Our Top Picks: 2025 Results

Your Favorite Stocks

The wisdom of crowds is amazing.

At the start of 2025, you were asked to share you top 3 stock picks.

In this article, we review the 10 most-picked stocks. How did they perform in 2025?

Amazing results

Wow. That’s the only thing I can say.

The S&P 500 increased by 17.1% in 2025.

It was almost impossible to beat the market if you didn’t own any Big Tech.

But guess what? The average stock of Our Readers just did.

The results? Impressive:

Average return (2025): +19.0%

S&P 500 return (2025): +17.1%

Outperformance in a market like this is no small achievement.

It speaks volumes about the quality of ideas in the Community.

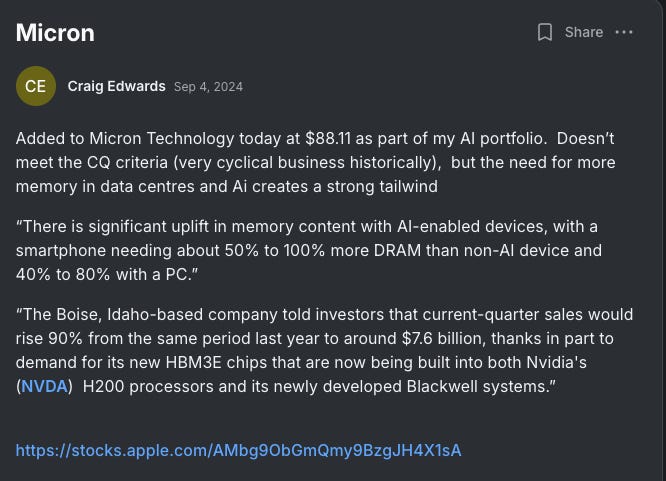

Just take this example of Micron from Craig Edwards.

The stock is up +219% since then:

Now, let’s dive into the 10 most-picked stocks and see how they performed

10. Melexis ($MELE)

Performance 2025: +3.8%

Company Profile

How does the company make money?

Melexis makes small chips used in machines, especially cars. The more cars that are built, the more chips Melexis sells—and the more money it makes. For example, its chips are used in sensors that measure a car’s speed.Electric cars need far more chips than traditional cars. As a result, Melexis is benefiting from the electrification of our vehicle fleet.

But the company disappointed in 2025:

