The 100-Year Dividend Club (27 Stocks)

The Ultimate Dividend List

John Rockefeller once said:

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”Today, TJ (Compounding Dividends) dives into 27 companies that have paid a dividend for over 100 (!) years.

Dividend investors love one thing: reliability.

Very few companies can pay dividends during wars or recessions.

Doing it for 100+ years? That’s almost impossible.

Only 27 stocks in the US have paid a dividend every single year for 100+ years.

That’s just 0.4% of all US stocks. A very exclusive club.

These companies survived everything: wars, crashes, and inflation. And they kept paying dividends.

Let’s dive in right away.

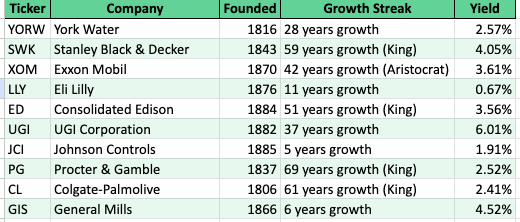

10. York Water ($YORW)

How does the company make money?

York Water makes money by supplying clean water and wastewater services to homes and businesses for a fee.Forward Dividend: $0.88 per share

Dividend Yield: 2.8%

Payout Ratio: 63.4%

Fun Fact: York has raised its dividend for 28 straight years, making it a Dividend Champion.

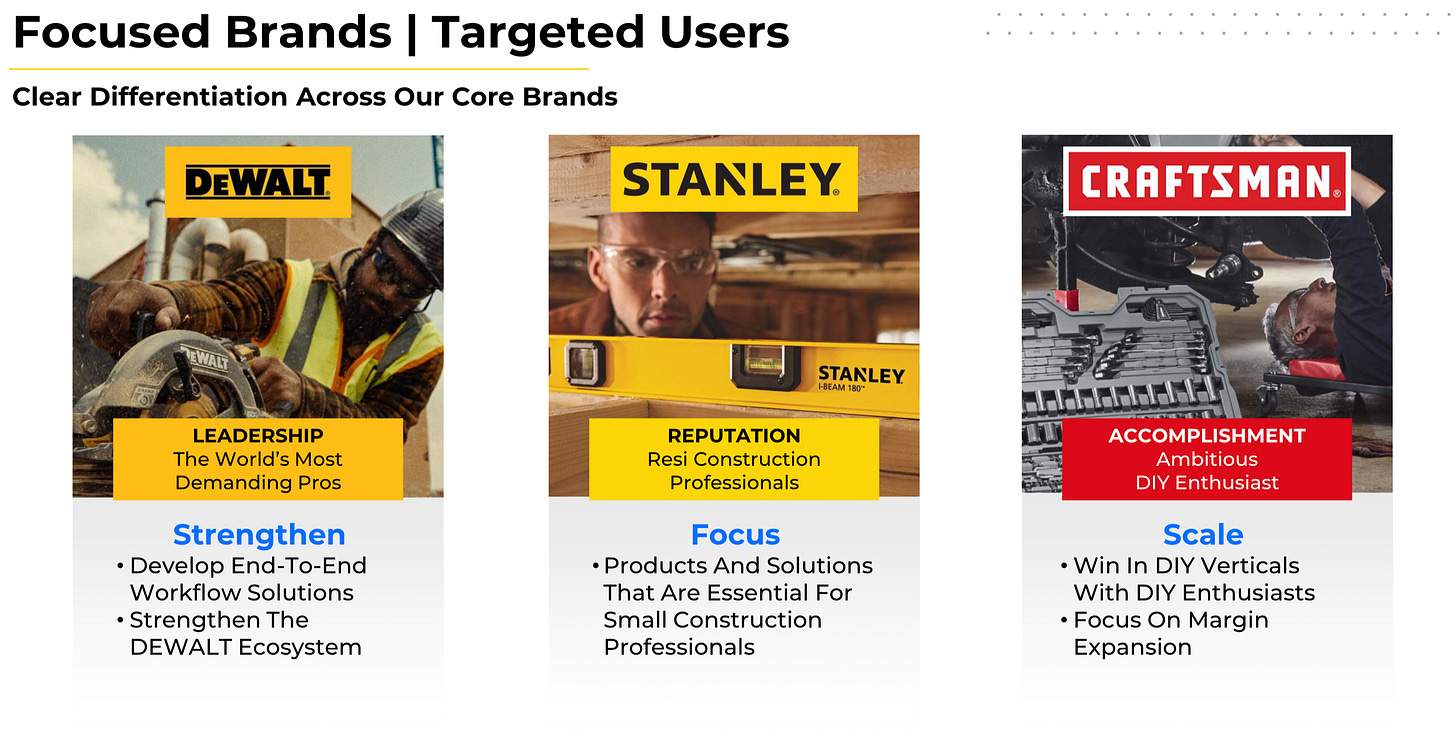

9. Stanley Black & Decker ($SWK)

How does the company make money?

Stanley Black & Decker makes money by selling tools, storage products, and industrial equipment to consumers and businesses worldwide.Dividend History: Since 1877

Forward Dividend: $3.32 per share

Yield: 4.2%

Payout Ratio: 103.5%

Streak: 59 years of growth (Dividend King)

8. Exxon Mobil ($XOM)

How does the company make money?

Exxon Mobil makes money by producing, refining, and selling oil, gas, and chemical products around the world.Dividend History: Since 1882

Forward Dividend: $3.96 per share

Yield: 3.7%

Streak: 42 years of growth (Dividend Aristocrat)

7. Eli Lilly ($LLY)

How does the company make money?

Eli Lilly makes money by developing and selling prescription medicines for diseases like diabetes, cancer, and obesity.Forward Dividend: $6.00 per share

Yield: 0.8%

Payout Ratio: 36.5%

6. Consolidated Edison ($ED)

How does the company make money?

Consolidated Edison makes money by providing electricity and gas to homes and businesses.Forward Dividend: $3.40 per share

Yield: 3.5%

Streak: 52 years of growth (Dividend King)

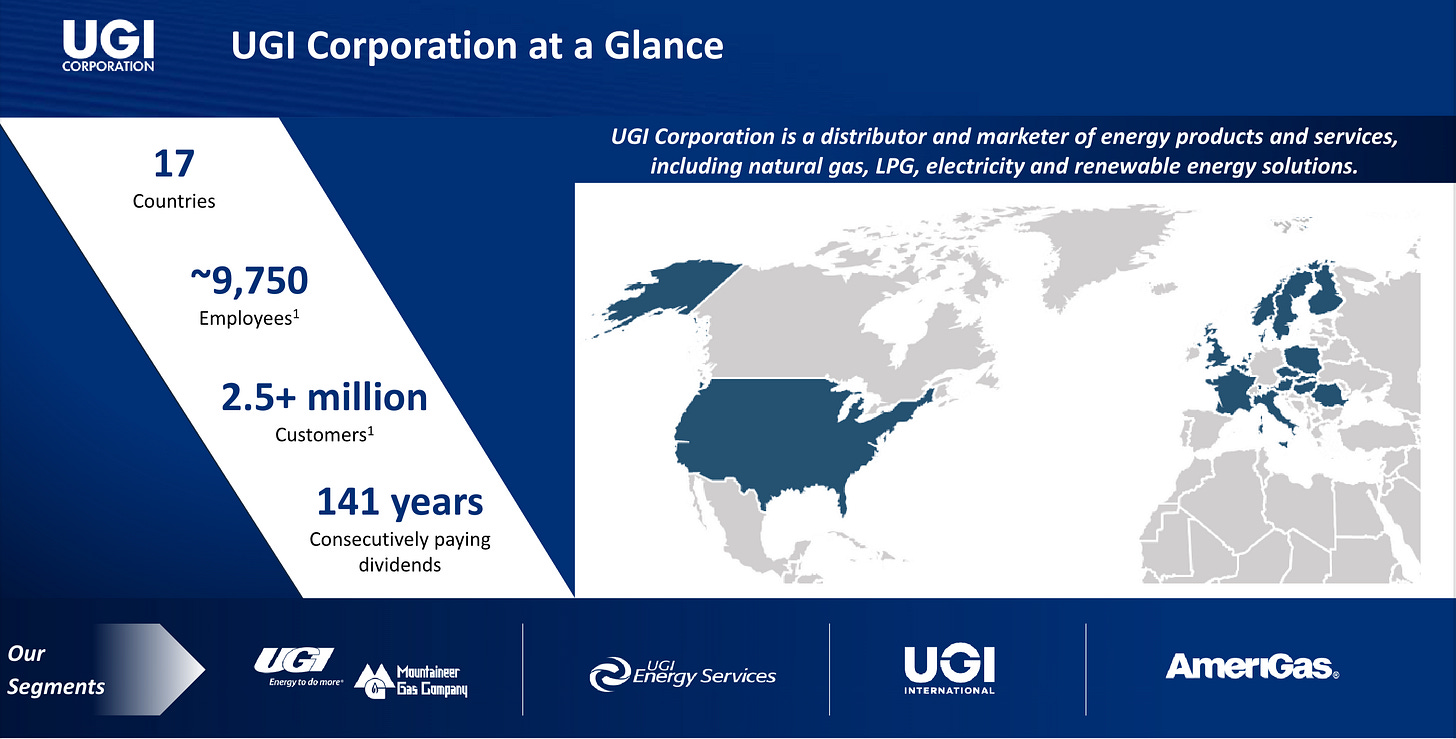

5. UGI Corporation ($UGI)

How does the company make money?

