Let’s try something new today.

Starting from today, we’ll publish at least 2 investment cases on a company each month.

Today we’ll dive into S&P Global.

S&P Global

General information:

Type: Oligopolistic Quality Stock

ISIN: US78409V1044

Ticker: SPGI

Current Stock Price: $349.1

Onepager

Here’s a onepager with the essentials of S&P Global.

You can click on the picture to expand:

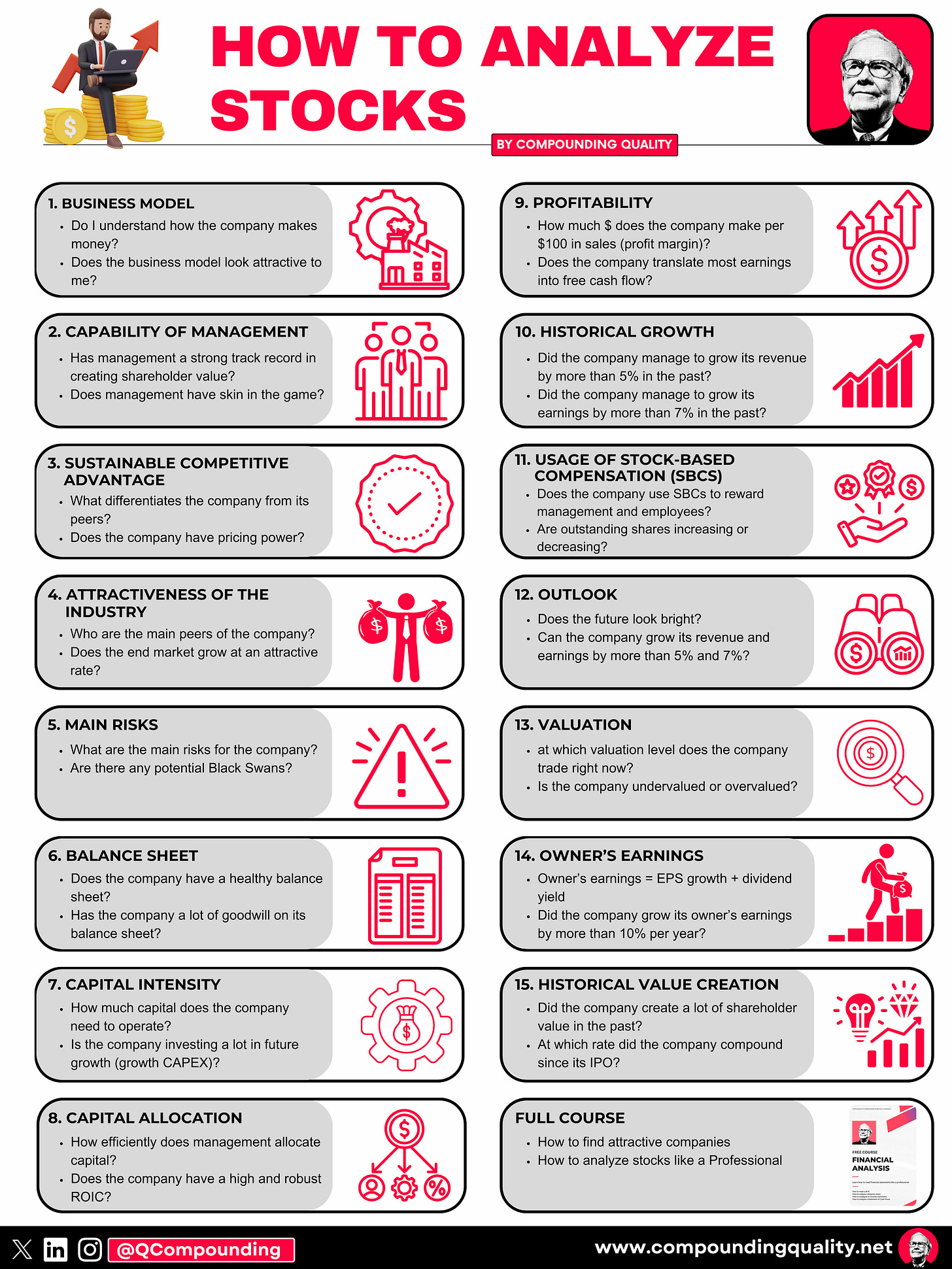

15-Step Approach

Now let’s use our 15-Step approach to analyze S&P Global.

At the end of this article, we’ll give S&P Global a score on each of these 15 metrics.

This will result in a Total Quality Score on 10.

1. Do I understand the business model?

S&P Global generates revenue primarily by providing financial data, analytics, and credit rating services to clients in the global financial and investment industries.

The company is active in 5 segments:

Market Intelligence: helps investment professionals, government agencies, corporations and universities to track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform evaluations and assess credit risk.

Ratings: independent provider of credit ratings, research and analytics, offering investors and other market participants information, ratings and benchmarks.

Commodity Insights: leading independent provider of information and benchmark prices for the commodity and energy markets.

Mobility: Data business inherited from IHS Markit. This segment includes a range of vital solutions for the auto industry.

Indices: S&P Global operates as a global index provider. S&P Global provides transparent benchmarks to help with decision making, collaborate with the financial community to create innovative products and provide investors with tools to monitor world markets.

2. Is management capable?

Douglas Peterson is the CEO of S&P Global since 2013. He has been working for the company since 2011. CFO Ewout Steenbergen has been working for the company since 2016.

Management doesn’t have skin in the game as insiders own less than 0.1% of S&P Global.

However, S&P Global has done really well under Douglas Peterson.

3. Does the company have a sustainable competitive advantage?

S&P Global has a strong competitive advantage based on pricing power, intangible assets and network effects.

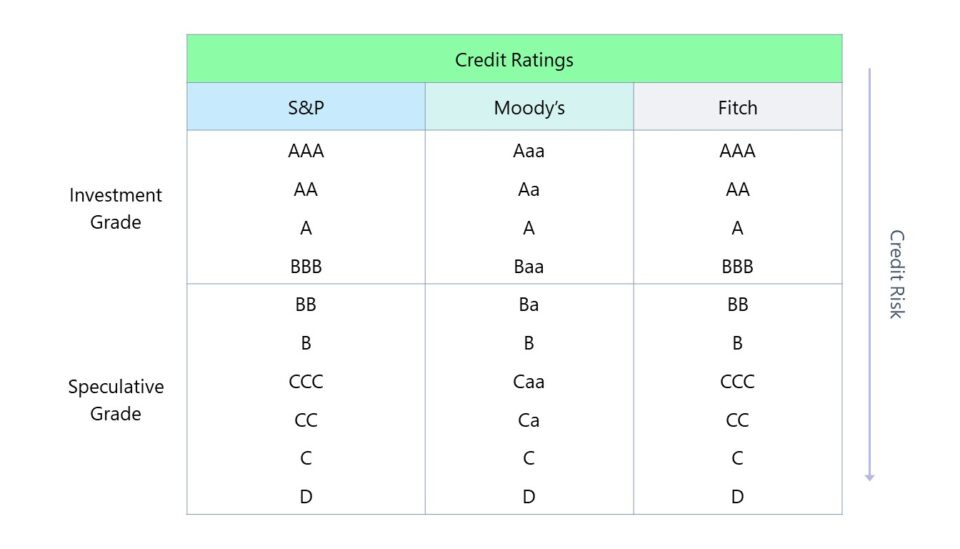

Their credit ratings provide value to bond issuers as well as bond investors. Ratings from S&P Global (and Moody’s) are widely accepted among asset owners and asset managers.

By getting a bond rating from S&P Global, the bond issuers pay less interests, resulting in significant cost savings.