The car industry is having a tough time

Melexis faces more competition

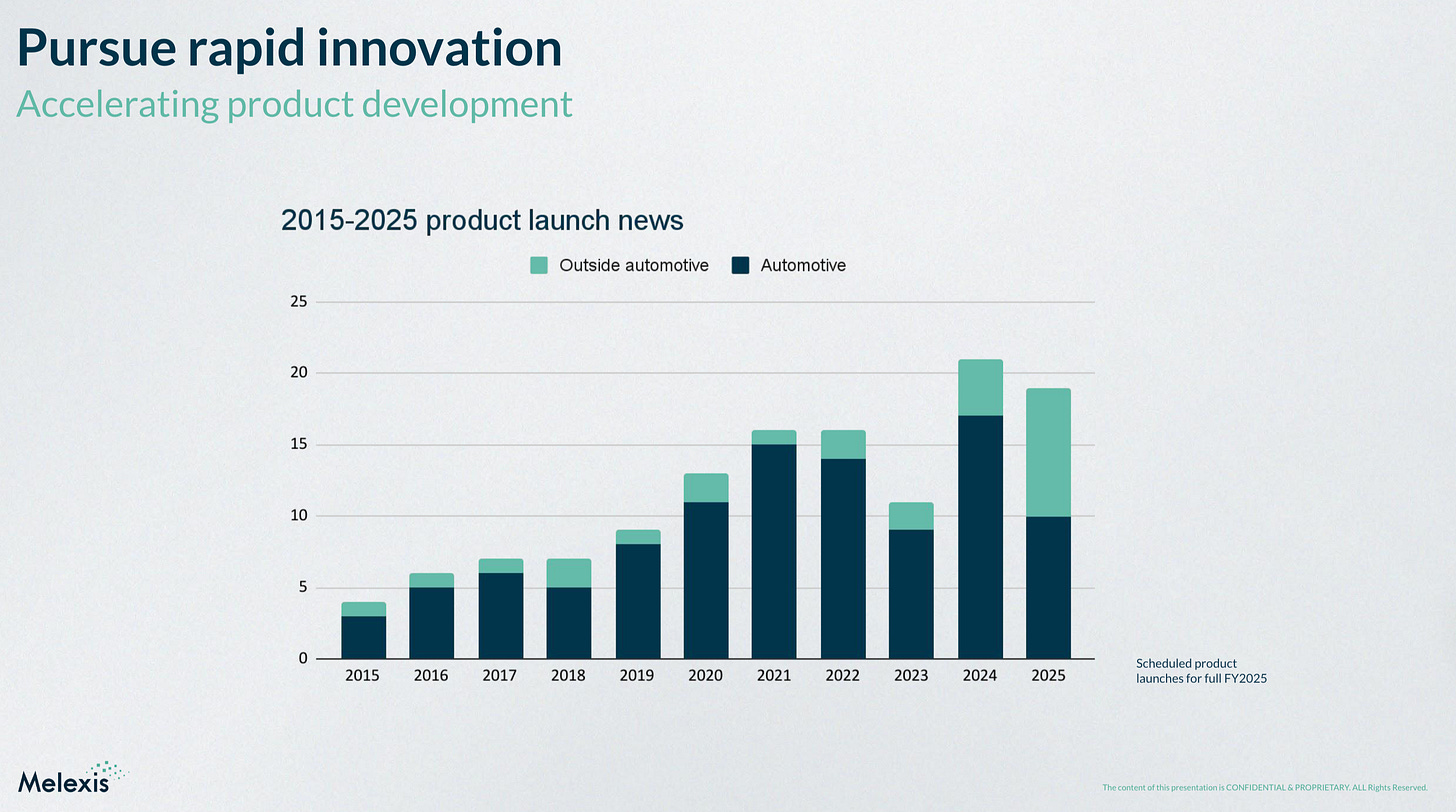

However, the company is diversifying its revenue streams.

As you can see, they are launching more and more products outside the automotive sector:

9. Dino Polska ($DNP)

Performance 2025: +3.1%

How does the company make money?

Dino Polska runs grocery stores across Poland that sell fresh food and everyday essentials. The stores are mainly in small towns and rural areas.2025 was an interesting year for Dino Polska.