UGI Corporation distributes natural gas, propane, and energy services to customers.Founded: 1882

Dividend History: Since 1885

Yield: 4.3%

Fun Fact: Has raised its dividend for 37 straight years, making it a Dividend Champion.

4. Johnson Controls ($JCI)

How does the company make money?

Johnson Controls sells building products and energy systems like HVAC and security solutions.Forward Dividend: $1.48 per share

Yield: 1.4%

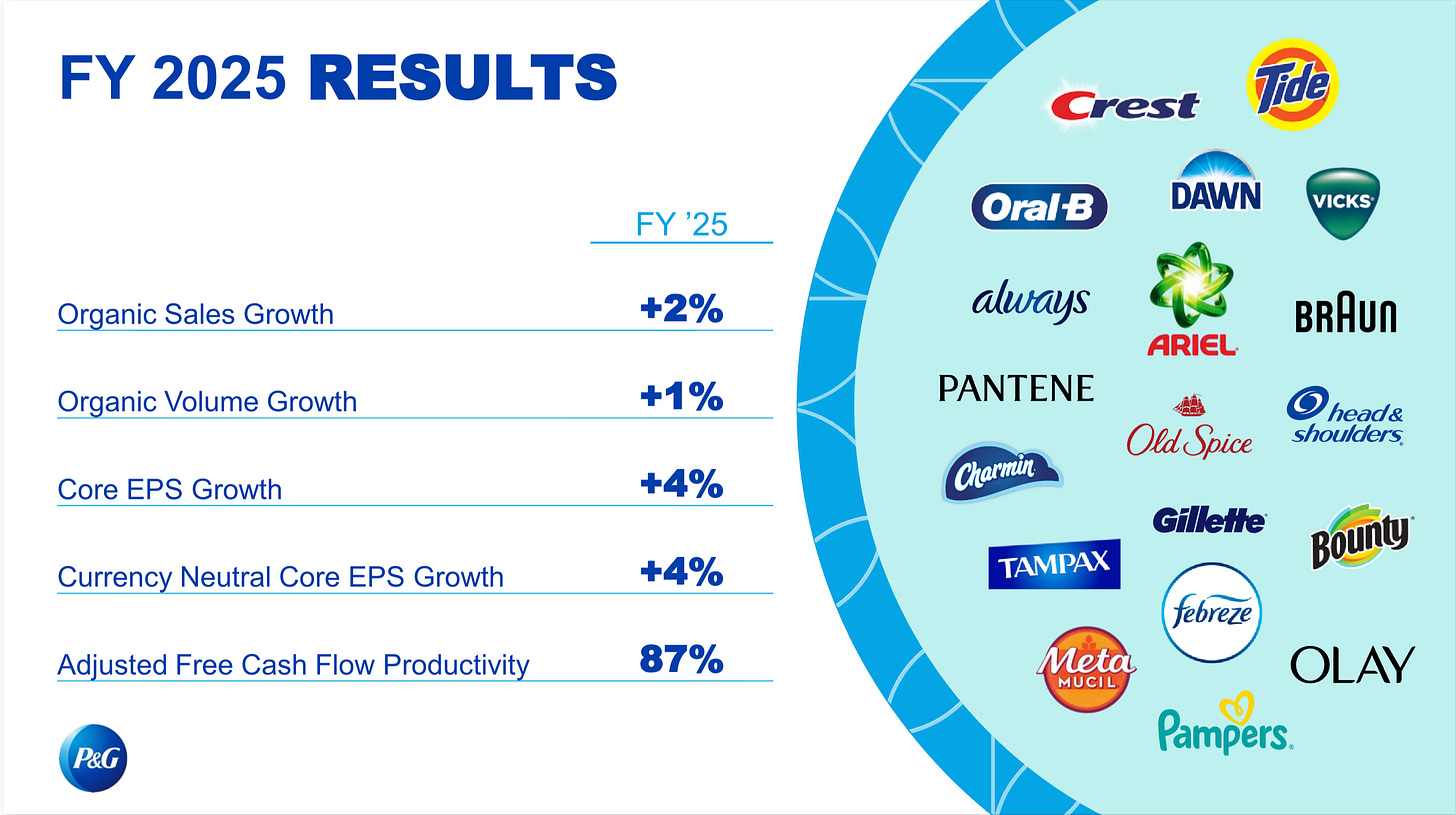

3. Procter & Gamble ($PG)

How does the company make money?

