Something similar to the launch of Apollo 11?

Palantir's stock price.

Is it still an interesting stock after the big rally? Let’s find out.

Palantir - General Information

👔 Company name: Palantir Technologies

✍️ ISIN: US69608A1088

🔎 Ticker: PLTR

📚 Type: Owner-Operator

📈 Stock Price: $158.1

💵 Market cap: $384.9 billion

📊 Average daily volume: $6.4 billion

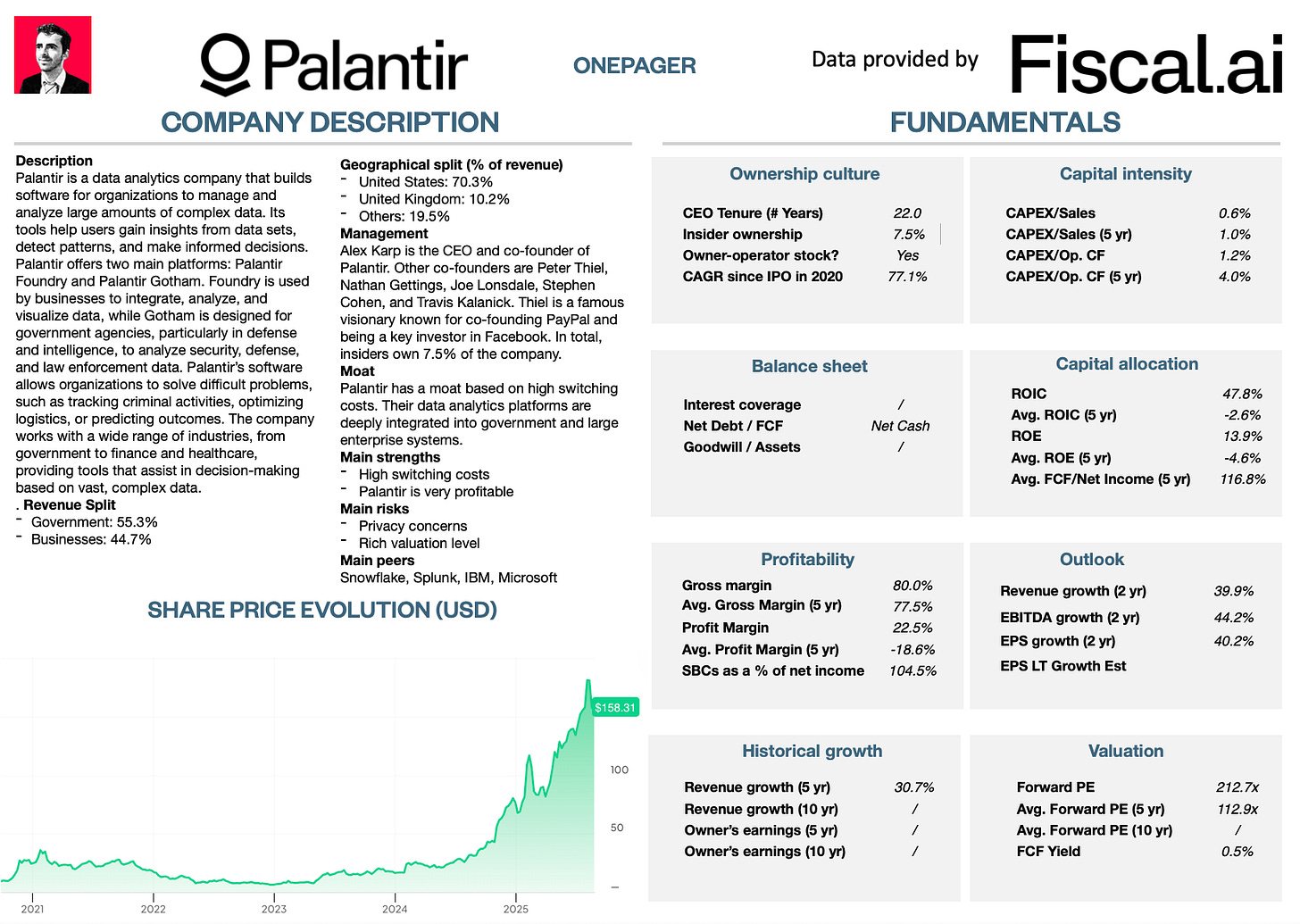

Onepager

Here’s a onepager with the essentials of Palantir:

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Palantir a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

We use technology every day. So you're probably familiar with the big tech companies.

