🤝 Meeting the CEO of Judges Scientific

Judges Scientific is a fantastic serial acquirer.

CEO and Founder David Cicurel started the company in 2002, and it's now a 100-bagger.

Let’s discuss what we learned during our conversation with David Cicurel.

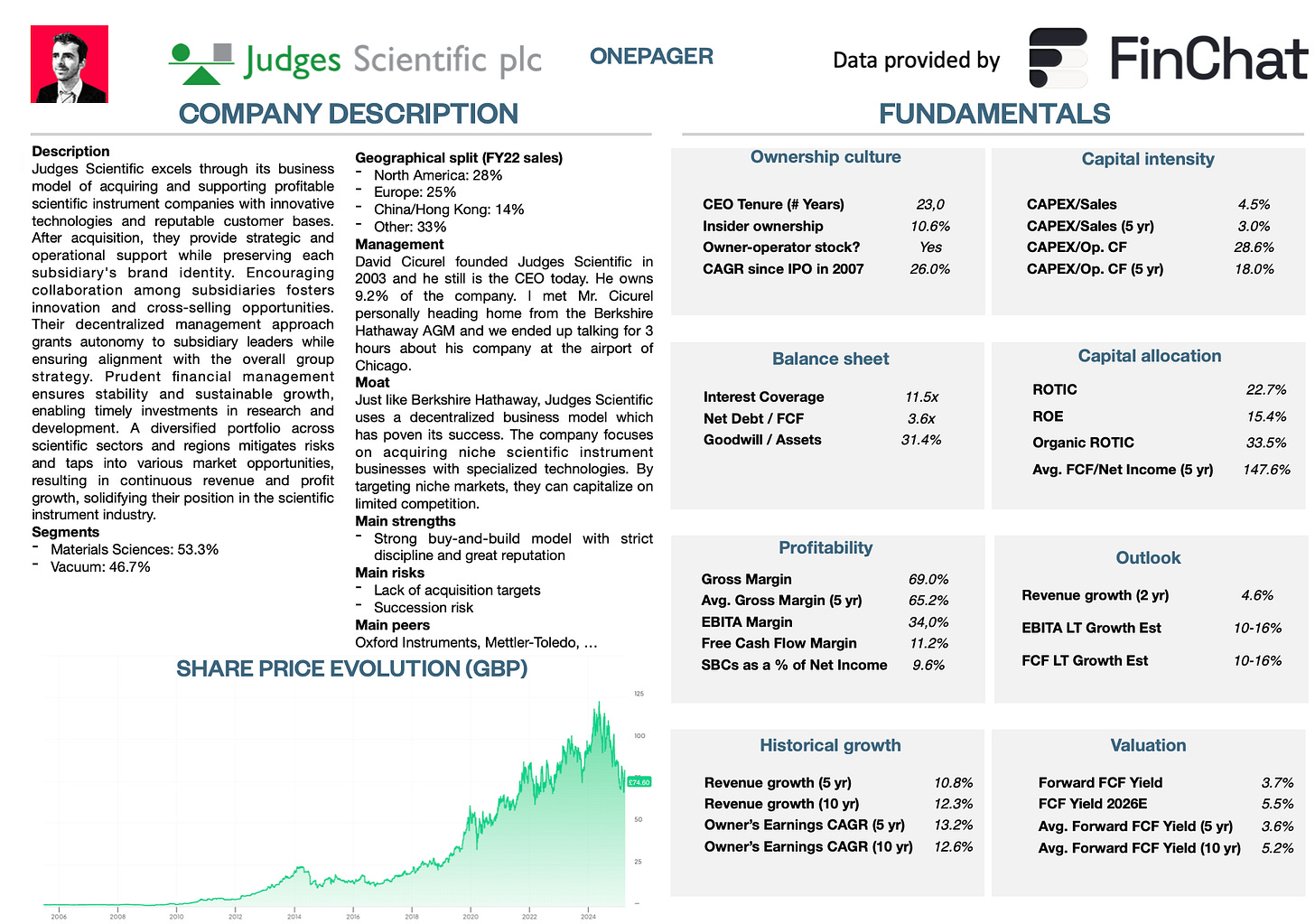

Onepager

Are you not familiar with Judges Scientific yet?

Here are the essentials:

🧠 Interview David Cicurel

Compounding Quality: What does your current acquisition strategy look like? Can you also expand a bit on the Geotek acquisition?

