Portfolio Update: October 2025

Key happenings in Our Portfolio

Our Portfolio consists of wonderful companies.

More than half of them receive a ‘Buy’ recommendation.

Curious how things are going? Let’s dive in together.

Performance

Our Portfolio is filled with high-quality stocks.

Only the best of the best is good enough.

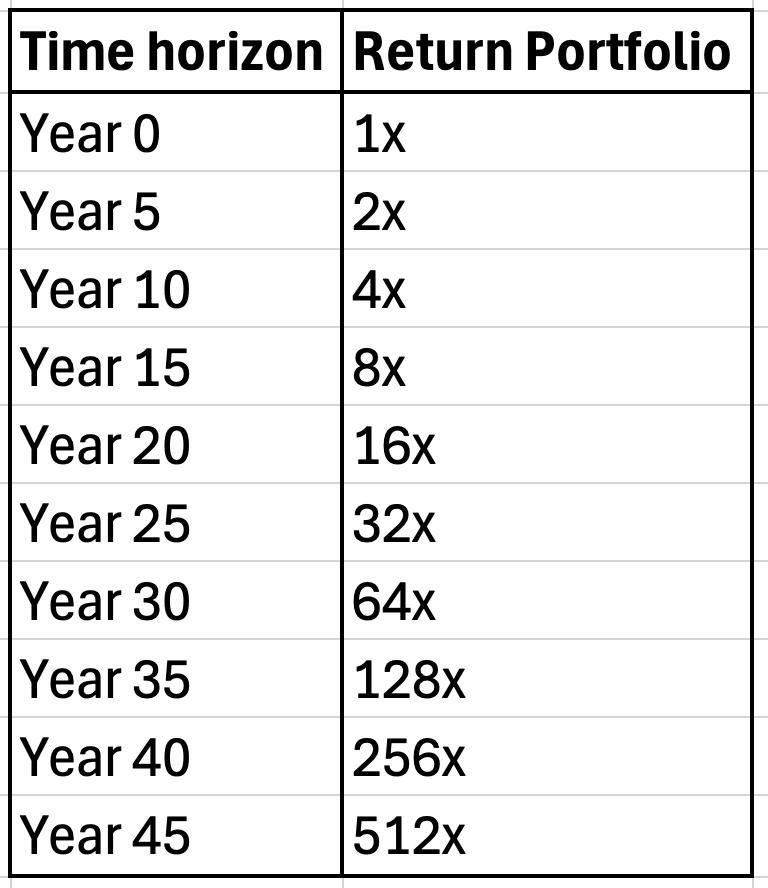

So far, it’s working. We’re compounding at 15.6% per year.

At this pace, we double every 5 years. That’s powerful thanks to the magic of compounding.

