🥂 Our Forever Portfolio

Extensive Portfolio Update (Part I)

Hi Partner 👋

What a journey it has been so far.

Compounding Quality is read by over 1.5 million people

We own 16 high-quality stocks right now

The Portfolio compounded at a CAGR of 15.2% since inception

And guess what? The best is yet to come.

It’s time to take Compounding Quality to the next level.

This means:

More Deep Dives

More Frequent Portfolio Updates

Potentially a monthly Q&A session (webinar)

Extensive Portfolio Update

In the next two weeks, you’ll get a full Portfolio Update.

I’ll go through every stock and tell you if it’s still interesting or not.

The update is super broad, so I’ve split it into 4 parts (!). This is article 1 in this series.

Perfectly positioned

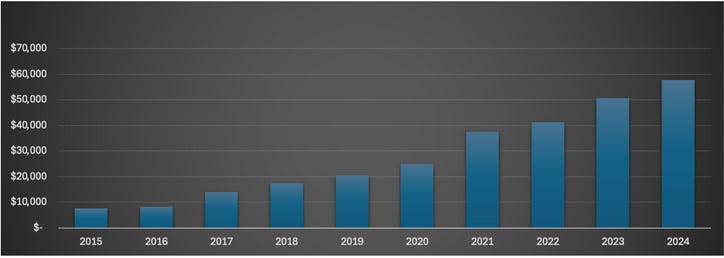

Here’s how much Free Cash Flow Our Portfolio is generating for us:

As you can see, Our Portfolio is making more and more money for us every single year.

That’s why I feel very comfortable with our current positions.

On top of that, I think the market is exaggerating at this point in time.

My great friend Michael Gielkens (Partner of Tresor Capital) shared this chart recently:

How to read this chart?

GSPEMFMO: Momentum stocks

GSPEQUAL: Quality stocks

As you can see, momentum stocks massively outperformed since half 2023.

This is a trend that can’t continue. Momentum outperforms the most when the market is euphoric.

That’s exactly why quality outperforms the most when markets go down or sideways.

It makes me extra comfortable with the companies we own.

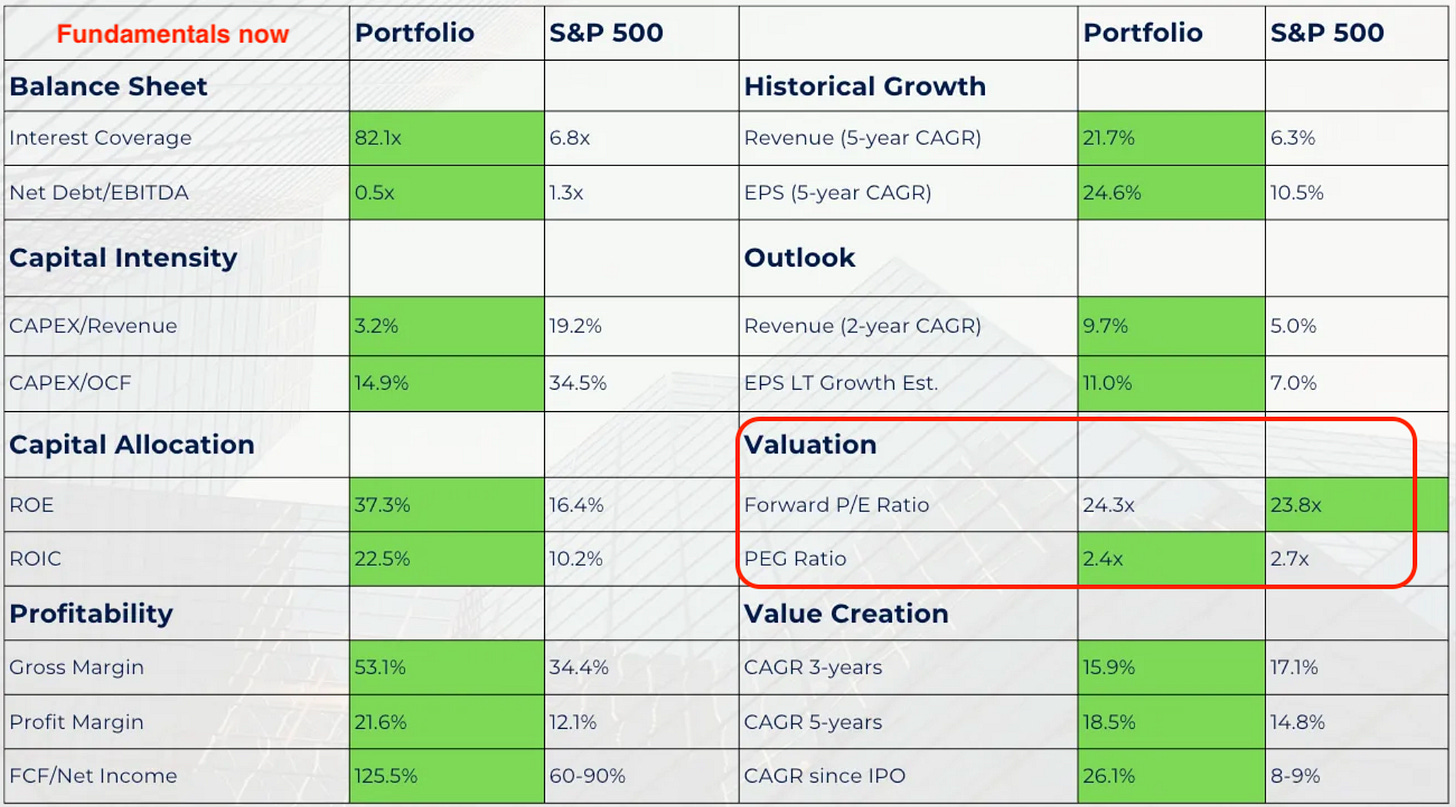

We own way better companies that create shareholder value year after year, and this while our companies are as expensive as the S&P 500.

Medpace ($MEDP)

How does the company make money?

Medpace is a company that helps drug and medical device makers test and develop new treatments by managing clinical trials and research.Weight in Portfolio: 10.1%

