator

Buy when Consumer Confidence and CEO Business Confidence is low.

(Since November 2022, the S&P 500 is up +50%).

Declining stock prices are good

We invest with a long-term mindset.

If you plan to buy more stocks in the next few years, lower prices are a GOOD thing.

But please don’t take my word for it:

"You can’t predict what stocks will do in the short term but you can predict that businessees will do well over time. Just take the 20th century, the Dow Jones went from 66 points to 11,497 points and you had two World Wars, a Great Depression, flue epidemics, … American businesses will do fine over time. The only person that can cause you to get a bad result in stocks is yourself." - Warren BuffettHere are some extra quotes from some of the best investors to help you:

"Every economic recovery since World War II has been preceded by a stock market rally. And these rallies often start when conditions are grim." — Peter Lynch

"Be fearful when others are greedy and greedy when others are fearful." — Warren Buffett

"After a stock market decline, people may perceive more risk than before when, in fact, the decline may have taken some of the risks out of the market." — Robert Shiller

"The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell." — Sir John Templeton

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." — Warren Buffett

"As soon as you realize you can afford to wait out any correction, the calamity also becomes an opportunity to pick up bargains." — Peter Lynch

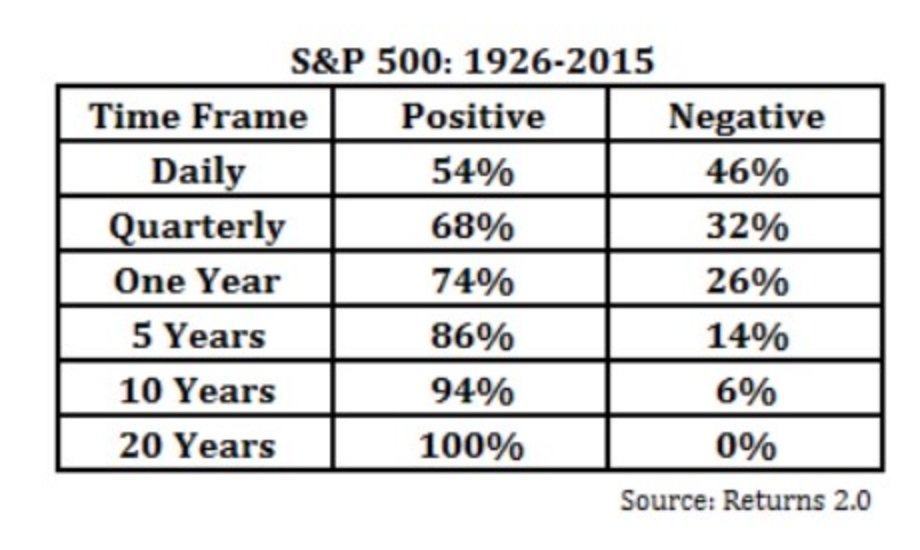

As you can see in this chart, stocks always go up in the long term:

Just keep buying

Currently, Our Portfolio is invested for 91%.

But here’s a little secret… After we are 100% invested I will just keep buying.

I will probably keep adding to the Portfolio every single month.

I think everyone should use some of their money to buy stocks each month.

It's one of the easiest ways to build wealth.

If you invest $500 per month for 10 years, you’ll have almost $100,000

If you invest $500 per month for 20 years, you’ll have over $300,000

If you invest $500 per month for 30 years, you’ll have over $900,000

If you invest $500 per month for 40 years, you’ll have over $2.3 million

*These calculations were made under the assumption of a 9%/year return

It also shows that the sooner you start investing, the better.

The longer your investment horizon, the more likely you’ll make money:

Conclusion

Here’s what you should remember from today’s article:

Stay patient – The market goes up over time.

Buy when others panic – Crashes create opportunities.

Think long-term – Investing consistently pays off.

Ignore the noise – Focus on great companies.

Start now – The sooner you invest, the richer you become.

Everything In Life Compounds

Pieter

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

What is you monthly purchase strategy? Will you consistently buy the ones that are undervalued every month?

Very good post, with apt illustrations and quotes. Thanks!