TerraVest has compounded at 44.7% per year since 2012.

That means a $10,000 investment turned into almost $1 million.

Will the journey continue? Let’s find out.

TerraVest - General Information

👔 Company name: TerraVest Industries

✍️ ISIN: CA88105G1037

🔎 Ticker: TVK.TO

📚 Type: Serial Acquirer/Owner-Operator Stock

📈 Stock Price: CAD 170.4 ($121.9)

💵 Market cap: CAD 3.3 billion ($2.4 billion)

📊 Average daily volume: CAD 7.7 million ($5.5 million)

This amazing investment case was made by my friend Chris Waller.

He is the Founder and Portfolio Manager of Plural Investing. Chris previously worked at Goldman Sachs and has an MBA from the Value Investing Program at Columbia Business School. Furthermore, Chris does an amazing job writing Hidden Gems Investing on Substack.Onepager

Here’s a onepager with the essentials of TerraVest:

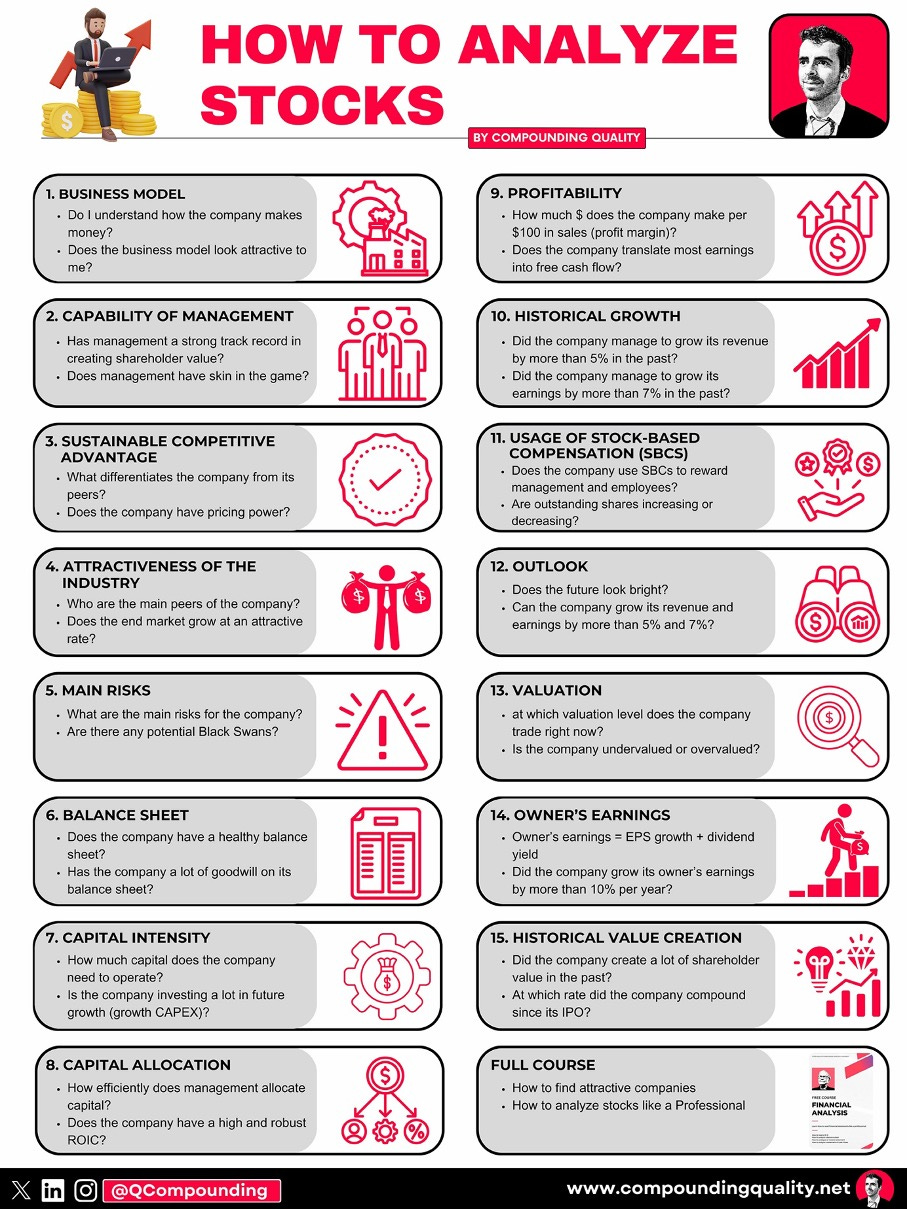

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give TerraVest a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

In remote parts of the US and Canada, many homes are heated with propane.

