Portfolio Update: Buying more?

Crazy times in the market today.

While the S&P 500 is trading near it’s all-time high, many companies are trading at their cheapest valuation level ever.

Mr. Market is looking for direction.

This provides incredible opportunities to rational long-term investors like ourselves.

Mr. Market is Extra Moody

Never a dull moment on the stock market.

One day Mr. Market loves AI.

The next day he fears it will destroy every (software) business model on earth.

The sectors Mr. Market is moody about right now?

Software

Credit agencies

Data providers

We love these companies as they have high margins and a lot of recurring revenue.

But as the saying goes:

The SaaSpocalypse

Today, all AI stocks seem to do really well.

On the other hand, software companies are in pain.

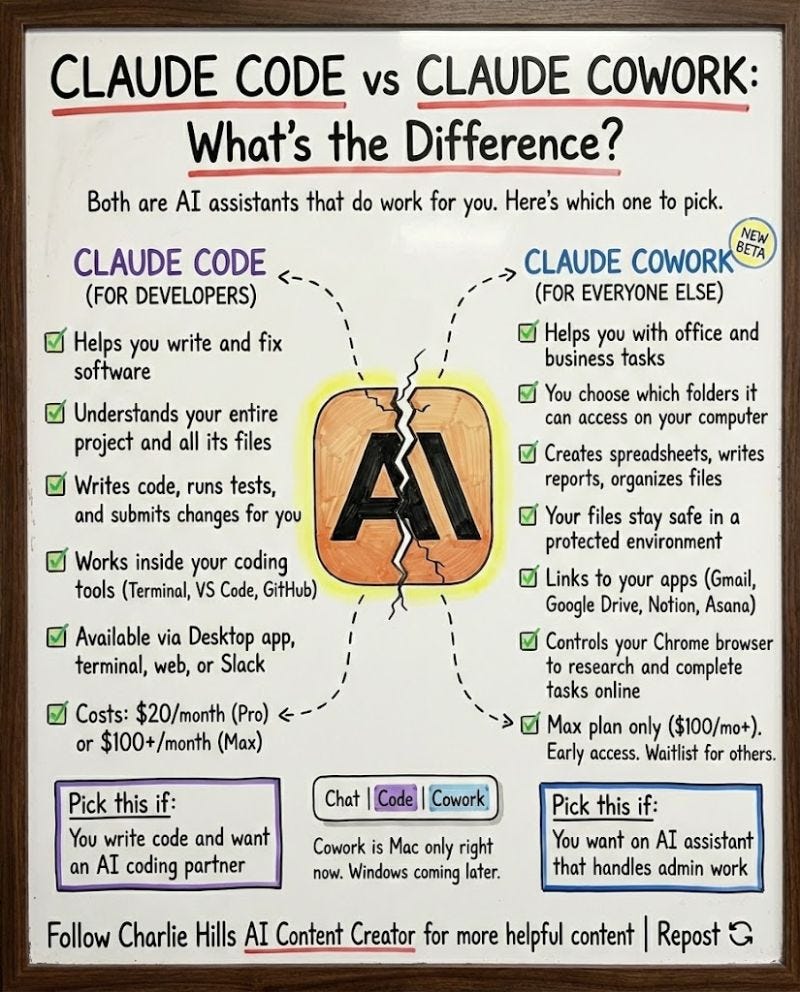

One of the main reasons? Anthropic recently released Claude Cowork.

It seems like the market thinks everything could be automated by a Claude plugin.

Claude Cowork is a tool designed to automate tasks.

They help automate you in legal, sales, and marketing.

Those segments were once the bread and butter of SaaS (Software as a Service).

The market reaction? Panic.

Investors worry that AI agents could replace many software licenses.