Procter & Gamble makes money by selling everyday consumer goods like shampoo, detergent, and diapers.Dividend History: Since 1891

Yield: 2.7%

Streak: 70 years of increases (Dividend King)

2. Colgate-Palmolive ($CL)

How does the company make money?

Colgate-Palmolive sells oral care, personal care, and household products worldwide.Dividend History: Since 1895

Yield: 2.5%

Streak: 63 years of growth (Dividend King)

1. General Mills ($GIS)

How does the company make money?

General Mills sells packaged foods like cereals, snacks, and baking products.The famous maker of Cheerios, Pillsbury, and Haagen-Dazs.

Dividend History: Since 1898

Yield: 4.6%

Grab the entire list

These were the first 10 companies on the list.

All these companies paid a dividend for over 100 (!) years.

You can download the entire list here:

You might have heard it already… but something big is coming.

On November 4th, we launch Compounding Dividends 2.0.

Here’s what’s waiting for you:

🌱 A brand-new platform with more tools than ever

💸 Exclusive insights into My Dividend Portfolio

📈 Every Wednesday in November: a fresh stock idea

🏗 An updated Watchlist full of dividend opportunities

🚀 A growing community of dividend lovers

📝 A full Dividend Toolkit – learn how to pick stocks yourself

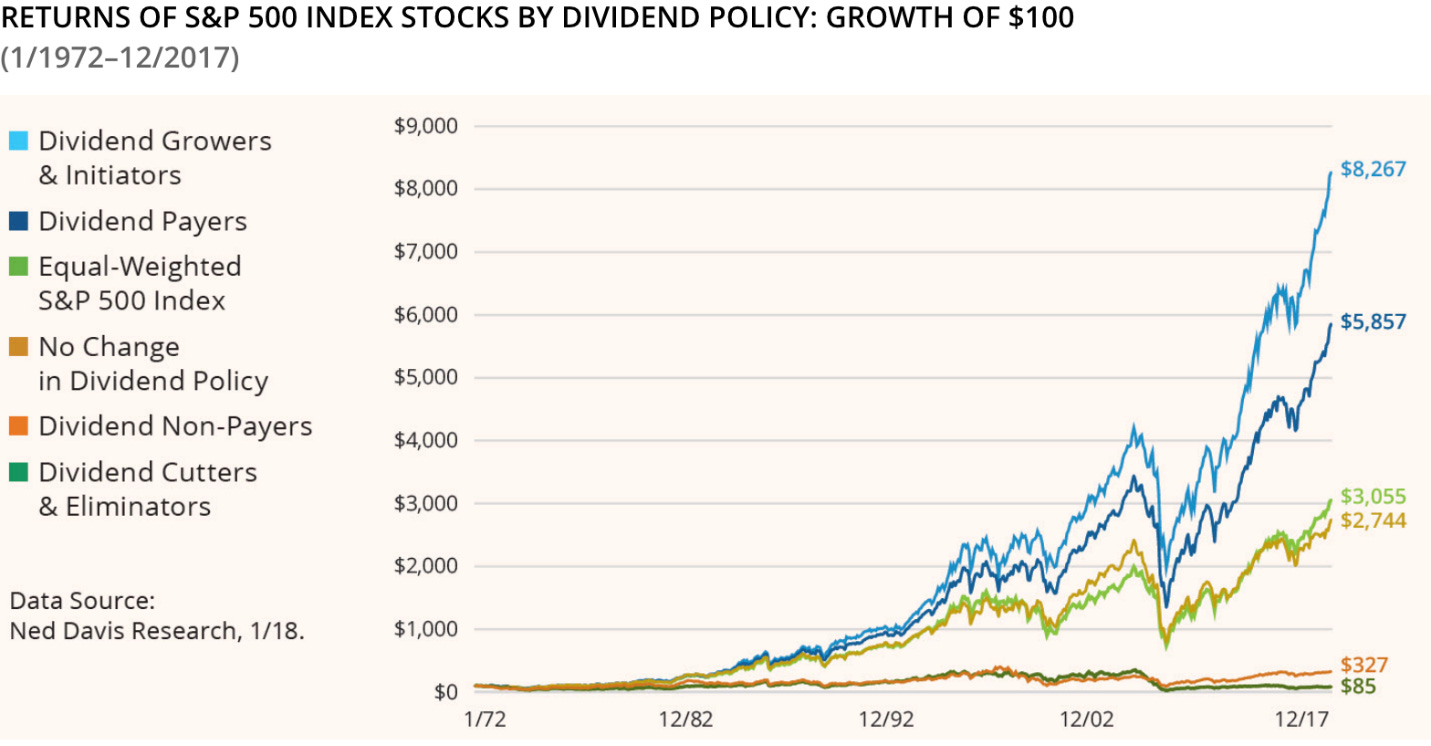

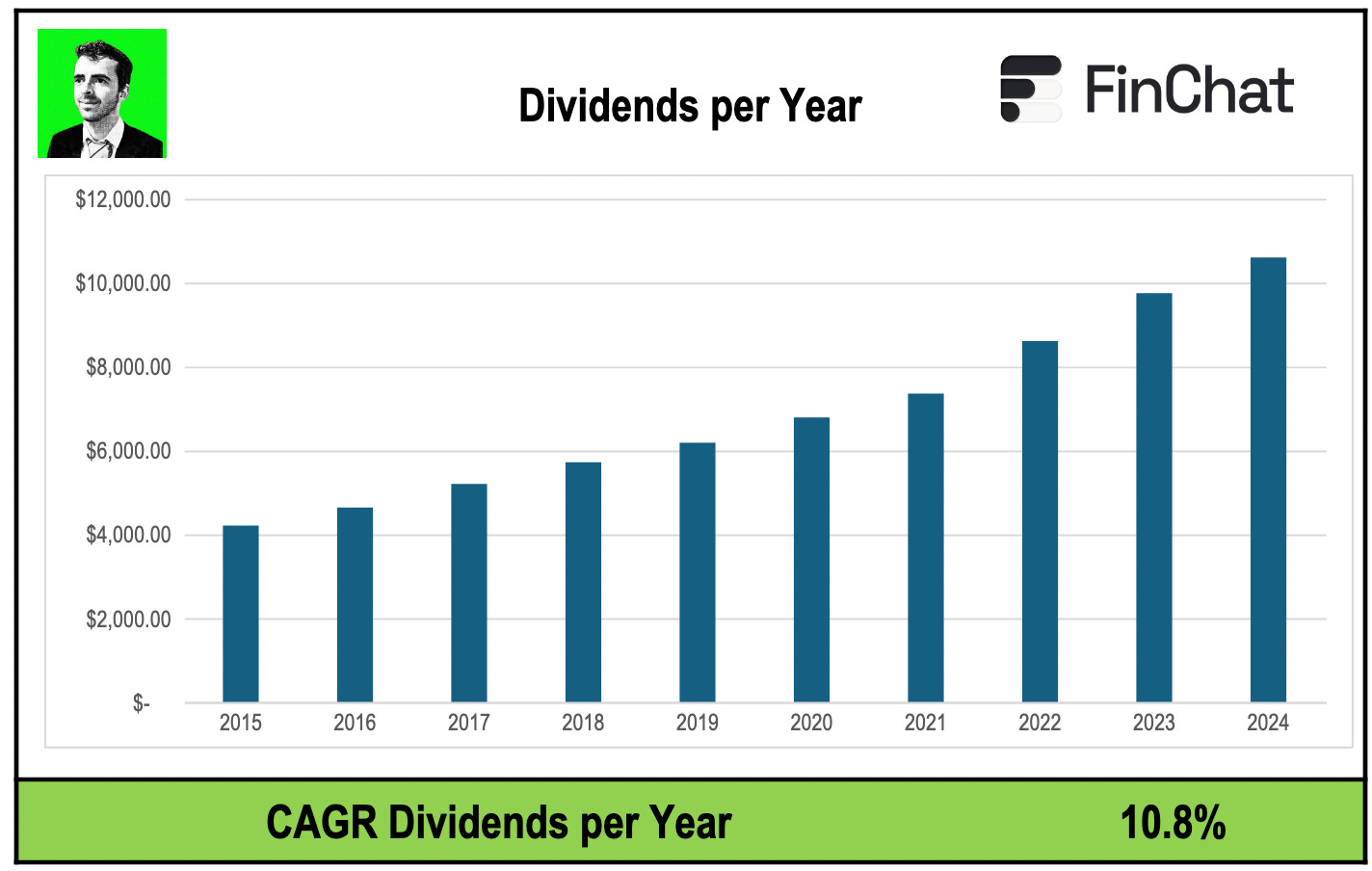

We don’t buy dividend stocks just for the yield.

The dividend also keeps growing every single year.

Just look at this chart:

More income, without more effort.

Mark November 4th in your calendar and make sure you don’t miss it.

This could be the start of something special.

Everything In Life Compounds

Pieter

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Check out Dividend Farmer!

http://Dividendfarmer.substack.com