Portfolio Update: August 2025

Hi Partner 👋

The summer is almost over.

An excellent moment to provide you with a Portfolio Update.

How are positions performing? And what’s happening in the market? Let’s dive in.

Performance

Our Portfolio is filled with high-quality stocks.

Only the best is good enough for us.

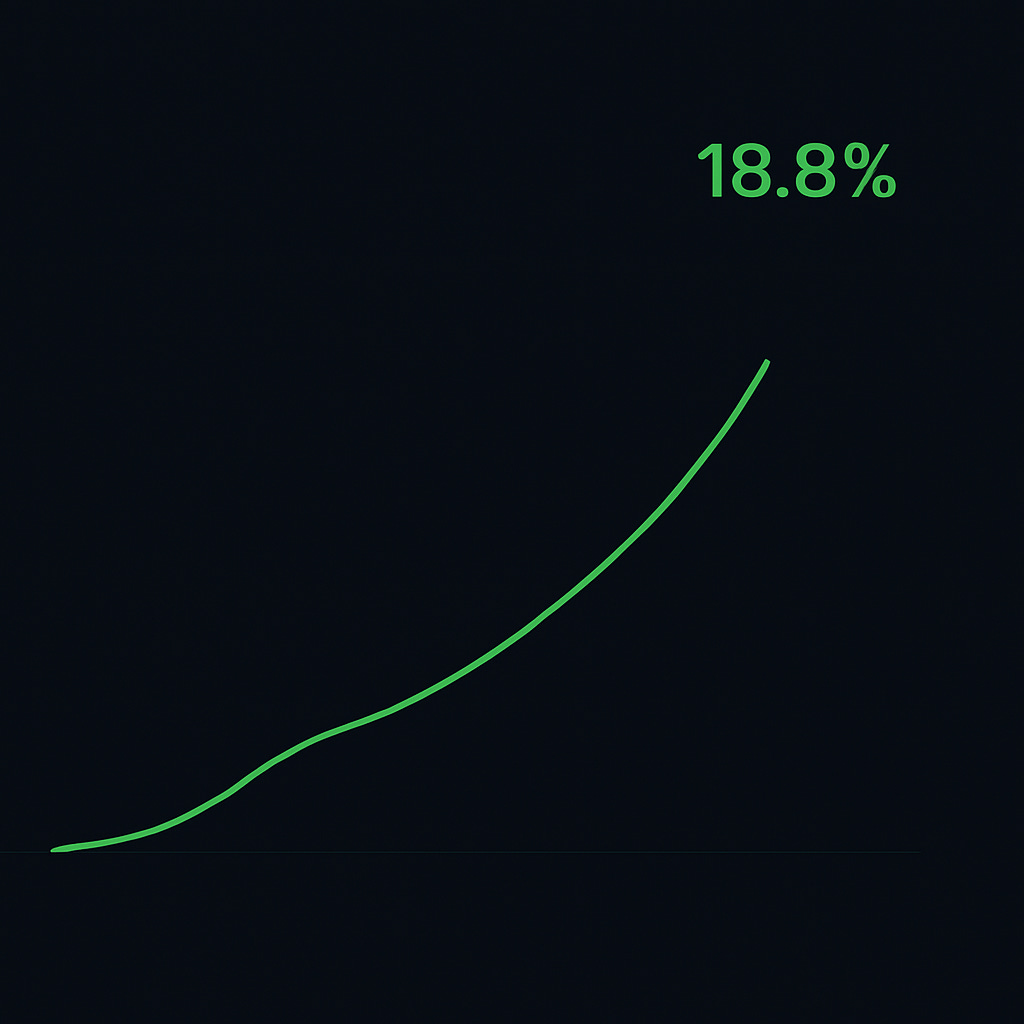

So far, this strategy has worked for us. The Portfolio managed to perform at a CAGR of 18.8%.

Is this sustainable in the long term? No.

A return of 12% per year on average would already be amazing.

The screenshot above is the official track record from Interactive Brokers.

I use Interactive Brokers for all my transactions. You can explore Interactive Brokers here.

Portfolio Fundamentals

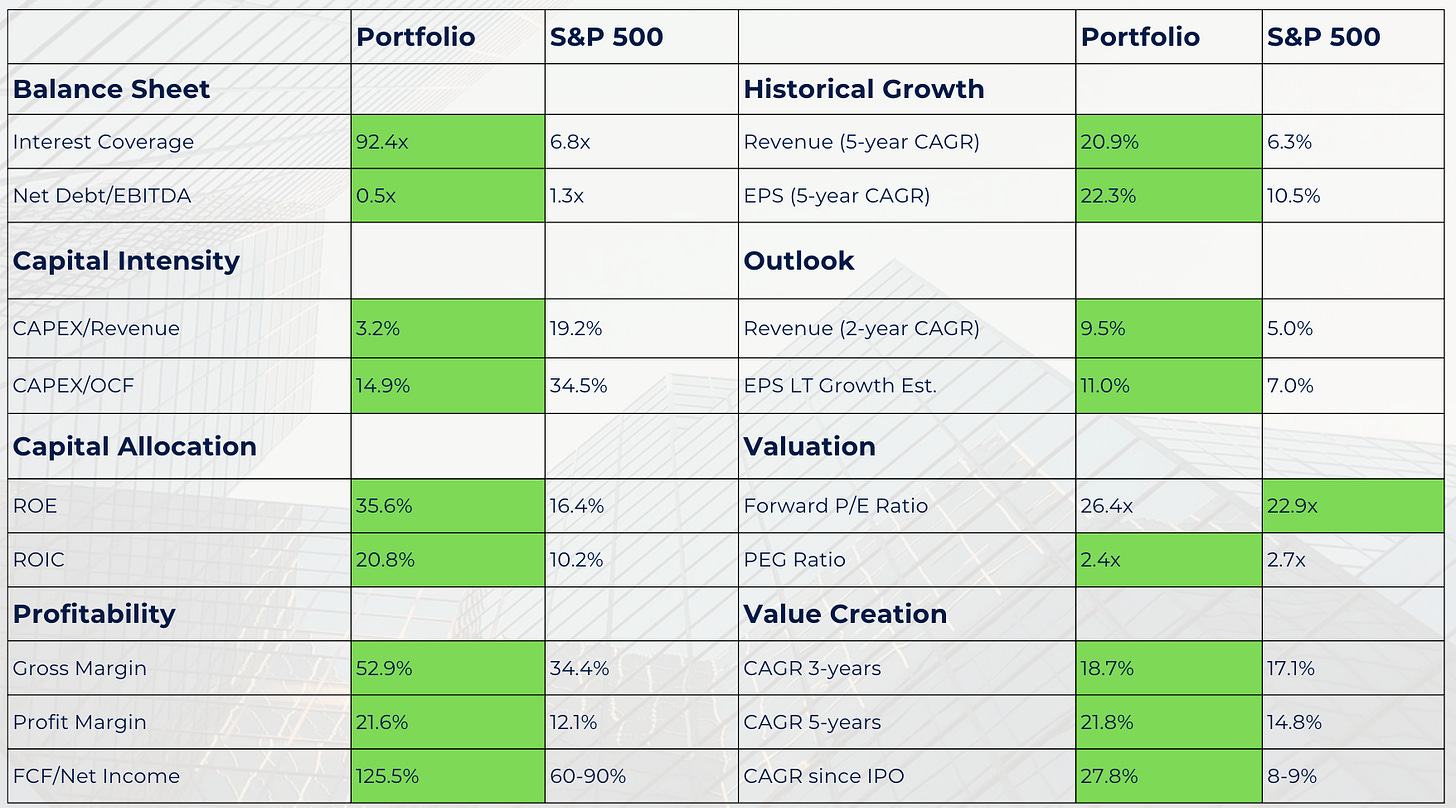

Our goal is to outperform the S&P 500 by more than 3% over the long term.

We dive deeper into the Portfolio Fundamentals in this article.

As you can see, we invest in significantly better companies compared to the S&P 500.

This makes me believe we’ll do really well in the long term.

How much money are we making?

Currently, we are invested in 16 companies for a total amount of roughly $1.4 million*.

An easy way to calculate how much money each company is making for us?

What each company makes for us per year = Number of shares we own * FCF per shareAs an example, we own 180 shares of Visa. Visa is expected to generate a Free Cash Flow Per Share of $11.7 over the next 12 months.

What each company makes for us per year = Number of shares we own * FCF per share

What Visa earns us = 180 * $11.7 = $2,109.0This means Visa generates $2,109 in pure cash for us every single year. And this while we don’t have to work for it!

When we do these calculations for the entire Portfolio, we get the following: