Luxury never goes out of fashion.

You know how Bernard Arnault has built his luxury empire?

Let’s dive into LVMH today.

“Luxury goods are the only area in which it is possible to make luxury margins.” - Bernard Arnault

LVMH

👔 Company name: LVMH

✍️ ISIN: FR0000121014

🔎 Ticker: EPA:MC

📚 Type: Owner-Operator Stock

📈 Stock Price: €740

💵 Market cap: €371 billion

📊 Average daily volume: €615 million

Onepager

Here’s a onepager with the essentials of LVMH.

You can click on the picture to expand it:

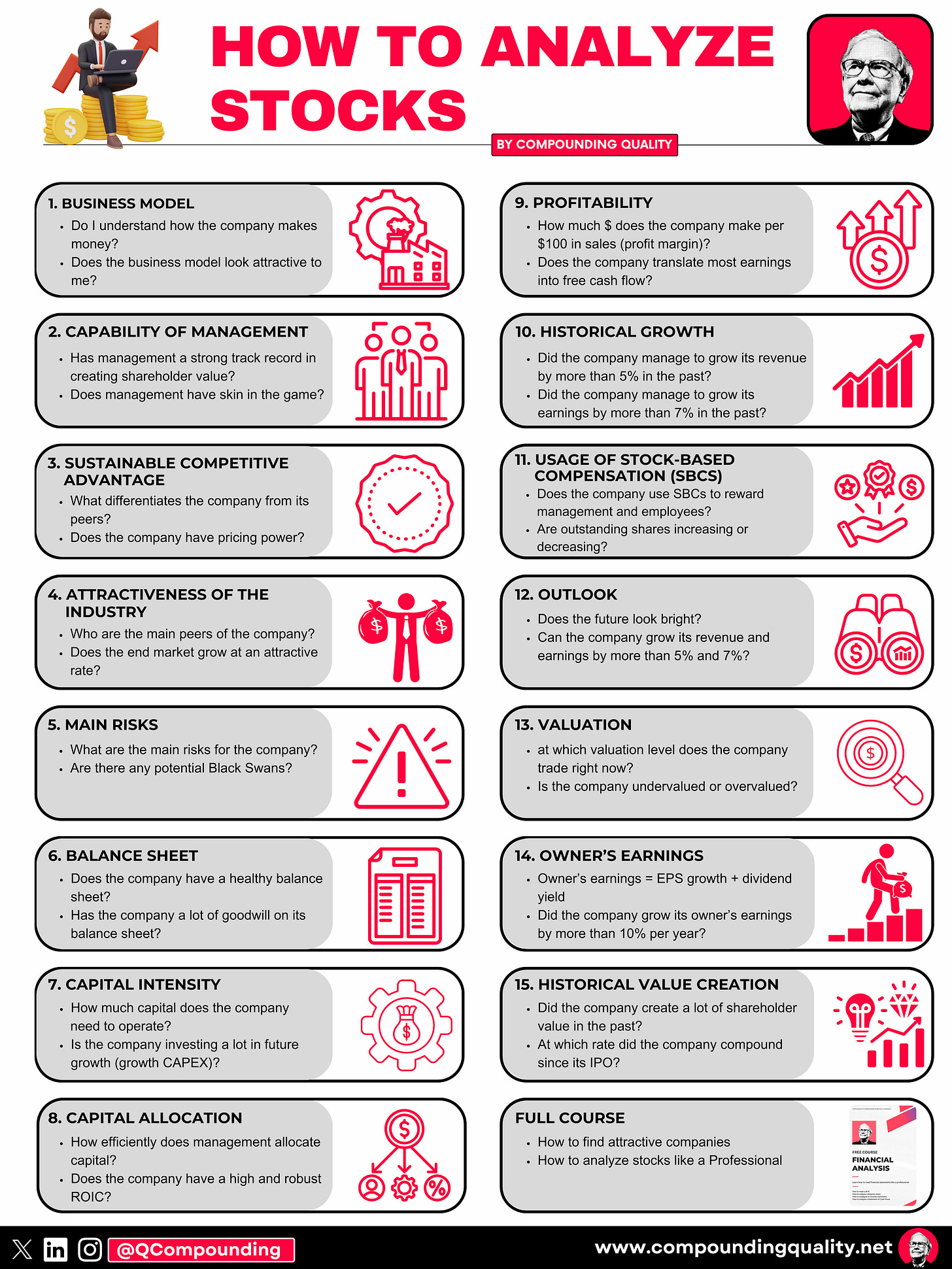

15-Step Approach

Now let’s use my 15-Step approach to analyze LVMH.

At the end of this article, we’ll determine whether we’ll buy LVMH.

1. Do I understand the business model?

LVMH is a global producer and distributor of luxury goods.