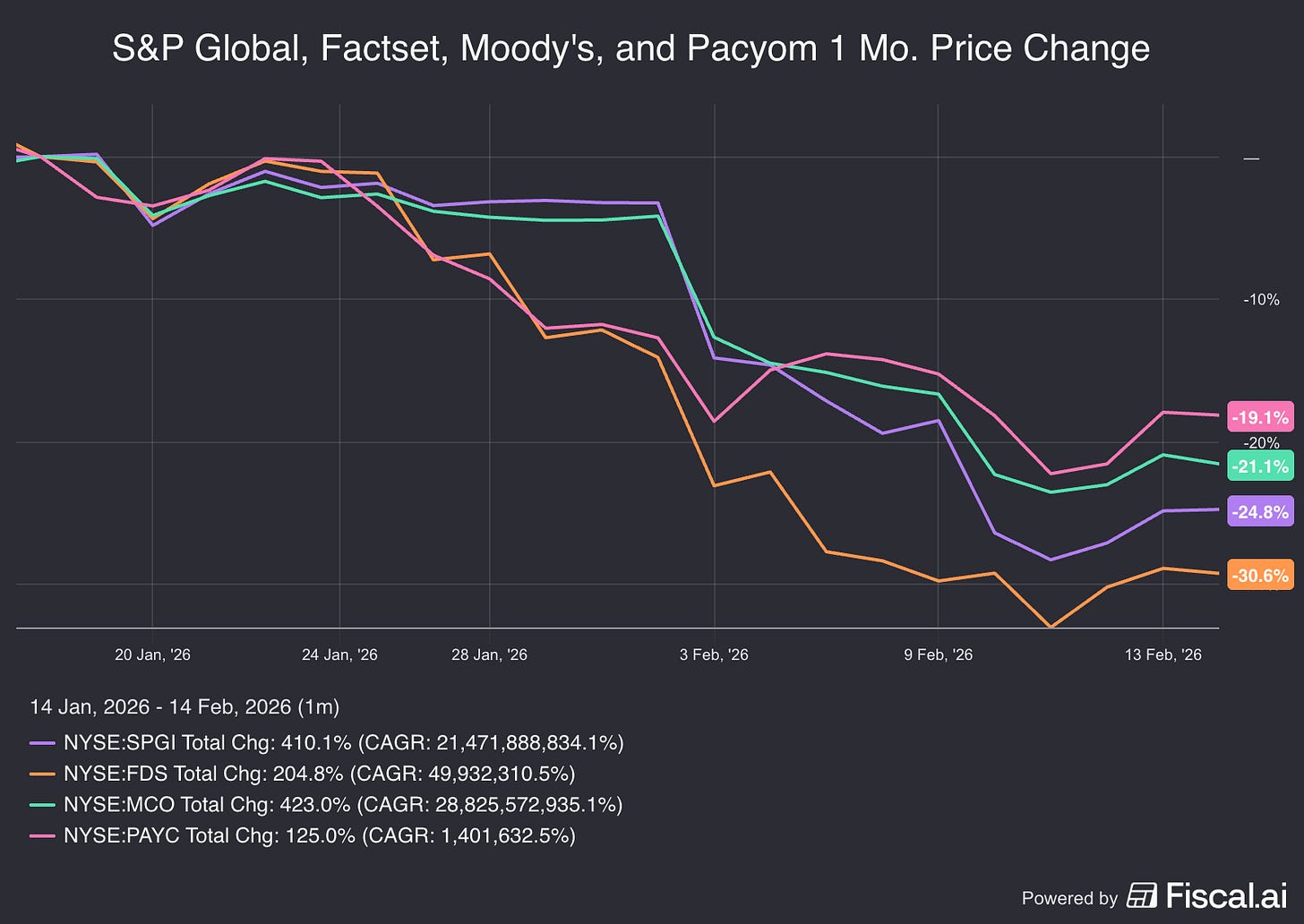

Just look at what happened to these names last month:

S&P Global: -25%

FactSet: -31%

Moody’s: -21%

Paycom Software: -19%

The companies above are great companies.

It has been a while we’ve seen them fall so much so quickly.

Should you be worried?