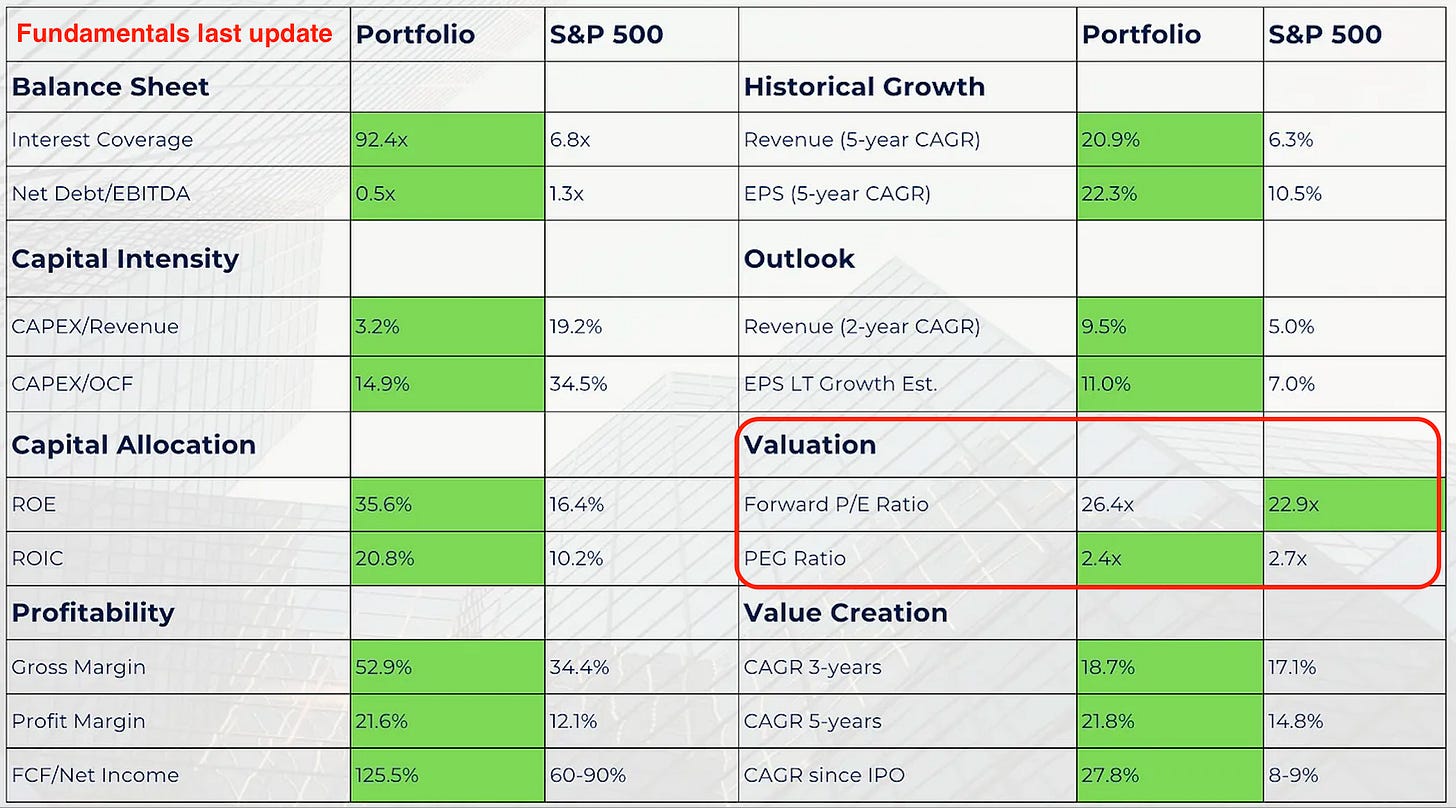

Portfolio Fundamentals

Our goal is to outperform the S&P 500 by more than 3% over the long term.

We dive deeper into the Portfolio Fundamentals in this article.

As you can see, we own significantly better companies compared to the S&P 500.

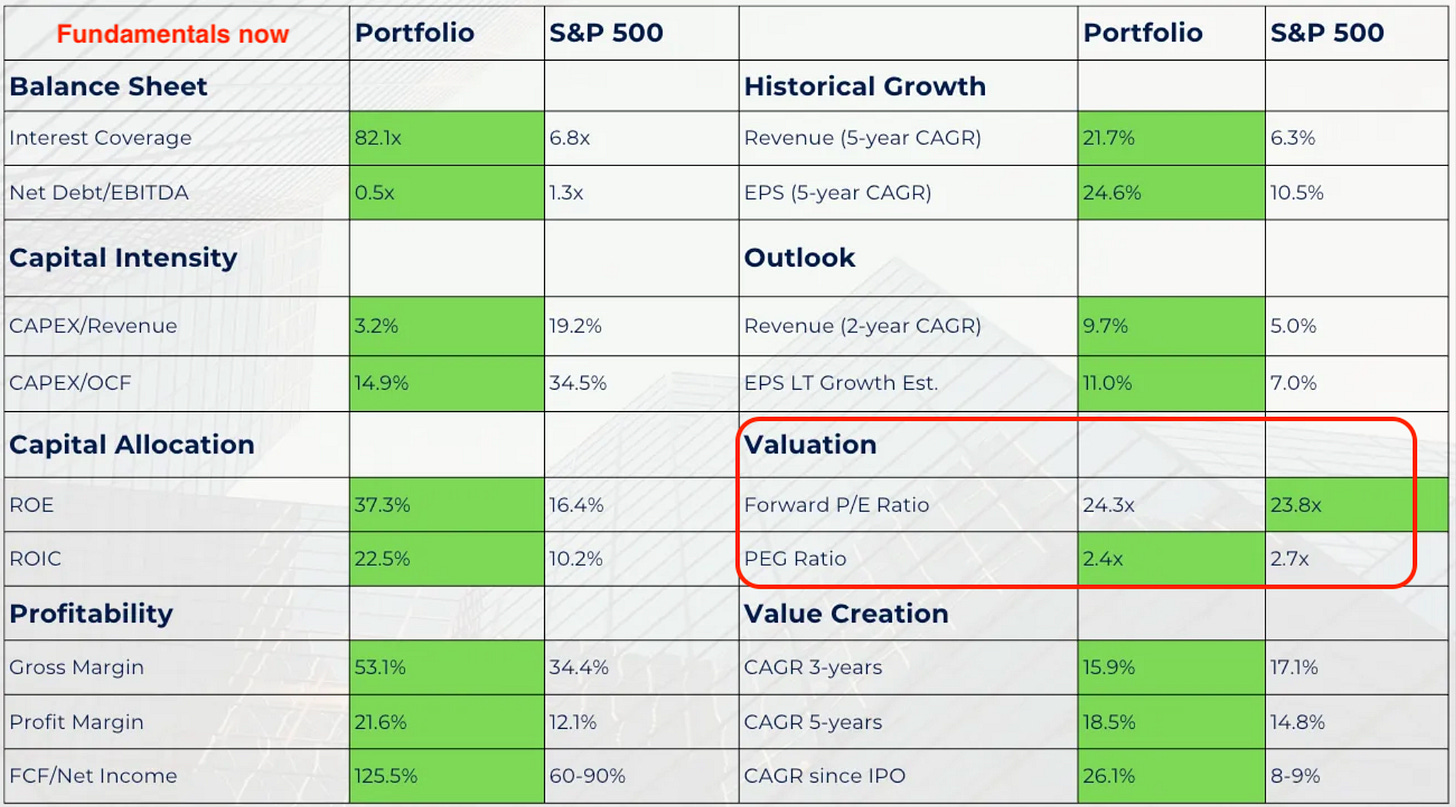

Our Portfolio has also gotten cheaper and the S&P got more expensive since the last Portfolio Update in August:

This means our Quality Stocks look even better than last time.

How much money are we making?

Currently, we are invested in 16 companies for a total amount of roughly $1.4 million.

An easy way to calculate how much money each company is making for us?

What each company makes for us per year = Number of shares we own * FCF per shareAs an example, we own 260 shares of Medpace. The company is expected to generate a Free Cash Flow Per Share of $18.6 over the next 12 months.

What each company makes for us per year = Number of shares we own * FCF per share

What Medpace earns us = 260 * $18.6 = $4,836.0This means Medpace generates $4,836.0 in pure cash for us every single year. And this while we don’t have to work for it!

When we do these calculations for the entire Portfolio, we get the following: