Text SA: Another Compounding Machine

Investment case Text SA

An Owner-Operator quality stock that translates almost all revenue into pure cash.

That’s how you can define Text SA (formerly Livechat).

Let’s discuss everything you need to know.

📈 Investment case: Text SA

The full investment case will consist of 4 parts:

Analyzing the business model part I

Analyzing the business model part II

Diving into the fundamentals

Bringing it all together

Today, we’ll dive into the essence of Text SA’s business model.

If you don’t want to read the entire analysis, you can scroll down to the conclusion at the bottom of the article.

You’ll also find out whether we’re buying Text SA or not.

General information

👔 Company name: Text SA

✍️ ISIN: PLLVTSF00010

🔎 Ticker: $LCHTF

📚 Type: Owner-Operator Stock

📈Stock Price: 114.8 PLN ($28.5)

💵 Market cap: 2.96 billion PLN ($735 million)

📊 Average daily volume: 3.6 million PLN ($900k)

Please note that earlier this year, the company changed its name from Livechat Software to Text SA.

Do I understand the business model?

Let’s start with a beautiful quote from Chris Mayer: “A lot of beautiful companies can be found in Poland.”

We completely agree with him. Think about companies like Dino Polska and Text SA. This investment case will talk about Text SA.

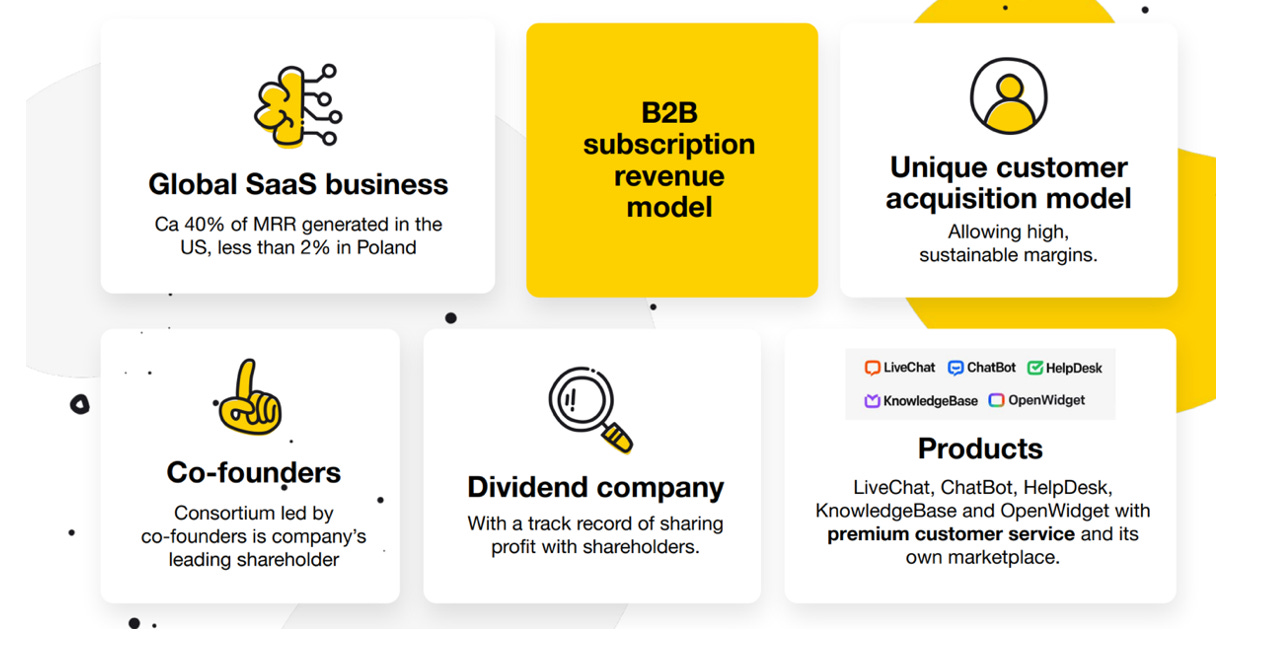

Text SA is a global provider of solutions for managing online business communications, generating leads, and selling online.

The Company offers its solution under a SaaS (Software as a Service) model. They are used for managing text communication with customers both in business-to-consumer (B2C) and business-to-business (B2B) sectors.

Text SA focuses mainly on the United States. One third of revenues are generated in the US and two-thirds of sales are derived from English-speaking countries. Text SA is headquartered in Poland but Poland only accounts for 2% of the company’s revenues.

The business can be seen as a horizontal software provider. They provide a ‘chat button’ plugin. This allows users to chat with service reps and get assistance:

All the products are a part of the ecosystem. As a result, their users can integrate them to enhance their teams’ productivity and effectiveness, fulfill business needs, and improve customers’ experiences.

How does the company make money?

Text SA is a SaaS company (Software as a Service) model. This means their revenue is recurring in nature.

Its business model revolves around offering live chat software to enable companies to engage with their website visitors and customers in a personalized and instant manner.

Customers subscribe to LiveChat's services, paying a monthly or annual fee based on the chosen plan and the number of agents using the platform. The company generates revenue primarily through recurring subscriptions. It’s also important to highlight that all clients pay in US Dollars (also clients based in Europe).

“What is important, we, first of all, received all the payments in U.S. dollars. And that's also the reason why we provide this information in U.S. dollars. So no matter the country where our customer comes from, it can be Germany, it can be Poland, U.S. or China, for example, all the customers will be paying in U.S. dollars.”

Earlier this week, the company announced its Monthly Recurring Revenue (MRR) was equal to $6.5 million. This implies that (almost) all Text SA’s revenue is recurring in nature.

History

The company’s story began in 2002 when Jakub Sitarz, Mariusz Ciepły, and Maciej Jarzębowski founded LiveChat. LiveChat Software was supposed to solve the problem of the lack of easy online communication between companies and their customers in real-time.

The first version of the LiveChat solution was created very quickly and the company gained its first Polish customers. However, the process of obtaining them was often very long and ineffective. Due to the poorer accessibility of the Internet and the growing popularity of e-commerce, the awareness of the benefits of LiveChat was not high. As a result, Livechat wasn’t profitable during this period.

In 2007, a financial investor, then Capital Partners S.A. acquired 50% of LiveChat Software. A year later, the fund sold its shares in LiveChat Software for PLN 2 million and they reached 50% return on investment. The buyer was the Gadu-Gadu company (in total, they acquired 63% of the shares for PLN 3.7 million), the owner of the popular internet messenger. Interestingly, this is how Livechat became part of the Naspers group that owned this company.

In Gadu Gadu, Livechat’s team worked, among others, on the version of this communicator dedicated to business. The founders of LiveChat Software believed very strongly in the prospects of this solution. In 2011, with the support of the Tar Heel Fund, they managed to buy back their Company's shares.

What is even more important, a year earlier Livechat started providing services in the SaaS model. This enabled them to build an effective customer acquisition model and expand abroad. Currently, Poland is responsible for only 1.5% of the business.

Over the past quarters, Livechat witnessed a breakthrough in the availability of AI-driven tools and the dynamic development of this technology. Artificial intelligence is already transforming its products as well as the way their organization operates. LiveChat has long been helping agents to become more efficient, enabling them to handle more chats simultaneously, better and faster.

Five years ago, they introduced its product, ChatBot, and a year later, HelpDesk, which development also focuses on automation. AI is an exciting perspective but also a tremendous challenge.

Now let’s do the following:

Analyze the attractivenes of Text SA’s business model

Give the company a Quality Score on its business model

Determine whether we’ll buy Text SA