Adding To Our Portfolio

Mr. Market is a Manic-Depressive.

Most wealth is created by buying stocks in times of high uncertainty.

Let’s help you navigate the market today.

Some facts

The S&P 500 declined by 12% from its peak.

The cheaper we can buy great companies, the better.

Investing in times of uncertainty creates a lot of wealth.

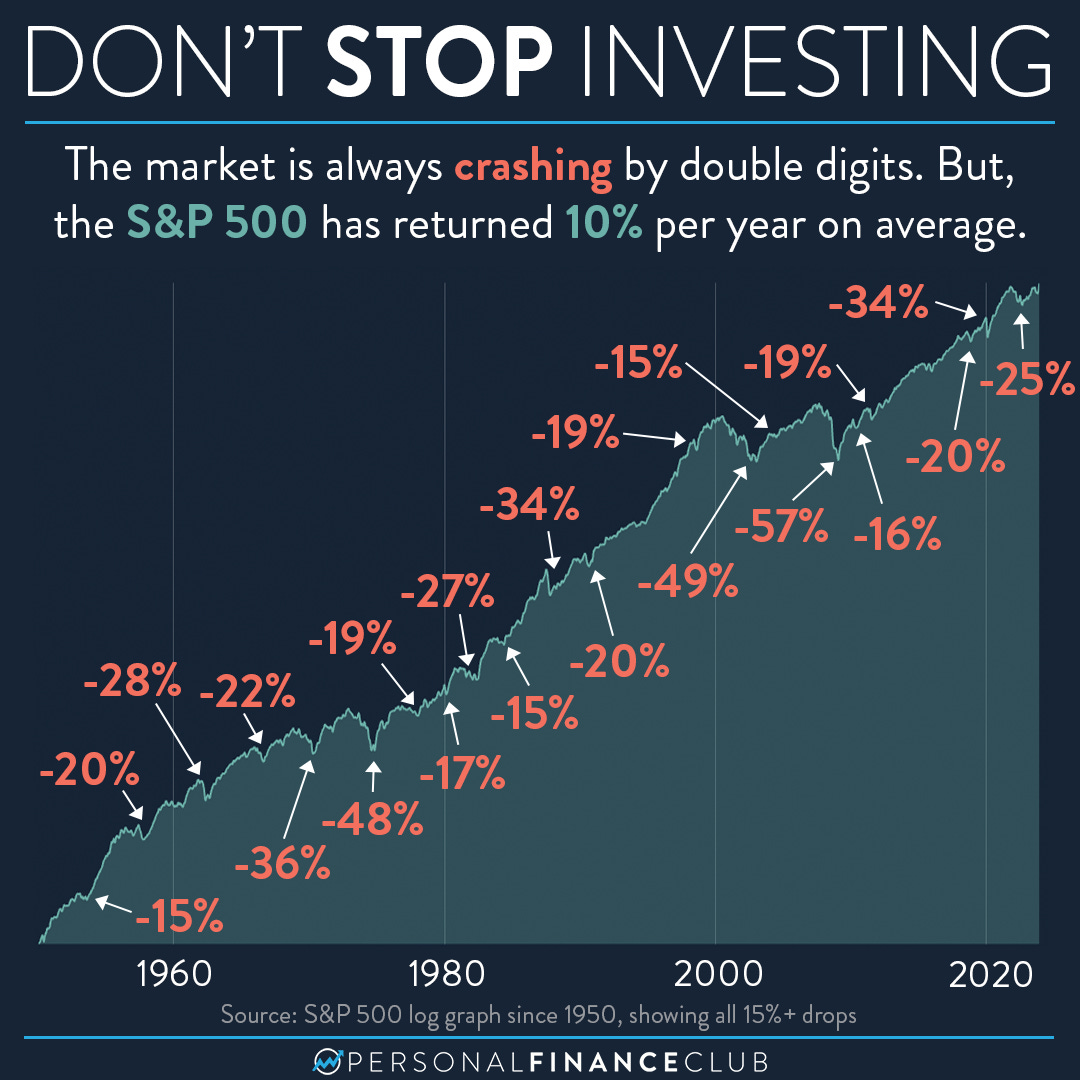

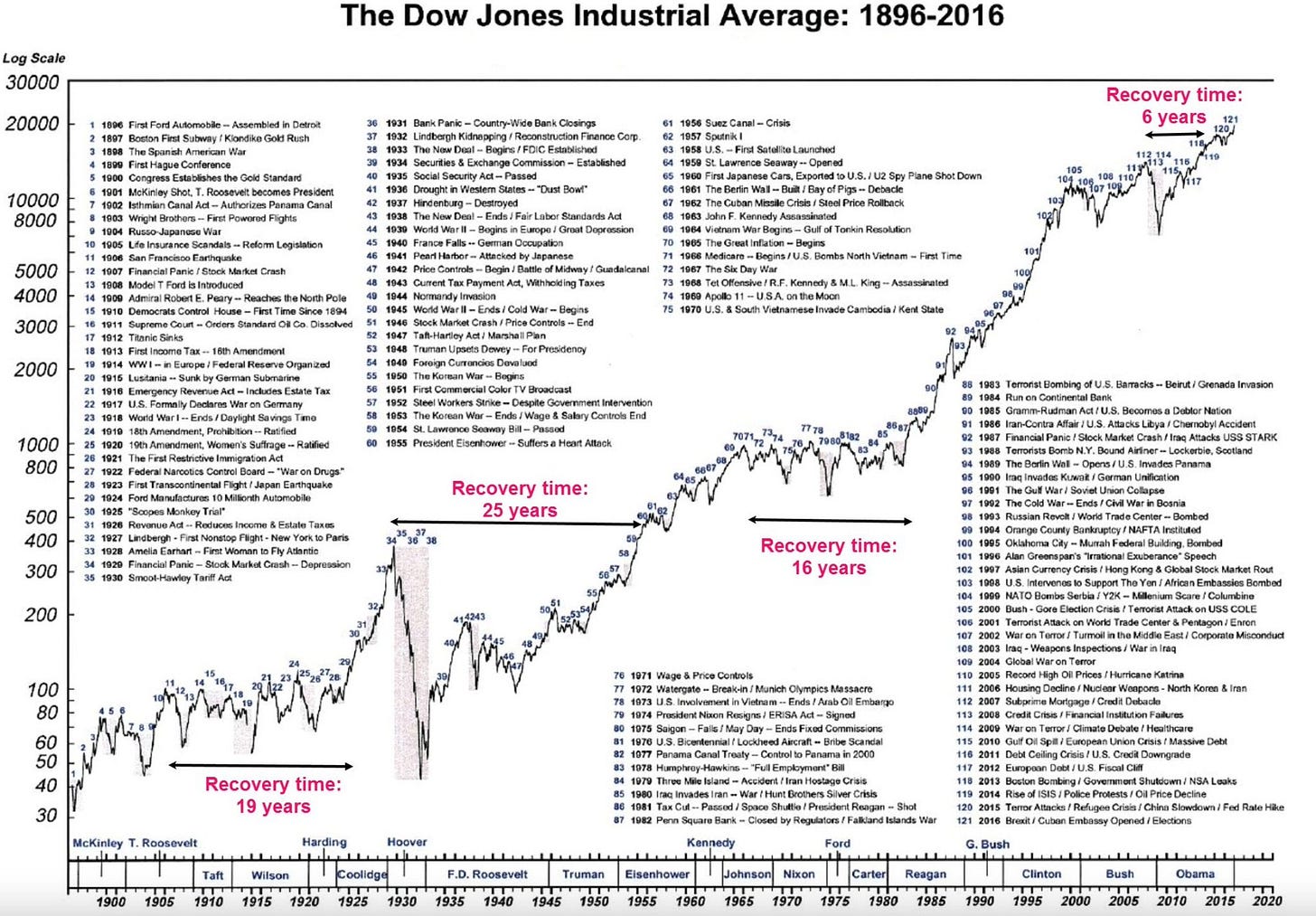

Just look at this chart:

As shared by my friend Kris, the bearish sentiment is very high right now.

