🏰 One of the best paragraphs Buffett has ever written

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

If you are reading this and are not subscribed yet, feel free to join the Compounding Quality Family via the button hereunder.

1️⃣ One of the best paragraphs Buffett has ever written

There is no such thing as value or growth investing.

Every investor tries to buy a company below its intrinsic value.

2️⃣ 16 habits that will make you poor

Do you want to build wealth? Avoid these 16 bad habits.

Source: MarketingMentor

3️⃣ One simple investment quote

To invest successfully, you should be able to go against the crowd from time to time.

"An investor needs only two things to make a lot of money during a crisis; cash and the nerve to invest that cash when no one else is willing to." - Howard Marks

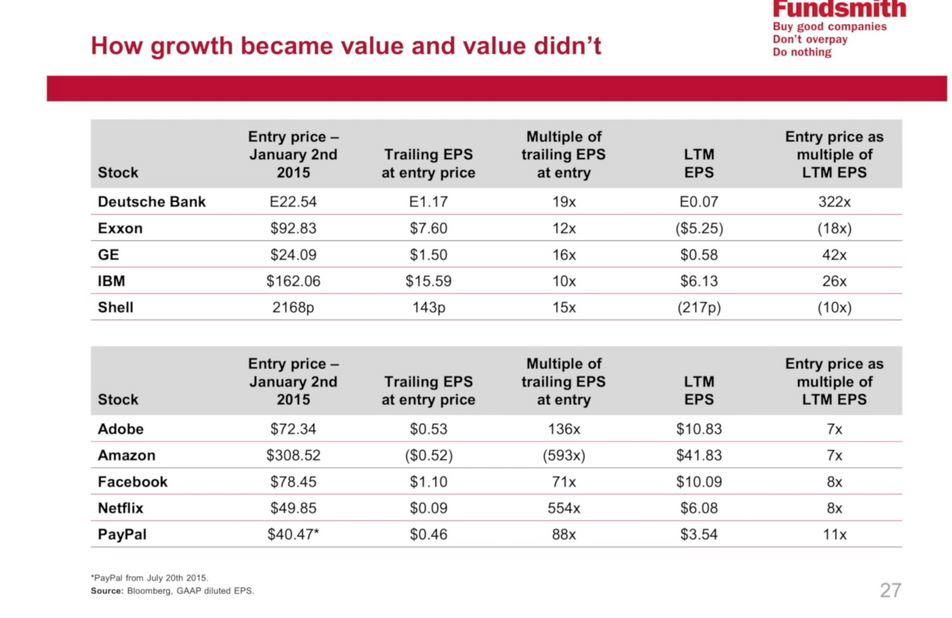

4️⃣ How growth became value

How growth became value, and value became a value trap.

Valuation matters. However, the longer your investment horizon, the more free cash flow growth per share matters.

5️⃣ Example of a Quality Company

There are a lot of beautiful companies in the beauty segment.

Which company do you prefer?

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Glad to hear a professional investor echo Buffetts correct argument on growth and value being two sides of the same coin. I’ve worked with lots of funds and investment advisors, it’s very engrained in the industry to talk and view stocks that way.

10 years ago Microsoft was a value stock, now they call it a growth stock. Is Microsoft different? Is Microsoft getting into cloud computing radically different than what they were doing before? I don’t think so.

In a lot of the professional investment world you have to talk that way, growth and value stocks. So I don’t write people off for talking that way, but I do typically try and poke around to see if they really believe it. If they do, I kind of write them off.