Hi Friend 👋

Today I have a big announcement to make. There’s something big coming up.

But before telling you more about it, let’s give you a short update.

The journey we’ve walked so far is amazing.

Since its inception, Our Portfolio compounded at a CAGR of 25.2%:

While short-term performance doesn’t tell you anything, it’s great to start this way.

Compounding Quality tries to invest in the best companies in the world.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Our investment philosophy is straightforward:

Buy wonderful companies

Led by excellent managers

Trading at fair valuation levels

But guess what? Multiple roads lead to Rome.

While we use Quality Investing, you can also use Growth Investing, Dividend Investing, and much more:

Over the past few months, I got more and more requests from people who were seriously interested in Dividend Investing.

But there was only one problem…

My passion lies in Quality Investing.

All my time and dedication goes to finding the best companies in the world for you.

I want to provide you with as much value as I possibly can.

But guess what? Some people are as passionate about Dividend Investing as I am about Quality Investing!

And only the best of the best is good enough for you.

That’s exactly how I met Josh (better known as TJ Terwilliger in Our Community).

His insights are invaluable and he has a lovely personality.

TJ’s investment philosophy closely aligns with mine. Like a brother from another investing mother.

His (dividend) investing insights are phenomenal.

The good news? Josh would love to work on Compounding Dividends full-time.

And that’s exactly what he’s going to do.

TJ will dedicate all his energy towards Compounding Dividends.

He will make all investment decisions and invest real money in the Portfolio (after pitching the ideas to me).

The goal?

Provide you with a reliable stream of dividend income while investing in companies that can keep growing at attractive rates.

Josh (TJ Terwilliger)

Name: Josh (TJ Terwilliger)

Country: United States

Age: 39

# Years of investing experience: 15

Favorite Dividend Stock right now: Domino’s Pizza

Hobbies: Running, cycling, and reading

Why Dividend (Growth) Investing

Investing in dividend-growth stocks can be very lucrative.

A very interesting niche? Dividend Kings.

These companies have grown their dividend for 50 (!) consecutive years.

Think about companies like S&P Global, Lowe’s, Altria, and Johnson & Johnson.

If you invested in every Dividend King 20 years ago, you would have $302,271 versus $224,365 for the S&P 500. A difference of almost $80,000.

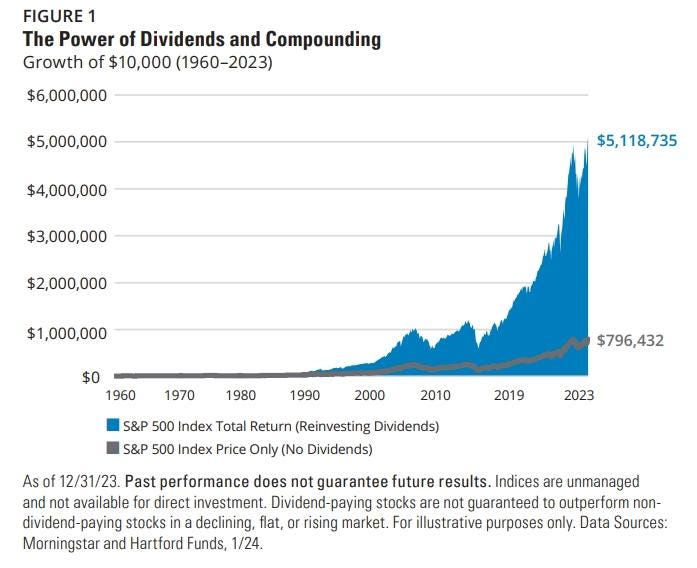

What’s also important? To reinvest your dividends:

You are not convinced yet?

If you invested $10,000 in J.P. Morgan 20 years ago and reinvested your dividends:

You would have $89,000 today

You would receive over $2,000 in annual dividend income

You would have collected more in dividends than your original investment!

Compounding Dividends Portfolio

The Compounding Dividends Portfolio aims to build a reliable income stream while growing your wealth.

How? One Dividend At A Time.

The Portfolio will invest in three buckets:

Companies that qualify? Domino’s Pizza, Charles Schwab, Paypal, Automatic Data Processing, Realty Income, T. Rowe Price, …

Compounding Dividends will work just like Compounding Quality does.

Here’s what you’ll get:

📈 1. Access to the Portfolio

You will get access to Our Portfolio with 100% transparency. REAL MONEY is invested in this Portfolio.

💰 2. Buy-Hold-Sell List

Based on the investable universe of interesting Dividend Stocks, you’ll receive a Buy-Hold-Sell List that will be updated monthly.

📊 3. Idea of the Month

Each month, you’ll receive an interesting Dividend Idea you can invest in.

🔎 4. Investment cases

You’ll receive Deep Dives and Not So Deep Dives about interesting Dividend Stocks.

💡 5. ETF Portfolio

As a Partner of Compounding Dividends, you’ll get access to the ETF Portfolio. This ETF Portfolio will provide you with attractive dividend payments.

✍️ 6. Best Buys

Each month you’ll get an email notifying you about the 5 Best Buys of this month. These Best Buys are Dividend Stocks trading at attractive valuation levels.

👬 7. Partnership approach

All paid subscribers of Compounding Dividends are called Partners. We’re in this together and we all learn from each other.

Why Is Now The Right Time?

We want to do something special for readers of Compounding Quality.

That’s why we’re giving away a special discount to join Compounding Dividends.

The first 100 people who subscribe get a discount of 30% AND you’ll get free access to Finchat Pro for 14 days.

What to expect?

Here’s everything you’ll get:

Make sure to lock in your discount of 30% forever AND receive access to Finchat Pro for 14 days:

One Dividend At A Time

TJ & Pieter