The French company is a dominant force in the luxury industry with a diverse portfolio of brands that cover a wide range of consumer products and experiences.

LVMH operates more than 5,000 stores around the world. They are the second largest company in Europe after Novo Nordisk.

The company is active in 6 segments:

Fashion and Leather Goods (49% of sales): This segment includes renowned fashion brands like Louis Vuitton, Dior, Fendi, Celine, and Givenchy, as well as high-end leather goods and accessories.

Watches and Jewelry (13% of sales): Luxury watch brands like TAG Heuer, Hublot, and Zenith, along with jewelry brands such as Bulgari.

Wines and Spirits (9% of sales): LVMH is famous for its fine wines and spirits, including Moët & Chandon, Dom Pérignon, Hennessy, and Veuve Clicquot.

Perfumes and Cosmetics (9.8% of sales): LVMH owns prestigious beauty and fragrance brands such as Christian Dior, Guerlain, Givenchy, and Benefit Cosmetics.

Selective Retailing (19% of sales): LVMH operates high-end retail outlets, such as Sephora, DFS (Duty-Free Shops), and Le Bon Marché, which offer a curated selection of luxury products.

Other (0.2% of sales): This segment includes LVMH's various businesses, like hospitality (Cheval Blanc hotels and resorts), fashion brands like Kenzo and Marc Jacobs, and multimedia group Les Echos.

Here’s what the geographical split looks like:

Please note that Asia is a very important market for LVMH (30% of sales).

This also means that by investing in LVMH, you benefit from the growing Asian middle class (secular trend) without investing directly in Asian companies.

2. Is management capable?

Bernard Arnault has been the CEO of LVMH since 1989. He owns a 97.5% stake in Christian Dior, which controls 41.4% of LVMH.

Bernard Arnault is an excellent Owner-Operator who has built a luxury empire since he took charge of the company.

Today, Bernard Arnault and his family are worth $173 billion. This makes Arnault the second richest man in the world after Elon Musk.

It is also satisfactory to see that Bernard Arnault has been buying shares of LVMH recently:

3. Does the company have a sustainable competitive advantage?

LVMH has a sustainable competitive advantage as they are a market leader in luxury goods with a portfolio of leading brands spanning multiple industries.

The majority of brands within LVMH's collection have a history spanning over 100 years. The renowned Louis Vuitton brand derives approximately 75% of its earnings from its iconic handbag collections.

Over the past decade, LVMH's various segments have consistently surpassed industry averages in terms of revenue growth and have successfully expanded their market shares.

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin:

4. Is the company active in an attractive end market?

Luxury products often benefit from pricing power and price inelasticity.

This means that customers don’t stop buying the product when prices increase.

According to Bain & Company, the global luxury goods market is expected to reach a size between $500 billion and $600 billion by 2030. This would double the size of the market compared to 2020.

Here are some of LVMH’s main competitors:

Hermès: Hermes is a 180-year-old family controlled luxury goods company best known for its Birkin and Kelly bags. Its biggest segments are leather goods and saddlery, accounting for around half of revenue. Hermès focuses even more on exclusivity than LVMH.

Richemont: Richemont is a prominent luxury goods conglomerate with a portfolio of 20 brands. The majority of its sales, more than 70%, comes from jewelry and watch brands.

Kering: Kering is the world's second-largest luxury goods conglomerate, following LVMH. Its most prominent brand is Gucci, which contributes to more than 50% of its revenue and nearly 70% of its operating profits. Additionally, Kering owns other major brands like Bottega Veneta and Saint Laurent.

5. What are the main risks for the company?

Here are some of the main risks for LVMH:

Emerging markets are very important for LVMH. Their performance depends on the economic conditions in this area

Growth for the flagship Louis Vuitton brand is limited by the economic cycle and exclusivity perception

Risk of overpaying for its M&A activities

Succession risk for Bernard Arnault

Foreign currency risk: the majority of production and administrative expenses are denominated in euros, whereas nearly 80% of the revenue is generated in different currencies

There are only limited synergies in terms of cost and revenue when it comes to LVMH’s various industry segments

6. Does the company have a healthy balance sheet?

We look at 3 ratios to determine the healthiness of LVMH’s balance sheet:

Interest Coverage: 34.1x

Net Debt/FCF: 2.5x

Goodwill/Assets: 18.0%

As you can see, LVMH’s balance sheet looks healthy.

7. Does the company need a lot of capital to operate?

The less capital a company needs to operate, the better.

Here’s what things look like for LVMH:

CAPEX/Sales: 7.2%

CAPEX/Operating Cash Flow: 35.1%

LVMH needs some capital to operate (preferably we want CAPEX/Sales to be lower than 5%) but the situation still looks healthy.

Now let’s dive into the most important Fundamentals of LVMH.

We’ll also give LVMH a Total Quality Score and decide whether we’ll buy the company.