But Palantir may not ring a bell. It mainly works behind the scenes.

What does the company do? Analyzing data.

It’s one of the world’s most powerful data analytics companies.

The company was founded in 2003 to help governments spot patterns in data to prevent threats.

Today, it runs on three key platforms:

Palantir Gotham: Built for governments to track crime, terrorism, and fraud

Palantir Foundry: Helps businesses make smarter decisions with data

Palantir Apollo: Keeps Palantir’s software running (Gotham & Foundry) smoothly

The company makes money from contracts:

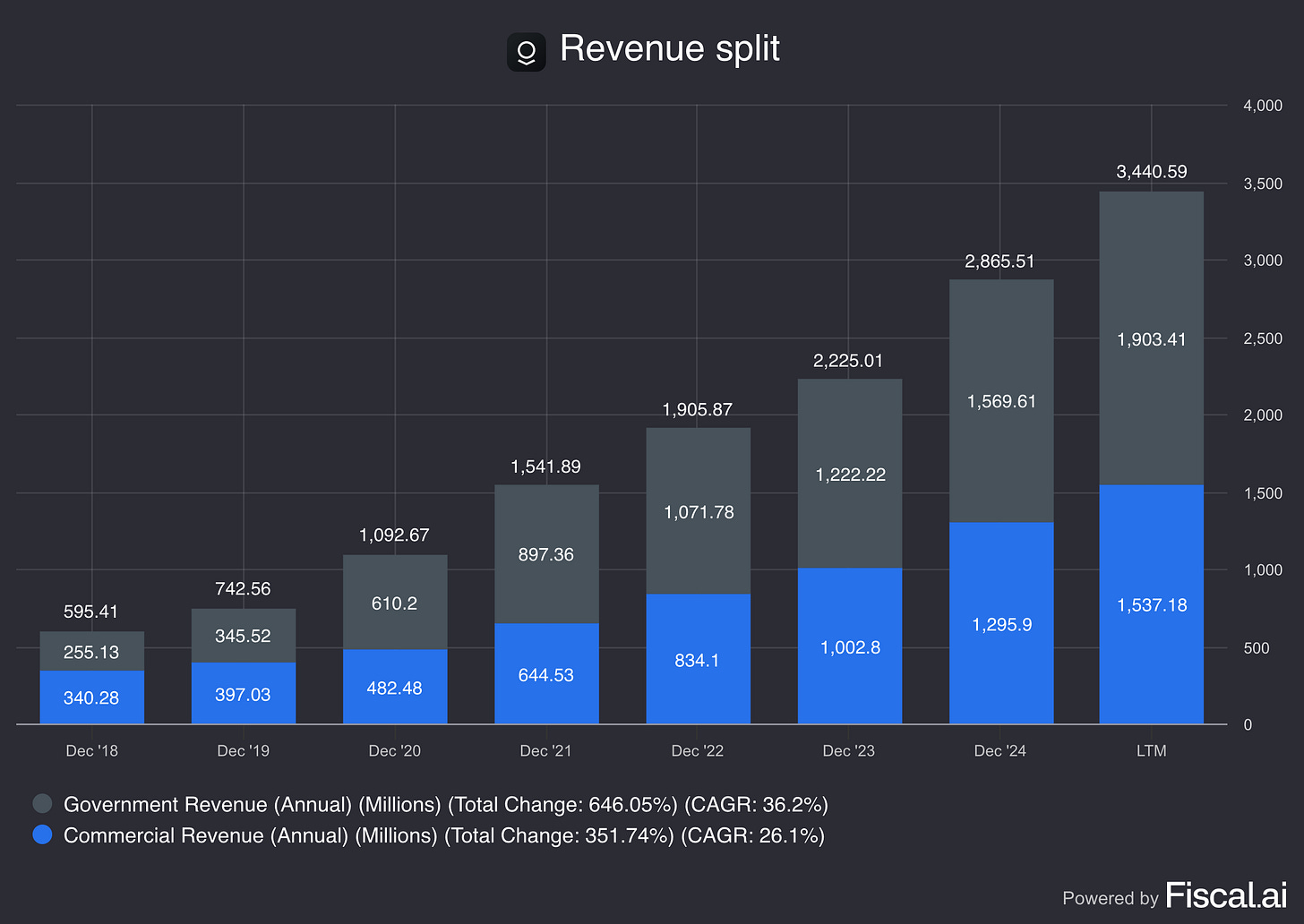

Government Contracts (55.3%): Their tools are trusted by the U.S. military, law enforcement, and allies worldwide