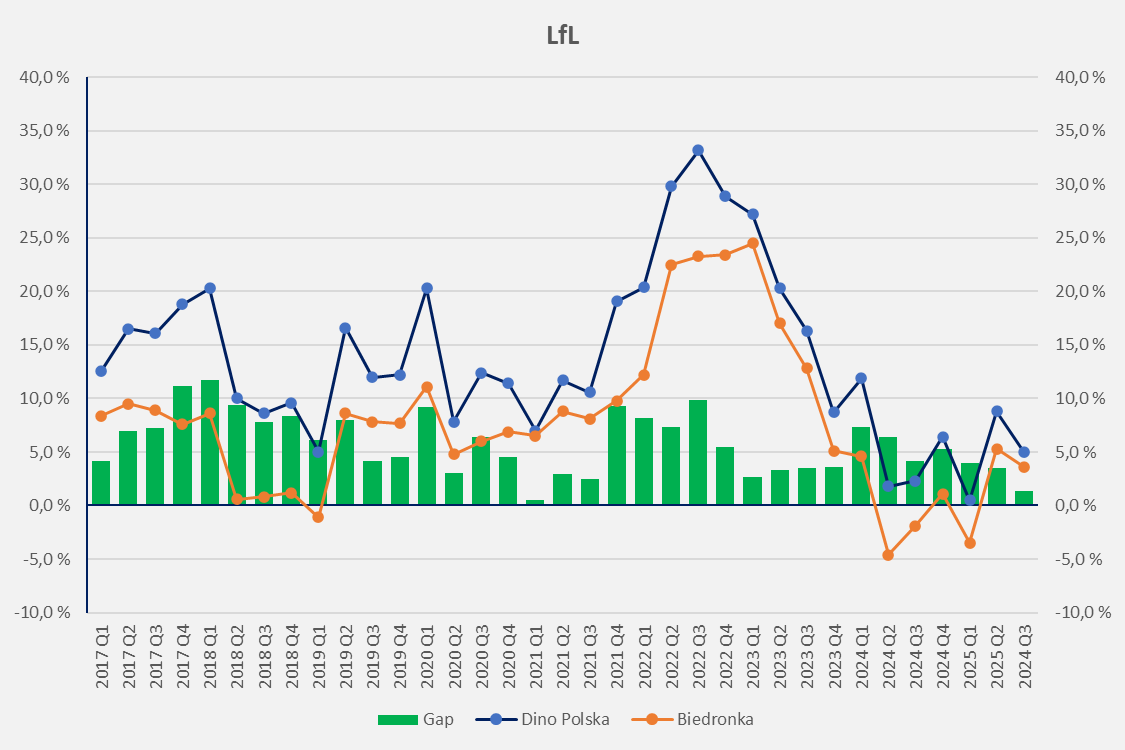

The market was not happy about the slowing like-for-like growth.

What is like-for-like growth?

Like-for-like growth measures how sales change in existing stores, excluding new store openings. It shows whether a company is actually selling more to customers, and not just growing by expanding its store count.Here’s a graph that shows the declining like-for-like growth of Dino Polska (blue line) and its most important competitor Biedronka (orange line):

Am I worried about this? Not really.

I’ll give you two reasons:

1. Poland is in a secular trend

Poland benefits from a secular trend. Their economy is growing way faster than Western European countries.

Michael Gielkens of Tresor Capital highlights just how striking this is: Poland’s economy is currently growing ten times faster than the UK.

The numbers speak for themselves. In 1995, Poland’s GDP per capita was only $13,600, about 36% of the UK level. Today, it stands at $44,500, or 81% of the UK’s GDP per capita, and the gap continues to shrink rapidly. Since the end of 2019, Poland’s per capita economy has grown by nearly 18%, compared with less than 1% for the United Kingdom—meaning, in real terms, Poland is growing ten times faster.To state the obvious, as the Polish economy expands, the growth potential for Dino Polska does too.

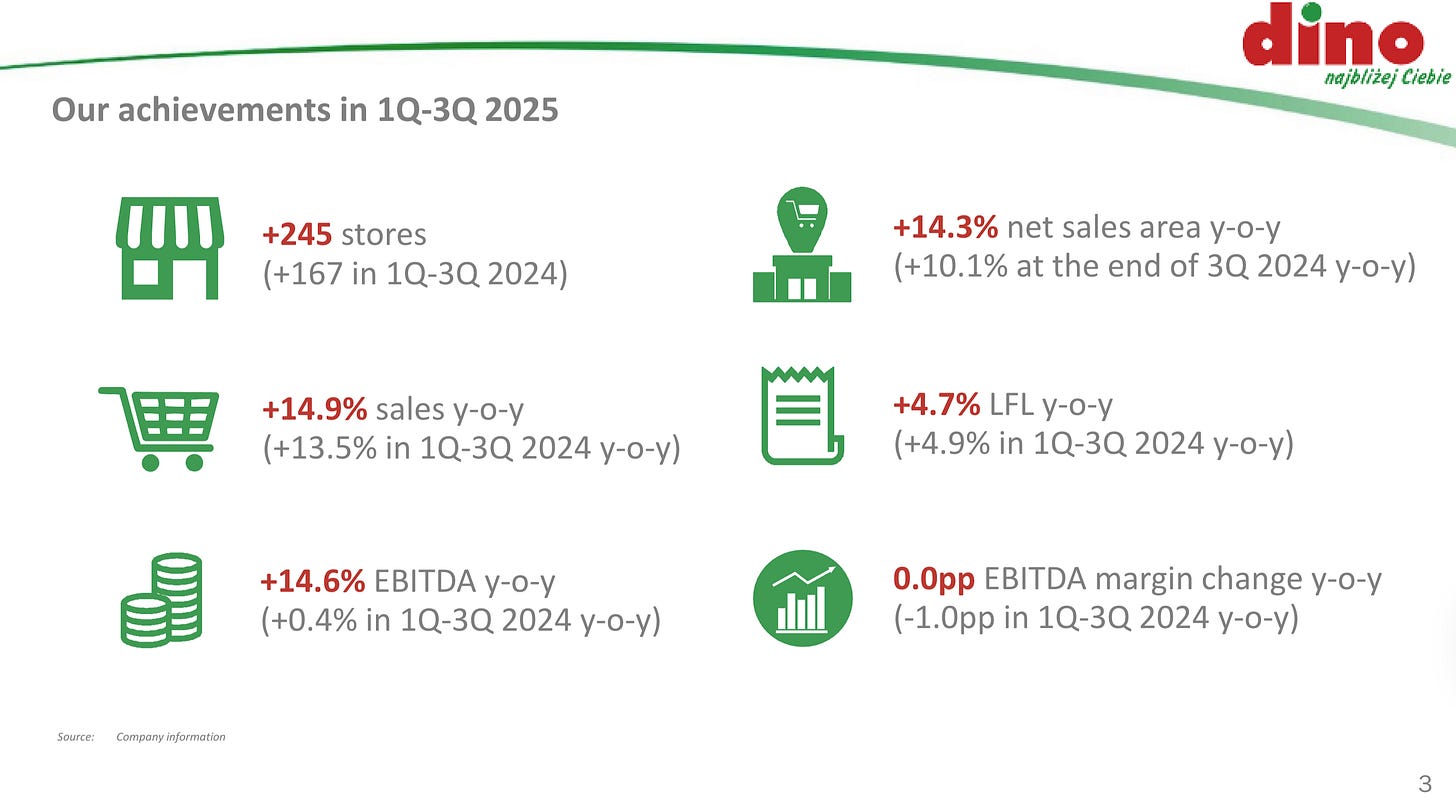

2. Overall revenue growth looks great

In the first nine months of 2025, total revenue grew by 14.9% compared to the first nine months of 2024.

The limited sales growth of existing stores is more than offset by the sales growth from new stores.

8. Kelly Partners Group ($KPG)

Performance 2025: -22.9%

How does the company make money?

Kelly Partners Group is an Australian serial acquirer in accounting businesses. They offer services like accounting, tax advice, and business planning to help these companies grow and succeed.Kelly Partners Group grew its intrinsic value (Owner’s Earnings) by 22.6% last year.

Yet the stock moved in the opposite direction, falling -22.9% year to date.

The result? The company became 45% cheaper!

And that’s not all.

Brett Kelly recently said they’re overwhelmed with opportunities.

This is a good problem to have. It’s why KPG hasn’t been buying back shares recently:

“We are currently limited by the capital available to take on opportunities to bring new firms into the group. We’re overwhelmed with opportunities, so we haven’t done any buybacks… If we had extra capital, we would be buying back shares enthusiastically and on a large scale.” - Brett KellyBrett Kelly clearly thinks the stock is undervalued at today’s price.