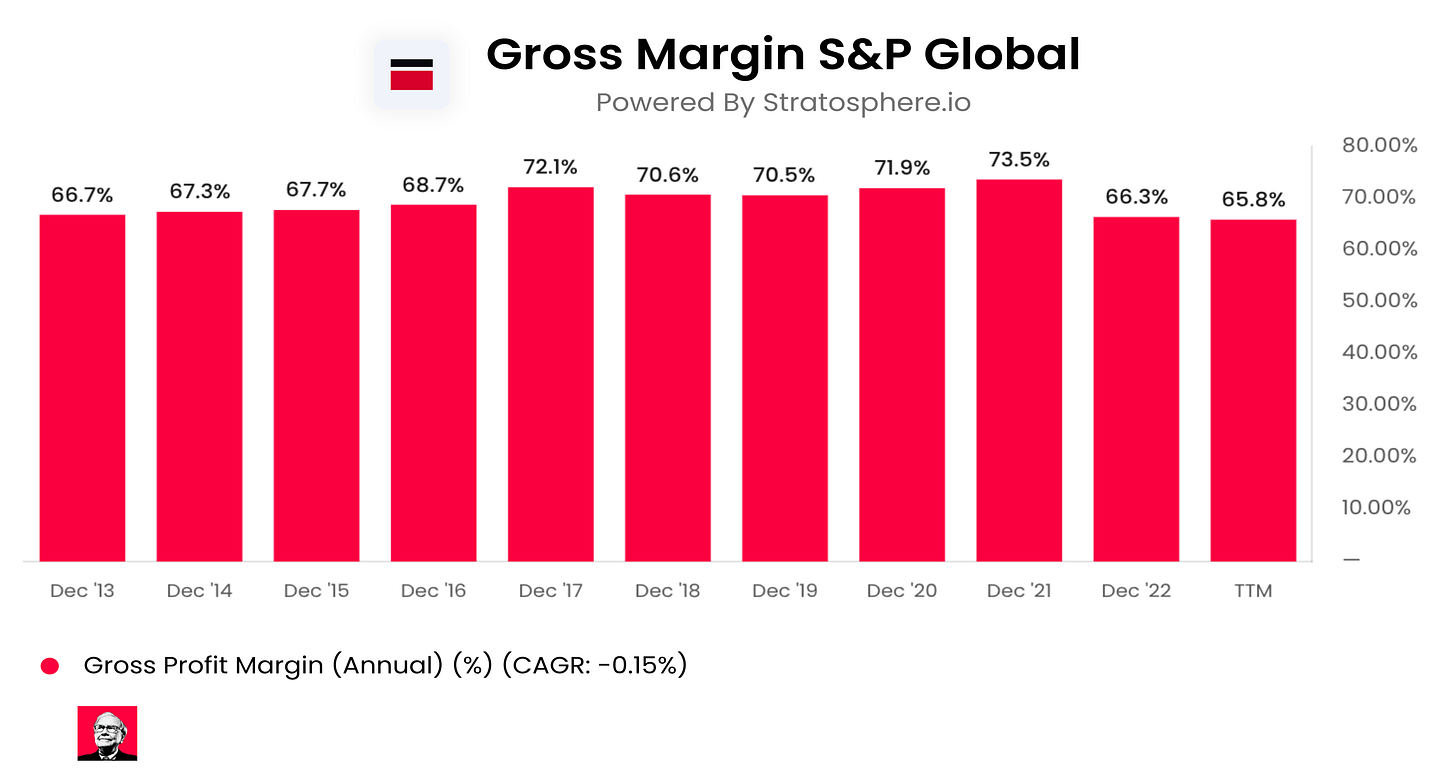

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin:

4. Is the company active in an attractive end market?

S&P Global is active in an oligopoly together with Moody’s and Fitch.

These 3 companies dominated the Ratings Market 20 years ago and probably will continue to do so in 20 years from now.

When an US listed company wants to issue debt, they need a rating from at least two of the three big rating agencies: S&P Global, Moody’s or Fitch.

In practice, this means that American listed companies are almost obliged to use the ratings service of S&P Global.

5. What are the main risks for the company?

Here are some of the main risks for S&P Global:

Successful integration of IHS Markit

Slowing global economy and interest rates can pressure bond issuance

Fee pressure to lower-fee ETFs on index providers such as S&P Global and MSCI

Quite rich valuation level (see later)

Growth issues due to large size

6. Does the company have a healthy balance sheet?

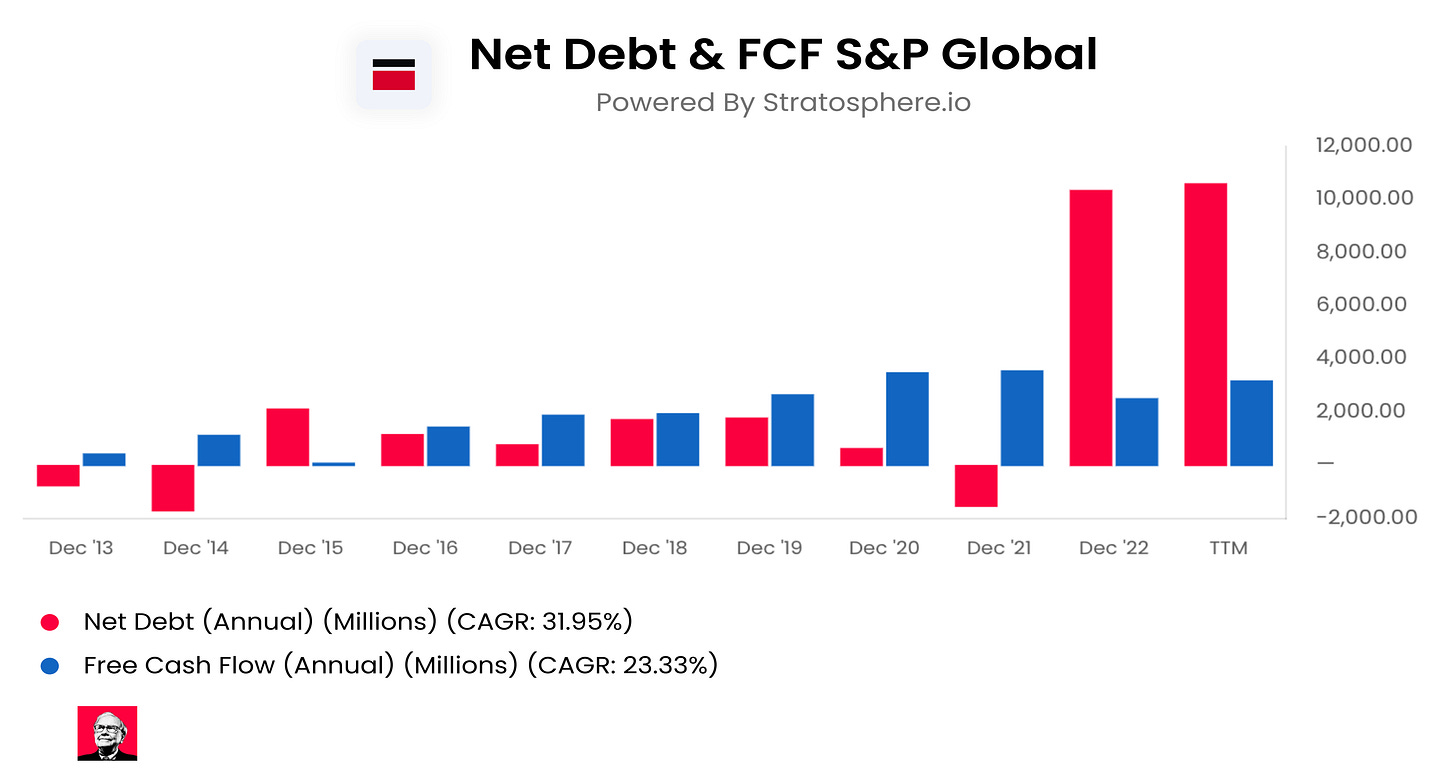

We look at 3 ratios to determine the healthiness of S&P Global’s balance sheet:

Interest Coverage: 7.8x

Net Debt/FCF: 3.3x

Goodwill/Assets: 57.3%

S&P Global’s balance sheet looks a bit stretched as a result of the takeover of IHS Market for $44 billion in 2022.

However, the company’s cash flows are predictable enough to tolerate S&P Global’s leveraged balance sheet.

7. Does the company need a lot of capital to operate?

We prefer to invest in companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

S&P Global:

CAPEX/Sales: 0.9%

CAPEX/Operating Cash Flow: 3.3%

As you can see, S&P Global has a very low capital intensity.

Now let’s dive into the most important Fundamentals of the company and give S&P Global a Total Quality Score based on all 15 metrics.