Commercial Contracts (44.7%): Companies in healthcare and energy use Palantir’s software to solve tough problems

2. Is management capable?

Five people co-founded Palantir:

Alex Karp: Co-Founder and CEO

Karp has a philosophical approach and focuses on the long-term strategy

He owns 2.4% of the company

Peter Thiel: Co-Founder and Chairman

You might know him as the billionaire investor behind PayPal and an early investor in Facebook

Thiel owns 4.4% of total shares outstanding

Stephen Cohen: Co-Founder, President, and Secretary

Helped build Palantir’s main platforms and kept its technology advanced

Cohen owns 0.6% of Palantir

Nathan Gettings and Joe Lonsdale: Co-founders who are not involved in the company anymore

This quote tells you a lot about the philosophy of Palantir:

“We told the Wall Streeters that we will focus on building the long-term health of our company. Not everyone on Wall Street has a short-term focus. Nevertheless, it remains one of the most destructive, corrosive attributes of an otherwise interesting and largely functioning system.” - Alex KarpThe Co-Founders named the company after the palantíri in The Lord of the Rings. These are magical stones used for communication and seeing distant events.

In total, insiders own 7.5% of the company.

3. Does the company have a sustainable competitive advantage?

Palantir has a moat based on high switching costs.

Imagine you’ve used your iPhone for years, saved all your photos, and downloaded tons of apps.

Switching from Apple to Android would be a huge hassle, right?

Palantir is like that for governments and businesses. Once they start using Palantir’s software, they build systems and processes around it.

Moving to a different company’s software would take time, effort, and money.

Furthermore, Palantir also benefits from network effects, a strong brand name, and pricing power.

Companies with a sustainable competitive advantage are often characterized by the following:

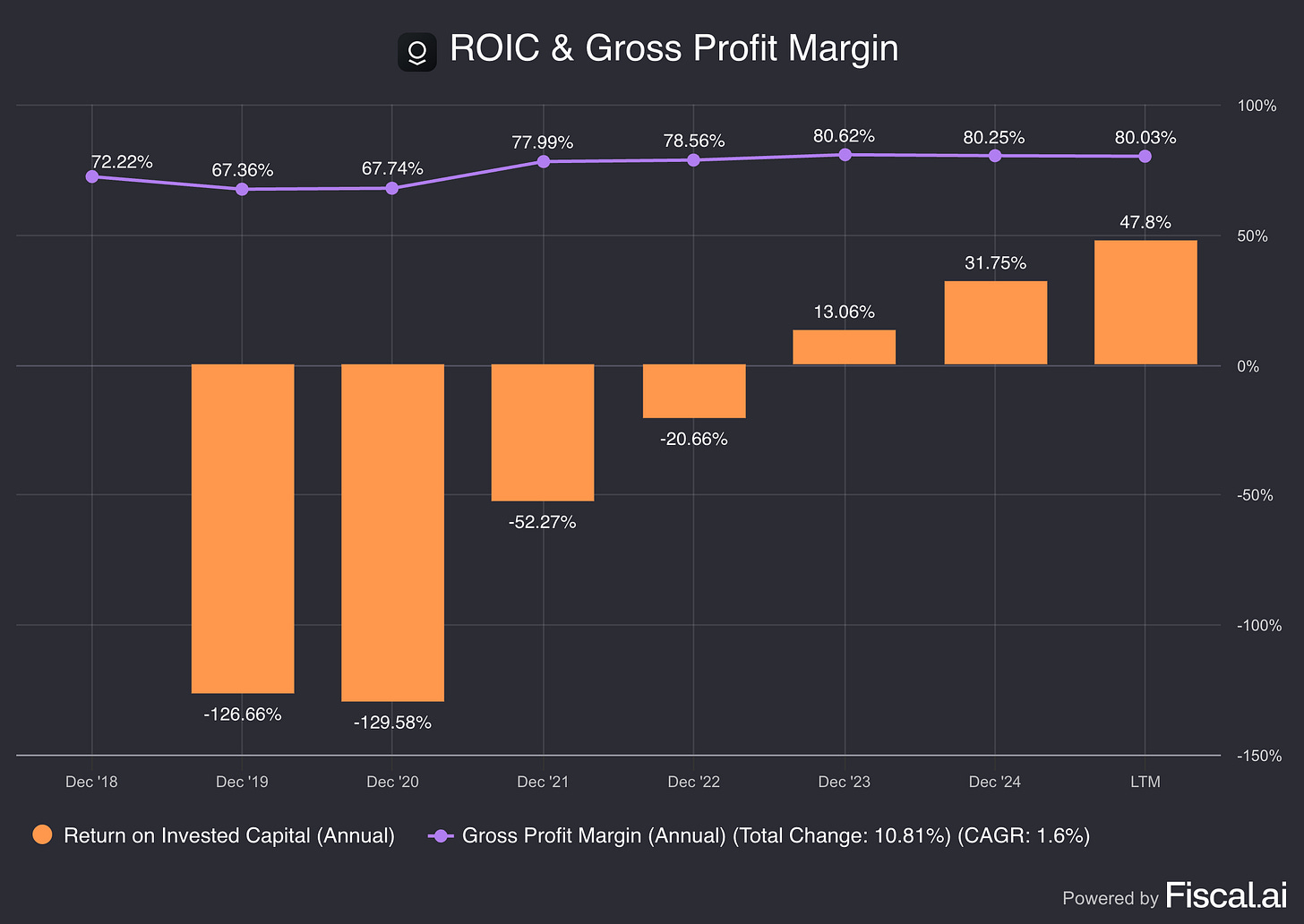

Gross Margin: 80.0% (Gross Margin > 40%? ✅)

Return On Invested Capital (ROIC:) 47.8% (ROIC > 15%? ✅)

Palantir had a negative ROIC until 2022, as it was still unprofitable until then.

4. Is the company active in an interesting end market?

Palantir is active in an interesting end market.

Palantir is active in Big Data.

This market is expected to grow at a CAGR of 14.9% until 2030, according to Grand View Research.

The Analytics as a Service (AaaS) market is expected to grow even faster: 25.6% (!) per year until 2030.

Palantir’s Foundry platform can benefit from this secular trend.

Here are the main competitors for Palantir:

Snowflake: Provides cloud-based data warehousing and analytics

Splunk: Specializes in real-time data monitoring and analysis

IBM: Provides AI-powered analytics for big data across industries

Microsoft (Azure): Integrates big data and data warehousing for analytics

5. What are the main risks for the company?

Here are the main risks for Palantir:

Dependence on government contracts

Privacy concerns: Their sensitive data raises privacy and ethical questions

Dependence on Co-Founders

High costs: The big price tag on Palantir’s software limits its customer base to large organizations

Complexity: Their software requires significant training and adaptation

Public perception: Surveillance and data misuse could harm Palantir’s reputation

Rich valuation levels (see later)

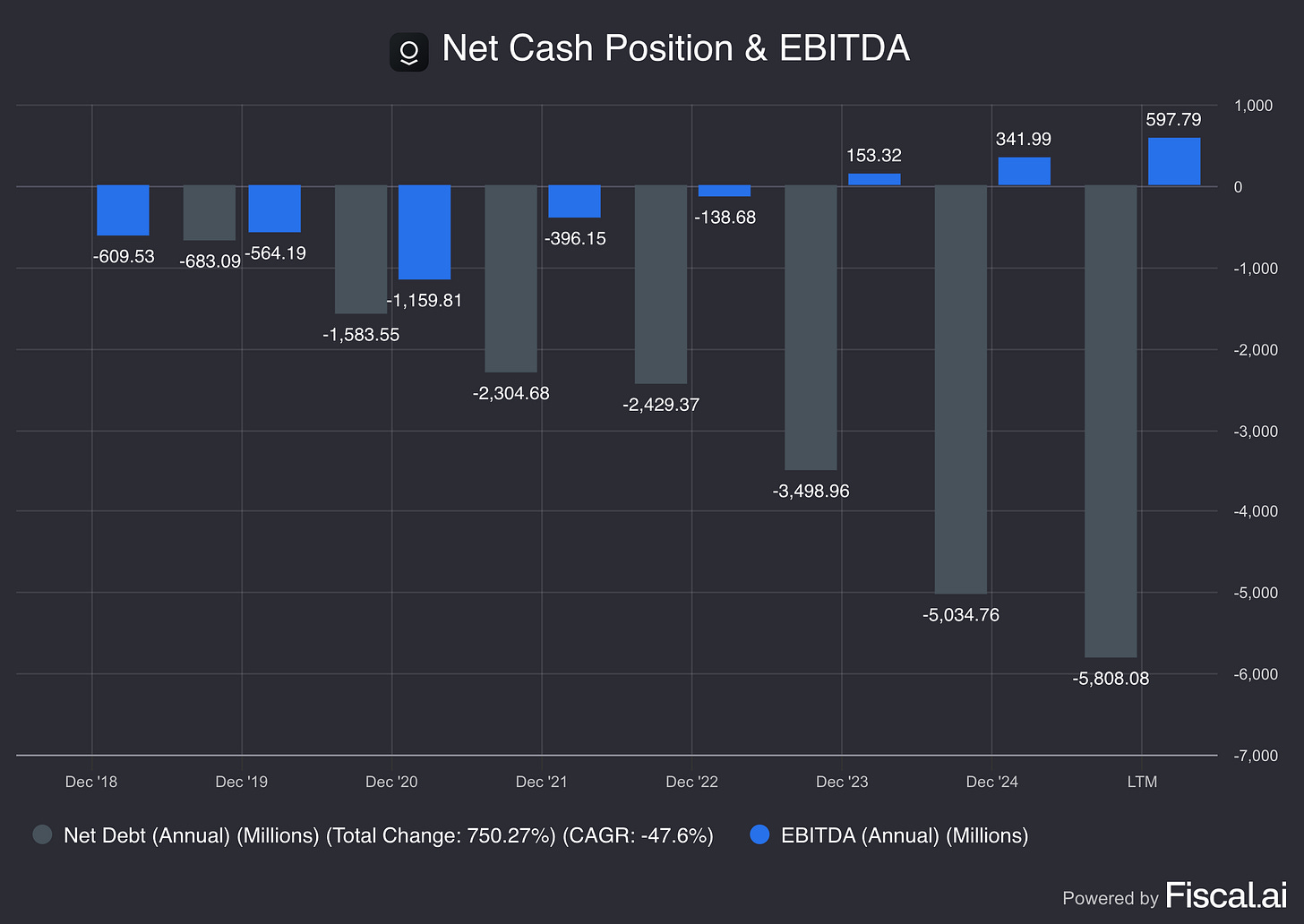

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

Interest coverage: / (Interest Coverage > 15x? ✅)

Net Debt/FCF: Net Cash Position equal to 1.5% of Market Cap (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 0.0% (Goodwill to assets < 20%? ✅)

Palantir has a very healthy balance sheet.

7. Does the company need a lot of capital to operate?

The less capital a business needs to operate, the better.

Here’s what things look like for Palantir:

CAPEX/Sales: 0.6% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating Cash Flow: 1.2% (CAPEX/Operating CF? < 25%? ✅)

Software companies like Palantir are typically very capital-light businesses.