TerraVest makes storage tanks for propane and other gases, like ammonia and industrial gases.

The company is also expanding into new niches like water storage, LNG, and even hydrogen.

Their mission is simple:

“Our objective is to grow free cash flow per share through organic growth and acquisitions.” - Dustin Haw (CEO)

TerraVest can be seen as a serial acquirer. Its business model is to:

Acquire: Sellers are generally mom & pops or less price-sensitive sellers.

Restructure: It takes 1-3 years to complete and often involves bulk buying discounts on raw materials like steel and valves, consolidation of factories, labor reductions, cross-selling, and always an increased focus on profits.

Operate: A decentralized approach where businesses receive limited interference from the core Terravest team, which is just a handful of people.

TerraVest has acquired over 20 companies since 2014.

On average, they pay 10x Free Cash Flow. However, after they restructured the acquired business, they paid ‘only’ 6x Free Cash Flow in hindsight as they make the business more efficient.

The great news? TerraVest has a long runway to keep acquiring businesses, with hundreds of mom & pops to acquire across these niches.

How does the company create so much value after an acquisition?

Let’s take the example of a 60,000-gallon propane tank.

TerraVest increases the gross profit by over 75%:

There are three main reasons why TerraVest can significantly increase the profitability of acquired businesses:

Mindset

Buying power

Shared resources

1. Mindset

Many of the companies that TerraVest buys were primarily focused on revenues and growth. TerraVest is focused on costs and profits.

TerraVest will shut unprofitable operations, pay salespeople on margins rather than volumes, reward staff throughout the company with a profit share, and reorganize its businesses so that each one is focused on manufacturing its highest margin products.

In some cases, TerraVest has invested in modernizing production. For instance, the company invested $8.5 million into a new 110,000 square feet plant that consolidated production from several acquisitions into a single site in Cowansville, Quebec, in 2019. Some manufacturing processes were modernized, and production capacity doubled.

2. Buying power

TerraVest is the largest player in most of its markets, and that scale is the company's largest and most sustainable competitive advantage.

While many of the acquired companies buy steel from distributors, TerraVest buys directly from mills, and its scale gives it bulk-buying discounts of 10-30%. This is a critical saving as steel is often over half the cost of producing a tank. Similarly, TerraVest achieves savings by procuring valves and other parts.

The company's scale also means it can sometimes afford to stock more inventory than a mom & pop. For instance, TerraVest can buy $10 million in steel plates and can sit on that inventory, whereas the previous owners may have risked bankruptcy if they invested that into working capital and orders did not quickly follow. That means customers receive the products sooner, and their projects are not held up.

3. Shared resources

TerraVest often consolidates multiple facilities into one.

The Canadian company sometimes has several businesses that make similar products. Depending on production schedules, backlogs, and location, the company selects the shop that maximizes delivery speed and minimizes costs. The company’s businesses also share leads.

2. Is management capable?

Warren Buffett once said:

“Over time, the skill with which a company’s managers allocate capital has an enormous impact on the enterprise’s value.”TerraVest’s management is an exceptional capital allocator and well incentivized.

Management pay is very low, with most board members getting paid CAD 44,000-54,000. The CEO earned a base salary of CAD 412,500 last year.

Most key managers are extremely incentivized through shares. The majority of their net worth is invested in TerraVest.

We spoke with eight sources who have worked closely with the CEO, Dustin Haw.

They told us he is a star. Here’s why:

Haw was hired in 2012 by Canadian investor George Armoyan after earning a PhD in physics. He started as an analyst at Clarke, then quickly took charge of TerraVest.

Haw is both a great operator and capital allocator. A source said: ‘Unlike most in finance, he knows how things are made. He understands customers and manufacturing, which is rare.’

He prioritizes returns on capital over growth or empire-building, redeploying funds where they generate the most value.

Haw runs a lean, cost-conscious business. There’s no fancy HQ or investor relations team—he handles inquiries himself.

He has a strong reputation for integrity. Sources and our own experience confirm he’s a trusted partner.

Despite his success, he avoids publicity. TerraVest skips earnings calls and only recently started engaging with analysts.

Haw is deeply invested, earning a salary of CAD 412,500 but holding CAD 74M in stock and options.

At 40, he has a long future ahead to keep compounding.

3. Does the company have a sustainable competitive advantage?

TerraVest has a strong moat based on its Efficient Scale and Cost Advantages.

Efficient Scale

The large scale compared to mom-and-pops brings two advantages:

Inventory advantage: TerraVest can hold a larger inventory than its competitors

This could drastically improve delivery time compared to mom-and-pops

Consolidation: Merging multiple facilities into one reduces costs

In 2019, it spent $8.5 million to modernize production. It built a 110,000-square-foot facility in Cowansville, Quebec. Manufacturing processes were upgraded, and production capacity doubled.

Cost Advantage

TerraVest has a Cost Advantage compared to the competition. Other players in the market buy steel and other parts from distributors. TerraVest buys directly from mills.

Furthermore, the company can buy larger quantities compared to mom-and-pops.

This gives them a discount of 10-30%.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 29.2% (Gross Margin > 40%? ❌)

Return On Invested Capital (ROIC) 13.9% (ROIC > 15%? ❌)

In 2014, TerraVest’s management took over. Back then, most of its businesses made a 10% return on invested capital (ROIC). The company mainly sold oil and gas equipment. It also sold old-fashioned products like cast-iron boilers, which were losing popularity.

Management has redeployed capital to areas of higher returns. Incremental returns on capital are 20-25%.

This is why TerraVest’s ROIC has been increasing over time. It’s something we love to see.

That is important because what matters is the returns that the next dollar of capital will generate when deployed, not what previous dollars have generated.

As management continues to redeploy capital at 20-25%, ROIC at a group level should continue to increase.

4. Is the company attractive in an interesting end market?

TerraVest has grown revenues at a CAGR of 25.5% over the last five years.

How?

While TerraVest’s core markets are not growing rapidly, management continues to make smart acquisitions and reallocate capital into more attractive markets like LNG, hydrogen, and water storage.

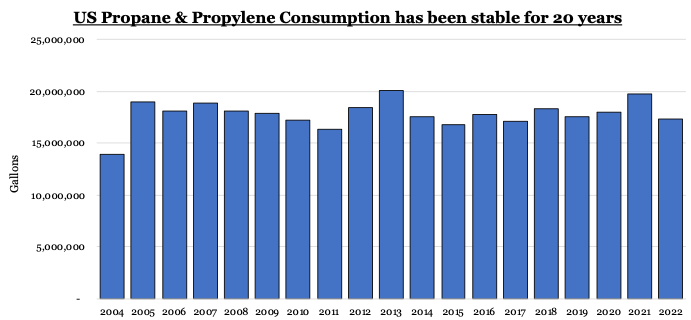

Many people assume that the use of propane is declining, but it is in fact stable:

More importantly, there is a long runway for TerraVest to continue its acquisition strategy.

At a recent trade show, TerraVest was one of many exhibitors. Many of the others are potential acquisition targets for the company.

5. What are the main risks for the company?

The biggest risk to TerraVest is succession risk.

Management is crucial to making successful acquisitions. The company will only collaborate with smart capital allocators.

However, the CEO Dustin Haw is only 40…

And has most of his net worth invested in the stock.

Haw is very incentivized to stay at TerraVest and continue growing his net worth with the company.

Another big risk for the company is that the US and Canada move away from propane and other fuels over time.

Nevertheless, the US system means that regulations and building codes differ by state, and Canadian local governments tend to be more favorable.

The move against propane is likely a multi-decade process.

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of the balance sheet:

Interest coverage: 4.9x (interest coverage > 15x? ❌)

Net Debt/FCF: 2.7x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 8.9% (Goodwill to assets < 20%? ✅)

TerraVest has a healthy balance sheet.

7. Does the company need a lot of capital to operate?

The less capital a business needs to operate, the better

Here’s what things look like for TerraVest:

CAPEX/Revenue: 6.1% (CAPEX/Revenue < 5%? ❌)

CAPEX/Operating cash flow: 35.6% (CAPEX/Operating CF < 25%? ❌)

Manufacturers like TerraVest are quite capital-intensive.

However, the numbers already look better when you exclude Growth CAPEX:

Maintenance CAPEX/Revenue: 4.6% (CAPEX/Revenue < 5%? ✅)

Maintenance CAPEX/Operating Cash Flow: 27.0% (CAPEX/Operating CF < 25%? ❌)

Now let’s dive into the most important fundamentals of the company.