🏰 Quality or Dividends?

Everyone is a genius in a bull market.

It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

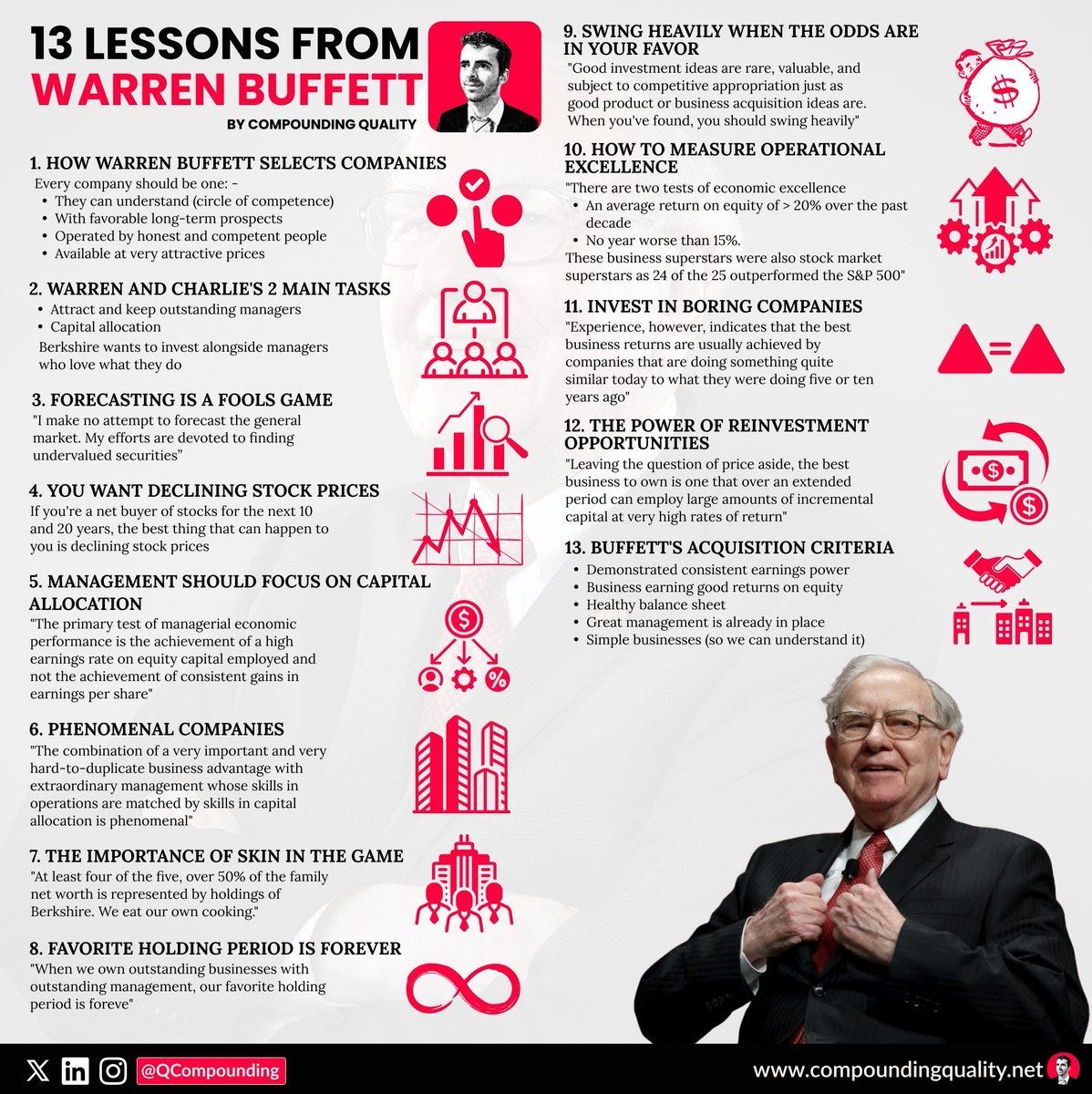

1️⃣ 13 Lessons from Warren Buffett

I've read everything Warren Buffett has ever said and written.

That's more than 5,000 pages full of investment wisdom.

Here are the 13 most important lessons I learned:

2️⃣ Free E-book

Do you believe in the Efficient Market Hypothesis (EMH)?

It’s a theory stating that stock prices reflect all available information and that it’s impossible to beat the market as a result.

Learn everything you need to know about this theory here:

3️⃣ One simple investment quote

Everyone is a genius in a bull market.

It’s during bear markets that the great investors stand up.

4️⃣ Quality or Dividend Investing?

One question I always get?

Should I become a Partner of Compounding Quality or Compounding Dividends?The honest answer? I don’t know. It depends on your personal situation.

TJ and I explain the difference between Quality and Dividend Investing in this webinar:

5️⃣ Stock Pitch: Teqnion ($TEQ)

How does the company make money?

Teqnion is a Swedish serial acquirer. They make money by acquiring a portfolio of niche industrial companies. These businesses typically serve stable, specialized markets with low competition and strong margins.Teqnion’s stock is down 40% from its ATH in 2024.

Why? Investors are concerned about financial results and market conditions.

However, Teqnion is a quality company that will likely continue to do well in the future.

This could provide opportunities for long-term Quality Investors.

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Great roundup! Warren Buffett’s lessons never get old — so much wisdom packed into those 5,000 pages. Loved the mix of investing insights, from EMH to quality vs. dividend strategies.

If no dividends, there shouldn't be any director compensations other than salary under employment.