Most investors know how to find attractive stocks to buy.

But when should you sell a stock?

In this article I’ll teach you everything you need to know.

The biggest mistake I ever made

The biggest investment mistake I ever made? Selling my winners too soon.

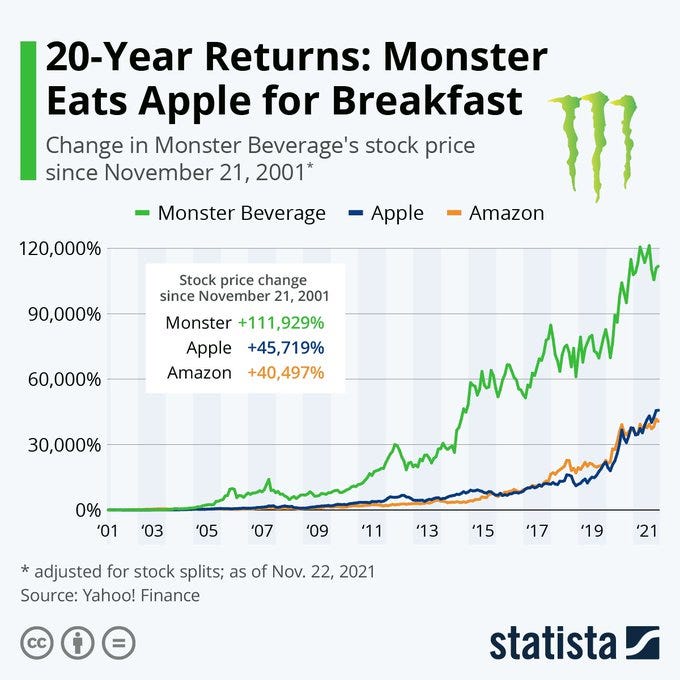

You know why? A stock can only lose 100% in value but it can increase more than 10,000%.

Just imagine that you sold Monster Beverage for $0,01 in 1987 or Apple for $0,3 in 1991.

Since their IPO, both stocks are up 72,000% and 85,000% respectively.

The secret of successful investing lays in the fact that you should let the magic of compounding work for you as long as possible.

It is not without reason that compound interest has been called the eighth wonder of the world.

Reasons to sell a stock

The above doesn’t mean that you should never sell a stock.

In general, you should let your winners run as long as possible while selling your losers as soon as possible.

As Peter Lynch once stated: “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

In this article, I’ll discuss 7 reasons where it makes sense to sell a stock.

1. You made a mistake

John Maynard Keynes once said: "When the facts change, I change my mind.”

And so should you as an investor.

When you’ve bought a stock for a certain reason and after a while it turns out that you’ve made an error of judgement, you should consider selling the stock.

Example: In 2021 I sold Starbucks because I spoke with some employees of $SBX who stated that the company’s moat wasn’t as wide as I initially thought.

2.You’ve found a better opportunity

Just as life, investing is a game of opportunity costs.

You should always own the best companies you possibly can which generate the most attractive risk-return characteristics for you as an investor.

Example: Very recently I sold a big part of my position in Meta Platforms because of the very strong stock price performance and added to my position in a great US owner-operator quality stock.

“The real cost of any purchase isn't the actual dollar cost. Rather, it's the opportunity cost—the value of the investment you didn't make, because you used your funds to buy something else.” - Warren Buffett

3. The company is losing its moat

A moat is essential for quality investors.

Successful companies must reinvent themselves all the time to keep their competitive advantage.

That’s why disruption is one of your worst enemies as a quality investor. You want to invest in companies with predictable cash flows.

Example: Nokia used to be the clear market leader in the phone market. In 2007, they had a market share of 49.4% (!). They lost their edge completely over the years because they didn’t take the treat of smartphones seriously.

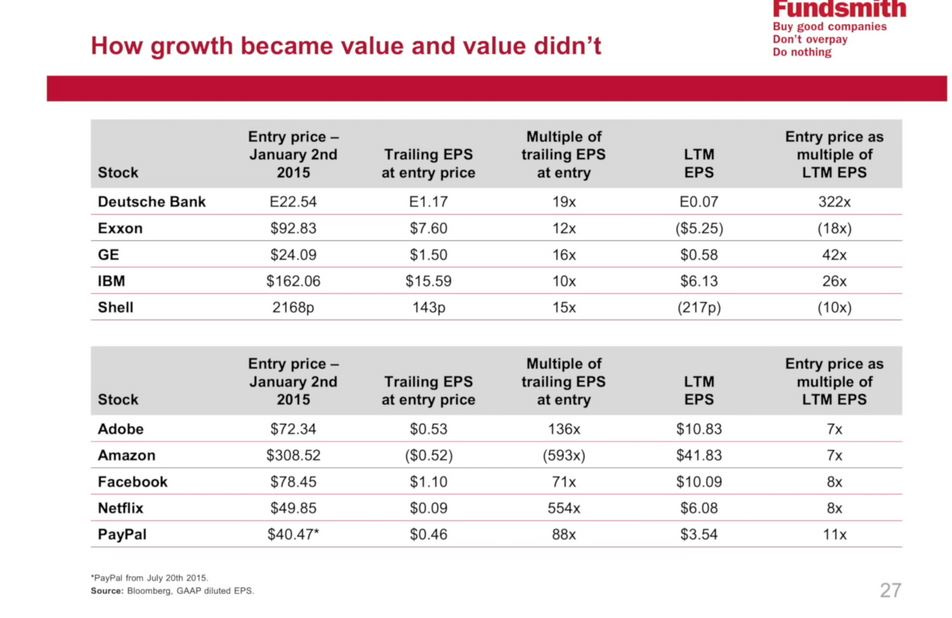

4. The stock is overvalued

This is by far the most dangerous reason to sell a stock.

Why? Because great companies always tend to exceed expectations.

Cheap stocks are often cheap for a reason, and expensive stocks are often expensive for a reason.

I would recommend you to not sell a great business when it looks (slightly) overvalued.

If the company looks expensive but can grow its earnings at attractive rates of return for several years, the stock might turn out to be not expensive at all.

That’s why, at least in my opinion, you should only sell great businesses when they are ridiculously overvalued.

Example: Artificial Intelligence will change our lives. It’s no secret that Nvidia is a clear market leader in AI. However, the company trades at 221x (!) earnings today. This means that even when Nvidia can grow its EPS with 20% per year for 10 years, the stock would trade at a PE of 30x in 2033. And this while you would have generated no return at all as an investor.

5. Change in management

Skin in the game matters. A lot.

I’ll repeat it one more time because it’s so important.

Skin in the game matters. A lot.

As an investor you want to invest in companies which are led by managers with a strong track record and very high integrity.

When great managers start leaving the company, it might be a reason to sell the stock.

Example: In 2014, Bob Kierlin, CEO and founder of Fastenal, retired from Fastenal’s board. As a result, quality investor François Rochon sold the stock. After 2014 the stock still performed very well but not as good as it used to.

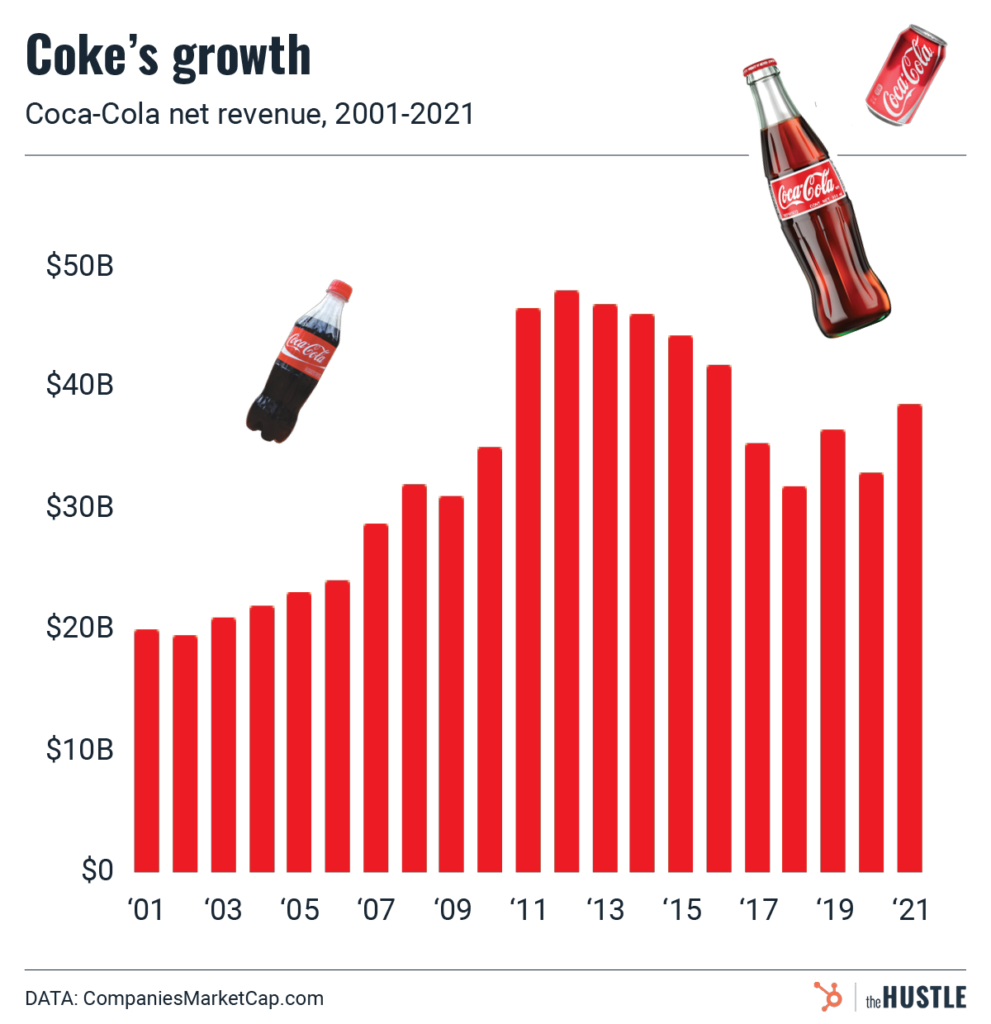

6. Growth is slowing down

In the long term, the growth of the intrinsic value per share is all what matters.

This also means that to generate above-average returns as an investor, you should own companies which are able to grow at above-average rates. When growth slows down, your expected return will as well.

Example: Coca-Cola is a beautiful company. Today they sell more than 1.9 billion (!) servings per day. Due to their size, Coca-Cola won’t be able to grow at let’s say 10% per year. The low growth rate is one of the key reasons why I don’t own shares of Coca-Cola today.

7. Need for cash

If you need cash, it might make sense to sell the least attractive stock you own.

But always remember: in the long term stocks offer the highest rate of return.

Every dollar that works for you right now, will be worth multiple dollars in the future.

Example: You need cash to buy a house or support your children. As a result, you sell the least attractive stock in your portfolio.

Bad reasons to sell a stock

Obviously there are also some bad reasons to sell a stock:

The stock has gone up with x%

The stock has gone down with x%

Comparing the current stock price with your purchase price

Short-term concerns (quarterly results are often noise)

A weakening macro economy

Trying to make a quick gain

Other investors are selling (you should always make your own homework)

Conclusion

That’s it for today. To conclude:

Let your winners run as long as possible

Reasons to sell a stock

You made a mistake

You found a better opportunity

The company is losing its moat

The stock is overvalued

Change in management

Growth is slowing down

You need cash

Last but not least, I want to share this great visual made by Vishal Khandelwal with you:

The end

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

My dear friend CQ,

in furtherance to my texts on Thursday, let me quote the old saying: "If you give a man a fish, you feed him for a day. If you TEACH a man to fish, you feed him for a lifetime." With the metaphor in mind, I am convinced that you are turning all of us into fine fishermen!

Thank you for yet another amazing article! Have a wonderful weekend! I am off to the lake to catch some trout! : )

Thanks! the article was very educational for me. So accurate.