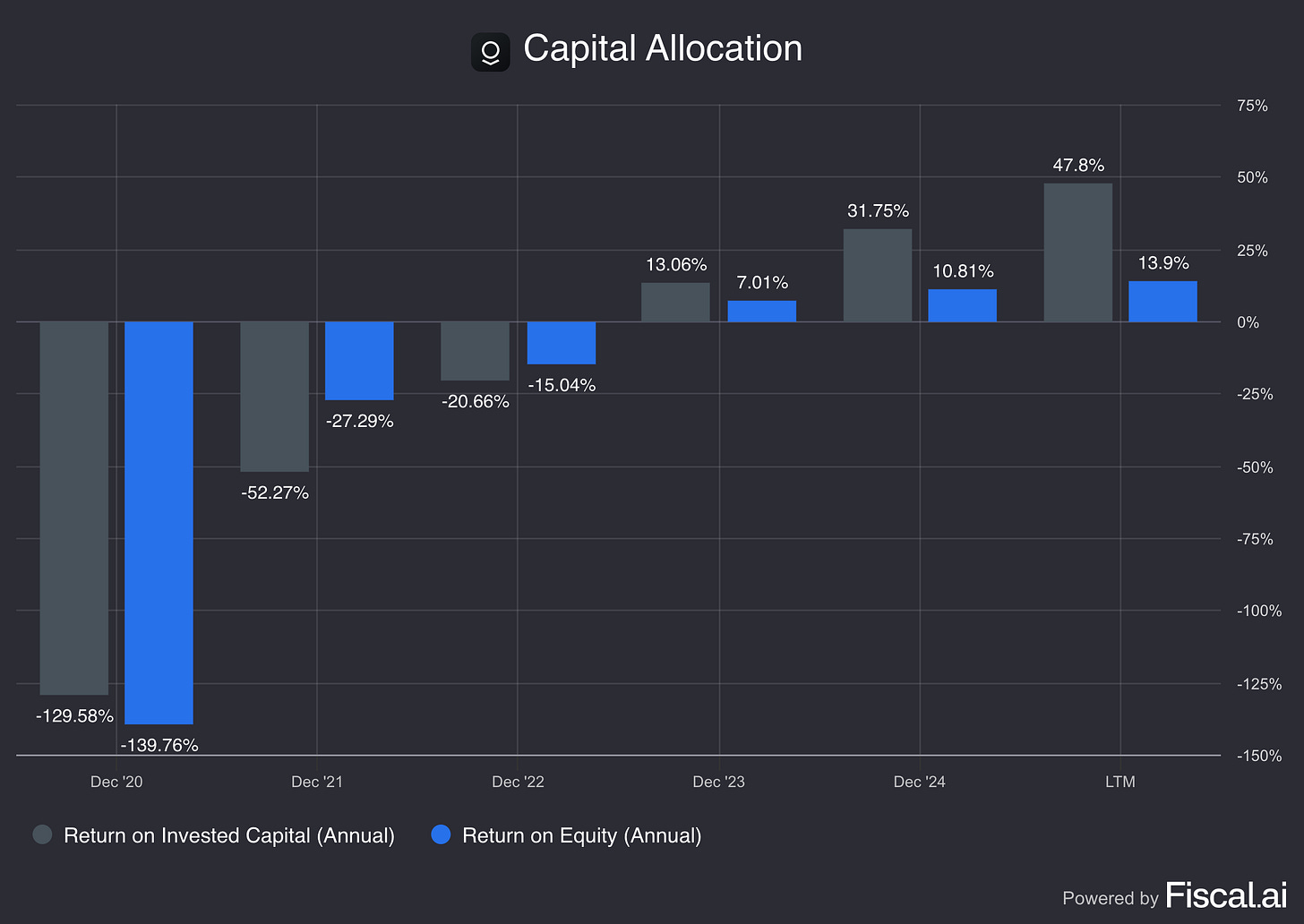

8. Capital allocation

Capital allocation is the most important task of management.

Here’s what things look like for Palantir:

Return on Equity (ROE): 13.9% (ROE > 20%? ❌)

Return on Capital (ROIC): 47.8% (ROIC > 15%? ✅)

The capital allocation metrics aren’t optimized yet. I expect ROIC and ROE to rise even more in the future.

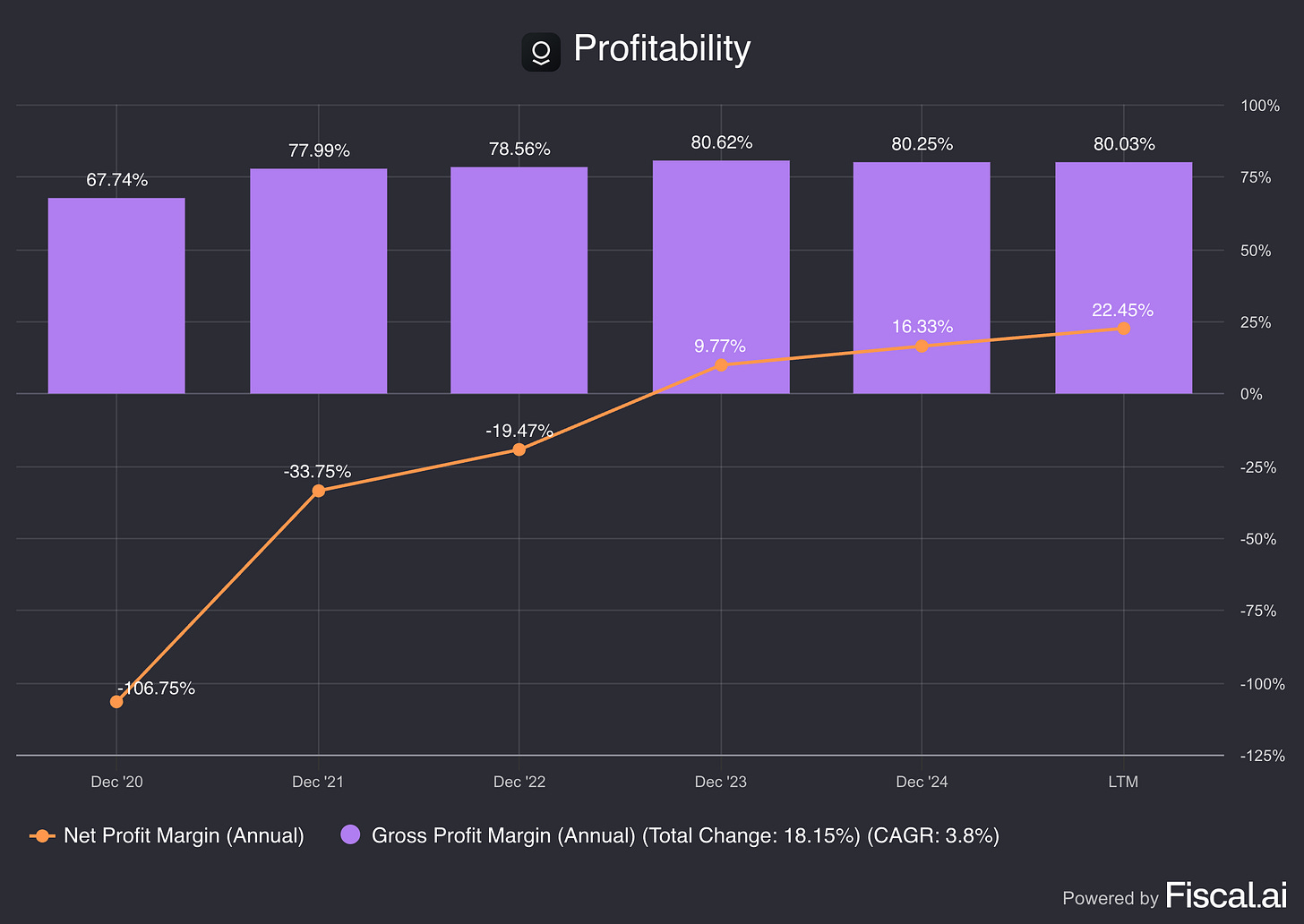

9. How profitable is the company?

The higher the profitability of the business, the better.

Here’s what things look like for the company:

Gross margin: 80.0% (Gross margin > 40%? ✅)

Net Profit Margin: 22.5% (Net Profit Margin > 10%? ✅)

Average FCF/Net income past 5 years: 104.5% (FCF/Net income > 80%? ✅)

Palantir’s Profit Margins are increasing year after year:

10. Does the company use a lot of Stock-Based compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably, we want SBCs as a % of Net Income to be lower than 10%.

Palantir:

SBC of a % of Net Income: 104.5% (SBC/Net income < 10%? ❌)

Stock-based compensation as a percentage of Net Income exceeds 100%.

For Quality Investors, this is a red flag. We will treat this as a cost in our reverse DCF.

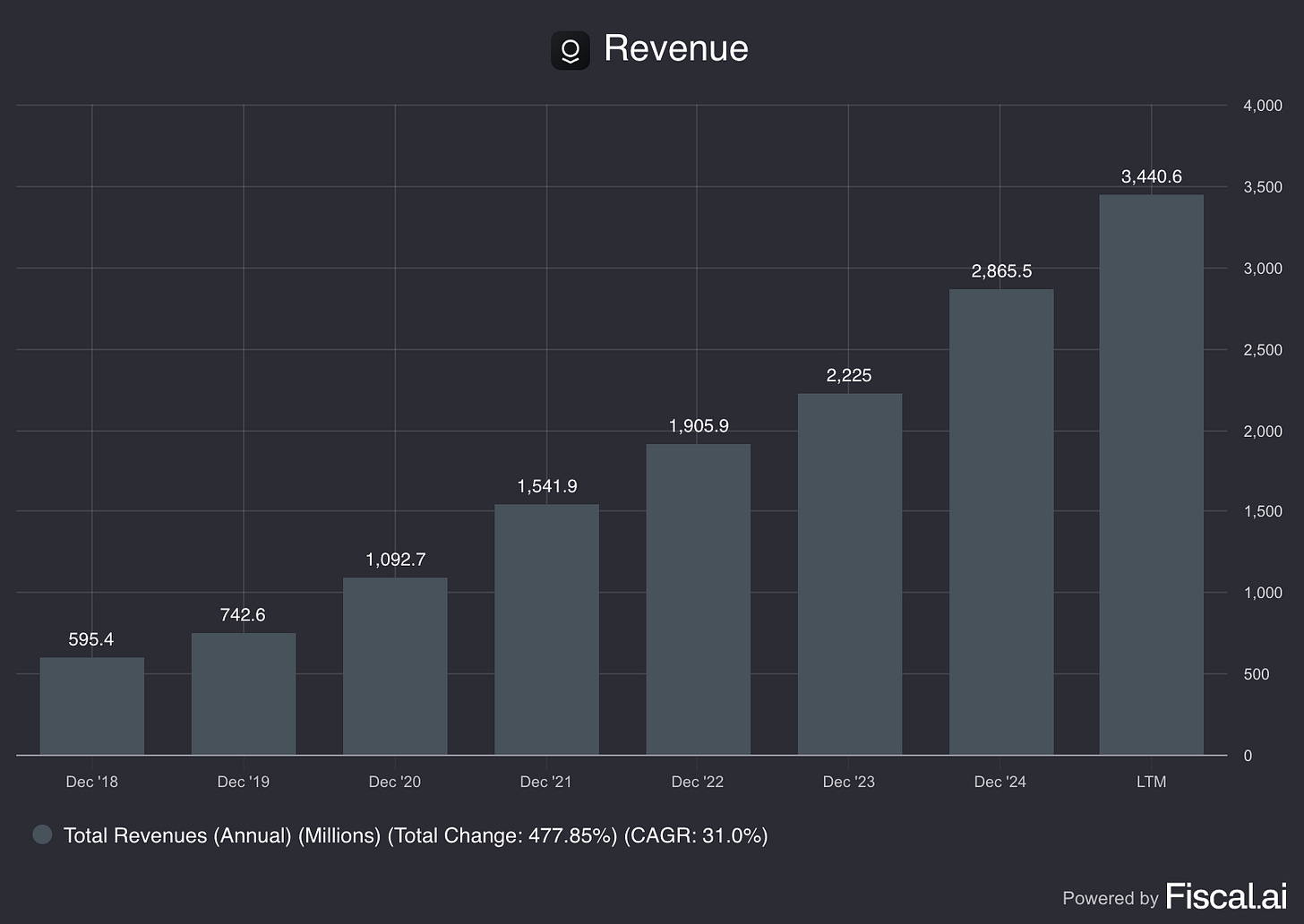

11. Did the company grow at attractive rates in the past?

Let’s look at what recent history tells us:

Revenue growth past 5 years (CAGR): 30.7% (revenue growth > 5%? ✅)

EPS growth past 5 years (CAGR): / (EPS growth > 7%? ❓)

Palantir has grown at very attractive rates in the past.

Please note that Palantir has only been profitable since 2023.

12. Does the future look bright?

Let’s look at what the estimates are:

Exp. Revenue growth next 2 years (CAGR): 39.9% (revenue growth > 5%? ✅)

Exp. EPS growth next 2 years (CAGR): 44.2% (EPS growth > 7%? ✅)

Long-term growth estimate EPS (CAGR): 40.2% (EPS growth > 7%? ✅)

This outlook looks very attractive. It’s important to know that analysts are usually too optimistic.

Now let’s look at the valuation.