My Newsletter Journey

On a boring Friday night in June 2022, I started Compounding Quality.

Today, we have over 1 million followers/subscribers across all channels.

When you would have said this to me 3 years ago, I would have said you’re crazy.

In this article, I’ll share some things I’ve learned during this journey.

Have you ever heard about The Walnut Fund?

With The Walnut Fund, you invest in real walnut trees that produce nuts (and cash) every year, for over 40 years.

It's a simple way to earn passive income and help the environment. Plus, for every 10 trees you buy, you get 1 free. Be fast, there are only 5,400 trees available.

The Role of Luck

Never underestimate the role of luck in your life.

I believe 90% of Compounding Quality’s success comes from luck, and only 10% from skill.

When I created a Twitter account for Compounding Quality, I tweeted a LOT in the beginning (at least 20 tweets per day).

My first posts took quite some time:

The 10 best investing books ever

How to value a stock

10 Undervalued Quality Stocks

…

After a week, I had 4 followers (among which my brother and my best friend).

I’ll give it one more week, I thought. Otherwise, it’s not worth the effort.

But then luck found me. Gautam Baid, a role model for me, recommended that his followers follow Compounding Quality.

In one night, my follower count jumped from a few to 1,500.

And that’s exactly the day that the snowball started rolling.

Today I have:

450,000 followers on Twitter

250,000 followers on LinkedIn

475,000 email subscribers

That’s over 1 million readers, including people like Jeff Bezos, Bill Ackman, and Lebron James.

Writing for free for 1 year

When I started Compounding Quality, I was still working in the industry.

There was a strict policy that you could have no side pockets.

You weren’t allowed to earn anything in the Finance & Investing industry except for your job.

As a result, I ran Compounding Quality anonymously and completely for free.

The first year of this journey, I spent multiple hours per week writing for Compounding Quality, while it only cost me money.

Initially, I just tweeted on Twitter (X). But as a writer, you want to ‘own your audience’.

When people subscribe to your website, you ‘own’ the email address.

That’s exactly why I created the newsletter in the first place.

I wrote 2 articles per week completely for free until the summer of 2023.

The first article was published on the 22nd of July 2022:

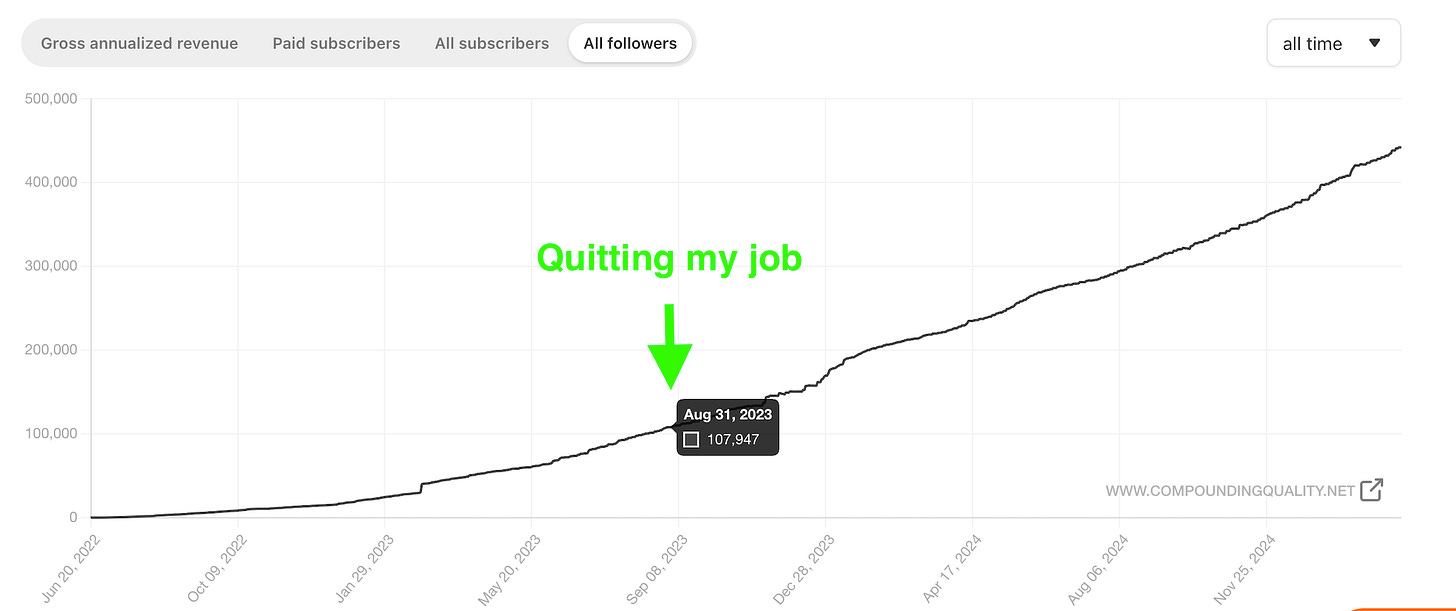

Quitting my job

In the summer of 2023, I decided to quit my job.

I figured out that when I would just keep writing for free and put advertisements on the website, I could make at least what I was making from my regular job.

Until I quit my job, I was only writing general articles:

How to read a balance sheet

10 Investment Lessons from Warren Buffett

The importance of moats

…

As quitting provided me with a lot of extra freedom (and time), I decided to take Compounding Quality to the next level:

I would start writing Deep Dives on Quality Stocks

A Portfolio would be shared (all my investable assets are in this Portfolio)

…

You can find the announcement here:

The Portfolio

Honesty and transparency are the most important things.

Especially in Finance.

You need to be authentic and operate with high integrity.

That’s why Partners of Compounding Quality can see the Portfolio, performance, and all transactions with 100% transparency.

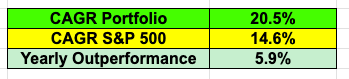

Since its inception, the performance has been good, which has definitely helped the popularity of Compounding Quality.

I think it’s very unrealistic to expect these kinds of returns in the long term.

The goal is to outperform the S&P 500 by 3% per year in the long term (we will face multiple periods of underperformance along the way).

Influencing stock prices

And since I started doing this full-time, the newsletter kept growing:

The newsletters grew from 108,000 subscribers at the end of August 2023 to 475,000 email subscribers today.

Every month, articles are read over 4 million times.

This is lovely, but it also has a negative effect.

When I write about a smaller (more illiquid) stock, it influences the stock price.

The stock price of one of the latest buys I announced increased by 10% the next day (I always make announcements on Sunday).

This means it’s getting harder and harder to write about small stocks (which is a sad thing).

It’s something we will probably need to take into account in the future. That’s why Tiny Titans might be very interesting.

The newsletter business

Three essential pillars

What’s very important in the newsletter business?

There are three important pillars:

Investing: It needs to be your passion. You need to live and breathe investing 24/7

Writing: You need to be able to communicate your ideas well

Business: Make sound decisions regarding aspects like the pricing of your newsletter, partnerships, …

You have a lot of people who are amazing investors, amazing writers, or amazing entrepreneurs, but doing a bit of all is hard. Very hard.

The power of clear writing can’t be overestimated. If you have the best investment idea in the world, but you can’t communicate well, you won’t succeed in the newsletter business.

Newsletters 🆚 Asset Managers

Newsletters are also something completely different compared to asset managers:

Newsletter Business:

Very easy and cheap to start

High profitability and very scalable

High churn (people subscribe to different newsletters)

Asset Management:

Very hard and expensive to start

Very scalable, but you probably need some employees to run the business

Low churn (very loyal clients)

In a way, I think it makes a lot of sense for asset managers to acquire a newsletter and use it as a lead magnet for their funds (if regulators allow it).

When I asked around about starting an equity fund, it quickly became clear that raising $100 million was possible.

Will I ever do this? The future will tell.

Organic 🆚 Paid Growth

For Compounding Quality, all growth has been organic so far.

I never used advertisements to grow the newsletter.

This results in very high profitability margins (EBIT Margin > 85%). The two main costs you have:

Substack fees: 10% of revenue

Stripe fees: 2.9% of revenue

And whether you write for 10 people, 10,000 people, or 10 million people, it’s the same amount of work.

I know quite a few newsletters that spend tens of thousands of dollars per month on advertising. But only a small fraction of them succeed in profitably running ads.

"Half the money I spend on advertising is wasted; the trouble is I don't know which half." - John WanamakerThe dark side

One of the hardest things about running a newsletter? It never stops.

Every week, 3 articles need to be published (Tuesdays, Thursdays & Sundays).

Don’t get me wrong, I love doing this, but sometimes it feels like you are being chased all the time.

Are you going to Omaha for the Berkshire AGM? The articles must be there.

Want to take a week off? The write-ups must be ready (and good).

Something bad happens in your personal life? Too bad. But make sure the analyses are published.

The only people who last are the ones who love writing and investing.

Some other lessons learned

Here are a few key lessons learned from this journey:

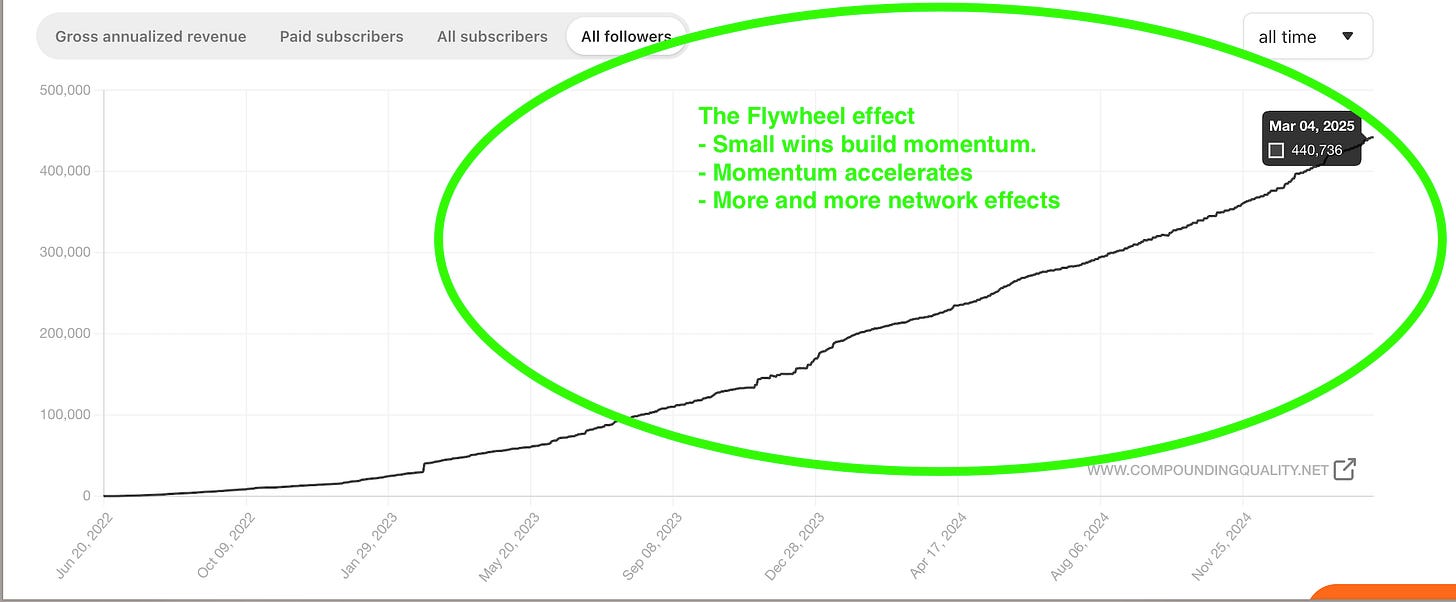

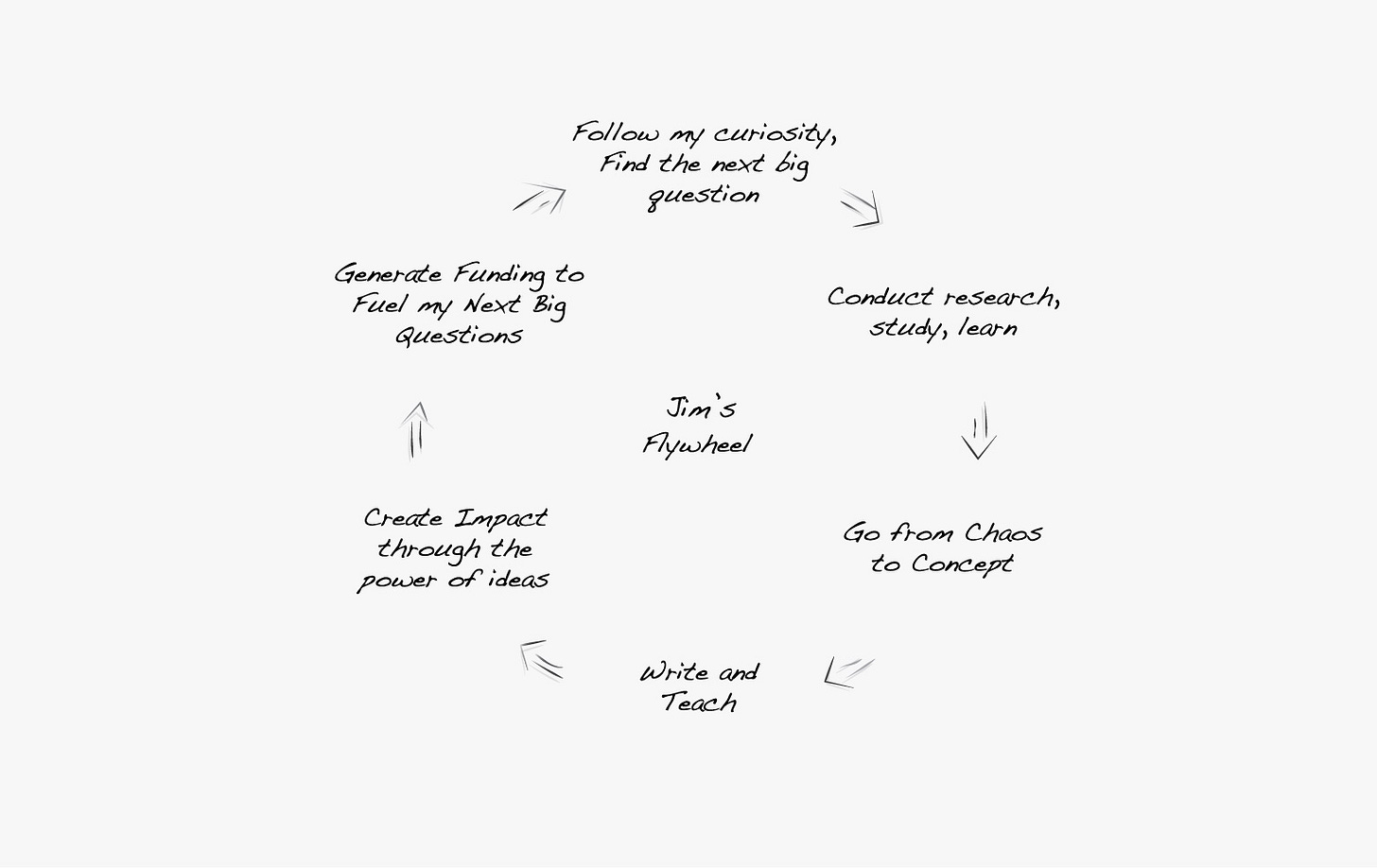

It’s all about flywheels

The newsletter business is all about flywheels.

Jim Collins has written an amazing little book called ‘Turning the Flywheel: A Monograph to Accompany Good to Great.’ I highly recommend everyone read it.

It’s all about providing as much value as you possibly can.

Give without expectation and you’ll be rewarded one day.

The hardest part of this business is getting your first 1,000 loyal readers. Afterwards, life gets a lot easier.

Be authentic

Honesty and transparency are key. Be yourself and put your heart into what you write.

In the world of Artificial Intelligence, it becomes easier and easier for chatbots to write about stocks. The only way you can differentiate yourself? Be authentic.

PS Here’s a picture of my dad, my brother, and me. :)

Have fun

People notice it when you’re having fun.

I’m highly convinced that when you’re passionate about something, by definition, you’ll do better than those who aren’t.

Expectations for New Subscribers

That’s it for today.

Are you new to Compounding Quality?

Compounding Quality is not for you if you want to:

❌ Get rich quick

❌ Blindly follow someone else’s advice

❌ Outperform the market every single year

You are in the right place if you want to:

✅ Learn and become a better investor

✅ Be assisted alongside your investment journey

✅ Outperform the market in the long term

Partners have access to My Portfolio here.

Everything In Life Compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

A question , I see you use finchat, do you think is reliable? Because I happened to be looking up a company's numbers the other day, and when I compared them with other sites, I saw that there was a big difference, and ultimately, the data shown in Finchat

Lwas incorrect

thanks for this one, appreciated the review and reflections. keep it going and best of luck.