The last time this happened was in 2009, a great time to invest in hindsight.

Since 2009, the S&P 500 has been up over 500%.

Morgan Housel also summed it up quite well:

The market is going crazy.

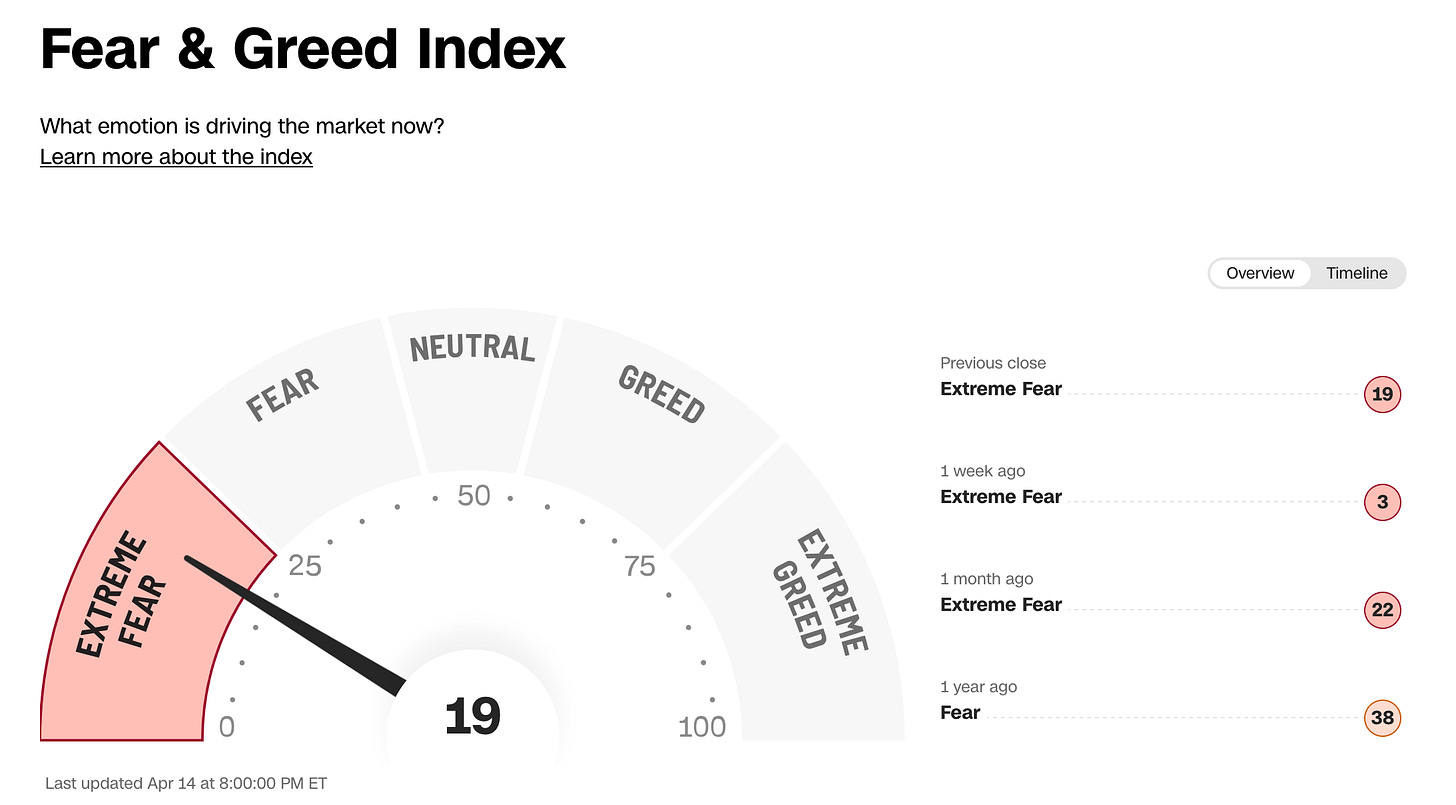

The Fear & Greed Index trades at a very low level right now:

I think it’s a great time to buy stocks today.