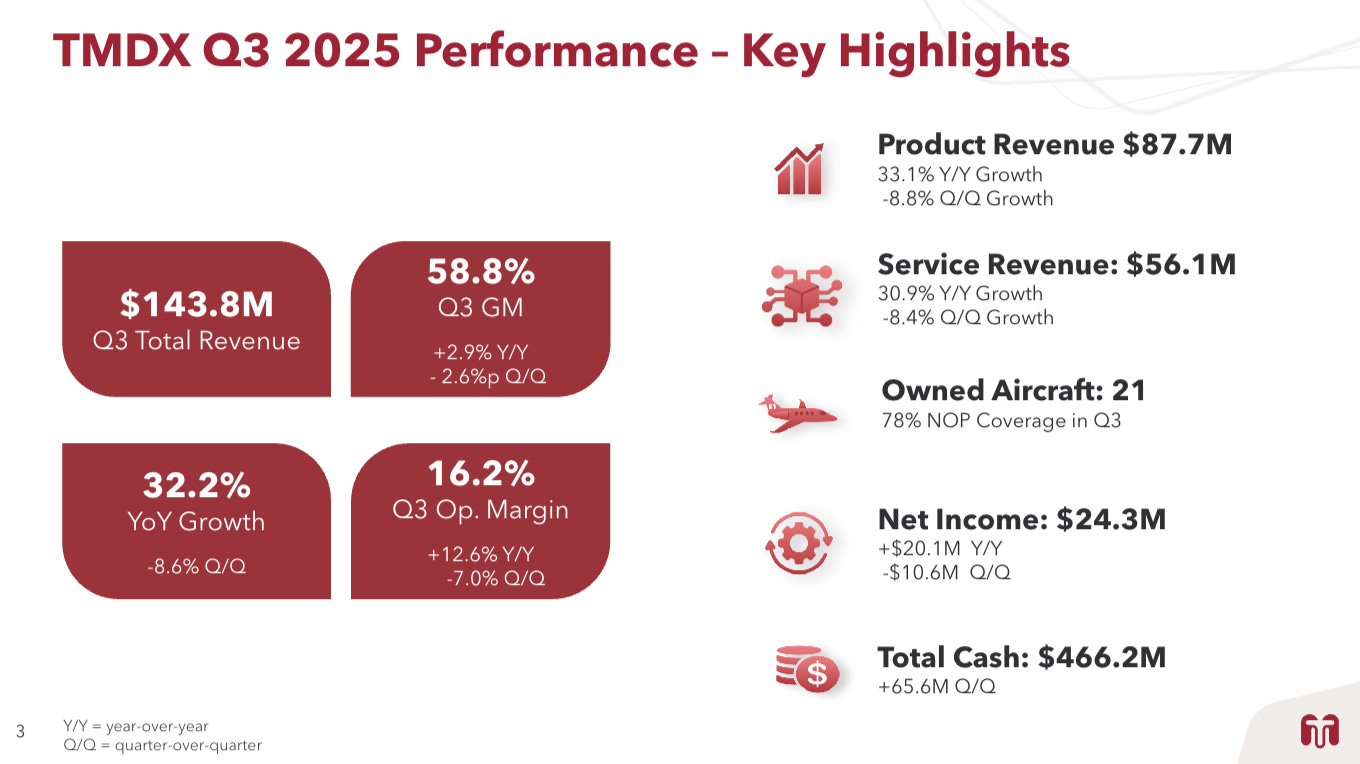

7. TransMedics ($TMDX)

Performance 2025: +82.9%

How does the company make money?

TransMedics makes technology for organ transplants, including hearts, lungs, and livers. The company works with hospitals worldwide to make transplants safer and more effective.Instead of storing organs on ice, TransMedics devices keep them warm and working outside the body.

This helps doctors better evaluate organs before surgery, which leads to more successful transplants and saves more lives.

In 2025, investors realized TransMedics is a fast-growing leader in organ transplant technology.

Revenue increased sharply. The company remained profitable despite higher costs from expansion.

That’s exactly what a high-quality compounder does.

6. Alphabet ($GOOGL)

Performance 2025: +65.2%

How does the company make money?

Alphabet, Google’s parent company, leads the online search and digital advertising markets. Every Google search or YouTube video you watch generates ad revenue. They also make money from subscriptions like Google Workspace, devices such as phones & smart home gadgets, and cloud services.The sentiment around Google completely changed last year.

Google’s search faces its biggest threat: people are turning to AI chatbots like ChatGPT, which give answers instead of just links.

Since most of Google’s revenue comes from search ads, fewer searches mean less ad money.

But today, many believe Google is leading the AI race.

OpenAI CEO Sam Altman has declared a “code red” as the company scrambles to catch up with Google’s Gemini 3 models.

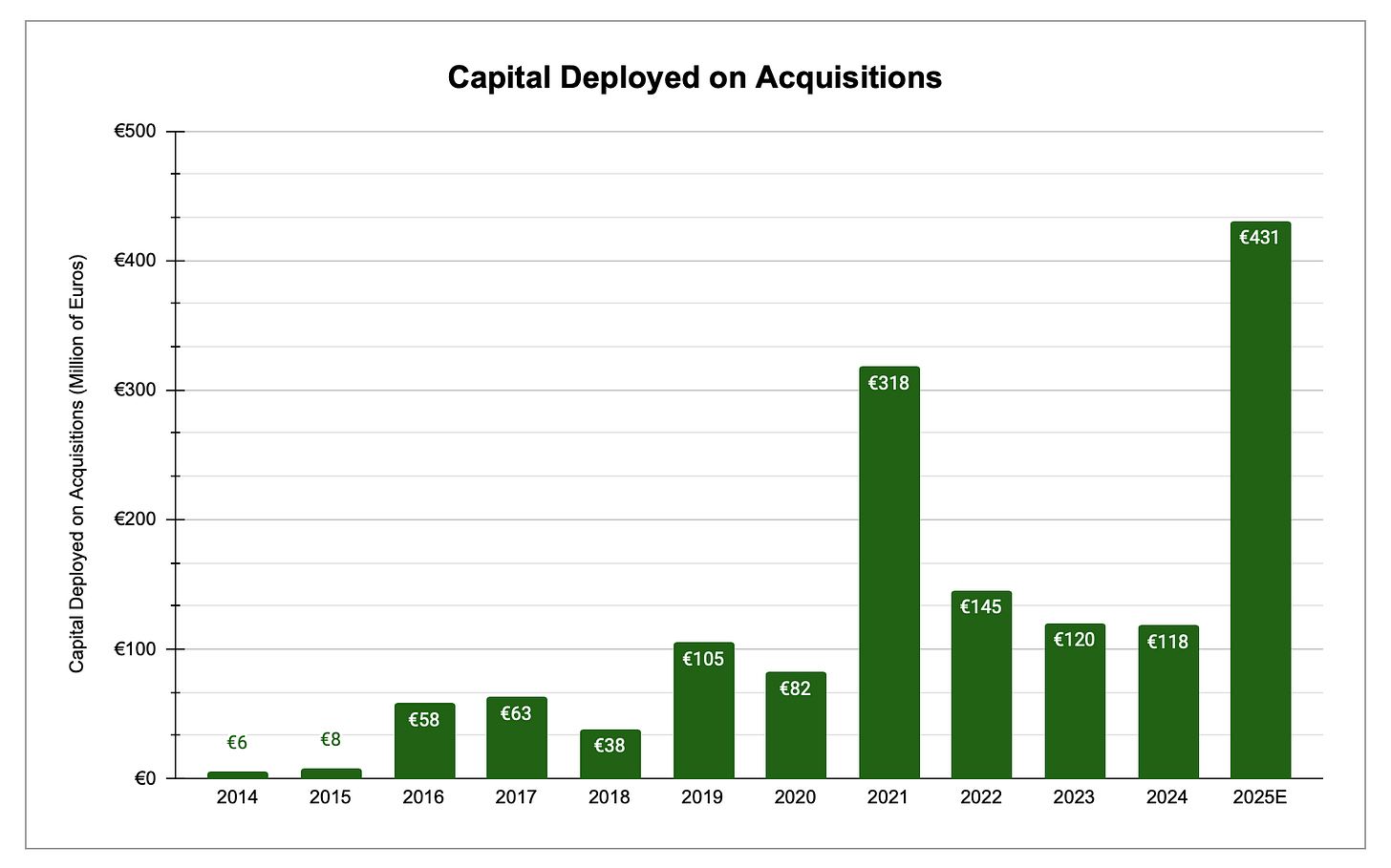

5. Topicus ($TOI)

Performance 2025: +1.2%

How does the company make money?

Topicus buys software companies that serve specific industries. This lets them dominate niche markets, since their products are hard to replace. Topicus had an amazing 2025.

The company spent more capital on acquisitions in 2025 than the last three years combined:

However, the stock didn’t do well in 2025. Investors worry that VMS businesses are an easy target for AI disruption.

The topic sparked so much interest that Constellation Software, Topicus’ parent company, held a conference call specifically to discuss the (potential) impact of AI. You can listen to it here.

I personally don’t believe AI will disrupt VMS companies like Constellation Software and Topicus.

4. ASML ($ASML)

Performance 2025: +33.5%

How does the company make money?

ASML makes advanced machines that create computer chips used in phones, laptops, and video games. These machines use light to draw tiny patterns on silicon, which makes the chips.ASML dominates the market for EUV lithography machines.

In fact, it’s a monopoly.

As a monopoly, you can regularly raise your prices because no one makes the same products as you.

That’s what makes ASML so interesting.

Also, the company benefits from a secular trend in Artificial Intelligence (AI).

The market clearly noticed this in 2025:

Now let’s dive into the top 3.

Spoiler alert: Two of these three stocks are key convictions of Our Portfolio.

In other words, I would buy them right now.