My Tiny Titans Investment Philosophy

48 Hours left

In exactly two days, Tiny Titans will launch.

Are you ready? Join me on a 🎥 free webinar on Tuesday the 16th of September.

📈 Real examples of 10x stocks

🔑 My secrets to identify 100-baggers

🏆 3 Small caps to buy today

🎁 A special gift people would pay > $1,000 for

✨ And much more!

The best part? It's free.

Register here to secure your spot (and 🎁 special gift).The launch of Tiny Titans is almost there.

The goal? Find high-quality small caps with huge upside potential.

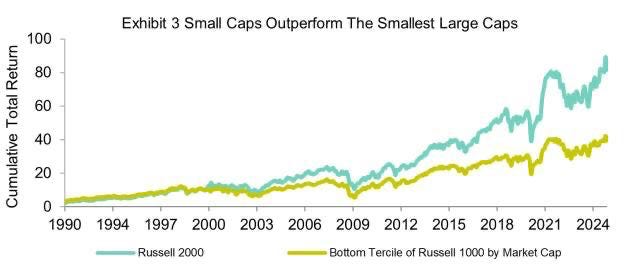

These companies tend to outperform the market over time:

What Are Tiny Titans?

Tiny Titans are small companies with the potential to grow 10x (or more) over time.

But they’re not just any small companies.

They need to be profitable, growing fast, and led by great managers who own a big stake themselves.

It’s like finding baby versions of Microsoft, Constellation Software, or Games Workshop.

Why is this interesting?

Just look at these two quotes from Warren Buffett:

1. "The secret of life is weak competition."

2. "Anyone who says size doesn't hurt performance is selling."You can learn two things from this:

1. Almost nobody covers small- and micro-cap stocks. The competition is weaker here. As a result, you can make a real difference in this field.

2. Small caps usually beat the market. If you only buy high-quality small caps, the outperformance is massive.Here you can see that small caps outperform the market:

What’s the difference with Compounding Quality?

Have you ever heard me talk about Staying Rich, Living Rich, and Getting Rich?

Getting Rich: Quality stocks with plenty of growth potential

Staying Rich: Established quality stocks that are still growing attractively

Living Rich: Great companies that are paying an attractive dividend

Compounding Quality (Staying Rich)

Compounding Quality is the main newsletter. It focuses on buying wonderful companies at a fair price.

Think about companies like Visa and Mastercard.

They consistently outperform the market.

Compounding Quality is all about ‘Staying Rich’.

Compounding Dividends (Living Rich)

Compounding Dividends focuses on growing your wealth while receiving an attractive dividend.

The goal is to build a Dividend Growth Portfolio that generates more dividend income than your monthly expenses.

Compounding Dividends is all about ‘Living Rich’.

Tiny Titans (Getting Rich)

Tiny Titans uses the same philosophy as Compounding Quality, but applies this strategy to smaller companies.

The upside potential of this strategy is higher, but there are also more risks involved. The goal is to find a few stocks that can 10x in the future.

Tiny Titans is all about ‘Getting Rich’.

This is the strategy that delivers the highest return in the long term.

How much will you invest in Tiny Titans?

All my money is invested in the companies I write about.

This aligns our incentives. We are Partners in this.

Here’s what the split will look like:

Compounding Quality: 75% of My Portfolio

Tiny Titans: 25% of My Portfolio

Why is Tiny Titans needed?

I started to notice that we influence the stock prices of small companies too much when I wrote about them.

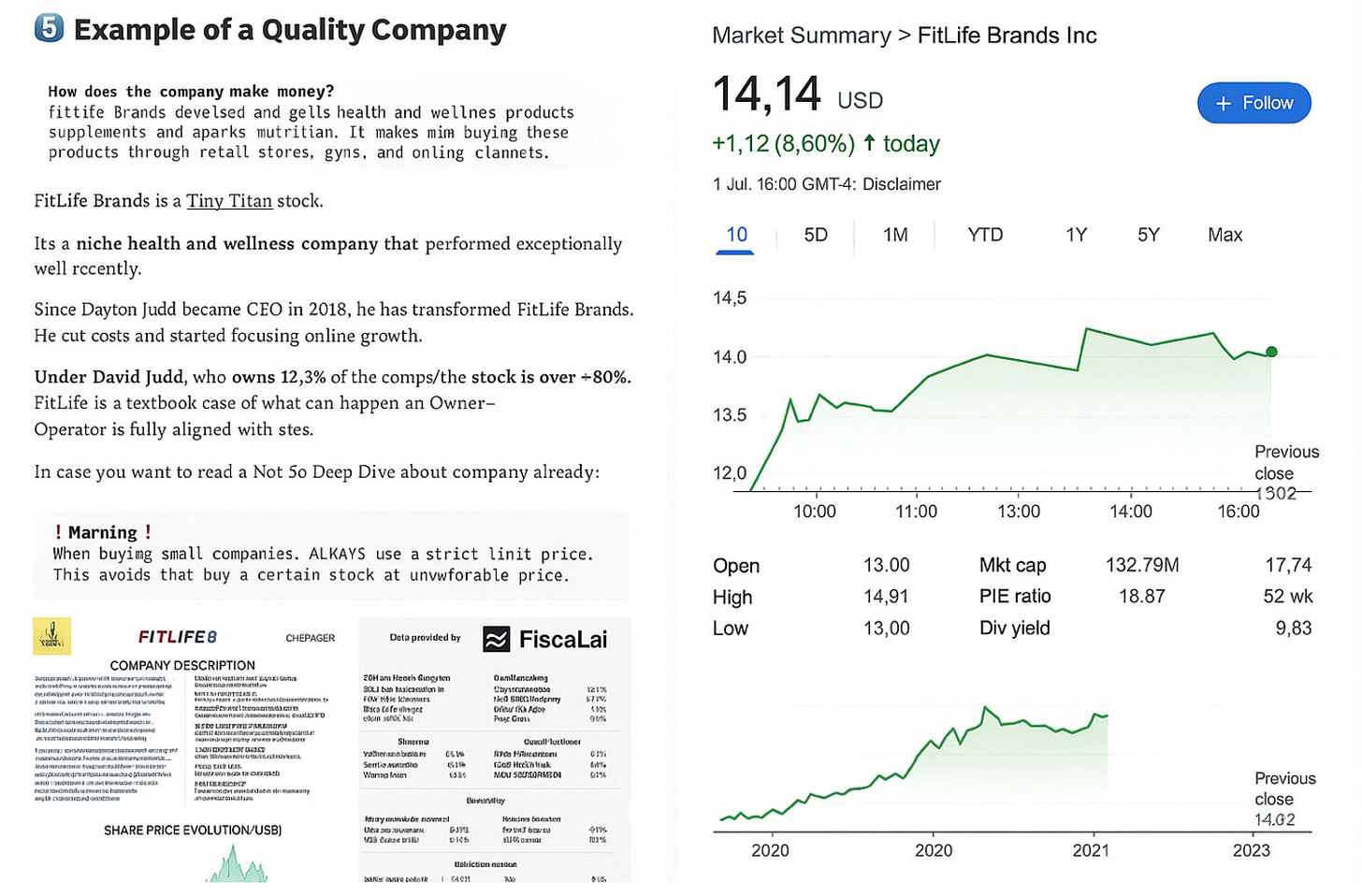

Just look at what happened when I wrote about FitLife Brands ($FTLF):

The stock jumped +8.6% that day.

And even +40% (!) the days thereafter.

And it wasn’t the only one…

➔ Kelly Partners jumped +5% after we bought

➔ Topicus moved +4%

➔ Judges Scientific rose +10%

That’s why there is a high need for Tiny Titans.

To allow us to still write about Tiny companies that have the potential to become Titans.

As we don’t want the same thing to happen with Tiny Titans as with Composing Quality, Tiny Titans will be very exclusive.

There will only be a few available spots on the launch of the 16th of September.

The investment philosophy

Stocks for Tiny Titans will be identified in 7 steps:

🛡️ Healthy balance sheet: Low debt and plenty of cash = more flexibility.

🤝 Insider ownership: Founder or the CEO must own shares himself.

💰 Profitability: Only invest in very profitable companies.

🚀 Attractive growth: Revenue and EPS should grow >10% per year.

🧠 Capital allocation skills: The company uses its cash wisely.

🌱 Reinvestment opportunities: Heavy reinvestment in future growth.

🔍 Valuation: A wonderful company at a fair price is better than a fair company at a wonderful price.

Based on these 7 criteria, we will use a stock screener to build our watchlist:

📉 Market cap < $3 billion

🏦 Net Debt / EBITDA < 3

🚫 No new shares issued in the last 3 years

💸 Net Profit Margin > 10%

🧠 ROIC > 15%

📈 Revenue growth > 10% per year (5-year average)

💥 EPS growth > 10% per year (5-year average)

The Watchlist

Based on these criteria, a watchlist of 94 companies is created.

So, how have these companies done since their IPO?

📊 Average return since IPO: +33.1%

📈 Median return since IPO: +17.3%

That’s an amazing performance.

The average performance over the past 20 years looks like this:

Here are some examples with their YTD returns:

✅ Intellego Technologies: +279.9%

✅ Pop Mart International: +251.5%

✅ STIF France: +208.6%

✅ Sezzle: +110.4%

✅ Norbit: +103.7%

I am quite comfortable that these companies will keep performing well.

Why? Just look at this comparison between the watchlist and the S&P 500:

Our watchlist companies are higher quality and cheaper than the S&P 500 based on the PEG ratio.

If you own better companies that aren’t more expensive, I think it makes complete sense that you’ll outperform the market.

The Portfolio

Here are the essentials of the Portfolio for Tiny Titans:

✅ The portfolio will invest worldwide

✅ Owning 30-35 companies

✅ Market cap < $3 billion

✅ Small-cap high-quality stocks with 10x potential

✅ Companies operating in attractive growth industries

✅ The CEO still has a significant stake in the company

What return can I expect?

The future is by definition uncertain.

There are only two kinds of people who can predict what will happen: fortunetellers and liars.

While we can’t predict the market, we can set clear goals for ourselves.

The goal of the Portfolio is to double every 5 years.

As the power of compounding is very powerful, this means that you:

2x your money every 5 years

4x your money every 10 years

16x your money every 20 years

64x your money every 30 years

256x your money every 40 years

An example

You still want everything to be a bit more concrete?

Let me give you one example of a Tiny Titan.

Installed Building Products (+1.914% since 2014)

How does the company make money?

Installed Building Products is a distributor and installer of insulation and other building materials for new and existing homes.Installed Building Products is active in insulation, sealants, garage doors, gutters, mirrors, and more.

They make everything that goes into making a house.

It’s a boring business with steady demand. Exactly the kind of under-the-radar operator we love at Tiny Titans.

The company generated an average return of 30.6% (!) per year for shareholders since 2014.

Wrapping up

That’s it for today.

You want to learn how to identify these kind of companies yourself?

Attend the 🎉 Big Launch Party of Tiny Titans next Tuesday.

Who knows… it might lead you to your first 100-Bagger.

Everything in life compounds

Pieter

PS The webinar will be amazing. You can register for free here.