My Best Decision Ever

The big secret

Investing is a beautiful intellectual game.

Which other hobby is so interesting AND makes you money?

In this article, I’ll talk about my best investments ever and what you can learn from them.

The biggest secret

Usually, I save the best for last when writing articles.

But in today’s article, I’ll give away my best decision ever right away.

The best investment decision I ever made?

The decision that paid off more than any decision I’ll ever make in the future?

To just start.

Or as Nike says:

The stock market is one of the only ways to let your money work for you while you sleep.

Since I was born in 1996:

Asian Financial Crisis (1997): Collapse of currencies and markets across Asia

Dot-Com Crash (2000-2002): the Nasdaq plunged by almost 80%

9/11 Market Shock (2001): Stock markets shut down. The Dow Jones fell 684 points upon reopening

Global Financial Crisis (2007-2008): Lehman Brothers collapsed, markets tanked by 50%

U.S. Debt Ceiling Crisis (2011): S&P downgraded the U.S. credit rating, causing volatility

Chinese Stock Market Crash (2015-2016): China’s market lost trillions in value

COVID-19 Market Crash (2020): Fastest bear market in history. The FED needed to make a major invention

And yet… The S&P 500 is up +1,100% since 1996.

This means that if my parents had invested $10,000 for me when I was born, I’d have $120,000 today.

Become a learning machine

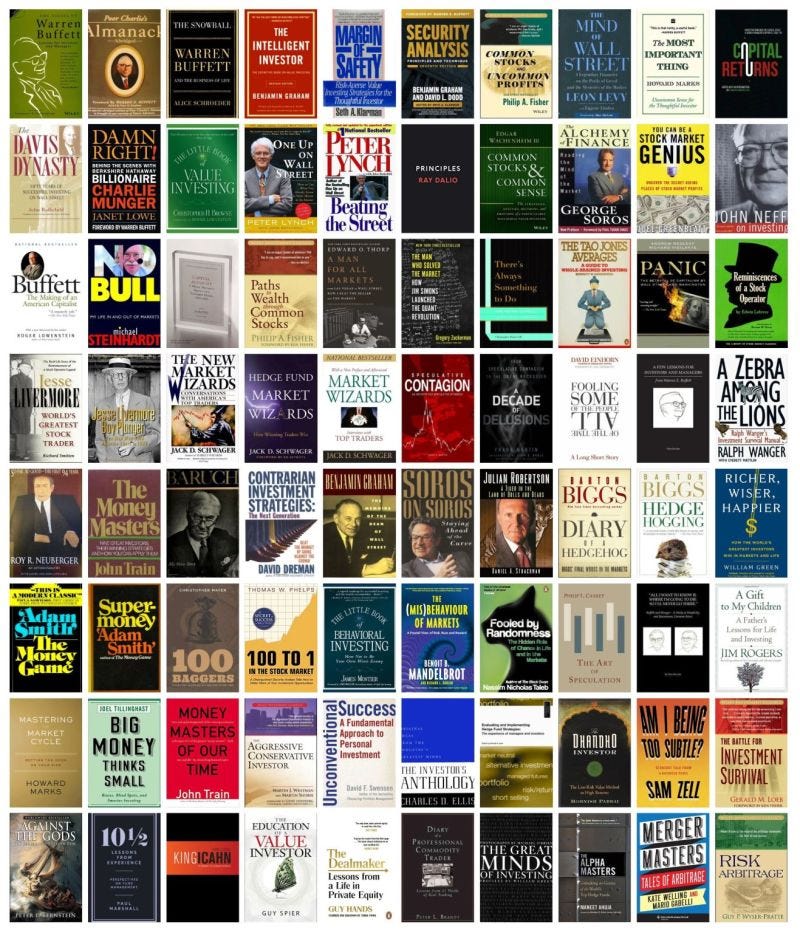

Charlie Munger once said: “My children laugh at me. They think I'm a book with a couple of legs sticking out.”

The most successful people in the world keep learning all the time.

Intellectual curiosity is a beautiful thing.

It could even determine whether you succeed or not.

I’ve set myself the goal to read 52 weeks per year for the next 52 years.

When I achieve this goal, I will have read 2,704 new books by the time I’m 80 years old.