Medpace currently is the largest position in Our Portfolio

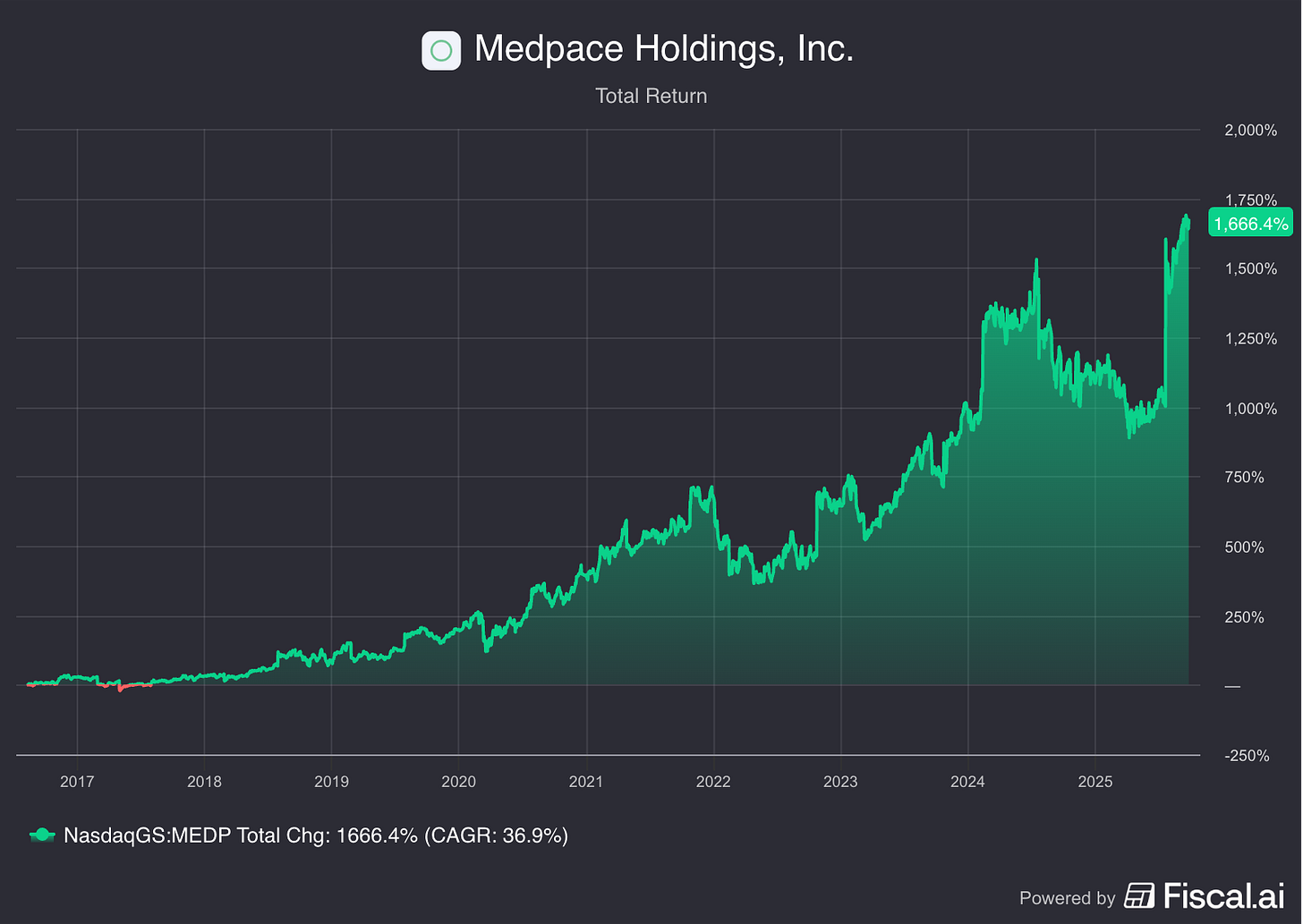

Performance (%): +112.5%

Update investment case

Medpace is an amazing business. The stock jumped +50% (!) in July after publishing its results.

Since we bought it in October 2023, the stock is up +112.5%.

Despite funding challenges in the biotech world, Medpace keeps executing on its long term plan, creating a lot of value for shareholders like us.

Last quarter, cancellations dropped to a 5-quarter low. It’s great seeing Medpace is up on its feet again.

As a result, backlog is recovering again with a book-to-bill ratio of 1.03x.

Management raised its guidance thanks to faster client decisions, better funding, and a shift to quicker-moving therapies. Revenue is now expected to grow by +19.5% this year.