David Cicurel: Our acquisition approach is centered on quality, but price remains crucial for shareholder returns.

Typically, smaller businesses yield better returns, but we realized we couldn’t reinvest all our capital into small acquisitions alone. That led us to consider larger deals from time to time, which usually come at higher multiples.

One such acquisition was Geotek. The company had challenges during COVID but rebounded strongly post-acquisition, earning £11 million and qualifying for an earnout. The previous owner was 70 years old, and due to our reputation, they approached us directly.

At the time, they expected to return to a profit level of around £6 million per year. But at that age, whether the multiple is six or seven times earnings becomes less relevant—speed and certainty matter more.

We acquired Geotek at a multiple of seven, which was a fantastic deal. Especially considering one company in our sector regularly pays 12 times for businesses of this size. Another one recently paid 14 times prospective EBIT plus synergies plus an earn-out.

Compounding Quality: How has the Geotek acquisition impacted Judges Scientific’s performance?

David Cicurel: Before acquiring Geotek, our group generated around £20 million in profit per year. Thanks to Geotek, that figure has risen to £30 million.

The company has three key revenue streams:

Manufacturing and selling instruments for scientific and industrial applications

Services: Digitizing and analyzing vast core sample repositories on-site, aiding modern mineral exploration

Coring: Extracting and stabilizing core samples, including gas hydrates, for scientific analysis and research funding

Compounding Quality: How do you view the current market?

David Cicurel: After COVID, governments worldwide spent enormous amounts to keep people at home. Many didn’t realize that this was essentially borrowed money.

Now, many countries are struggling with high debt levels. They make budgetary decisions that impact research funding, which affects our market.

For instance, in China, our order intake dropped by two-thirds in the first half of 2023. This was partly due to the government shifting its focus from public investment to consumer spending.

Additionally, China is now actively encouraging domestic purchases, which has negatively impacted demand for our instruments.

Despite this, I believe our sector remains fundamentally strong. Historically, we have achieved an 8% compound annual organic growth rate, even through periods like the 2008 financial crisis and COVID.

There will be fluctuations, but overall, science continues to progress, driving long-term demand.

Compounding Quality: How do you look at the current stock price development?

David Cicurel: The market never likes less-than-expected results. We strive to be conservative and realistic in our outlook. There’s an old saying: Profit warnings are like buses: you wait for hours, and then four arrive at the same time.

In 19 years, we’ve had only four profit warnings.

We are going through a tough period right now, but we’ll be fine in the long term.

Compounding Quality: Given the cash position, have you considered buying back shares?

David Cicurel: We would do so if it were the best use of capital, but never just to boost the stock price. That’s not a sustainable strategy.

We believe acquisitions offer better returns.

Compounding Quality: With rising interest rates and government spending cuts, how will this affect Judges Scientific in the coming years?

David Cicurel: Governments worldwide are facing tough financial realities.

Following COVID, many offered generous subsidies, effectively lending money to citizens in advance.

Now, they must repay that debt, and we’re seeing policy shifts. Some countries are cutting back on spending, while others attempt to stimulate growth.

For our business, this means research budgets in universities and government institutions may be constrained. This could impact demand for our products.

However, the private sector remains strong, as companies invest in capital expenditures for growth rather than relying on government funding. We saw a temporary freeze in capital expenditures during COVID, but that is no longer the case.

2024 was a tough year for getting new orders. But I still believe our industry is strong in the long run.

Compounding Quality: You mentioned earlier that the order intake in China dropped significantly. Could you elaborate on how you see the Chinese market evolving for Judges Scientific?

David Cicurel: China has been an incredible growth story for us over the past 19 years. However, there are three key trends affecting our business there:

Slower economic growth: China historically enjoyed 8-10% growth rates, but now struggles to reach 5%. That’s good compared to Europe but weak by Chinese standards.

Shift from public to consumer-driven growth: The government is focusing more on consumer spending rather than building new universities, which affects demand for our scientific instruments.

'Buy Chinese' policies: There is increasing pressure for institutions to purchase domestic alternatives instead of Western-made products.

While we will continue doing business in China, it will no longer be the major growth driver it once was.

That said, we are seeing new opportunities in regions like India, where the population is growing, education levels are rising, and demand for high-quality scientific instruments is increasing.