Here are some books I’m reading right now (I always read multiple books at the same time):

Buffett & Munger Unscripted (Alex Morris)

The Innovator’s Dilemma (Clayton Christensen)

The Art of Impossible (Steven Kotler)

Elon Musk (Walter Isaacson)

Capital Returns (Edward Chancellor)

Masterinvest provided a great overview of some of the best investment books if you’re still looking for more inspiration:

Playing the long game

In investing, it’s all about the long term.

Jeff Bezos summed it up quite well:

Everyone on Wall Street is focused on the short term.

When I still worked in the industry, I had a hard time with the many reports from JP Morgan, Morgan Stanley, Goldman Sachs, …

Everything revolved around the figures. For example, Waste Management (a waste management company - what's in a name ) was in our portfolio.

Analysts expected a profit per share of $1.54, but the company booked a profit of ‘only’ $1.52. Bad news, according to them. And the stock price plummeted.

All those very expensive analyst reports, often tens of thousands of dollars per year, described in detail how a share performed two euro cents below expectations. But no one asked the most important question: Is Waste Management a good or a bad company?

By investing with a long-term mindset and focusing on the evolution of the intrinsic value per share, you cut out the noise.

This will help you make rational decisions.

"All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies." - Warren BuffettInvesting through cycles

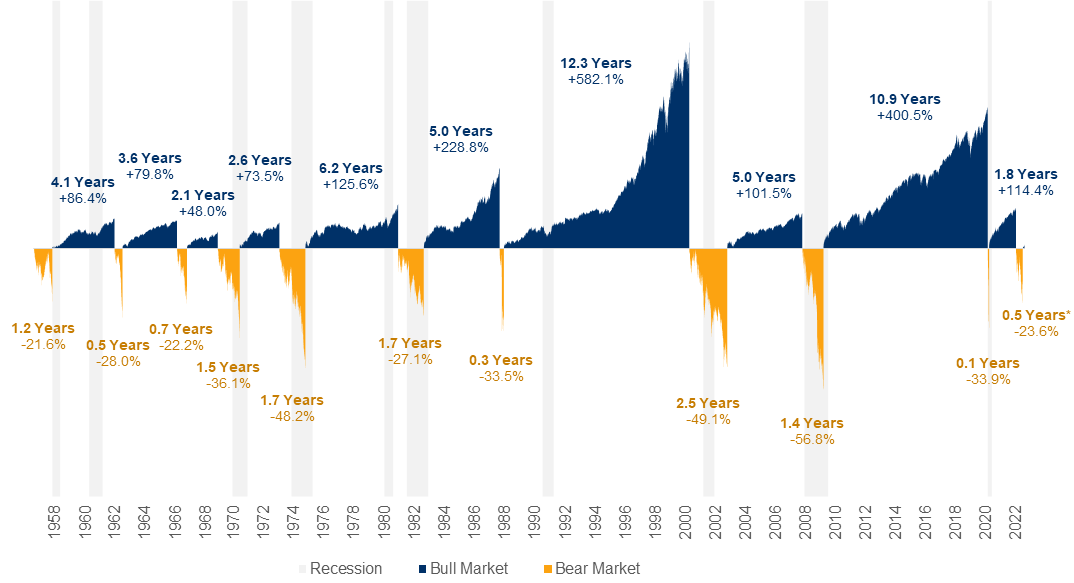

Just like the sea, the stock market ebbs and flows.

And sometimes it’s great to have stock market corrections. Why?

“In bear markets, stocks return to their rightful owners.” - J.P.MorganStocks will go down from time to time.

If you can’t stand the heat, you should stay out of the kitchen.

Even Berkshire Hathaway, the best conglomerate in the world, declined by over 50% four (!) times since Warren Buffett first bought the stock in 1965:

But always remember: after rain comes sunshine.

The best returns are made by investing heavily in times of market turmoil.

The magic of compounding

One of the largest secrets to investing? Let your winners run as long as possible.

All it takes to have a very successful investment career is a few very large winners.

Just imagine you invested $10,000 spread equally across 10 stocks in 1997.

Nine (90%) of them went bankrupt.

This doesn’t sound good. Does it?

But what if the 10th stock was Amazon?

Your investments would be worth $2.8 million!

This means you compounded at a yearly return of 22.3% versus 9.6% for the S&P 500.

And this while 9 out of your 10 investments became worthless.

Our Portfolio

In Our Portfolio, we always keep the Rule of 3 from François Rochon in mind:

One year out of three, the stock market will go down at least 10%

One stock out of three we buy will be a disappointment

One year out of three, we will underperform the market

Let’s take a look at the performance per position.