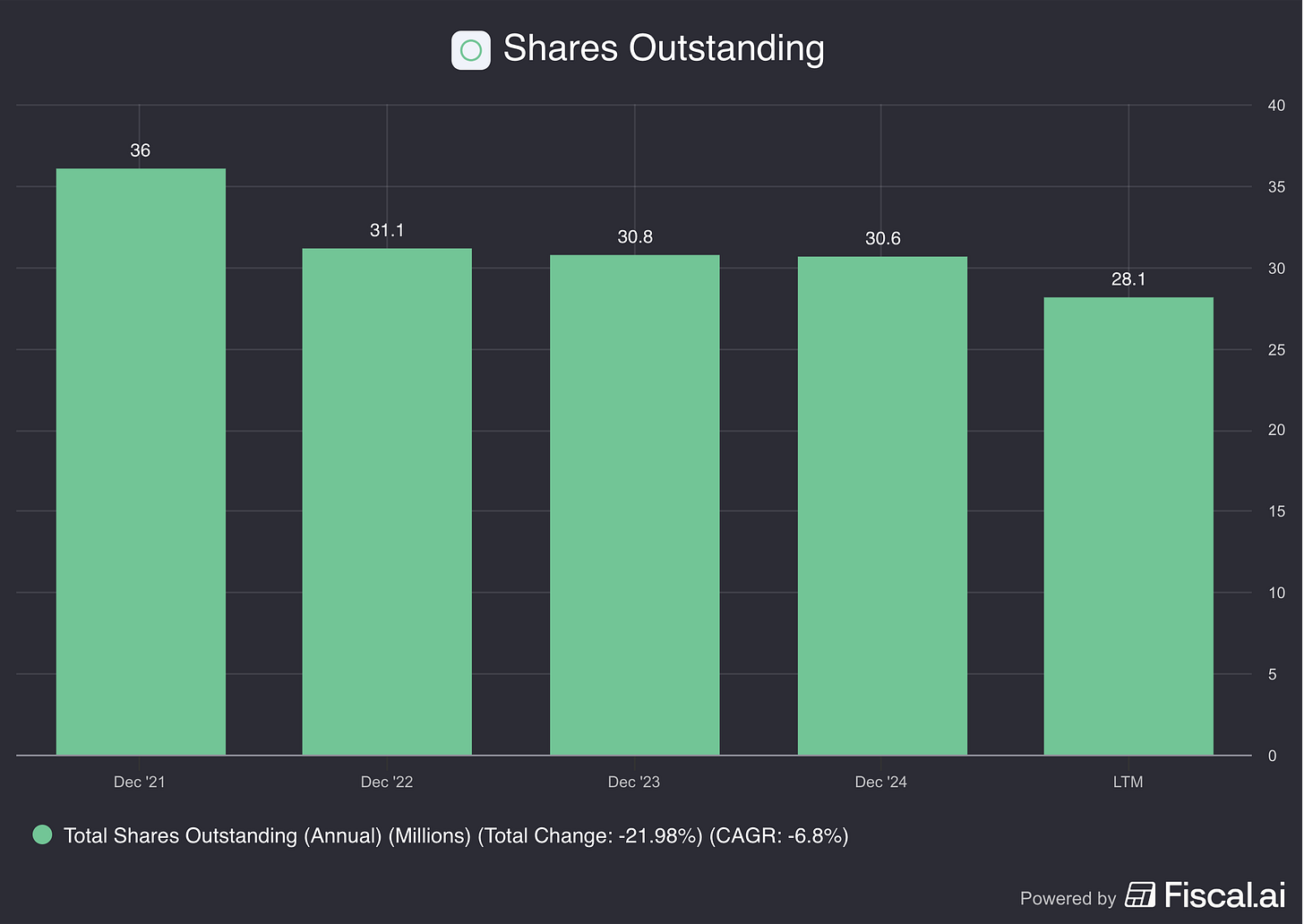

Furthermore, Medpace also heavily bought back shares while its stock price was low. This is a strong sign of great capital allocation skills.

In short, I am very happy to own Medpace.

Sometimes, a chart can tell you everything you need to know. Medpace is an amazing compounder:

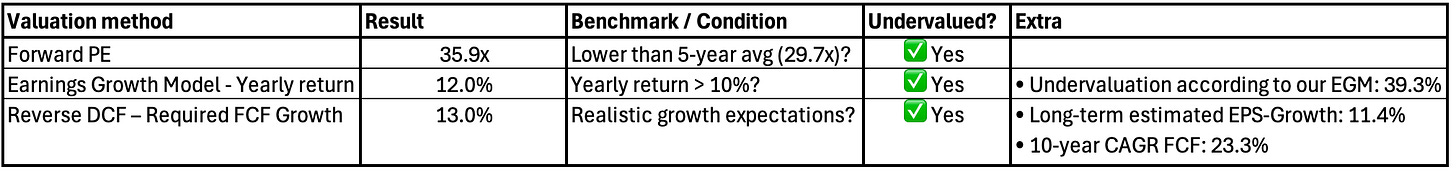

Current valuation level

Expectations intrinsic value

Expected growth intrinsic value 2026: 10.7%

Expected growth intrinsic value in the long term: 11.4%

Conviction level

8/10: Medpace is an amazing company. The only thing not to like about the company is the current valuation level

Relevant articles