🎲 Skin in the game matters

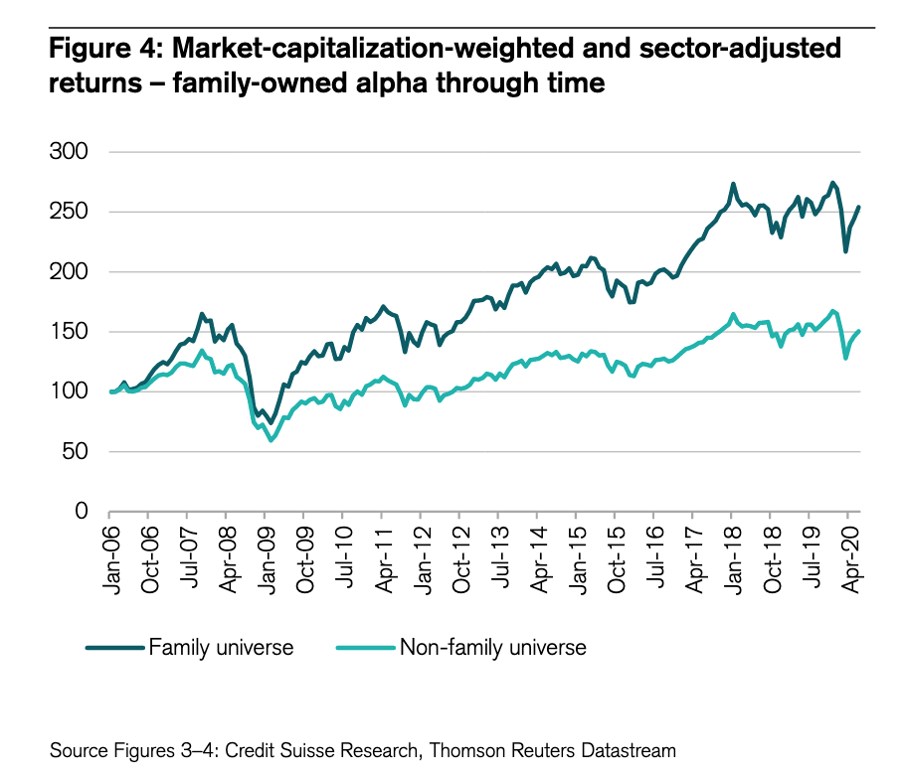

Companies with skin in the game (owner-operator stocks) have outperformed the market by 3.7% (!) per year since 2006. Credit Suisse studied the characteristics of more than 1000 family companies.

Great lessons from this study can be found in this article.

Lesson 1: Skin in the game is essential

Invest in companies where interests of management are aligned with the one of you as a shareholder. When you invest in family companies, you increase your chance that management puts the interests of the company first.

Family businesses can be defined as companies where the founder or his family owns at least 20% of the company.

Lesson 2: A long-term mindset creates value

Family-run companies think on the long-term. They want to pass their company to their (grand)children and keep the family wealth intact.

Companies with a long-term mindset dare to take decisions which might hurt results in the short term, but are very good for long-term value creation. This is a BIG advantage compared to other companies.

Lesson 3: Healthier balance sheet

In general, companies run by people with skin in the game use less debt. This is very beneficial as cash is just like air for humans. If you don’t have air, you can’t breathe. Cash gives companies a lot of flexibility.

During the financial crisis in 2008, family companies also reduced their debt levels much more quickly than non-family companies.

Lesson 4: More revenue growth

Family-owned companies generate superior top-line growth.

Since 2006, revenue growth for family companies averaged 11.3% compared to ‘only’ 6.8% for non-family companies.

Lesson 5: Higher profitability

Besides generating stronger revenue growth, companies with skin in the game are more profitable too.

Since 2006, family companies generated higher EBITDA margins every single year compared to non-family companies.

Lesson 6: Better capital allocation

The cash flow returns on investment (CFROI) is a great metric to measure the capital allocation of a company. This metric shows a clear and consistent degree of outperformance by family companies.

Good capital allocation is essential for long-term value creation. As a result, family companies outperform non-family businesses in the long term.

Lesson 7: More robust against disruption

Disruption is one of the biggest enemies of Compounding Quality stocks.

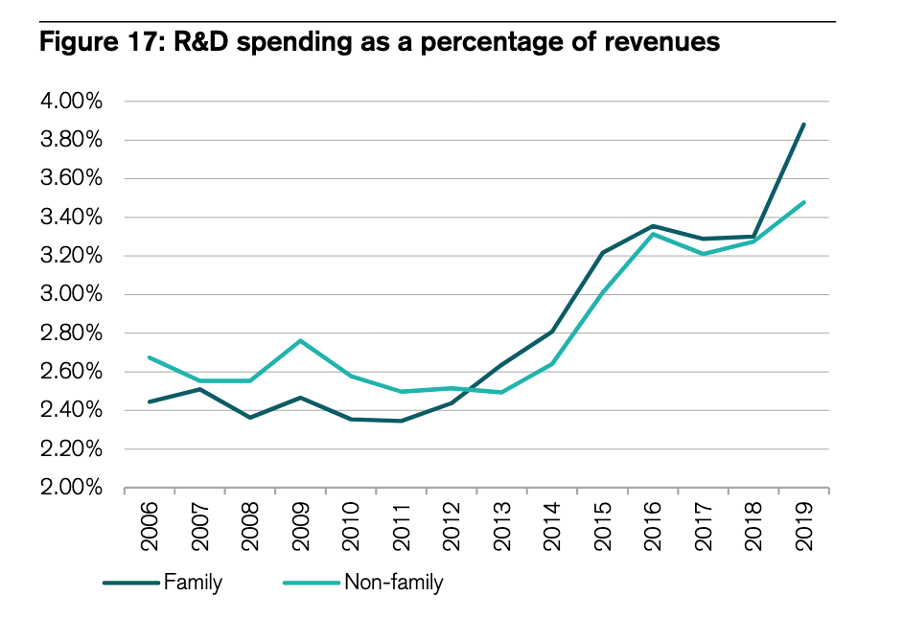

In general, family companies invest more in R&D compared to other businesses (measured by R&D as a % of sales). Investing in R&D goes hand in hand with a long-term mindset and is a good protection against disruption.

Lesson 8: Clear outperformance on the stock market

Family-owned companies outperformed non-family-owned peers on average by 3.7% (!) per year since 2006.

The outperformance of companies with skin in the game has been the greatest for smaller companies. Within this segment, family companies outperformed with 6.5% (!) per year.

Lesson 9: Some examples of family companies

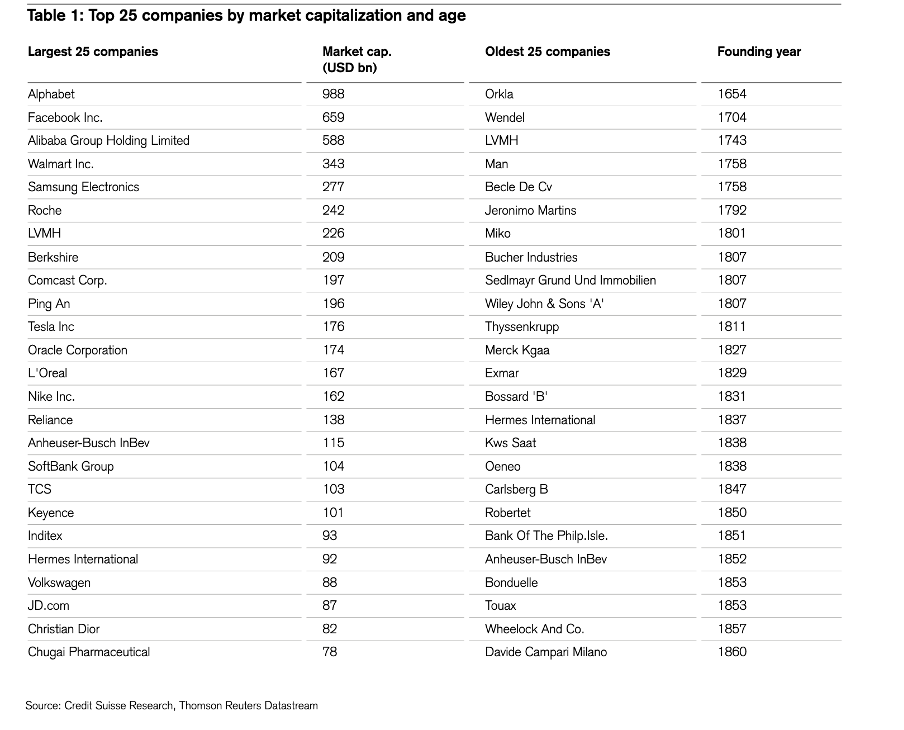

In the picture below you can find some examples of companies with skin in the game.

10. Study Credit Suisse

This article was based on the Family 1000 Study from Credit Suisse.

You can download the full report here for free:

More from us

Do you want to read more from us? Please become part of the Compounding Quality Family by subscribing to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Yes, but usually, if the owner appoints his children as managers simply because they are his children, they do not have the competence and motivation, which reduces the company's results