That’s exactly why we added heavily to Our Portfolio last week.

You’re not convinced yet? Here are 5 extra tricks to survive a declining market.

1. Don’t Panic

"The real key to making money in stocks is not to get scared out of them." - Peter LynchThe market is going through a rough time right now.

When prices fall quickly, fear often takes over.

But fear is rarely a good guide, especially when it comes to investing.

Selling in panic might seem like the safe choice, but it is one of the most expensive mistakes you can make as an investor.

Let’s take a moment to look at the bigger picture.

History tells a very clear story. Markets always recover.

Whether it was the Great Depression, the financial crisis, or the COVID crash, every major drop was followed by a strong comeback.

Take the COVID crash in early 2020, for example.

The MSCI World Index fell by 31 percent in just one month, making it the fastest crash in modern history.

But here is what happened next. Within six months, the index had fully recovered.

Investors who stayed calm and held on to their shares saw their losses turn into gains.

This is something many people forget. Market downturns are a normal part of the investing journey.

They are not something to fear, but something to understand and prepare for.

If you can stay calm while others are panicking, you give yourself a real advantage.

It is one of the few true edges you have as an individual investor.

2. Time Is Your Friend

"Volatility is the price of long-term returns" - Christopher DavisNever start panicking on the stock market.

Always ask yourself: when do I need my money?

If you’re investing with a long-term mindset, a market crash is not a setback, it’s a great opportunity.

You can add to amazing companies at cheaper prices.

This sets you up for long-term gains. Because over time, stocks always go up:

Always remember: time is your greatest friend when investing.

3. Buy Quality

"Use the storm to check your sails — not to abandon ship" - AnonymousNever start panicking.

Zoom out and look at your Portfolio in a clear, rational way.

What do you own?

Why do you own it?

Do your investments match your long-term goals?

Are you well-diversified across sectors and regions?

If you would still be happy to own those companies even if the stock market closed for the next ten years, you know you’re invested in the right companies.

What matters most is that you own high-quality businesses, because strong companies keep winning.

4. Cash = Opportunity

“Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.” - Warren BuffettMarket crashes are great when you have some cash available.

Cash is more than a safety net. It’s gunpowder, ready to be used when the market crashes.

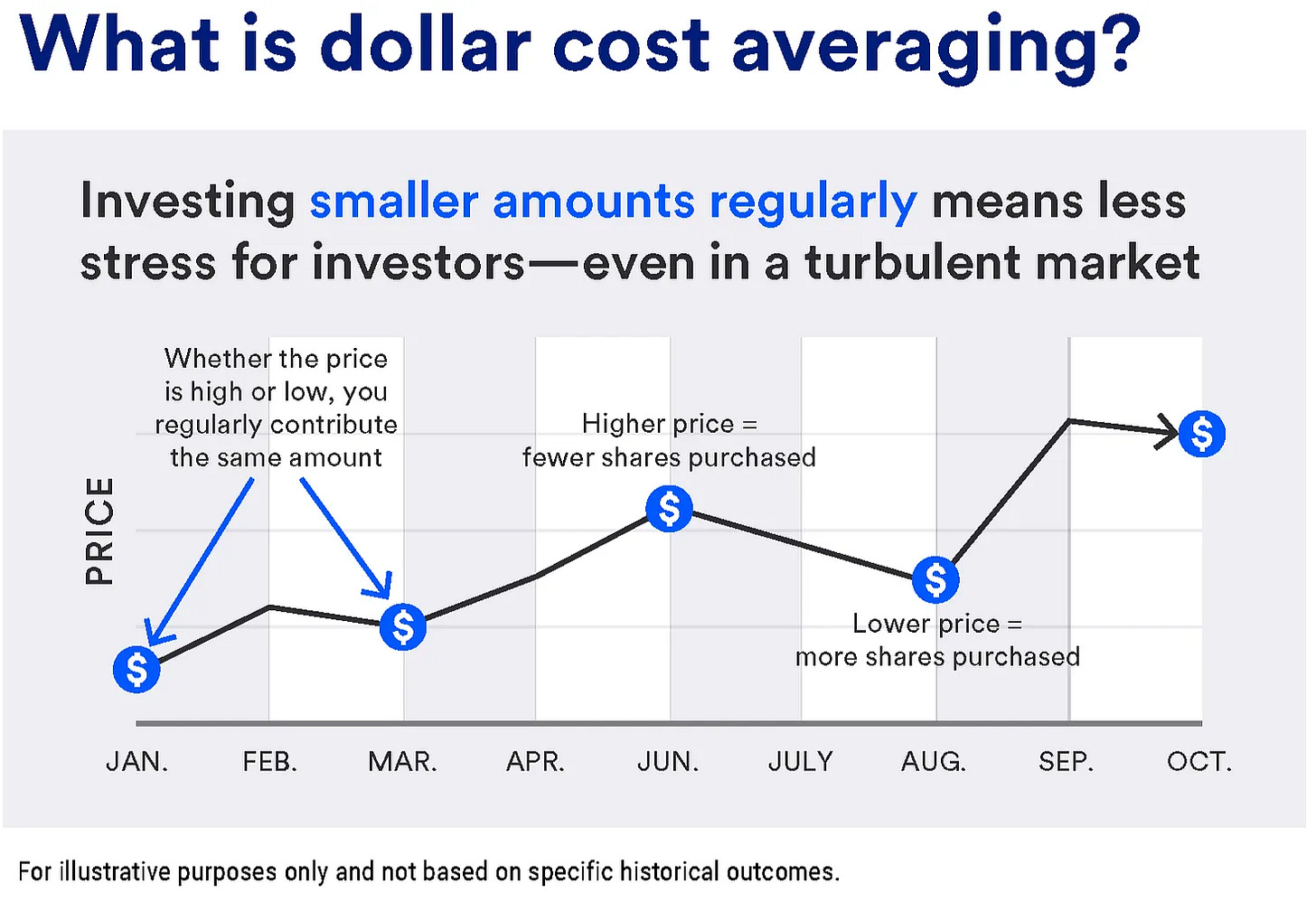

The best thing you can do? Use a certain percentage of your income to add to your positions every single month.

Dollar-Cost Averaging is one of the best and easiest ways to become wealthy:

5. Stick To The Plan

"The most important quality for an investor is temperament, not intellect." - Warren BuffettIn the land of the blind, one-eyed man is king.

If you have a clear plan, there is no reason to panic.

The best investors are very disciplined during a market crash.

They start with the end in mind and use the volatility of Mr. Market to their advantage.

Your plan doesn’t need to be complicated. It can be as simple as:

Invest 10% of your income in stocks every single month

Use the Compounding Quality Portfolio as a guide for investment ideas

You don’t have an investment plan yet?

Create one with these 5 steps:

Conclusion

That’s it for today.

It seems like a great time to invest right now as Mr. Market is in a ‘depressive’ phase.

The best time to buy stocks is when there’s blood running through the streets.

The most important thing? Don’t buy companies that are in bad financial shape. In times of uncertainty, it’s even more important to buy high-quality assets.

At Compounding Quality, only the best of the best is good enough.

"I am constantly amazed at the number of people who talk about investment and spend most or all of their time talking about asset allocation, regional allocation, sector weightings, economic forecasts, bonds vs equities, interest rates, currencies, risk controls and never mention any need to invest in something good." - Terry SmithEverything In Life Compounds

Pieter

PS You are not a Partner of Compounding Quality yet? You can join here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Great writing Pieter - the following are indeed great questions!

What do you own?

Why do you own it?

Do your investments match your long-term goals?

Are you well-diversified across sectors and regions?