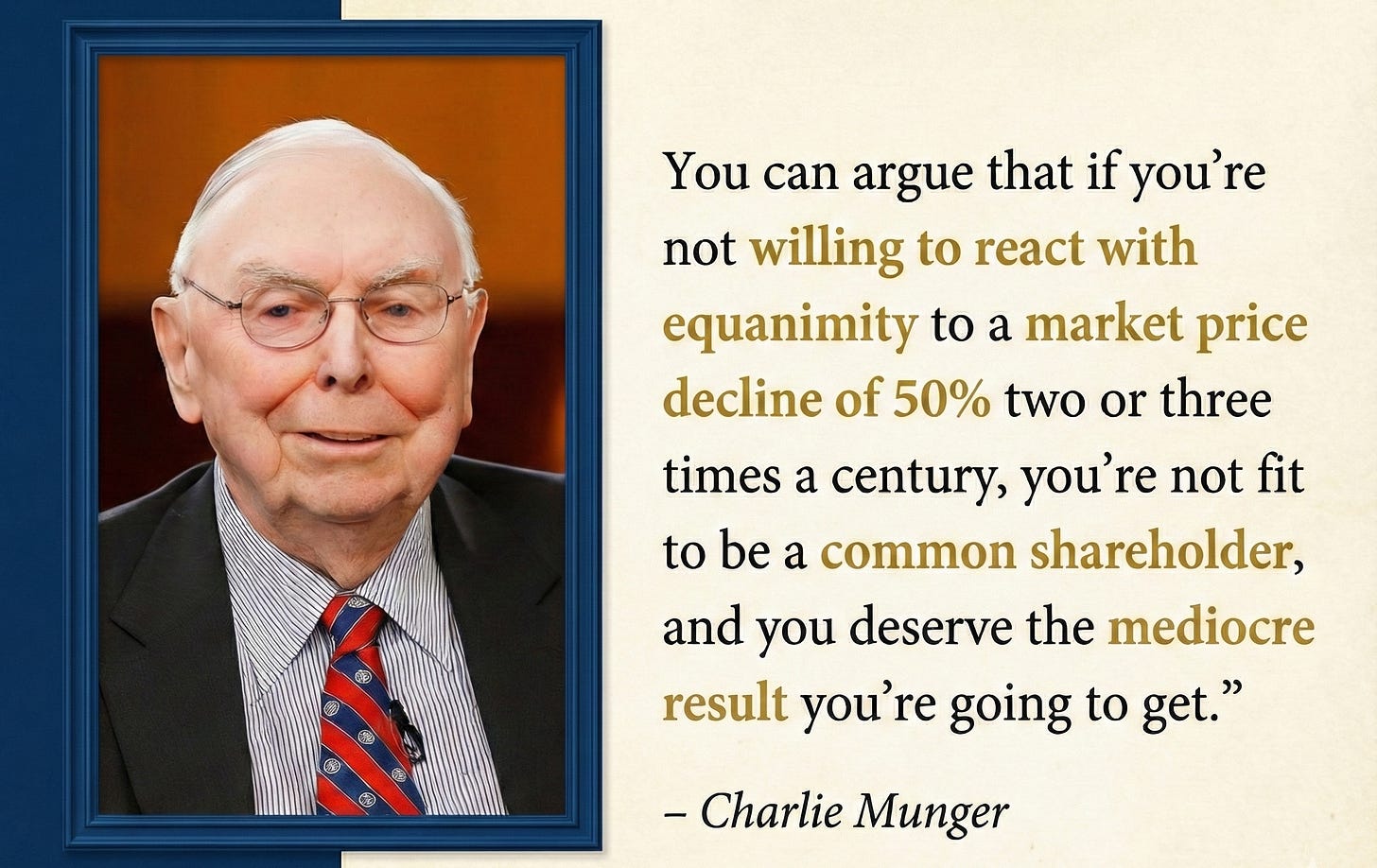

Many investors are asking: “Should I be worried about this volatility?”

The answer is simple.

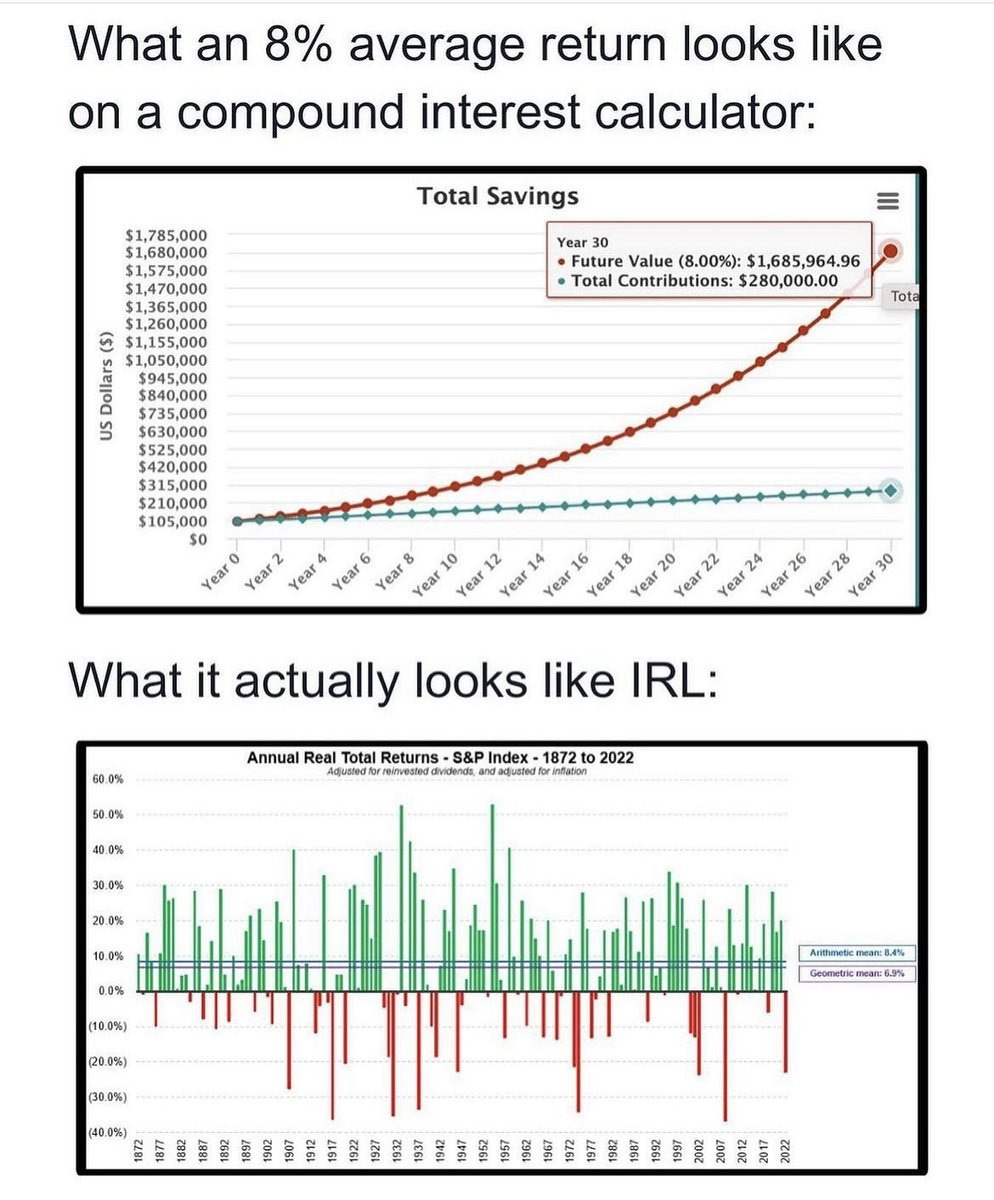

Volatility is the price you pay for outperforming the market in the long term.

Just listen to Charlie Munger:

If you don’t want to take any risk, you accept the low return of your bank account.

You want a return of 10% per year via stocks? In that case you have to accept volatility.

Here’s how I see the market today:

S&P 500: Very expensively valued and lower expected returns

Quality stocks: The most undervalued since 1999 (relatively seen)

This sets us up for outperformance.

Our game plan in this uncertain market?

Owning the best companies in the world.

Fundamentals

Just look at how the fundamentals of Our Portfolio compare to the S&P 500.

Compared to the S&P 500, Our Companies have:

Better balance sheets

Better management

Lower capital intensity

Higher margins

According to my own calculations, the expected return for Our Portfolio now equals 15.0% per year.

This would mean you double your money every 5 years.

Another thing we love to look at?

The evolution of the Owner’s Earnings of Our Portfolio.

Owner’s Earnings

Here’s the evolution of Our Owner’s Earnings in the past 10 years:

A yearly growth of almost 20% is very remarkable.

Now let’s look into the expectations for 2026.

The S&P 500 is expected to grow earnings between 10% and 15%.

Our Portfolio is expected to grow Owner’s Earnings by 13.6% this year.

Another crazy thing to see?

Every company except for 1 is undervalued in Our Portfolio today:

You know that in the long term stock prices follow the evolution of the Owner’s Earnings.

As a result, I truly think we have a great setup for amazing results.

If Our Companies:

Grow their Owner’s Earnings by 13.6%

Valuation goes up from 17.1x to 22.0x (P/E ratio)

… You can expect a return of 19.3% per year on avarage.

That’s ridiculous.

But remember that stock prices are volatile in the short term.

If you can’t stand the heat, stay out of the kitchen.

If you want great returns as an investor, you should accept volatility.

Our Portfolio

Today, we own 18 wonderful companies in which we truly believe.

Our Portfolio looks like this: