🥂 Portfolio Update 2026

A look at every position in Our Portfolio

Hi Partner 👋

I hope you celebrated the start of the year well with you and your loved ones.

May all your wishes come true.

Let’s give you an update about every position in Our Portfolio today.

Investing Masterclass: Quality investing in 2026

Join us for an insightful discussion on the most important trends shaping Quality Investing today.

📅 January 29, 2026 | 2 PM ET / 8 PM CET

🌐 Online Event

Portfolio Overview

Here are the essentials of Our Portfolio in a nutshell:

18 Top-Quality Companies:

We own eighteen of the world’s best businesses

Double-Digit Growth Expected:

Our companies should grow their intrinsic value by 13.6% in 2026.

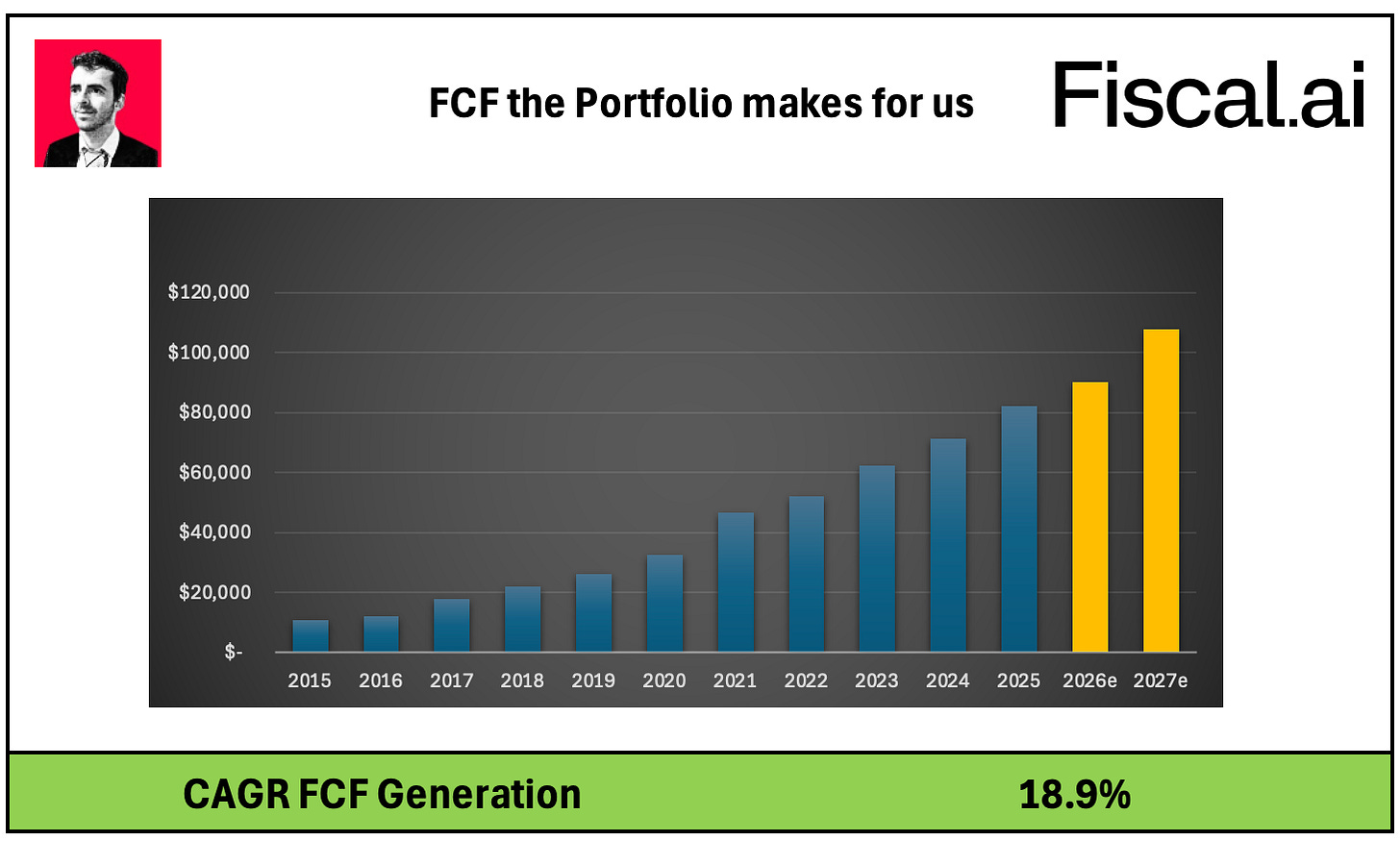

Cash Flow Keeps Growing:

Back in 2016, Our Portfolio made $11,985 in Free Cash Flow. Today? $82,100.

Rare Buying Opportunity:

Our Portfolio is trading at the cheapest valuation level of the past 10 years

How the Portfolio is Positioned

Our strategy is built on three buckets:

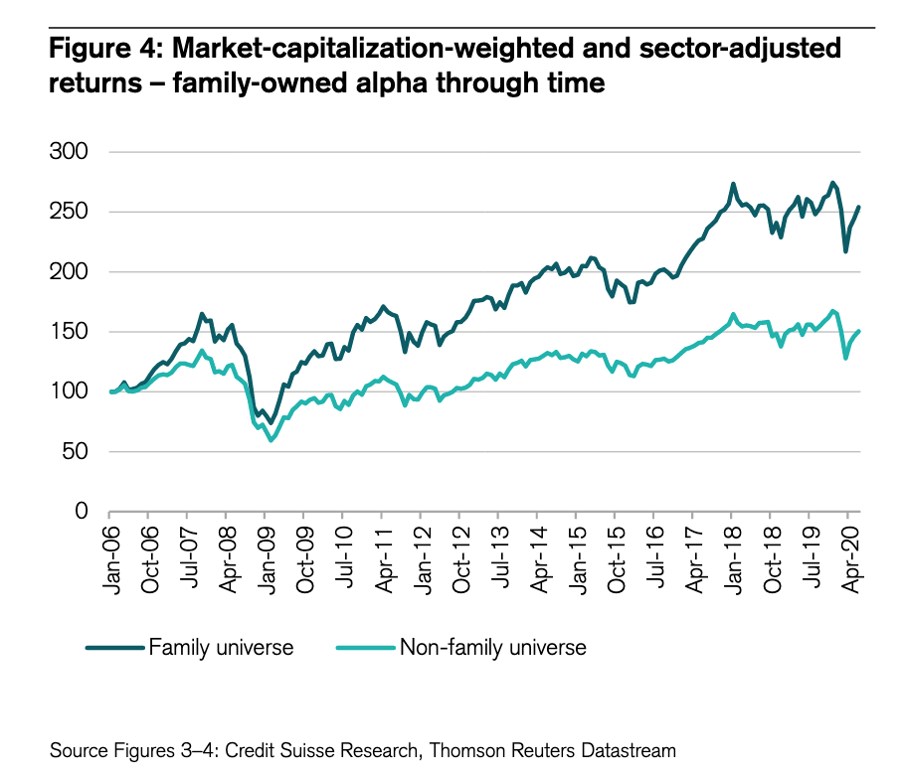

Owner-Operator Stocks (73.1% of Our Portfolio)

Monopolies & Oligopolies (20.7% of Our Portfolio)

Cannibal Stocks (6.2% of Our Portfolio)

Over the past year, we’ve increased our exposure to Owner-Operators from 66.3% to 73.3%.

Owner-Operators tend to outperform the market in general:

It is hard not to be incredibly optimistic about the year ahead.

Now let’s dive into a review of the companies we own.

How did they perform recently and is the investment case still intact?